Lately, there’s been a lot of talk about whether the crypto market is heading for a big fall. You see headlines everywhere asking, ‘Is crypto about to crash?’ It’s understandable why people are asking. Prices have been all over the place, and it feels like things could get shaky. We’ve gathered some expert opinions to try and make sense of what’s happening and what might come next. Let’s see what they have to say about all this market ups and downs.

Key Takeaways

- Federal Reserve policy and ongoing liquidity concerns are major factors influencing crypto prices, with no immediate signs of aggressive rate cuts.

- Geopolitical events are adding a layer of uncertainty to the market, potentially impacting global trade and inflation, which in turn affects investor risk appetite.

- Technical indicators, like moving averages and chart patterns, are showing some bearish signals, suggesting caution is warranted in the short term.

- On-chain data indicates that some experienced investors are selling, but long-term holders seem to be maintaining their positions, pointing to a potentially healthier market structure than in previous peaks.

- While severe crash scenarios exist, the current market dynamics suggest a controlled reset rather than a disorderly unwind, with sentiment showing persistent fear but not extreme panic.

Is Crypto About to Crash? Expert Perspectives on Market Volatility

The crypto market’s been a bit of a rollercoaster lately, and a lot of folks are wondering if a big crash is just around the corner. It’s not just one thing causing the jitters; it’s a mix of factors that have experts talking. The big question on everyone’s mind is whether the current volatility signals a major downturn or just a temporary pause.

Federal Reserve Policy and Liquidity Concerns

The US Federal Reserve’s recent decision to hold interest rates steady at 3.50%–3.75% was pretty much expected. While this didn’t cause a huge shock, it also didn’t give the market the boost some were hoping for. Fed Chair Jerome Powell didn’t give any strong hints about when rate cuts might happen, basically saying it’s unlikely unless the economy really slows down. This means the amount of money flowing into markets, often called liquidity, isn’t increasing much. We’re seeing this play out with US spot Bitcoin ETFs, which have had net outflows recently. It’s not a massive exodus, but it shows that fresh capital isn’t rushing in like it did before. This lack of new money can make it harder for prices to climb.

Geopolitical Risk Adds Uncertainty

On top of economic policy, global events are adding another layer of worry. Tensions in the Middle East, for instance, have people concerned about potential disruptions to global trade, especially key shipping routes. If conflicts escalate, oil prices could jump, which might bring back inflation worries and make the Fed even more hesitant to cut rates. For crypto, this kind of uncertainty can be a double-edged sword. In the short term, it often leads to a move away from riskier assets, and crypto definitely falls into that category for many investors. It’s another reason why caution is the word of the day.

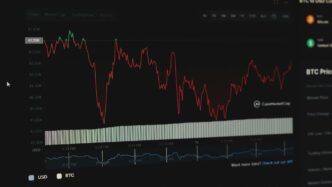

Technical Indicators Signal Caution

Looking at the charts, some technical signals are also suggesting a need for caution. Bitcoin has pulled back from its recent highs and is now trading below some key moving averages, which is usually seen as a short-term bearish sign. There’s also a pattern forming that could suggest prices might continue to move lower if current support levels don’t hold. The momentum indicators are also showing less strength. Right now, immediate support is around the $86,000 mark. If Bitcoin can’t hold that level, we could see it test lower prices, potentially heading towards the $85,000 range.

Here’s a quick look at some key levels and indicators:

- Bitcoin Price: Currently trading within a range, showing indecision between buyers and sellers.

- Moving Averages: BTC has fallen below its 50-day and 100-day EMAs, a bearish signal.

- Relative Strength Index (RSI): Dropped below 50, indicating weakening momentum.

- Support Levels: Immediate support is near $86,000, with further levels at $85,300.

Understanding the Current Crypto Market Downturn

So, what’s going on with crypto prices right now? It feels like we’ve hit a bit of a speed bump, and frankly, it’s not exactly a surprise given everything happening.

