If you’ve ever wished you could spend your crypto as easily as cash, you’re in luck. What once sounded futuristic is now totally possible. With a crypto card, you can pay for things with your digital assets almost anywhere – just like using your regular bank card.

Let’s take it step by step. Here’s how crypto cards work, how to get one, and what to know before you start spending.

What Is a Crypto Card?

A crypto card works a lot like a Visa or Mastercard, but instead of connecting to a bank account, it’s connected to your crypto wallet. When you buy something, your crypto is automatically converted into local currency – like USD, EUR, or BRL – as soon as you pay. So the store still gets paid in regular money, but what’s actually being used is your crypto.

The whole process happens in seconds. You don’t have to sell crypto first or move it to an exchange. You just tap or swipe, and you’re done. To you, it feels just like using a normal card – the difference is where the money comes from.

Types of Crypto Cards

There are two main types of crypto cards, and it helps to know the difference before you get one:

- Prepaid or debit-style cards– You deposit crypto onto the card before you spend. When you pay for something, it automatically converts just what you need into local currency. This is simple, fast, and beginner-friendly.

- Credit-style crypto cards– These let you spend first and pay later, just like a traditional credit card. Some even use your crypto as collateral or give you cashback in crypto.

Then there’s KAST, which blends the best parts of both. It’s a prepaid crypto card that runs on credit card networks, so it works nearly anywhere – online, in-store, or abroad.

Because it uses those same credit rails, KAST even works for things that normally don’t accept prepaid cards since they require pre-authorization – like hotel bookings, car rentals, or travel reservations. This gives you more flexibility wherever you spend.

How to Get a Crypto Card

Getting started with a crypto card is much easier than you might think. Here’s how:

- Choose a provider– Find one that supports your favorite cryptocurrencies, is accepted worldwide, and clearly explains any fees.

- Verify your identity– Most providers require KYC (Know Your Customer) checks. This keeps your account safe and compliant with regulations.

- Activate your card– You can usually start using a virtual card right away. A physical card can be sent to you by mail.

- Add crypto– Deposit supported assets (e.g. Bitcoin, Ethereum, Solana) – or stablecoins like USDC or USDT.

- Start spending– Use your card anywhere Visa or Mastercard is accepted.

With KAST, this process is familiar. Once you’re verified and funded, you can start spending immediately. The KAST app keeps it simple – you can deposit funds, track spending, and check your balance all in one place.

Using Your Crypto Card for Every Day Spending

Once you have your card, using it is just like any other card. You can:

- Shop online– for clothes, electronics, or subscriptions.

- Cover daily expenses– like coffee, groceries, or dinner out.

- Travel– book hotels, pay for flights, or withdraw cash abroad.

Imagine you’re traveling in another country and want to grab lunch. Instead of exchanging money or worrying about conversion rates, you just tap your crypto card. It instantly converts your crypto into local currency at checkout. That’s what makes crypto cards so useful – they fit right into your normal spending habits.

Handling Crypto Volatility and Fees

If you’re new to crypto, one thing to know is that prices can change quickly. That’s called volatility. But it’s easy to manage once you know how.

- Stick to stablecoins for less risk.Stablecoins are tied to regular currencies, so their value doesn’t jump around like Bitcoin or Ethereum.

- Always check your fees.Some providers hide them, but good ones show you exactly what each transaction costs.

- Keep track of your balance.Most apps update in real time, so you always know how much you’ve spent.

KAST makes all of this clear – it uses stablecoins to keep your spending consistent, transparent with the fees, and updates balances instantly so you’re never left guessing.

