Thinking about using Shopify Payments for your online store? It’s a big decision, and like with anything, there are good things and not-so-good things to consider. We’ve looked into what people are saying in Shopify Payments reviews to give you a clearer picture. This isn’t about pushing you one way or the other; it’s about giving you the facts so you can decide if it’s the right fit for your business. Let’s break down what you need to know before you commit.

Key Takeaways

- Shopify Payments is built right into Shopify, making it super easy to set up and use without needing extra apps or complicated steps. This means you also skip Shopify’s extra fees for using outside payment processors.

- Most users find the pricing straightforward, with flat rates for transactions. However, it’s important to watch out for potential extra costs like chargeback fees, which can add up.

- A major plus is that it removes the extra transaction fees Shopify charges when you use a third-party payment system. Many reviews mention this as a big cost saver.

- Some users have reported issues with account restrictions or funds being held, especially if their business is considered ‘high-risk’ or if they have a lot of chargebacks. It’s not always ideal for every type of business.

- Security is generally strong, with PCI compliance and fraud tools. However, customer support can be a mixed bag, with some users feeling it’s lacking, especially on lower-tier plans.

Understanding Shopify Payments: Core Features and Functionality

So, what exactly is Shopify Payments and how does it work? Think of it as Shopify’s own way of handling money for your store. It’s built right into the platform, which is a pretty big deal. This means you don’t have to go out and find a separate company to process credit card payments for you. It’s all managed in one place.

What Is Shopify Payments?

Shopify Payments is essentially Shopify’s in-house payment processor. It’s designed to make accepting payments as straightforward as possible for anyone running a store on Shopify. You can start accepting payments pretty much right away once you set it up. This is a big plus because it cuts out a lot of the usual hassle involved in getting a payment system ready to go. It’s a service that’s available to Shopify merchants, and it works by partnering with Stripe behind the scenes for the actual processing.

Integrated Payment Processing Explained

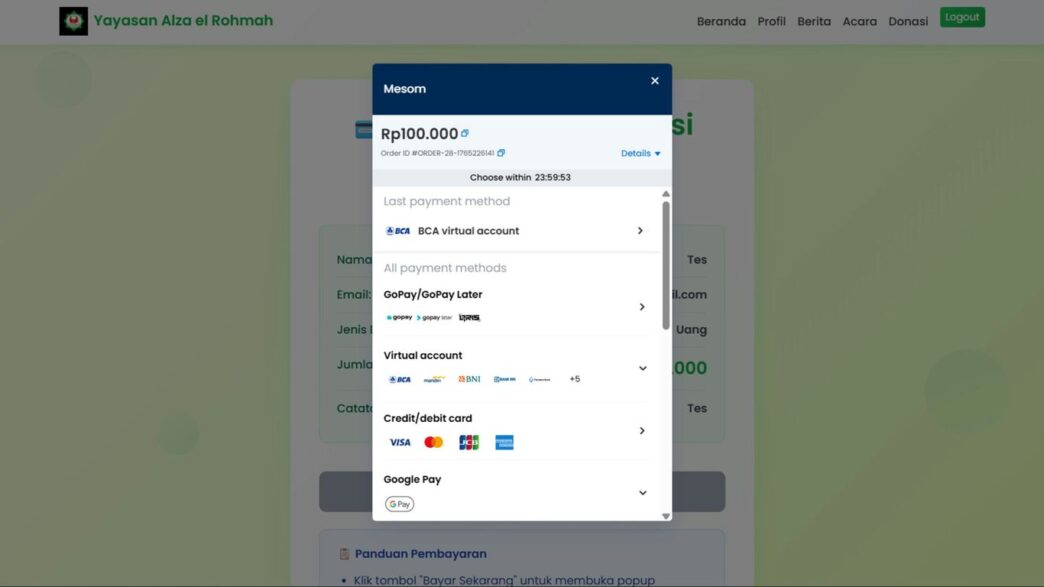

When we talk about integrated payment processing, it just means that the system for taking payments is already part of the software you’re using. With Shopify Payments, this integration is really tight. You don’t need to install extra apps or connect different services. Everything happens within your Shopify admin panel. This makes managing your sales and finances a lot simpler. You can see all your transactions in one spot, which is handy for keeping track of your business. It supports a bunch of different ways for customers to pay, like major credit cards, digital wallets like Apple Pay and Google Pay, and even manual payment options. For businesses selling internationally, it also handles currency conversions automatically, so customers can pay in their own money. This can really help reduce abandoned carts.

