IonQ Stocktwits Sentiment Analysis

Retail Investor Buzz Surges

The chatter around IonQ on Stocktwits has really picked up lately. It feels like more and more regular investors are talking about IONQ, and the general vibe is getting pretty positive. This surge in interest is a big deal for a company in such a new field. It suggests that people are starting to understand the potential of quantum computing and IonQ’s place in it.

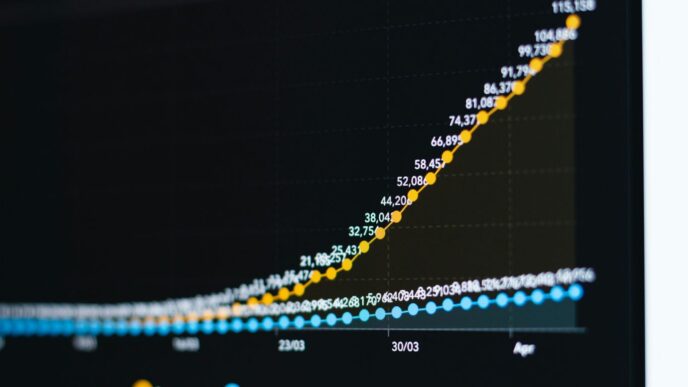

Message Volume and User Activity

Looking at the numbers, the activity on Stocktwits has gone way up. We’re seeing a significant jump in how many people are posting about IonQ and how often. In just the last week, the number of messages about the stock increased by about 90%. This kind of engagement usually means people are paying close attention, maybe looking for the next big move or trying to figure out the best time to get in.

Here’s a quick look at the recent activity:

| Metric | Previous | Current |

|---|---|---|

| Sentiment | Neutral | Extremely Bullish |

| Message Volume | Normal | Extremely High |

| Weekly Message Count Increase | N/A | 90% |

Overall Bullish Outlook

When you put it all together, the sentiment among retail investors seems to be leaning heavily towards bullish. People are excited about the company’s recent progress, like the UK regulatory clearance for the Oxford Ionics acquisition. This kind of news tends to get people talking and feeling optimistic about the future. It’s a sign that the community believes IonQ is on the right track, even with the usual ups and downs of the stock market.

Strategic Acquisitions and Partnerships

IonQ isn’t just building qubits in a vacuum; they’re actively making moves to grow and connect within the quantum ecosystem. It’s like they’re building the roads and bridges for future quantum networks.

UK Regulatory Clearance for Oxford Ionics

So, the big news here is that IonQ got the green light from the UK’s Investment Security unit. This clears the way for their planned acquisition of Oxford Ionics. This move is pretty significant because it brings more talent and technology under the IonQ umbrella, especially in the UK. It’s not just about buying a company; it’s about integrating their expertise to speed up IonQ’s own development.

Expanding Quantum Networking Capabilities

Beyond just acquiring companies, IonQ is focused on building out the infrastructure for quantum networking. Think of it like setting up the internet, but for quantum computers. They’re working on ways to connect different quantum systems, which is a huge step towards making quantum computing more accessible and powerful. This involves developing the hardware and software needed to link up these complex machines.

Government and International Collaborations

IonQ is also busy partnering up with governments and other international players. These collaborations are key for a few reasons:

- Funding Research: Government grants and partnerships can provide a lot of the financial backing needed for cutting-edge quantum research.

- Setting Standards: Working with international bodies helps shape the future standards for quantum computing, making sure different systems can talk to each other.

- Accessing New Markets: These partnerships can open doors to new applications and industries where quantum computing can make a difference.

It shows they’re playing the long game, not just focusing on the tech itself but also on how it fits into the bigger picture of global innovation.

Technological Advancements and Future Vision

RMQA: Enhancing Qubit Density

IonQ is really pushing the envelope with their new Reconfigurable Multicore Quantum Architecture, or RMQA. Think of it like being able to pack more processing power onto a single chip by rearranging how the quantum cores work. This is a pretty big deal because it means they can fit more qubits, which are the basic building blocks of quantum computers, onto one piece of hardware. This move is a significant step towards making quantum systems more scalable and practical, potentially allowing them to tackle problems that even today’s best supercomputers can’t handle. It’s all about getting more bang for your buck, quantum-style.

Scalability Goals: Qubits by 2026 and Beyond

Looking ahead, IonQ has some ambitious targets for increasing their qubit count. They’re aiming for a substantial jump in the number of qubits available in their systems by 2026 and are already planning for what comes after that. This isn’t just about having more qubits; it’s about making sure those qubits are high-quality and can work together effectively. The roadmap suggests a steady climb, moving from current capabilities to much larger, more powerful quantum machines in the coming years. It’s a long-term play, for sure.

High-Fidelity Ion-Trap Chips

What really sets IonQ apart is their focus on accuracy, or ‘fidelity’ as they call it. They use a method called ion traps, which is widely considered one of the most precise ways to build a quantum computer. This means their qubits are less prone to errors, which is a huge hurdle in quantum computing.

Here’s a quick rundown of why this matters:

- Precision: Ion traps allow for very stable qubits, leading to more reliable calculations.

- Connectivity: The architecture allows qubits to interact with each other, which is key for complex computations.

- Scalability: While challenging, the ion trap method has a clear path toward building larger systems.

This commitment to high-fidelity chips is what allows IonQ to make claims about their systems being the most accurate available today. It’s not just marketing; it’s rooted in the physics of how they build their machines.