Bitcoin and Ethereum Price Movements

Bitcoin, the big kahuna, has been doing its usual thing – moving quite a bit. After hitting some highs, it’s pulled back, slipping below that $90,000 mark that everyone watches. It’s been trading in a pretty tight range, bouncing between around $86,000 and $90,000. This tells us there are buyers stepping in when it dips, but sellers are also showing up when it tries to climb higher. Ethereum isn’t doing much differently. It also failed to hold onto the $3,000 level, which was acting as a bit of support. Now, it’s looking at lower levels, with key support points around $2,890 and $2,790.

Other major coins are feeling the pinch too. Dogecoin and Solana have seen noticeable drops, while Litecoin took a bigger hit. Binance Coin has held up a bit better, and Tron was actually one of the few gainers. It’s a mixed bag, but the overall trend for the big players has been downward recently.

Broader Market Performance

It’s not just Bitcoin and Ethereum. The whole crypto market seems to be in a bit of a funk. The total value of all cryptocurrencies has dipped, and most of the top 100 digital assets are trading in the red. This isn’t just a few coins having a bad day; it’s a more widespread slowdown. The Nasdaq Crypto Index, which tracks a bunch of digital assets, also fell, showing that this isn’t an isolated crypto issue but part of a larger market sentiment.

Elevated Trading Volumes

Here’s an interesting point: even though prices are down, trading volumes have been pretty high. This isn’t necessarily a sign of panic selling, like you might see in a full-blown crash. Instead, it suggests that people are actively moving their positions around. They’re buying and selling, repositioning their portfolios based on the current market conditions. It’s more like a busy marketplace where everyone’s trying to figure out their next move, rather than a stampede for the exits.

Macroeconomic Factors Influencing Crypto Prices

Interest Rate Decisions and Future Policy

The Federal Reserve’s recent decision to keep interest rates steady at 3.50%–3.75% was pretty much what everyone expected. It didn’t cause a huge drop, but it also didn’t give the market a big boost. Fed Chair Jerome Powell didn’t give any strong hints about cutting rates anytime soon, basically saying they’ll likely wait until later in 2026 unless the economy really starts to slow down. This means the current level of money available in the system is staying put – not getting tighter, but not getting looser either. For crypto, this is okay for now, but it’s not exactly a green light for massive growth. Think more along the lines of the market just kind of hanging out, maybe trading sideways. Bitcoin, for instance, is expected to stick around the $88,000 to $91,000 mark. To really push higher, like past $95,000, we’d need to see some clearer positive signs from the broader economy.

Inflation Fears and Currency Debasement

While the Fed’s current stance might be keeping things stable, there’s always the background worry about inflation. If inflation starts to creep up again, especially if there are global issues like conflicts that disrupt oil supplies and push energy prices higher, it could complicate the Fed’s plans. Higher energy prices often mean higher inflation, which could make the Fed hesitant to cut rates. In such a scenario, some investors might look to assets like Bitcoin again as a way to protect their money from a weakening dollar, a concept often called currency debasement. However, right now, the immediate focus seems to be more on the risk of assets going down rather than hedging against inflation.

Impact of Traditional Equity Markets

It’s become pretty clear that Bitcoin isn’t acting like a safe place to park your money anymore. Instead, it’s behaving more like a high-risk tech stock. When investors get nervous and pull back from stocks, Bitcoin tends to go down with them. Things like the Fed’s cautious approach to interest rates, a strong US dollar, and generally high stock market valuations all create a tougher environment for riskier assets like crypto. This connection means that what happens in the stock market has a pretty direct effect on crypto prices. If the stock market takes a hit, it’s likely that crypto will follow suit, at least in the short term.

On-Chain Data and Investor Behavior

Looking at what’s happening directly on the blockchain can tell us a lot about what people are actually doing with their crypto, not just what they’re saying.

Exiting Investors and Distribution Patterns

When prices drop, we often see a pattern where some investors decide to cash out. This can show up as a lot of coins moving from private wallets to exchanges, ready to be sold. It’s like people rushing for the exits when they get nervous. On-chain data indicates significant Bitcoin realized losses since late 2025, suggesting a bearish sentiment. However, on-chain metrics also reveal a more complex investor behavior, painting a nuanced picture of the market. This distribution can put more selling pressure on the market, especially if it happens quickly.