Seamless Integration with Shopify Stores

This is where Shopify Payments really shines. Because it’s built by Shopify, for Shopify, the integration is super smooth. There aren’t any complicated steps to connect it to your store. It just works. This is especially good news if you’re new to running an online store and aren’t super tech-savvy. You get access to features like Shop Pay, which is a faster checkout option for returning customers who have saved their details. It also comes with security features to help protect against fraud, like fraud analysis tools. Plus, Shopify handles the PCI compliance for you, which is important for keeping customer data safe. If you’re looking to accept payments online, Shopify Payments is a solid choice for Shopify users.

Navigating Shopify Payments Fees and Pricing Structures

When you’re setting up your online store, figuring out the costs involved is a big part of the process. Shopify Payments has a pretty straightforward fee structure, which is a relief for many new business owners. The main thing to get your head around is how they charge for processing transactions.

Transparent Fee Disclosure

One of the good things about Shopify Payments is that they’re pretty upfront about what they charge. You won’t find a lot of hidden fees popping up unexpectedly. This transparency means you can actually plan your budget without worrying about surprise charges. They lay out the rates clearly on their website, and generally, users report that what you see is what you get. This makes it easier to compare their costs against other payment processors.

Understanding Transaction Rates

Shopify Payments uses a flat-rate pricing model. This means the percentage you pay per transaction is fixed, and it varies slightly depending on your Shopify plan. For example, if you’re on the Basic Shopify plan, you’ll pay a certain rate, and if you’re on the Advanced Shopify plan, that rate might be a bit lower. This is a big plus because you don’t have to deal with complex interchange-plus pricing, which can be confusing.

Here’s a general idea of how it works:

- Basic Shopify: Typically around 2.9% + $0.30 per online transaction.

- Shopify Plan: Slightly lower, around 2.6% + $0.30 per online transaction.

- Advanced Shopify: The lowest rates, around 2.4% + $0.30 per online transaction.

It’s important to note that these rates can change, and they also differ for in-person sales versus online sales. Always check the latest rates directly on Shopify’s site for the most current information.

Additional Costs and Potential Add-Ons

While Shopify Payments itself doesn’t charge monthly fees, setup fees, or extra charges for payment security, there are a couple of other things to be aware of. If a customer disputes a charge and files a chargeback, there’s a fee for that. In the US, this is typically $15 per chargeback. While this might seem high, it’s pretty standard across the payment processing industry.

Also, if you decide to use a third-party payment gateway instead of Shopify Payments (which you can do, but it’s usually not recommended if you want to avoid extra fees), Shopify will charge you an additional transaction fee. This fee depends on your plan, ranging from 0.5% to 2% on top of what the third-party processor charges. So, sticking with Shopify Payments usually saves you money in the long run. An optional add-on is POS Pro, which offers more advanced features for in-person sales, but this comes with an extra monthly cost.

Key Benefits Highlighted in Shopify Payments Reviews

When you’re looking at payment processors, it’s easy to get lost in all the technical details. But what do actual merchants say they like best about Shopify Payments? Based on reviews, a few big advantages keep popping up.

Eliminating Third-Party Transaction Fees

This is a pretty big one for most sellers. If you use a payment processor other than Shopify Payments, Shopify adds its own fee on top of what the processor charges. It’s like paying a toll on a toll road. But when you use Shopify Payments, that extra Shopify fee disappears. This means you keep more of the money from each sale. For businesses trying to make every dollar count, this can make a real difference.

