Getting money for a new business idea is a big deal. It’s the fuel that helps turn a concept into something real, letting founders build their product, hire people, and start getting it out there. This early money is super important because it not only gives you the cash you need but often comes with advice from people who know the ropes. It’s all about getting your startup off the ground and ready for the next step.

Key Takeaways

- Early cash helps build products, hire staff, and get your business moving.

- Investors can make your startup look more solid and connect you with useful people.

- Getting money early means you get help with ideas and building your team, not just cash.

- Early funding can lead to bigger deals later, but you might give up some ownership.

- Pick investors who know your industry and have good advice, not just money.

Understanding Early-Stage Investment: The Foundation of Startup Growth

The Crucial Role of Seed Funding News

Getting your hands on early-stage investment is a bit like finding the right fertiliser for a young plant. It’s not just about the money, though that’s obviously a big part of it. This initial capital is what allows a new business to actually get off the ground, to build that first version of a product, and to start telling people about it. Without it, many brilliant ideas would just stay as ideas, never getting the chance to grow.

Think about it: you’ve got this amazing concept, but you need people to build it, materials to make it, and a way to reach potential customers. Seed funding provides the fuel for all of that. It’s the difference between a dream and a tangible business that can start making waves.

Financial Advantages for Startups

So, what does this early money actually do for a startup’s bank account? Well, primarily, it gives you the breathing room to actually develop your product without constantly worrying about where the next pound is coming from. This means you can focus on getting the details right, testing things out, and making sure what you’re building is something people actually want and will pay for.

Here’s a quick look at what that cash injection can mean:

- Product Development: Funds for research, design, prototyping, and initial manufacturing.

- Market Entry: Money for early marketing efforts, sales teams, and getting your name out there.

- Operational Costs: Covering rent, salaries, and other day-to-day expenses while you’re still building revenue.

- Team Building: The ability to hire key people who have the skills you need to grow.

Securing early investment isn’t just about having more cash; it’s about having the right amount of cash to hit specific, important milestones that prove your business model and attract more attention.

Beyond Capital: Strategic Investor Value

It’s easy to get fixated on the cheque size, but the people who provide this early money often bring much more than just their financial contribution. Good investors have usually been around the block a few times. They’ve seen other startups succeed and, perhaps more importantly, fail. This experience means they can offer advice that’s genuinely useful, helping you avoid common mistakes that could sink your venture before it even gets going.

They can also open doors. Their network might include potential customers, partners, or even future investors who might be interested in later funding rounds. Think of them as having a rolodex of contacts that can significantly speed up your growth and market penetration. It’s about getting guidance, connections, and a bit of validation from someone who believes in your vision enough to put their money behind it.

Pre-Seed Funding: Validating Concepts and Building Momentum

The Purpose of Pre-Seed Funding

So, you’ve got a brilliant idea, maybe even a rough sketch of how it could work. That’s fantastic, but turning that spark into something an investor will back is the next big hurdle. Pre-seed funding is where that journey really begins. It’s not about having a fully polished product; it’s about proving that your concept has legs and that you’re the right person, or team, to make it happen. Think of it as the initial test drive before you commit to buying the car.

Idea Validation and Early Traction

This is where you show that your idea isn’t just a good thought, but something people actually want or need. Investors at this stage aren’t expecting millions in revenue, but they do want to see some proof. This could be anything from a few people signing up for a waiting list, some positive feedback from potential users, or even a simple demo that shows the core functionality. The goal is to gather concrete evidence that your concept is viable and has a market. For instance, running a small pilot program with a handful of customers and getting their honest feedback can be incredibly powerful. It shows you’re not just guessing; you’re actively learning and adapting.

Team Formation and Operational Setup

Beyond the idea itself, investors are betting on the people behind it. Pre-seed funding often goes towards building the core team. This means bringing on key individuals who have the skills you lack, whether that’s technical expertise, marketing know-how, or operational experience. It also covers the initial setup costs – think basic office space (even if it’s just a co-working desk), essential software, and legal fees to get things properly registered. Getting these foundational elements in place demonstrates that you’re serious about building a real business, not just a side project. It sets the stage for what comes next, making it easier to attract more significant investment down the line.

