The world of artificial intelligence is moving fast. New companies are popping up all the time, and the ones already here are getting big investments. We’re seeing AI pop up everywhere, from helping doctors to making software better. This article looks at the latest ai startups news, covering who’s getting money, what’s new, and where things seem to be headed.

Key Takeaways

- AI continues to be the main driver for venture capital, with many top deals across different industries and areas going to AI companies. This trend is expected to continue.

- North America, especially the U.S., is leading the way in AI startup funding, attracting a large majority of global investments. This dominance is fueled by significant growth in the AI sector.

- While AI funding is strong, the overall startup funding recovery can seem a bit shaky. A lot of the growth comes from a few very large deals, mostly in AI, meaning smaller startups might not see the benefits yet.

- Generative AI and foundational models are attracting major investments, alongside significant funding in AI applications for life sciences, healthcare, and cybersecurity. These areas show strong investor interest.

- Major venture capital firms are launching large funds specifically for AI startups, and established tech companies are making big bets, indicating a strong belief in the future potential of AI innovation.

AI Startups News: Funding Landscape Overview

The world of AI startups is really heating up, and it looks like investors are taking notice. We’re seeing a lot of money flowing into this space, which is great news for innovation. It’s not just one or two big players either; the funding is spread across various types of AI companies, from those building the core technology to those applying it to specific industries. The sheer volume of capital being deployed suggests a strong belief in AI’s future impact.

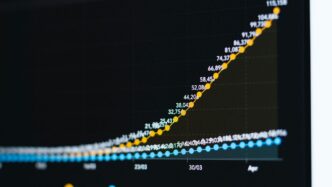

Global Venture Funding Trends in AI

Globally, venture funding saw a pretty solid uptick in the first half of 2025, largely thanks to AI. It seems like almost every major deal had some AI component. While some sectors like fintech are showing signs of recovery, with a few big IPOs giving investors some hope, AI is the consistent driver. A significant chunk of the money, nearly a third of all venture capital in the second quarter, went to just a handful of large companies, many of them in AI. This concentration means the overall recovery might feel a bit shaky if it doesn’t start spreading out more.

Here’s a quick look at how things shaped up:

- AI’s Dominance: AI was the common thread in most top deals across different regions and industries.

- Concentrated Capital: A large portion of funding went to a small number of big companies, many in AI.

- Sector Recovery: Fintech showed some positive movement, partly due to a few high-profile IPOs.

North America’s Dominance in AI Investment

North America is still the undisputed leader when it comes to startup funding. In the first half of 2025, the region snagged about 70% of all global funding. That’s a big jump from the previous year, with investors putting around $145 billion into companies in the U.S. and Canada. A huge part of this, nearly $90 billion, went directly to startups working on artificial intelligence. It’s clear that the U.S. AI sector is really leading the charge, attracting a massive amount of capital.

Asia and Europe’s Funding Dynamics

Things are a bit more mixed in Asia and Europe. Investment in Asian startups hit a low point in the first half of 2025, even with a slight bump in the second quarter. China, in particular, saw a big drop in funding. Overall, Asia-based startups raised about a third less money compared to the year before. India’s funding stayed about the same, while Israel actually saw a two-year high in quarterly investment. Europe’s funding has plateaued, showing a decrease compared to the previous year. Germany has now overtaken the UK as the top spot for venture capital investment in Europe for the second quarter.

Key AI Startup Funding Rounds

It’s been a busy start to 2025 for AI companies looking to grow and innovate. We’re seeing some really big numbers being thrown around, which tells us investors are still very keen on this technology. Let’s break down some of the most notable funding announcements from the first few months of the year.

Major AI Funding Announcements in Early 2025

Several big players have already secured substantial capital. Databricks, for instance, closed a massive $10 billion round in late January, valuing the company at $62 billion. This is a huge deal, and they plan to use the money for new AI products and expanding their reach. Not far behind, Anthropic, a company focused on AI safety, was reportedly in talks to raise $2 billion, potentially valuing them at $60 billion. Perplexity AI also had a strong showing, raising $500 million and reaching a $9 billion valuation. They’re even looking at adding ads to their search platform, which is an interesting move.

Here’s a quick look at some of the other significant rounds:

- Manas AI: Launched with $24.6 million from Reid Hoffman and Siddhartha Mukherjee, focusing on AI for drug discovery.

- KoBold Metals: Raised $537 million, likely for their AI-driven exploration efforts.

- CADDi: This Japanese startup got funding from Atomico to improve its AI supply chain tools.

- SplxAI: Secured €6.5 million to build out its security platform for AI chatbots.

- Lumi AI: Brought in $3.7 million in seed funding to help businesses get more from their data.

Significant Investments in Generative AI and Foundational Models

Generative AI and the companies building the underlying foundational models continue to attract a lot of attention. While specific figures for every round aren’t always public, the trend is clear: investors are betting big on the future of AI creation and intelligence. Companies working on large language models, AI image generation, and the infrastructure to support these massive models are seeing a lot of interest. It seems like every week there’s a new announcement about a company making strides in this area, often with significant backing.

