Before making any investment decisions, a cryptocurrency project’s Token Economics or tokenomics should be carefully considered, as a large portion of its success may indeed be attributed to this. Therefore, skipping over the tokenomics of the project you want to invest in may be the last thing you could do.

It might be difficult for a beginner investor in the crypto industry to decide which cryptocurrency to invest in, given the constant influx of new Defi projects into the market. You could be unsure about the precise value that you assign to a certain coin. This is where a cryptocurrency’s tokenomics might help you decide whether you should invest in it or not.

What Is Tokenomics?

We might quickly need to examine what a crypto token is before proceeding. This is essentially a unit of digital currency created on top of an existing blockchain–exchangeable with a set value, much like regular traditional currencies.

The term “tokenomics” is simply the combination of the terms “tokens” and “economics.” This describes a thorough examination of how blockchain technology applies to digital currency. Every crypto tokens project must have this in place, unlike traditional currencies that usually do not have a set amount of units that will be issued and distributed to the general public.

Central banks and governments create issue new currencies and distribute them into circulation to address problems like a poor economy, war, white elephant development projects, and many other economic challenges, all without taking into account the money’s value depreciation.

On the other hand, before a cryptocurrency is launched, its tokenomics are usually portrayed on the project’s website or in a white paper–which is a detailed document that outlines what the project will do, the issues it will address in the industry, as well as how it will function on a technological level. The tokenomics are usually built into a specific cryptocurrency’s computer code by its founding developers, right from the creation level.

What Makes a Good Tokenomics?

In this post, we will be going through the following five important things to consider in a crypto project’s tokenomics;

- Tokenomics Design Simplicity

- Token Supply

- Token Burn

- Emission Rate/Schedule

- Token Allocations and Vesting Periods

Tokenomics Design Simplicity

Good tokenomics should be extremely simple to grasp for both novice and seasoned crypto users. Unnecessarily complicated projects are more likely to conceal something critical than to provide true tokenomics in support of the value of investors and community members.

Token Supply

Tokenomics also determines a token’s maximum supply, which you must also take into consideration. For example, the maximum supply of Bitcoin (BTC) is limited to just 21 million units, with the last coin projected to be produced in the year 2140. Scarcity matters in every blockchain project, including non-fungible tokens (NFTs).

That’s obvious in how most of the NFT projects restrict the number of units that can be minted. Bored Ape Yacht Club, for instance, has a total of 9,999 NFTs that can ever be generated.

Token Burn

Some blockchains or protocols “burn” tokens, or remove them from circulation permanently, to lower the amount of currency in circulation and prevent inflation. Reducing a token’s supply will serve to boost its price as the remaining tokens in circulation become increasingly rare, as per the principles of supply and demand. Therefore, the price is expected to rise as the supply of tokens in circulation becomes limited.

Emission Rate/Schedule

The emission schedule or rate is the planned pace or speed at which new tokens are minted in accordance with the code protocols incorporated into the software of a particular blockchain. The emission rates are often high while a cryptocurrency project is still in its infancy, while it steadily decreases over time until the supply reaches its maximum. The core of tokenomics is how a token motivates users to maintain long-term viability.

The way Bitcoin develops its block subsidy and transaction fee is a fantastic example of this important approach. When bitcoin was launched in 2009, for instance, the cryptocurrency’s miners confirmed blocks of transactions every 10 minutes and were paid 50 BTC for each valid block. The block reward for each block, however, was reduced over time due to a series of halving events and has been placed in 6.25 bitcoins (BTC) per block rewards in 2022. This will continue to decline about every four years until all of the bitcoin has been mined, which is anticipated to happen in the year 2140.

Token Allocations and Vesting Periods

There must be a precise token allocation chart for each cryptocurrency project, either on the website or the whitepaper. Always verify if the project team is in possession of some of the tokens. While there will always be a part of the total supply allocated for the project’s developers, you need to keep in mind that the allocation shouldn’t be something up to 50%.

Being aware of a team that controls the bulk of the token’s supply is nothing but a “red flag.” This is due to the fact that if the team, for example, owns up to 50% of the total supply, they have the power to abandon the project at any time, sell their shares, and flee with the money from investors. Generally, the project must allocate most of the tokens to community members and public investors.

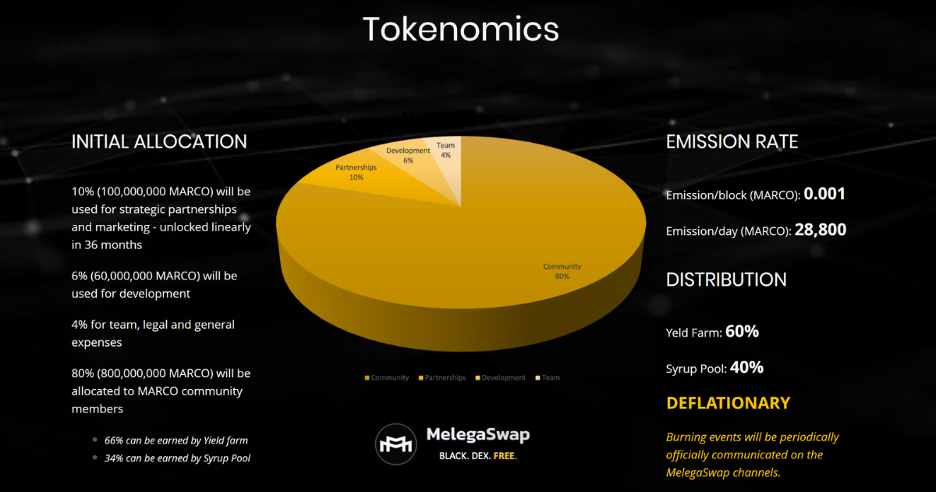

For instance, the MelegaSwap flagship token, $MARCO, is a deflationary token with a maximum supply of 1 billion. Only 4% of this, or 40 million of the supply, is set aside for team, legal, and general expenditures. The MARCO community members will receive 80% (800,000,000), of which 66% may be obtained through Yield farming and 34% through Syrup pooling.

Closing Thoughts

When deciding which cryptocurrency to invest in, you must comprehend the idea of tokenomics since the aspects it includes will undoubtedly have an impact on your investment. As a result, the factors stated above are the most significant and must be taken into account.