Who Provides Pre-Seed Funding and What to Expect

So, you’ve got this brilliant idea, maybe even a rough prototype, and you’re looking for that first bit of cash to get things rolling. But who actually hands over the money at this super early stage? It’s not usually the big venture capital firms you hear about; that comes later. Think more along the lines of individuals, smaller funds, and programmes designed to help brand new companies.

Types of Pre-Seed Investors

When you’re at the pre-seed stage, you’re typically looking at a few main sources for funding. These aren’t just people writing cheques; many bring valuable experience and connections too.

- Angel Investors: These are often well-off individuals who invest their own money. They might have experience in your industry or just a passion for backing new ventures. Some angels are hands-on, offering advice and introductions, while others are more passive.

- Micro-VCs (Venture Capital Firms): These are smaller VC funds that specialise in very early-stage investments. They might have a specific focus, like tech startups or companies in a particular region. They often invest larger sums than individual angels but are still focused on the initial stages.

- Accelerators and Incubators: These programmes offer a mix of funding, mentorship, and resources, often in exchange for a small amount of equity. They usually run structured programmes over a few months, helping you refine your business model and pitch.

- Friends and Family: While not always considered formal pre-seed investors, this is often the very first port of call for many founders. It’s important to treat these investments professionally, even if the relationships are personal.

Typical Check Sizes and Valuations

What can you actually expect to raise, and what’s your company worth at this point? It varies a lot, but here’s a general idea. Remember, these numbers are just guides, and your specific situation will influence them.

| Aspect | Pre-Seed Range |

|---|---|

| Typical Check Size | £100,000 – £750,000 |

| Valuation Range | £1.5M – £4M |

It’s worth noting that valuations at this stage are often more art than science. Investors are betting on the team and the potential, rather than established revenue. They’re looking for a strong concept and a clear path forward.

Angel Investors and Syndicates Evolve

Angel investors aren’t just individuals anymore. We’re seeing more and more angels team up to form ‘syndicates’. This means a lead angel might bring in other angels to invest alongside them in a single deal. This approach allows them to pool resources and expertise, making larger investments possible and spreading the risk. For founders, it can mean dealing with one main contact who represents a group of investors, which can streamline the process. It also means you’re getting the benefit of multiple perspectives and networks, which can be incredibly useful as you start to grow.

At the pre-seed stage, investors are primarily backing the founders and their vision. They want to see a dedicated team that understands the problem they’re solving and has a credible plan to address it. Demonstrating early traction, even if it’s just a few pilot customers or positive feedback from potential users, can significantly boost your chances of securing this initial capital.

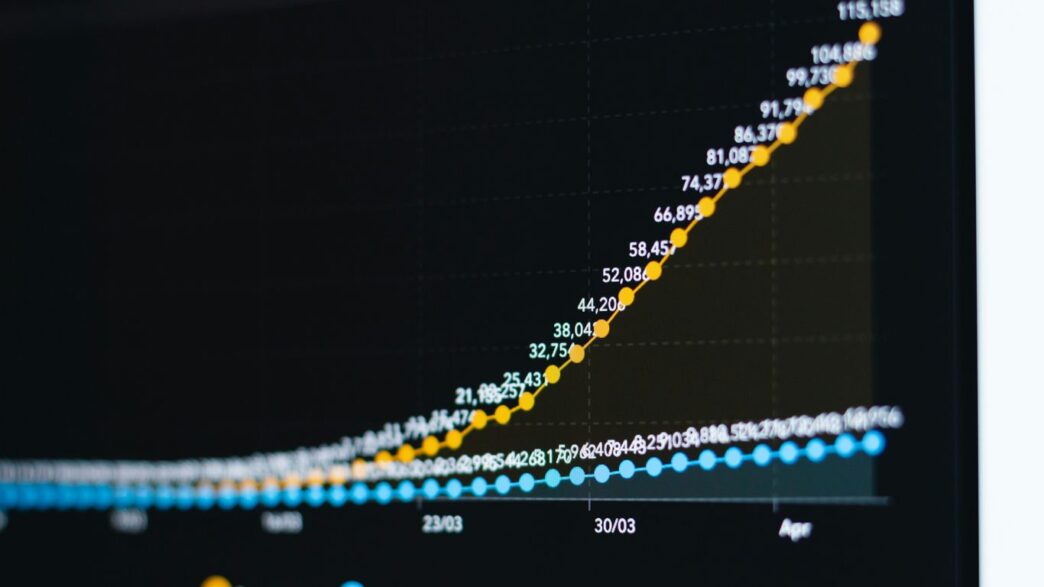

The Seed Stage: Scaling Operations and Attracting Future Investment

Right, so you’ve managed to get that initial bit of cash, which is brilliant. But that pre-seed money was really just the starting pistol. Now, at the seed stage, things get serious. It’s all about showing that your idea isn’t just a nice concept, but a real business that can grow. Investors at this point are looking for more than just a good story; they want to see actual progress and a clear path forward.

