AI Startup Funding Surges In 2025

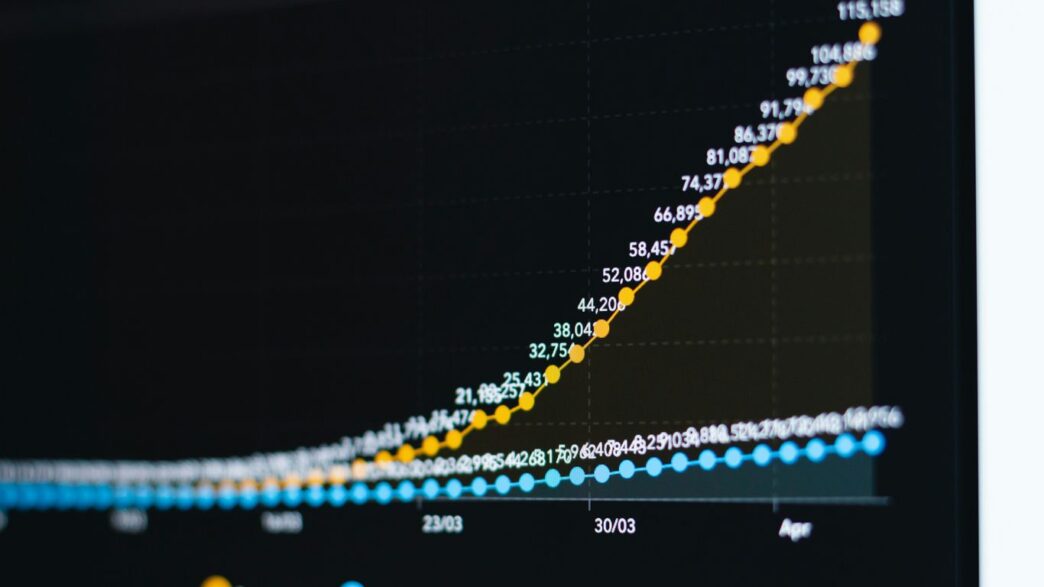

Wow, 2025 has been quite the year for AI startups, hasn’t it? It feels like every other week there’s news about some company raking in a huge pile of cash. Investors are really betting big on artificial intelligence, and it’s not just small amounts either. We’re talking billions being poured into companies that are building the next generation of AI.

Record-Breaking Investment Rounds

This year has seen some truly massive funding rounds that have set new records. Companies are raising capital at valuations that were almost unthinkable just a few years ago. It’s a clear sign that the market is hot and investors see huge potential for growth and returns in the AI space. For example, OpenAI closed a massive $8.3 billion round in July, valuing them at $300 billion. That’s a serious number! Then there’s Reflection.Ai, which snagged $2 billion in Series B funding, bringing their valuation up to around $8 billion. It’s not just the giants either; even earlier-stage companies are seeing significant investment.

Key Funding Announcements This Year

Looking back, several announcements really stand out. In April, Andreessen Horowitz started fundraising for a massive $20 billion fund specifically for AI startups, showing their commitment. Around the same time, SignalFire announced a $1 billion fund aimed at early-stage AI companies. We also saw Databricks raise an incredible $10 billion in January, one of the largest venture capital raises ever. These big moves signal a strong belief in the future of AI.

Here’s a quick look at some notable funding:

- OpenAI: $8.3 billion (July 2025)

- Databricks: $10 billion (January 2025)

- Reflection.Ai: $2 billion (Series B, Valuation $8B)

- SignalFire: $1 billion fund for early-stage AI

- Andreessen Horowitz: Aiming for a $20 billion AI fund

Investor Confidence in AI Innovation

It’s pretty clear that investors are feeling very confident about AI innovation right now. They’re not just throwing money at anything with an AI label, though. The focus seems to be on companies that are developing foundational models, creating practical applications across different industries, or building the necessary infrastructure to support AI development. This confidence translates into bigger checks and higher valuations, pushing the boundaries of what’s possible in AI.

Generative AI And Foundational Models Lead Investment

Funding For Large Language Models

It’s been a big year for companies building the brains behind the AI revolution. We’re seeing a ton of money flow into startups focused on generative AI and the foundational models that power them. Think of these as the super-smart engines that can create text, images, code, and more. Investors are really betting that these technologies will change how we work and create.

The sheer scale of investment in large language models (LLMs) and related generative AI platforms is staggering. Companies are raising hundreds of millions, sometimes even billions, to push the boundaries of what these models can do. It’s not just about making them bigger; it’s about making them smarter, more efficient, and more useful for specific tasks.

Here’s a look at some of the big players and trends:

- Model ML closed a significant $75 million Series A round. They’re using generative AI to automate some of the most tedious parts of investment banking. Imagine less paperwork and more strategic thinking – that’s the goal.