Competitive Processing Rates for Merchants

Beyond just avoiding Shopify’s extra fees, the rates themselves are often seen as quite good. While they might not always be the absolute lowest out there for every single transaction, they are generally competitive, especially when you consider the whole package. Many reviews mention that the rates are fair for the convenience and integration you get. It’s a solid middle ground that works well for a lot of different types of online stores.

Simplified Payment Management

This is where the "integrated" part really shines. Instead of logging into a separate payment gateway account to see your transactions, everything is right there in your Shopify admin. You can track sales, view payouts, and manage disputes all in one place. This makes running your business a lot less complicated, especially if you’re new to e-commerce. It means less time spent juggling different systems and more time focused on selling products. This unified approach helps streamline the entire payment processing experience for store owners.

Potential Drawbacks and Merchant Concerns in Shopify Payments Reviews

While Shopify Payments is a pretty sweet deal for a lot of online sellers, it’s not all sunshine and rainbows. Some folks run into issues, and it’s good to know about them before you jump in.

Account Ineligibility and Restrictions

Not everyone can use Shopify Payments, and sometimes accounts get shut down. A big reason for this is that Shopify Payments isn’t available in every country. So, if you’re not in a supported region, you’re out of luck. Also, Shopify can decide to stop offering payment services if they think your business is too risky. This can be frustrating if you weren’t expecting it.

Funding Holds and Reserve Policies

This is a common complaint. Merchants sometimes find their money is held up, or put into a reserve. It’s pretty standard practice for payment processors when they see a higher chance of chargebacks. Shopify does this to protect itself and its users from potential fraud. While it’s a normal part of the business, it can be a real headache if you’re counting on that cash flow.

Limitations for High-Risk Businesses

If your business falls into what Shopify considers "high-risk" – think things like gambling, certain financial services, or even some subscription boxes – you might not be able to use Shopify Payments at all. They’re generally set up for lower-risk retail businesses. If this is you, you’ll likely need to use a third-party payment gateway. Just remember, using an external processor usually means paying an extra fee on top of what Shopify already charges.

Security and Compliance in Shopify Payments

When you’re running an online store, keeping your money and your customers’ information safe is a big deal. Shopify Payments takes this pretty seriously, building in a bunch of security stuff right from the start. You don’t have to be a tech wizard to benefit from it either.

PCI DSS Compliance and Data Encryption

First off, Shopify Payments is compliant with PCI DSS. That’s a mouthful, but basically, it means they follow strict rules for handling credit card information. All the sensitive data, like card numbers, gets scrambled using encryption before it even travels over the internet. This helps stop bad actors from grabbing that info. Since Shopify handles all this, you don’t have to worry about setting up your own complex security measures for PCI compliance. It’s all part of the package.

Fraud Analysis Tools

Nobody wants fraudulent orders messing up their business. Shopify Payments has tools that look at each transaction as it happens. It checks things like if the shipping address matches the billing address, the buyer’s IP address, and if the order looks unusual compared to past purchases. If something seems fishy, the transaction might get flagged for you to review or even declined automatically. This can save you a lot of headaches down the road.

GDPR Compliance for EU Merchants

If you sell to customers in Europe, you’ve probably heard of GDPR. It’s a set of rules about how personal data is handled. Shopify Payments is designed to meet these requirements. This means that if you have EU customers, you can feel more confident that you’re handling their data in a way that follows the law. It’s one less thing to stress about when you’re trying to grow your business internationally.

Customer Support and User Experience

When you’re running a business, especially online, having reliable support when things go sideways is pretty important. With Shopify Payments, you’ve got a few ways to get help, and how easy it is to use often depends on what kind of help you need.