Hiring Talent and Scaling Operations

This is where you really start to build the engine of your company. You’ve probably got a small, dedicated team, but to scale, you need more hands on deck. Think about bringing in people with specific skills that can help you move faster – maybe someone to really nail down the marketing, or a developer who can take your product to the next level. It’s not just about filling seats, though. You need to think about how these new people will fit into your company culture and how you’ll manage a larger team effectively. Setting up proper systems for communication, project management, and even just day-to-day operations becomes really important. You don’t want to get bogged down in admin when you should be growing.

Increased Chances of Subsequent Funding Rounds

Getting seed funding is a big step, but it’s also a signal to future investors. If you’ve successfully raised a seed round, it means other people have looked at your business, liked what they saw, and put their money in. This makes it much easier to attract later-stage investors, like venture capital firms looking for Series A funding. They see that you’ve already passed a significant hurdle and have some validation for your business model. It’s like a domino effect; one successful round makes the next one more achievable.

Key Financial Benefits to Target

Seed funding isn’t just about having more money in the bank; it’s about what that money allows you to do. You can now invest in things that will directly impact your growth and make your company more attractive. This could mean:

- Product Development: Really refining your product or service based on early customer feedback.

- Market Expansion: Starting to reach a wider audience, perhaps in new geographical areas or customer segments.

- Sales and Marketing: Building out a proper sales team and running more targeted marketing campaigns to acquire customers.

- Operational Infrastructure: Investing in better tools, software, or even office space to support a growing team.

The goal at the seed stage is to demonstrate tangible growth and a clear path to profitability. Investors want to see that you’re using their capital wisely to build a sustainable business, not just burning through cash. Showing solid metrics, even if they’re early, is key to building trust and securing future investment.

Here’s a quick look at what seed investors often expect compared to pre-seed:

| Aspect | Pre-Seed | Seed |

|---|---|---|

| Typical Check Size | £100k – £800k | £800k – £3M+ |

| Evidence Required | Prototype, pilot feedback | Product-market fit, traction |

| Investor Focus | Idea, team, market potential | Growth, revenue, scalability |

| Valuation Expectation | Lower | Higher |

Enhancing Credibility and Market Position Through Early Investment

Securing early investment isn’t just about getting cash into the bank; it’s a powerful signal to the wider world. When reputable investors back your venture, it’s like getting a stamp of approval. This validation can make a huge difference when you’re trying to convince customers, potential partners, or even future employees that your idea is solid.

Early Pre-Seed Validates Concepts

Think of pre-seed funding as the first real test of your idea’s potential. Getting someone to put money into your concept, even at this very early stage, shows that others see value in what you’re trying to build. It moves your idea from just a thought in your head to something tangible that has attracted external belief. This initial backing can be instrumental in getting those first few customers on board or securing pilot projects, proving that your concept isn’t just a pipe dream.

Pitching Traction and Differentiation

Once you’ve got that initial funding, you can actually start building and showing progress. This is where you can demonstrate real traction – maybe it’s early user sign-ups, initial sales figures, or positive feedback from beta testers. This tangible progress, fuelled by early capital, is what truly differentiates you from other startups vying for attention. It gives you something concrete to talk about when you’re pitching for more significant investment or trying to attract key talent. It shows you’re not just talking; you’re doing.

Realistic Financials Build Trust

When you’re seeking investment, being upfront and realistic about your financial projections is key. Early investors, especially those who have been around the block, will look for sensible financial planning. They want to see that you understand the costs involved in growing your business and that you have a clear plan for how the investment will be used to achieve specific, measurable goals. Presenting well-thought-out financial forecasts, even if they’re ambitious, builds trust. It shows you’re serious about building a sustainable business, not just chasing a quick win. This careful financial planning can also help you secure seed capital more effectively.

