When in person gatherings disappeared almost overnight, many event and marketing teams pressed pause. Onyinye Gift Ejike hit play. The banker turned business development professional, now founder of The Velvet Expression, moved her clients onto virtual stages, digitised the workflows that drag down margins, and proved line by line on the dashboard that technology is more than a convenience. Used with discipline, it can turn cost centres into profit engines.

“Spend becomes investment the moment you can show the path from attention to income,” she says, crediting her early career in finance for teaching her that nothing matters until it is measured. “Technology is the bridge between an idea and its impact. Without it you are guessing. With it you are in control.”

Ejike’s professional journey began in 2008 at Skye Bank Plc, where she was immersed in credit risk management, product marketing and market penetration strategy. There she learned to connect initiatives directly to revenue, deposits and compliance targets. In 2012 she crossed into advertising at Centrespread, handling accounts for Skye Bank, MoneyGram and PZ Cussons. “That was when I realised technology could shape decisions at every level,” she says. “We used it for audience segmentation, market research, and campaign tracking so we could justify spend to clients and prove outcomes.”

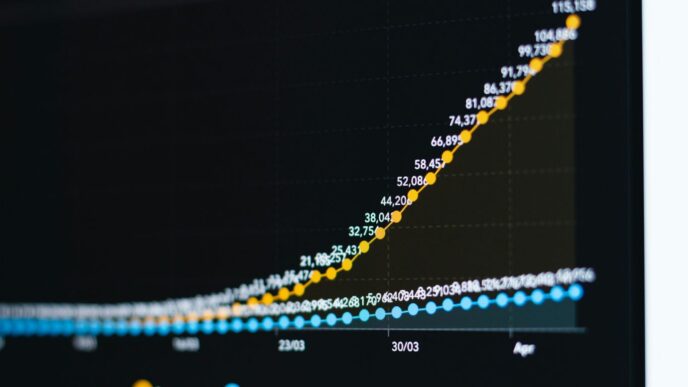

By 2015 she launched The Velvet Expression in Lagos with a clear thesis: every stage of a brand experience should be visible in data. Vendor coordination shifted onto collaborative software. Leads were captured and nurtured through a CRM instead of scattered across email chains. Campaigns were monitored and refined using real time analytics. The results were striking: event ROI climbed more than 50 percent year on year and project turnaround times dropped by nearly 30 percent compared to pre digital baselines.

“Technology was not an add on,” she explains. “It was the operating system of the business. It allowed a small firm like mine to deliver like a big one.”

The Velvet Expression ran on three interconnected pillars. The first was digital project management, bringing briefs, budgets and approvals into a single view so nothing was lost. The second was analytics everywhere, from RSVP conversions to post event surveys, to ensure every touchpoint had a metric. The third was automation for scale, retargeting engaged audiences, automating follow ups and reminders, and freeing staff to focus on creative work.

Her biggest stress test came with the FunnyBone Untamed Concert Series between 2016 and 2019. By leveraging Facebook and Google Ads analytics, per attendee acquisition costs fell by about 25 percent while ticket sales climbed each year. The campaigns reached Nigerian diaspora audiences in the UK and North America, showing that with data and targeting even a local promoter could compete globally. “Technology leveled the playing field,” she says.

Corporate events saw similar benefits. Online registration systems and QR code check ins cut manual errors by more than 60 percent. Same day wrap reports tied engagement data directly to business objectives, something finance teams could take to the boardroom. “We treat a program like a mini profit and loss statement,” Ejike says. “Every dataset must answer a commercial question.”

Then came 2020. Physical venues went dark. The Velvet Expression did not. The team pivoted to virtual and hybrid formats, deploying streaming technology, real time polls and moderated breakout rooms. Attendance ceilings disappeared. A corporate strategy retreat that previously maxed out at a few hundred participants drew 70 percent more people online than in person.

The global market was undergoing the same transformation. The virtual events market, valued at nearly 78 billion dollars in 2019, was projected to grow at about 23 percent annually through the mid 2020s as hybrid became habit and platforms matured. UK employer surveys conducted in 2021 showed that 73 percent planned to continue hybrid work and event models well beyond the pandemic. “Hybrid was not a stopgap,” Ejike says. “Technology made it measurable and the results made it non negotiable.”

This was also the period when data analytics became central to her operations. “We turned every program into a data laboratory,” she explains. Before an event, her team tracked RSVP conversions and cost per attention. During the event they measured watch time curves and interaction rates to know exactly where audiences leaned in or tuned out. Afterward they followed sponsorship ROI, lead quality and conversion percentages.

One campaign that stands out is the launch of Traveltank Limited in 2021. Using Google Analytics and social insights, the team refined messaging in real time and delivered a 40 percent increase in booking enquiries in the first quarter after launch. “Numbers tell you what happened, conversations explain why, and technology ties them together so you can act on both,” she says.

Her commitment to structure runs deeper than event planning. Ejike co authored research papers on financial advisory standardisation and tax compliance, work that shaped her approach to process design. “Technology thrives where there is structure,” she notes. “Once a process is codified you can digitise it, automate it, and remove the human error that costs money.”

She sees this mirrored in global policy trends. The UK’s Making Tax Digital initiative pushes VAT reporting into approved software, reducing errors and creating cleaner audit trails. “Compliance becomes lighter when the system does the heavy lifting,” she says. “That is what we aimed for internally too.”

For small and medium enterprises her advice is unapologetically practical. “Pick one friction that blocks revenue and fix it with technology,” she says. “Start with two tools, usually a CRM and cloud accounting. Then measure three numbers that everyone on the team understands: cost to attention, intent to income, and efficiency per head.”

Studies back her approach, showing that CRM adoption can boost sales by 18 percent, digital accounting by almost 12 percent, and e commerce platforms by roughly 7.5 percent over three years. UK government research found that using just two digital tools can raise SME productivity by about 25 percent. “The smallest wins are the loudest persuaders,” she says. “Automate one follow up flow, double a founder’s calendar bookings, and you never have to convince them again.”

Three lessons stand out from her arc. First, geography is optional because hybrid events erase borders and let a Lagos product demo host live participants from London and Houston. Second, resilience must be designed because firms with digital processes kept running while others froze. Third, compliance becomes part of the product because digitised workflows produce reliability that customers notice.

If there is a signature to her method it is that creativity is anchored by accountability. Stage concepts get 3D visualisations before build. Budgets sit in shared dashboards with clear ownership. Social clients preview their setups virtually, reducing late stage changes, while corporate clients receive reconciliations that tie spend to outcome. Her approach has helped some businesses trim up to 20 percent from event overheads without sacrificing quality. “Technology does not replace creativity,” she says. “It protects it and gives it a framework to deliver results.”

For Ejike, digital transformation is not about chasing trends but about creating continuity and clarity. “Digital is destiny,” she says with emphasis. “Instrument your sales, your service, your compliance. Train your people as hard as you buy your platforms. If you do that technology will not just make you faster. It will make you more truthful to what your customers really need.”