Personalized Support vs. Self-Service Options

Shopify keeps its customer service and technical support in-house, which is good because they know their own system inside and out. You can reach out 24/7 through live chat, email, or phone. For those who like to figure things out themselves, there’s a massive knowledge base packed with articles and guides. It’s pretty extensive, and honestly, you can usually find answers to common questions pretty quickly in there. They also have tutorial videos, though some users find them less in-depth than they’d like.

However, getting to a live person can sometimes be a bit of a maze. While chat and email are generally available, phone support might be limited to higher-tier plans. Some users have reported that lower-tier plans might even involve chatbots initially, which can be frustrating if you need a real human to sort out a payment issue. It seems like if your problem is directly with payments, you’re more likely to get a quick, helpful response compared to, say, a website design snag.

User Feedback and Review Aggregates

Looking at what other merchants say, experiences with Shopify’s support are mixed. Some folks have had really positive interactions, finding the support reps knowledgeable and quick to respond. Others, though, have shared stories of less-than-ideal service, feeling like they weren’t heard or that issues took too long to resolve. It’s not a universal problem, but it’s definitely something to be aware of. The self-service resources, like the knowledge base, tend to get higher marks across the board for being helpful and easy to find information in.

Ease of Use for New Entrepreneurs

For someone just starting out, the integrated nature of Shopify Payments is a big plus. It means less hassle setting up different payment gateways. The checkout process is designed to be straightforward for your customers, keeping everything within the Shopify environment. This consistency can build trust. The self-service options are also great for new entrepreneurs who might not have the budget for dedicated support staff and prefer to learn as they go. The biggest win is having payments handled directly within the platform you’re already using to build your store. While the live support can sometimes be a bit of a gamble, the readily available self-help tools and the overall simplicity of the integrated system make it a decent choice for many new online businesses.

Wrapping It Up

So, after looking at everything, Shopify Payments seems like a pretty solid choice for most people selling stuff online through Shopify. It’s built right in, which makes things way simpler, and you avoid those extra fees you’d get with other payment guys. It handles different currencies and has good security, which is a big plus. But, it’s not perfect. Some folks have had their accounts shut down unexpectedly, and sometimes your money might get held for a bit if they think your account is risky. Also, if you’re in a business that’s considered ‘high-risk,’ this probably isn’t the way to go. Make sure you read all the fine print before you commit, just like with any service. For many, though, the convenience and integration make it a good fit. It really comes down to what kind of business you run and what your priorities are.

Frequently Asked Questions

What exactly is Shopify Payments?

Shopify Payments is like a built-in payment system for your Shopify store. It lets you accept credit card payments directly without needing to set up a separate company to handle the money. Think of it as Shopify’s own way of making sure you get paid when customers buy your stuff online.

How much does Shopify Payments cost?

Shopify Payments has fees for each transaction, which is pretty standard for payment processors. The good news is that if you use Shopify Payments, you don’t have to pay an extra fee to Shopify itself on top of the payment processing fee. They try to be clear about their prices, but it’s always smart to check their latest rates.

Can anyone use Shopify Payments?

Mostly, yes, but there are some rules. Shopify Payments isn’t available in every country. Also, if your business is considered ‘high-risk’ (like selling certain types of products), Shopify might not let you use their payment service. It’s important to check if your business and location are eligible.

What happens if my account gets flagged?

Sometimes, if Shopify thinks there’s a higher chance of problems like too many customers asking for their money back (chargebacks), they might hold onto your funds for a little while. This is a safety measure to protect them and you from potential issues. It’s a good idea to understand their policies on this.

Is Shopify Payments safe to use?

Yes, Shopify Payments is designed to be very secure. They follow strict rules to protect customer information, like using encryption and meeting industry standards. They also have tools to help spot and prevent fraud, so you can feel more confident about your transactions.

What if I need help with Shopify Payments?

Shopify offers customer support, but the level of help might depend on your Shopify plan. While they have self-service options like guides and FAQs, some users on lower-tier plans might not get as much personalized support as those on higher plans. It’s good to know what kind of help is available before you sign up.