- Giotto.ai, a Swiss startup, is reportedly looking to raise over $200 million to compete in the race for Artificial General Intelligence (AGI). They’re focusing on models that can reason and plan, which is a big step up.

- xAI, Elon Musk’s AI venture, is rumored to have raised a massive $10 billion at a $200 billion valuation. This kind of capital injection signals a serious push to build out massive compute power and advanced training capabilities.

Advancements in AI Model Training Platforms

Building these powerful AI models isn’t easy. It requires massive amounts of data and serious computing power. That’s why startups creating platforms to train and manage these models are also attracting a lot of attention and funding.

These platforms are trying to make the process of training AI models faster, cheaper, and more accessible. Some are focusing on specialized hardware, while others are developing new software techniques to optimize the training process. It’s a complex area, but one that’s absolutely critical for the future of AI.

- SF Compute raised $40 million to expand its GPU-sharing marketplace. This is a smart way to make powerful computing resources available to more researchers and developers without them having to buy expensive hardware themselves.

- FortyTwo also secured funding to grow its decentralized network for training and running AI models. This approach aims to reduce reliance on big cloud providers and make AI development more distributed.

Investment in AI Compute Infrastructure

Underpinning all of this is the need for raw computing power. The demand for specialized hardware, like GPUs, and the infrastructure to support it, has exploded. Startups in this space are building everything from new chip designs to massive data centers.

It’s a bit like the gold rush – everyone needs the right tools to dig for AI gold. Investors are pouring money into companies that can provide the essential hardware and infrastructure that AI developers and researchers need to do their work. Without this foundation, none of the advanced AI models would be possible.

- Tenstorrent, an AI chipmaker, has received backing from notable investors like Jeff Bezos. They’re working on chips designed specifically for AI tasks, aiming to challenge established players.

- The sheer amount of compute needed for training foundational models means companies like xAI are reportedly raising billions to build out their own infrastructure, highlighting the immense capital required at the cutting edge of AI development.

AI Innovations Across Diverse Industries

It’s pretty wild how AI is popping up everywhere these days, not just in the usual tech circles. We’re seeing it make real waves in fields you might not expect, and honestly, it’s changing how things get done.

AI in Life Sciences and Healthcare

This is a big one. AI is really starting to speed up how we discover new drugs and figure out treatments. Think about it: instead of years of trial and error, AI can sift through massive amounts of data to find patterns we’d never spot. Companies are using it to predict how patients might respond to certain therapies or even to help doctors diagnose diseases earlier and more accurately. For example, ReportAid snagged €2.2 million in May to help hospitals sort out their data issues, which can apparently boost revenue by up to 25%. That’s a pretty tangible benefit.

AI for Climate Tech Solutions

With the climate situation, it’s good to see AI being used for something positive. Startups are building tools that help us use energy more wisely, develop new sustainable materials, and even monitor environmental changes more effectively. It’s not just about big, flashy projects either; smaller innovations are adding up. We’re seeing AI help optimize industrial processes to cut down on waste and emissions, which is a step in the right direction.

AI Transforming Financial Services

Banks and financial companies have been dabbling in AI for a while, but it’s really accelerating now. AI is getting used for everything from fraud detection to personalizing financial advice. It’s also making it easier for small businesses to get loans. Juice, for instance, raised $25 million in May to help UK small and medium-sized businesses get funding faster by using AI to look at their finances in real-time. This kind of tech can really make a difference for businesses that might otherwise struggle to get capital.

AI in Manufacturing and Supply Chain

This is where AI is really showing its practical side. Companies are using AI to make factories run smoother and to keep track of goods moving around the globe. Augury, which works on predictive maintenance for industrial machines, got $75 million back in February. Their AI helps factories avoid costly breakdowns by predicting when equipment might fail. On the supply chain front, AI is helping companies manage inventory better and figure out the most efficient ways to get products from point A to point B. It’s all about making things more reliable and less wasteful.

AI Startup Acquisitions And Mergers

The AI landscape in 2025 is really heating up, and not just with new funding rounds. We’re seeing a lot of big moves in terms of companies buying other companies, or merging to get stronger. It’s kind of like a big game of chess, with major tech players snapping up promising AI startups to boost their own tech stacks.

Strategic Acquisitions by Tech Giants

Big tech companies are definitely on the hunt. They’re looking for AI startups that have developed unique technologies or have a strong foothold in specific markets. For instance, we’ve seen major players acquire companies working on everything from specialized AI models for niche industries to platforms that help deploy AI more efficiently. It’s all about getting ahead of the curve and integrating cutting-edge AI capabilities quickly. Think about it: why build something from scratch when you can buy a company that’s already mastered it? This trend means that smaller, innovative AI companies can become attractive targets, offering a potential exit for founders and early investors.