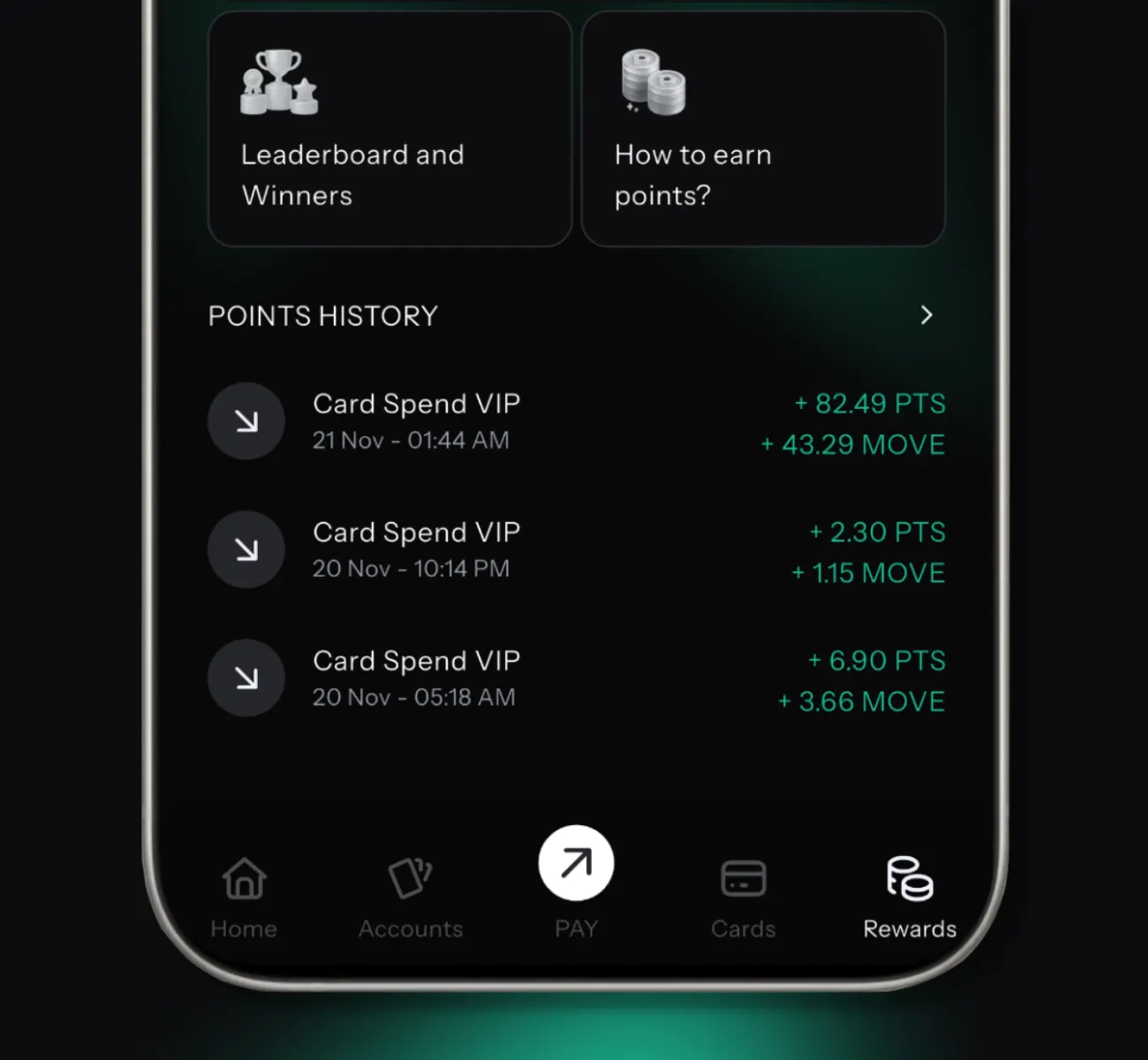

Rewards and Benefits

Many crypto cards give you rewards when you spend, just like regular cards do. Common perks include:

- Cashback:Get a small percentage of every purchase back. KAST, for example, offers up to 10% back on eligible transactions.

- Tiered rewards:Higher card tiers unlock better rates, lower fees, or extra perks like travel benefits and premium support.

- Staking bonuses:Some cards, such as the KAST Solana Card, let you boost rewards by staking certain tokens.

- Referral rewards:Invite friends and both of you can earn bonuses or temporary reward boosts.

These perks make crypto cards not just useful but also rewarding to use over time.

Staying Safe with Your Crypto Card

Security is just as important as convenience. Here are a few basics every beginner should follow:

- Turn ontwo-factor authentication (2FA) for extra protection.

- Enableinstant alerts so you’ll know right away if your card is used.

- Freeze your cardif it’s lost or stolen.

- Only keep spending money on your card– store the rest of your crypto in a secure wallet.

These small habits go a long way toward keeping your funds safe.

The Future of Spending

Crypto cards are changing how people use digital money. They make it easy to turn your crypto into something you can spend anywhere, instantly. As more people start using crypto in everyday life, platforms like KAST are helping make that shift simple, safe, and practical.

If you’re just starting out, a crypto card is one of the easiest ways to bridge the gap between the crypto world and the real one.

Choose a trusted provider like KAST, and see how smooth it can be to spend your crypto – anywhere, anytime.