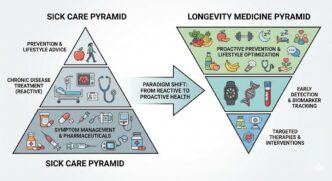

AI in Life Sciences and Healthcare Funding

The intersection of AI and healthcare is another hot spot for investment. We’re seeing startups use AI to speed up drug discovery, improve diagnostics, and personalize treatments. For example, Manas AI’s focus on cancer research with its new funding highlights this trend. Pittsburgh, in particular, is becoming a notable hub, with its AI life sciences companies attracting record venture capital. Companies like MapLight Therapeutics are raising hundreds of millions to develop AI-powered neuroscience treatments, and Ultromics is scaling its AI platform for heart failure detection. It’s really promising to see how AI is being applied to tackle some of the biggest health challenges we face.

Venture Capital Firm Focus on AI

It’s no secret that venture capital firms are really zeroing in on artificial intelligence these days. It feels like every other week, there’s a new fund announcement or a major firm declaring its AI-first strategy. This isn’t just a passing trend; it’s a fundamental shift in how capital is being allocated. The sheer volume of money pouring into AI startups is reshaping the investment landscape.

We’re seeing established players launch massive new funds specifically for AI. For instance, Andreessen Horowitz (a16z) is reportedly looking to raise a colossal $20 billion, aiming to capture the next wave of AI innovation in the US. That’s a huge bet, and it signals their conviction in the long-term potential of AI companies. Then you have firms like SignalFire, which has put together a $1 billion fund dedicated to early-stage AI ventures. They’re focusing on companies building foundational models and those creating AI solutions for specific industries. It’s a smart approach, trying to get in on the ground floor of what could be the next big thing.

Here’s a quick look at some of the major fund activities we’ve seen:

- Andreessen Horowitz (a16z): Reportedly raising a $20 billion fund for US AI startups.

- SignalFire: Launched a $1 billion fund for early-stage AI companies.

- FPV Ventures: Announced a $525 million fund targeting tech disruptors, with a strong AI component.

- King River Capital: Introduced a $157 million fund to back AI startups globally.

These aren’t just small, niche funds either. These are substantial amounts of capital, and they’re being deployed with a clear focus. It means that startups with strong AI components are finding it easier to attract attention and funding. However, it also means the competition is getting pretty intense. Getting noticed requires more than just a good idea; it needs a solid team, a clear market strategy, and demonstrable progress. The VC world is clearly betting big on AI, and it’s going to be fascinating to watch which companies manage to capitalize on this wave of investment. The sheer amount of capital available means that AI startups are dominating the funding scene, but it also raises questions about valuations and the long-term sustainability of some of these high-growth plays.

Innovations Across AI Sectors

Artificial intelligence isn’t just a buzzword anymore; it’s actively changing how different industries operate. We’re seeing AI pop up in places you might not expect, making things faster, smarter, and sometimes, just plain different. It’s pretty wild to see how quickly this tech is becoming part of everyday business.

AI in Fintech and Financial Services

The finance world is really leaning into AI. Think about credit risk. Companies like Experian have rolled out new tools that use AI to help banks and lenders update and check their credit risk models. This is supposed to make things faster and more transparent, which is a big deal when you’re dealing with money and regulations. It’s all about modernizing how they figure out who gets a loan and who doesn’t. Plus, with all the economic ups and downs lately, having smarter risk models seems like a good idea.

AI for Cybersecurity and Privacy Solutions

Cybersecurity is another area where AI is making waves, though it’s a bit of a double-edged sword. On one hand, AI is making cyberattacks, like Distributed Denial of Service (DDoS) attacks, way more sophisticated. These AI-powered bots can change their tactics on the fly, making them tough to stop with old-school defenses. But, and this is a big ‘but’, AI is also being used to fight back. Security companies are developing AI systems that can predict threats before they even happen. It’s like a constant arms race, with AI on both sides.

AI-Driven Platforms for Supply Chain and Operations

Even something as seemingly straightforward as delivering food is getting an AI upgrade. White Castle, for example, has started using AI-powered robots for deliveries in Chicago. These little bots use AI to get around and bring meals to customers. The idea is to cut down on delivery times and maybe save on labor costs. It’s a sign that AI is starting to automate logistics in places like fast food, which could change how we get our burgers and fries in the future.

Emerging AI Technologies and Applications

It feels like every week there’s some new AI thing popping up, and honestly, it’s getting hard to keep track. But some of these new applications are genuinely changing how we do things, not just in the tech world, but in everyday life and across different industries. We’re seeing AI move beyond just chatbots and image generators into some pretty specialized areas.

AI in Fintech and Financial Services

This is a big one. Banks and financial companies are really leaning into AI. Think about it: fraud detection is getting way smarter. AI can spot weird patterns in transactions that a human might miss, and it does it super fast. Lloyds Bank, for example, launched an AI assistant called ‘Athena’ to help with customer service and crunching financial reports. It’s all about making things quicker and cutting down on mistakes. Plus, AI is starting to help with things like personalized financial advice, making it more accessible to more people. The AI industry is growing fast, and finance is a huge part of that.