Consolidation Trends in the AI Market

This buying spree is leading to a noticeable consolidation in the AI market. As more capital flows into AI, the number of startups also grows. However, not all of them will make it. We’re seeing a pattern where successful startups are either acquired by larger entities or merge with peers to gain scale and resources. This isn’t necessarily a bad thing; it often means that the best technologies and teams get to continue developing and have a bigger impact. It’s just that the market is becoming more focused, with fewer, but often more powerful, players emerging.

Impact of Acquisitions on AI Ecosystem

So, what does all this buying and merging mean for the broader AI ecosystem? Well, it can be a mixed bag. On one hand, acquisitions can inject significant resources into a startup’s technology, accelerating its development and market reach. This can lead to faster innovation and better products for users. On the other hand, it can sometimes mean that a promising technology gets absorbed into a larger, slower-moving corporate structure, potentially changing its original vision or limiting its accessibility. It also means that competition can become even more intense, as these newly combined entities often have substantial market power. We’re watching closely to see how these moves shape the future of AI development and accessibility.

Emerging AI Hubs And Regional Growth

It’s not just Silicon Valley anymore. AI innovation is popping up in unexpected places, and some cities are really leaning into becoming AI hotspots. We’re seeing a real shift as different regions start to carve out their own niches in the AI world.

Pittsburgh’s AI Life Sciences Boom

Pittsburgh is making some serious waves, especially where AI meets life sciences. This city has been quietly building up its tech scene, and now it’s really paying off. A lot of venture capital money has been flowing into AI companies focused on healthcare and biotech. It’s pretty cool to see how they’re combining advanced computing with medical research.

- Record investment rounds have been seen for AI companies in the life sciences sector based in Pittsburgh.

- The city is becoming a go-to spot for startups working on AI-driven drug discovery and personalized medicine.

- This growth is attracting top talent and creating a strong ecosystem for future innovation.

Growth of AI Startups in Australia

Down Under, Australia is also stepping up its AI game. They’ve got some really interesting startups tackling everything from supply chain issues to industrial problems. It feels like there’s a real push to make AI work for local industries and then take those solutions global.

- CADDi, a Tokyo-based startup, recently got funding from Atomico to expand its AI supply chain platform, showing international interest in the region’s AI capabilities.

- King River Capital launched a significant fund specifically to back AI startups, both in Australia and elsewhere.

- There’s a growing focus on developing AI that addresses specific market needs, from manufacturing to resource management.

Switzerland’s Deep-Tech AI Ecosystem

Switzerland might be small, but it’s punching above its weight in deep-tech AI. Think cutting-edge research and highly specialized AI applications. They’re attracting serious investment for companies working on complex problems, often in areas like advanced materials or defense technology.

- Quantum Systems, a German drone company with a strong AI focus, secured a massive €160 million round, highlighting the broader European AI landscape.

- Startups like CuspAI are raising substantial funds for AI-driven materials discovery, showing a move towards AI in hard science.

- The Swiss ecosystem benefits from strong academic institutions and a supportive environment for high-tech ventures.

Venture Capital Firm Strategies In AI

It’s pretty wild how much money venture capital firms are pouring into AI startups these days. They’re not just throwing cash around randomly, though. Different firms have their own ideas about where the best opportunities are and how to help these companies grow.

Andreessen Horowitz’s $20B AI Fund

Andreessen Horowitz, or a16z as most people call them, made some serious waves in April 2025 by reportedly starting to raise a massive $20 billion fund. The whole idea is to put that money into AI startups, especially those based in the U.S. It shows just how much faith they have in the American AI scene right now. They’re clearly betting big on AI being the next huge thing.

SignalFire’s Focus on Early-Stage AI

SignalFire took a slightly different approach in April 2025, announcing a $1 billion fund specifically for companies just starting out. They’re looking at startups that are building the core AI models themselves or creating AI solutions for specific industries. It’s all about getting in on the ground floor with the next big AI ideas.

Perplexity’s Venture Fund for AI Startups

Even companies that are already making a name for themselves in AI are getting in on the investment game. Perplexity, the AI search engine folks, launched their own $50 million venture fund in March 2025. They’re not just looking to invest in early-stage AI startups; they also want to give them a hand with their own experience. It’s a smart move that helps them stay connected to the broader AI world while backing promising new ventures.

Looking Ahead

So, what does all this mean for the AI scene as we wrap up 2025? It’s pretty clear that the money is still flowing, and big players are pouring billions into companies that are building the next wave of AI tools and infrastructure. We’re seeing everything from AI that helps design new materials to systems that manage complex code and even AI for better healthcare. It feels like every industry is finding a way to use AI, and investors are definitely taking notice. This year showed us that AI isn’t just a buzzword anymore; it’s becoming a real part of how businesses operate and innovate. It’ll be interesting to see what comes next as these funded companies grow and new ideas keep popping up.