Financial Performance and Growth Trajectory

Revenue Growth Amidst Net Losses

IonQ is definitely showing some growth in terms of what they’re bringing in, which is good to see. They’ve reported increasing revenue, which tells us that their quantum computing solutions are starting to get traction in the market. However, like many companies in this super early-stage tech space, they’re still operating at a net loss. This isn’t totally unexpected, though. Building out cutting-edge technology like quantum computers costs a ton of money, and it takes time to reach profitability.

Sustaining Research and Expansion

This net loss is largely tied to their commitment to heavy investment in research and development, plus expanding their operations. They’re not skimping on pushing the boundaries of quantum computing. This includes everything from developing new hardware, like their RMQA system, to building out the software and cloud access needed for businesses to actually use their machines. It’s a long game, and IonQ seems focused on building a solid foundation for the future, even if it means spending a lot now.

Comparison to Early-Stage Tech Giants

When you look at IonQ, it’s helpful to compare them to other tech companies when they were just starting out. Think about the early days of cloud computing or AI companies. Many of them also went through periods of significant investment and net losses before they became the giants we know today. IonQ is in a similar boat, trying to pioneer a new technological frontier. The key will be how effectively they can manage their spending while continuing to innovate and capture market share as the quantum computing industry matures.

Market Position and Competitive Landscape

The ‘Nvidia of Quantum’ Comparison

People are throwing around the "Nvidia of Quantum" label for IonQ, and it’s easy to see why. Just like Nvidia became the go-to for AI hardware, IonQ is aiming to be that essential player in the quantum computing space. They’re building the actual quantum computers, the core tech that everyone else will eventually build on top of. It’s a big claim, for sure, but it highlights the foundational role they’re trying to play. This positioning suggests they could be a key enabler for a whole new wave of quantum applications.

Precision and Enterprise Distribution Edge

What sets IonQ apart is their focus on precision and making their technology accessible to businesses. They’re not just building powerful machines; they’re working on making them reliable and usable for real-world problems. This means focusing on things like error correction and making sure the qubits are stable. For companies looking to explore quantum computing for things like drug discovery or financial modeling, having a partner that offers this level of precision is a big deal. It’s about moving quantum from a lab experiment to a business tool.

Accessibility Through Major Cloud Platforms

IonQ isn’t trying to go it alone. They’re making their quantum computers available through major cloud providers like AWS, Azure, and Google Cloud. This is super smart because it means businesses don’t need to build their own quantum data centers. They can just access IonQ’s systems like they would any other cloud service. This dramatically lowers the barrier to entry for companies wanting to experiment with quantum computing. It’s like renting super-powered computing instead of buying it outright. This strategy is key to getting more people using and developing on their systems.

Technical Chart Analysis and Entry Points

Looking at the charts for IonQ can be a bit of a mixed bag right now, but mostly in a good way. The stock has been on a nice run, and a lot of indicators are pointing upwards, which is exciting if you’re already holding shares. However, for those looking to jump in, it might be worth watching for a slight dip first.

Bullish Momentum and Overbought Indicators

On the weekly chart, things look pretty solid. The conversion line is getting close to crossing above the baseline, which is often seen as a bullish signal, sometimes called a golden cross. This usually means more upward movement could be on the way. The daily chart is even more upbeat, with the candles sitting above the green cloud and the conversion line already above the baseline – that’s strong short-term bullish momentum.

But here’s the catch: the Relative Strength Index (RSI) is pretty high on both charts. On the weekly, it’s at 74, and on the daily, it’s even higher at 84. When the RSI gets this high, it means the stock has gone up pretty fast and might be a bit ‘overbought.’ Think of it like a runner sprinting – they might need a short break to catch their breath before they can sprint again. This often signals that a pullback or a period of consolidation could happen soon.

Key Resistance and Support Levels

There’s a bit of a pattern forming that looks like a double top. The all-time high around $54 is a major resistance point. If IonQ can break through that, it could signal a whole new upward trend. But if it struggles there, we might see the price come back down.

What’s interesting is that $18, which was a previous support level, now seems to be acting as a neckline for this potential double top. This makes it an important psychological level to watch. If the stock does pull back from the $54 resistance, we could see it test levels like $41.66, $37.12, or $33.41 before finding support. These are key psychological price points that investors often watch.

Potential Pullback Strategies for Investors

So, if you’re thinking about buying IonQ, waiting for a pullback might be a smart move. It’s not about timing the market perfectly, but rather finding a better entry point. Here are a few levels to consider, keeping in mind your own risk tolerance:

- High Risk Entry: Around $41.66. This is closer to the current price, so it carries more risk if the pullback goes deeper.

- Moderate Risk Entry: Around $37.12. This offers a bit more cushion.

- Low Risk Entry: Around $33.41. This is a more significant drop from current levels and would represent a larger pullback.

Before you decide, ask yourself: If I buy here and the price drops another 50%, how would I feel? Would I panic, or would I see it as a chance to buy more at a lower average price? Also, consider if you’d regret not buying if the stock suddenly takes off again. Investing is personal, and it’s always best to do your own homework based on your financial goals and how much risk you’re comfortable with.

Wrapping It Up: IonQ’s Quantum Leap

So, what’s the takeaway from all the chatter around IonQ? It looks like the company is making some serious moves, especially with that big acquisition getting the green light. The buzz on Stocktwits definitely picked up, showing people are paying attention. While IonQ is still in the early stages and not making money yet, they’re pushing hard with new tech and partnerships, kind of like a startup trying to hit it big. The comparison to Nvidia is a bold one, and time will tell if they can live up to it. For folks watching the quantum space, IonQ is certainly a name to keep an eye on, but remember, this is a long game, and things can get bumpy. It’s worth watching how they handle growth and keep delivering on their promises.