Early investment provides the resources to not only develop your product but also to build a strong team and establish initial market presence. This combination of capital and early validation significantly boosts your startup’s credibility, making it more attractive to future investors, partners, and customers alike. It’s about building momentum and demonstrating viability from the outset.

Navigating the Seed Funding Landscape: Best Practices

So, you’ve got a solid idea and maybe even a prototype. Now comes the tricky part: getting people to invest in it. It’s not just about having a good product; it’s about how you present it and who you talk to. Think of it like preparing for a big job interview – you need to know your stuff, look the part, and make a good impression.

Crafting a Compelling Pitch

Your pitch is your first real chance to sell your vision. It needs to be clear, concise, and, most importantly, believable. Investors see a lot of pitches, so yours needs to stand out. Focus on what makes your idea unique and why now is the right time for it. Don’t just talk about the problem; show how you’re solving it in a way no one else is.

- Clearly define the problem you’re solving. What pain point are you addressing?

- Showcase your solution. How does your product or service fix this problem?

- Explain your market. Who are your customers, and how big is this opportunity?

- Introduce your team. Why are you the right people to make this happen?

- Outline your business model. How will you make money?

Investors are looking for more than just a good story. They want to see evidence that you’ve done your homework and that your idea has real potential to grow. A well-structured pitch deck, backed by solid research, makes a huge difference.

Understanding Investor Expectations

What do investors actually want to see at this early stage? It varies, but there are common threads. They’re not just looking for a return on their investment; they’re often looking for a partner they can work with. They want to see that you understand the market, that you’ve thought about the risks, and that you have a plan.

| Expectation | What it Means for You |

|---|---|

| Proof of Concept | Show a working prototype, early user feedback, or pilot data. |

| Market Understanding | Demonstrate knowledge of your target audience and competitors. |

| Realistic Financials | Present sensible projections, not just wishful thinking. |

| Team Capability | Highlight relevant skills and experience of your core team. |

| Scalability Potential | Explain how your business can grow significantly. |

The Importance of Strategic Partnerships

Getting funding isn’t just about the money. The people you partner with can bring a lot more to the table. Think about advisors, mentors, and even other founders in your network. These connections can offer guidance, open doors to new customers, and help you avoid common pitfalls. Building these relationships early on is just as important as refining your pitch deck.

- Network actively: Attend industry events, join online communities, and connect with people on platforms like LinkedIn.

- Seek out mentors: Find experienced individuals who can offer advice and share their insights.

- Build genuine connections: Focus on creating relationships, not just asking for favours.

- Keep potential investors updated: Share your progress and milestones, even before you’re actively fundraising.

Wrapping Up

So, it’s clear that getting that first bit of cash, the pre-seed or seed funding, is a really big deal for new businesses. It’s not just about the money itself, though that’s obviously important for getting things off the ground. It’s also about the validation that comes with it, the doors it can open, and the guidance you might get from people who’ve been there before. Getting this early backing can really set a startup on the right path, helping them build a solid foundation and get ready for whatever comes next. It’s a tough journey, but seeing these companies secure the funds they need shows there’s still plenty of innovation happening out there.

Frequently Asked Questions

What exactly is pre-seed funding?

Pre-seed funding is like the very first bit of money a startup gets. It’s used to help founders test out their ideas, maybe build a basic version of their product, and show that people are interested before they try to get bigger investments.

How can I make my pre-seed idea sound really good to investors?

To impress investors, tell a great story about your idea. Show them you have some proof that it works, like early users or customer interest. Also, explain why you’re the right person to do this, what makes your idea special, and how you plan to use the money wisely.

What’s the difference between pre-seed and seed funding?

Think of pre-seed as getting things started – proving your idea is good. Seed funding comes a bit later, when you’ve already shown that your product works and people want it, and you need more money to grow bigger.

Who usually gives out pre-seed money?

Often, it’s individual investors called ‘angels,’ small investment companies, or special programs called accelerators. These people or groups might offer more than just cash, like advice and connections.

How much money can a startup expect to get at the pre-seed stage?

Typically, pre-seed funding can range from about £100,000 to £800,000. This can change depending on where the startup is located and how promising their idea looks.

Why is getting early funding so important for a startup?

Early funding is super important because it gives startups the cash they need to create their product, hire talented people, and start reaching customers. It also makes them look more trustworthy to bigger investors later on.