AI for Cybersecurity and Privacy Solutions

With all the online activity, keeping things secure is a massive challenge. AI is stepping in here too. It’s being used to find and block cyber threats before they even cause damage. For instance, Google has a tool that watches over domain names, flagging suspicious activity that could lead to phishing or malware. It’s like having a digital guard dog that never sleeps. This is super important because as more of our lives move online, so do the risks. We need these smart systems to keep our data safe.

AI-Driven Platforms for Supply Chain and Operations

Remember when supply chains seemed so straightforward? Yeah, not so much anymore. AI is making a real difference in managing all the moving parts. It can predict demand better, figure out the most efficient routes for deliveries, and even spot potential problems before they halt everything. This means fewer delays and less wasted product. Companies are using AI to get a clearer picture of their entire operation, from the factory floor to the customer’s doorstep. It’s about making things run smoother and saving money in the process.

AI Startup Success Stories and Valuations

It’s pretty wild to see how many AI companies are not just getting off the ground but are actually hitting some serious numbers. We’re talking about startups that are barely a few years old but are already being valued in the billions. It makes you wonder what’s going on, right? Some investors are even starting to say things are getting a bit too hyped up, especially for the really early-stage companies. You know, the ones that have ‘AI’ in their name and suddenly have a valuation that’s way out of sync with their actual income.

But then you look at companies like Databricks, which pulled in a massive $10 billion. That’s not pocket change. They’re planning to use that money for new AI products and to grow even bigger. And then there’s Anthropic, another big player in the AI research space, potentially raising $2 billion and aiming for a $60 billion valuation. It’s a lot of money, and it shows how much faith people have in these companies.

Here’s a quick look at some of the big funding rounds and valuations we’ve seen recently:

- Databricks: Raised $10 billion at a $62 billion valuation. They’re using the funds for AI product development and expansion.

- Anthropic: In talks to raise $2 billion, potentially reaching a $60 billion valuation. They’re a major AI research company.

- Thinking Machines Lab: Closed a $2 billion Series B round, valuing them at $10 billion. They’re focused on building infrastructure for agentic AI.

- Glean: Secured $150 million in Series F funding at a $7.2 billion valuation. Their AI platform helps businesses find information across different tools.

- Anysphere (Cursor): Hit a $9.9 billion valuation, reporting over $500 million in annual recurring revenue. They make AI tools for developers.

- Perplexity AI: Raised $500 million, valuing the company at $4 billion (though some reports put it higher). They’re known for their AI-powered search.

It’s not just about the big numbers, though. A lot of these companies are actually solving real problems and making things more efficient. For example, Glean is helping companies get answers faster, and Anysphere is making it easier for developers to write code. Even in areas like drug discovery, startups like Manas AI are using AI to speed up the process of finding new treatments. The speed at which these companies are growing and the impact they’re having is pretty remarkable.

Of course, with all this excitement, there’s always the question of whether the valuations are justified. Some experts are pointing out that a lot of early-stage AI companies are getting huge valuations with very little revenue. It’s a bit of a balancing act, trying to figure out which companies are the real deal and which ones might be overvalued. But one thing’s for sure: AI is definitely the place to be right now if you’re looking for big investments and groundbreaking innovation.

Wrapping It Up

So, what does all this funding and innovation mean for the AI startup scene? It’s pretty clear that artificial intelligence isn’t just a buzzword anymore; it’s driving real investment and creating new tools across all sorts of industries. We’re seeing big money flow into companies building the next generation of AI, from the core tech to specific applications like in finance, healthcare, and even making better drones. While there’s a lot of excitement, especially in North America, it’s also worth remembering that not every company is getting a piece of the pie. The big players are grabbing a lot of the attention and cash. Still, the pace of development is impressive, and it looks like AI will continue to be a major force shaping how we work and live for the foreseeable future. It’ll be interesting to see what comes next.

Frequently Asked Questions

What’s the big news in AI startups right now?

Lots of money is flowing into AI companies! Many new companies are getting big investments, especially those creating the core AI technology or using AI in specific areas like healthcare or making things easier for businesses. It’s a really exciting time for AI.

Where is most of the AI investment happening?

North America, especially the United States, is getting the biggest share of the money for AI startups. However, other places like Asia and Europe are also seeing important investments, even if the total amounts are smaller compared to North America.

Are there any specific types of AI getting a lot of funding?

Yes, absolutely! Companies that are building the main AI systems, called foundational models, are attracting a lot of attention. Also, AI that helps with things like creating new content (generative AI) and AI used in medicine and health are big areas for investment.

What are some cool new things AI is being used for?

AI is popping up everywhere! It’s being used to help write computer code faster, discover new materials for manufacturing, and even keep watch over important structures like bridges and roads to make sure they’re safe. It’s also making businesses run smoother.

Are venture capital firms interested in AI startups?

Definitely! Big investment firms are creating special funds just for AI startups. Some are putting billions of dollars into these funds, showing they believe AI is the future and want to be part of the success stories.

Are AI companies becoming very valuable?

Yes, many AI startups are reaching very high values, meaning investors think they are worth a lot of money. This is because they are helping companies save time and money, and are creating new and better ways to do things, like finding new medicines faster.