Long-Term Holder Conviction

On the flip side, we also look at the "hodlers" – those who bought crypto a while ago and tend to hold on through thick and thin. If these long-term holders are still keeping their coins, even when prices are down, it suggests they believe in the future value. Their conviction can act as a support level. We can track this by looking at how long coins have been held without moving. A large number of coins held for over a year, for instance, shows a strong base of patient investors.

Institutional Flows and ETF Activity

Lately, a big part of the story has been institutional money, especially with the new spot Bitcoin ETFs. Tracking how much money is flowing into and out of these ETFs gives us a clue about what larger players are doing. If institutions are buying, it can signal confidence. If they’re selling, it might mean they’re pulling back. While the launch of spot Bitcoin ETFs has brought new interest, institutional investors are still studying Bitcoin’s behavior and its cycles, which has slowed down massive inflows for now. This careful approach means we need to watch these flows closely to understand the bigger picture of institutional adoption.

Potential Downside Targets and Scenarios

So, what’s the worst that could happen? When we look at where Bitcoin and other cryptos might head if things really go south, a few different pictures emerge. It’s not all doom and gloom, but it’s smart to consider the possibilities.

Medium-Term Downside Projections

Right now, some analysts are pointing to Bitcoin potentially dropping to the $70,000 to $75,000 range in the coming months. If selling pressure really picks up, especially from those big ETF outflows we’ve been seeing, a move down to around $56,000 isn’t out of the question. This $56,000 mark is pretty significant because it’s close to Bitcoin’s "realized price," which is basically the average price people paid for their coins. Historically, bear markets have tended to find a bottom around this level.

Severe Scenario Warnings

Now, let’s talk about the more extreme possibilities. Some well-known figures in the crypto space have put out some pretty stark warnings. For instance, veteran trader Peter Brandt has suggested that an 80% drop from Bitcoin’s peak could send prices all the way down to $25,000. That’s a huge haircut, and it would likely require some truly catastrophic events, like a major economic collapse, serious policy blunders from governments, or a complete exit of big institutional players from the market. Similarly, analyst Mike McGlone has floated the idea of a drop to $10,000, though this is considered a very low-probability, "tail risk" scenario.

Historical Drawdown Comparisons

Looking back at past crypto downturns can give us some perspective. Remember May 2021? Bitcoin took a massive hit, dropping about 50% from its highs. That was triggered by a mix of things, like Tesla backing away from accepting Bitcoin, China cracking down on mining, and general worries about the environment. It took about six months for the market to start recovering from that dip. Comparing current price action to these historical drops helps us gauge the potential severity and duration of any future downturns. It’s a reminder that while crypto can see rapid gains, it can also experience sharp and prolonged declines.

Market Sentiment and Reset Dynamics

Right now, the crypto market feels a bit like a crowded room where everyone’s suddenly gotten quiet, looking around for a sign. The Crypto Fear & Greed Index is sitting at 26, which is definitely in the ‘fear’ zone. It’s been there for a bit, actually, down a few points from yesterday. This isn’t just a random number; it’s calculated from a bunch of market data, trying to capture how people are feeling about their investments. When it’s this low, it means folks are pretty nervous, and that can make prices do weird things.

The Crypto Fear & Greed Index

This index is a pretty neat tool. It goes from 0 (extreme fear) all the way up to 100 (extreme greed). A score of 26 means people are mostly worried. Historically, when the index gets this low, it sometimes means the worst is over, and things might start to turn around. Think of it like this: if everyone who’s going to sell has already sold out of fear, then there aren’t many sellers left. But, and this is a big ‘but’, sentiment can stay negative for a long time, longer than you’d expect. So, while 26 is a sign of fear, it doesn’t automatically mean prices will jump tomorrow. It’s more of a signal to pay attention.

