India has topped Chainalysis’s 2023 and 2024 Global Crypto Adoption Index, thanks to a continuous uptick in participation from both retail and institutional investors.

The crypto industry in the country has matured considerably over the past few years, and an increasing number of crypto traders are exploring investment avenues such as futures and options. But, crypto derivatives can be complex and highly volatile – demo trading accounts have become vital to allow traders to test their strategies before taking the plunge.

Delta Exchange ranks among the top crypto derivatives trading platforms in India. They offer a demo trading mode that is feature-packed and intuitive to use. In this mode, crypto traders can train themselves on advanced trading tools, test out strategies, and get familiar with the platform with virtual funds. In this article, we will take a look at how to use Delta Exchange’s demo trading feature effectively.

What is Demo Trading?

Demo trading, historically called paper trading, is the practice of simulating trading without using actual funds. It replicates real market conditions using virtual money, enabling crypto traders to buy/sell orders, experiment with derivatives, and experience price volatility – all without financial risk.

Unlike live trading, where capital is at stake, demo trading is designed for practice and education. It is an ideal entry point for those new to crypto derivatives, as well as experienced traders wanting to backtest strategies or understand a platform’s tools before going live.

Why Use Delta Exchange’s Demo Trading Mode?

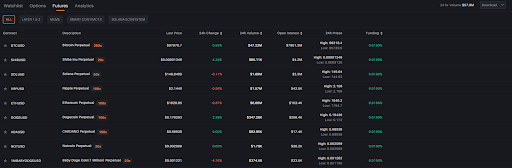

Source | The Delta Exchange demo trading mode.

Delta Exchange’s demo trading account offers crypto traders, especially those in India, several practical benefits:

- Zero Risk: Users do not need to risk real INR capital to be able to test out strategies and tools.

- Live Market Conditions: Orders are executed in accordance with real-time market data – this provides an authentic trading experience.

- INR-Focused Interface: Other platforms tend to work with USD or USDT, but this crypto derivatives trading platform offers an INR-first interface – a crucial advantage for Indian crypto trading.

- Tool Familiarity: Users can practice using Delta’s advanced features – multi-leg options, technical indicators, stop-loss tools, etc.

- Confidence Building: Newcomers can build their competence and confidence before they start using real funds.

Step-by-Step Guide to Accessing Demo Mode

Using the demo trading mode on Delta Exchange is quite straightforward and requires just a few steps:

- Visit Delta Exchange: Go to the Delta Exchange website.

- Sign Up or Log In: Create a free Delta Exchange account or log in if already registered.

- Access the Demo Trading Section: After logging in, navigate to the ‘More’ and select Demo Trading.

- Choose Your Instruments: Select from a variety of crypto derivatives like Bitcoin (BTC), Ethereum (ETH), and altcoins. Demo mode supports perpetual futures, and options.

- Place Orders Using Virtual Funds: Utilize the same interface and tools as in the live version. Place market or limit orders, use trailing stops, and execute options combos using the strategy builder.

- Monitor and Manage Trades: Track open positions, unrealized P&L, order history, and performance metrics as you would in a live environment.

- Review Results: Evaluate how strategies performed. Did stop-loss triggers work as expected? Was the position sizing effective? Use these learnings to refine your approach.

Key Features Available in Demo Mode

The Delta crypto derivatives trading platform ensures that users get access to nearly the full suite of trading tools, even in demo mode:

- Perpetual Contracts & Options

Trade virtual positions on major tokens via perpetual swaps and European-style options.

- Advanced Charting & Indicators

Leverage built-in TradingView charts, drawing tools, and indicators to run technical analysis.

- Multi-Leg Options Strategies

The strategy builder enables users to simulate iron condors, straddles, strangles, and other complex options positions.

- Order Management Tools

Try out stop-loss, take-profit, and trailing stop orders to fine-tune risk management.

- Real-Time Order Books

Get familiar with live bid/ask spreads and understand how liquidity impacts execution.

Who Should Use the Demo Trading Feature?

The demo trading mode is ideal for a wide range of users:

- First-Time Crypto Traders: Those new to crypto derivatives can learn without risk.

- INR-Based Users: Crypto traders in India who prefer dealing in INR can understand platform mechanics without currency confusion.

- Experienced Investors: Pros can test new strategies or evaluate Delta’s execution and pricing models.

- Institutions & HFT Firms: High-volume users can simulate algorithmic strategies before deploying real funds.

Tips to Make the Most of Demo Mode

While demo mode uses virtual capital, users are advised to treat it like a real-money environment for maximum benefit. Some tips include:

- Record Every Trade: Maintain a trade journal to evaluate decisions and outcomes.

- Start with Small Positions: Mimic real-world constraints by avoiding oversized positions.

- Test Different Market Conditions: Try out strategies during high and low volatility phases.

- Set Risk Parameters: Use stop-loss and risk-reward ratios even in demo mode for habit-building.

Why Delta Exchange’s Demo Mode Stands Out

Many crypto derivatives trading platforms offer demo trading, but Delta Exchange’s demo mode provides an edge through:

- INR Denomination: Give Indian crypto traders a familiar denomination to work with, helping them relate with much more ease.

- Regulatory Compliance: Delta Exchange is registered with India’s FIU and offers its users solid confidence.

- Seamless Transition: Users can easily switch from demo to live trading from the same interface.

- Mobile Access: Demo trading can be accessed on both Android and iOS devices using Delta’s mobile app.

Conclusion

The use of crypto exchanges in India is only set to increase, and Delta Exchange is enabling crypto traders to safely enter this space with its powerful demo trading feature. Traders can practice in real-time conditions, sharpen their skills, and explore powerful tools – all without any financial risk.

Regardless of whether one is testing multi-leg options strategies or simply trying to figure out how to place a stop-loss order, Delta Exchange’s demo mode offers the perfect sandbox to learn and grow.

Ready to start risk-free trading? Head to Delta Exchange’s demo mode today.

Disclaimer: Cryptocurrency trading involves a high degree of risk and may not be suitable for all investors. Prices are very volatile and subject to market risks. Readers are advised to carry out their own research and consult licensed financial advisors before making any investment decisions. Delta Exchange operates in compliance with applicable Indian regulations and is registered with the Financial Intelligence Unit (FIU) of India.