Controlled Reset vs. Disorderly Unwind

So, is this a big, messy crash, or is the market just taking a breather and cleaning house? Some analysts think it’s more of a controlled reset. The trading volumes haven’t gone completely haywire, and the price drops, while painful, haven’t been completely chaotic. It’s not like everything is just falling apart all at once. This is different from past times when things got really messy, with lots of forced selling. Now, it seems like people are being a bit more careful. It’s like cleaning out your closet – you might toss a few things you don’t need, but you’re not burning the whole house down.

Selective Accumulation Strategies

Even with all the fear, some people are still buying, but they’re being picky. Instead of buying everything, they’re looking for specific assets that they believe have strong long-term potential. It’s not a free-for-all buying spree. Think of it like shopping after a sale – you don’t just grab random items; you look for the good deals on things you actually want. This selective approach suggests that while the overall mood is cautious, there’s still some confidence in certain parts of the crypto market. It’s about picking your spots rather than betting the farm.

Here’s a quick look at how sentiment can shift:

- Extreme Fear (0-25): Often a sign that a market bottom might be near. Sellers are exhausted.

- Fear (26-50): Indicates caution and uncertainty. Investors are hesitant.

- Neutral (51-74): A balanced market, neither overly optimistic nor pessimistic.

- Greed (75-100): Suggests potential market tops, as euphoria can lead to irrational buying.

Right now, we’re firmly in that ‘Fear’ zone, which, historically, has sometimes been a good time to start looking for opportunities, but only if you’re doing your homework and not just jumping in blindly.

So, What’s Next?

Looking at everything, it’s clear the crypto market is in a bit of a holding pattern right now. Experts point to big economic factors like interest rates and global events as the main drivers, not just crypto-specific news. While some see this as a necessary reset, clearing out some of the hype, others are watching for signs of a bigger downturn. It seems like a good time to be cautious, keep an eye on those big economic shifts, and maybe focus on projects with solid foundations. Nobody has a crystal ball, but understanding these influences can help you make smarter decisions in this bumpy ride.

Frequently Asked Questions

Why is the crypto market seeing a downturn right now?

The crypto market is currently experiencing a dip due to a mix of factors. The U.S. Federal Reserve is keeping interest rates steady, which doesn’t add much new money to the economy. Also, worries about global conflicts are making investors nervous, causing them to move away from riskier assets like crypto. This combination is leading to a period of consolidation rather than a strong upward trend.

What are the main concerns for Bitcoin and other cryptocurrencies?

Key concerns include the Federal Reserve’s cautious approach to lowering interest rates, which affects the amount of money available for investment. Geopolitical tensions are also a big worry, as conflicts can disrupt markets and make investors seek safer options. Additionally, some technical signs on charts suggest that prices might continue to fall in the short term.

Are big investors (institutions) still buying crypto?

Institutional interest has cooled off a bit. For example, Bitcoin exchange-traded funds (ETFs) have seen more money leave than come in recently. While some big players might still be investing, the overall trend shows less new institutional money entering the market compared to earlier periods. This means the market is relying more on existing long-term holders than on new big inflows.

Could crypto prices drop significantly, like in past ‘crashes’?

Some experts believe there could be further drops, with targets around $70,000 or even $56,000 for Bitcoin. More extreme predictions suggest prices could fall much lower under severe economic conditions. However, many analysts think the market is undergoing a controlled reset, not a complete collapse, especially since a lot of risky trading has already been cleaned out.

What does the ‘Fear & Greed Index’ tell us about the crypto market?

The Fear & Greed Index is currently showing a score in the ‘fear’ zone. This means most investors are feeling anxious or pessimistic about the market. While extreme fear can sometimes signal a potential rebound, it mainly indicates that people are being very cautious and holding back from buying.

Is this a sign that a long-term ‘crypto winter’ is coming back?

It’s not necessarily a full ‘crypto winter’ like we’ve seen before. Many experts see this as a necessary reset period. The market is clearing out excess speculation, which could pave the way for future growth once there’s more clarity on economic policies or if inflation fears return. For now, it’s a time for caution and careful investment choices.