Welcome to our look at the latest startups funding news for 2026. It’s been a busy time, with money flowing into new companies and some interesting shifts happening. We’ll cover what’s making waves, from big tech trends to how different countries are doing. It’s a good time to get a handle on where the money is going and what it means for the startup world.

Key Takeaways

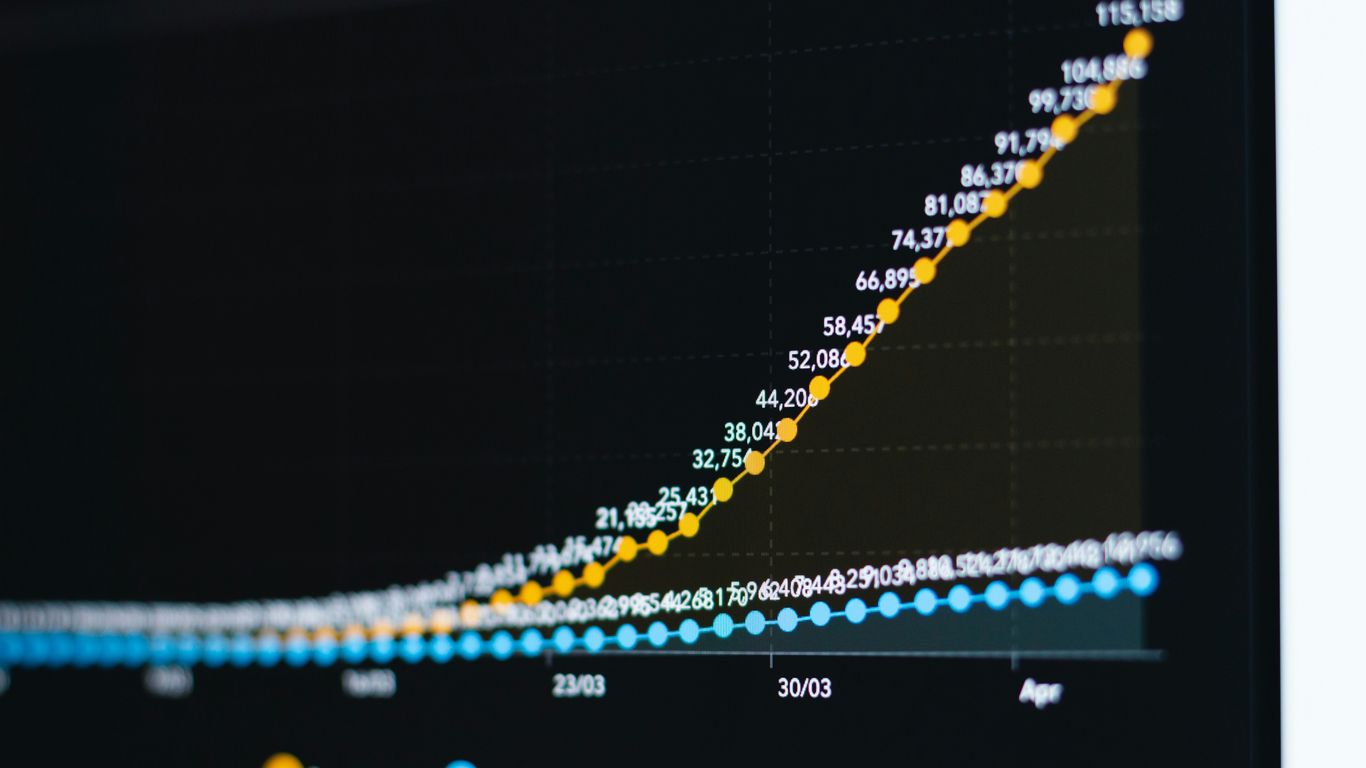

- Global venture funding has seen a strong year, building on previous successes, with record highs reported.

- The IPO market is showing signs of recovery, with more companies expected to go public, especially those in AI.

- Mergers and acquisitions are on the rise, driven by the need for talent and offering exit routes for some companies.

- AI and robotics are attracting significant investment, while other sectors see varied levels of interest.

- Concerns are growing about capital concentration, with a few companies receiving a large portion of funding, and the potential for an AI market bubble.

Navigating The 2026 Startups Funding Landscape

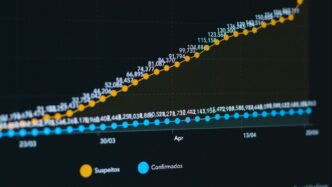

Global Venture Funding Surges To Record Highs

Right, so, 2026 is shaping up to be a bit of a rollercoaster for startup funding, but the overall picture is looking pretty rosy. We’re seeing global venture funding hit some seriously impressive highs, actually surpassing what we saw in 2021 and 2022, which were already pretty wild years. It’s not just a little bump either; we’re talking about a significant surge. This isn’t just about more money sloshing around; it’s about a renewed confidence in the startup ecosystem.

The IPO market is definitely making a comeback. After a bit of a wobble, it seems like companies are feeling more comfortable about going public again. We saw a decent number of big listings in 2025, and the word on the street is that 2026 is set to be even stronger. Think profitable companies, especially those with a solid AI angle or a clear plan for how AI will boost their business, are prime candidates for a public debut. It’s not just the tech giants either; we’re seeing a lot of interest in fintech and AI-focused startups looking to make their mark on the stock exchange.

Here’s a quick look at what’s been happening:

- 2025 saw at least 23 US-based companies valued over $1 billion go public. That’s a big jump from the 9 we saw in 2024.

- Total valuations at IPO price for these big listings hit at least $125 billion, more than doubling from the previous year.

- Experts predict this momentum will continue into 2026, with more companies eyeing public market exits.

It’s interesting to see how the market is reacting. While there’s a lot of excitement, there’s also a growing awareness that not every company will get a piece of this funding pie. The focus seems to be sharpening on those with clear paths to profitability and strong technological foundations.

Key Trends Shaping Startups Investment

Beyond the headline funding figures, there are some really interesting shifts happening that are changing how and where money is being invested. It’s not just about throwing cash at anything that moves; investors are getting more strategic. One of the big stories is the rise of crowdfunding, which is becoming a really significant way for smaller companies to get funded, even surpassing traditional venture capital in some areas. You can see how this is changing the landscape for early-stage funding.

We’re also seeing a noticeable increase in mergers and acquisitions (M&A). This isn’t just about big companies buying smaller ones; it’s often about acquiring talent or specific technologies. Larger corporations are actively seeking out startups, sometimes for their teams and sometimes for their innovative tech, especially in the AI space. This also means that startups that might have been struggling to find an exit route are now finding opportunities through M&A.

Here are some of the key trends to keep an eye on:

- Dual-Track Strategies: Companies are increasingly preparing for both an IPO and an M&A deal simultaneously. This gives them more options and bargaining power.

- Talent Acquisition: Big companies are buying smaller startups primarily to get their hands on skilled employees, particularly those with AI expertise.

- Exit Opportunities: Startups that were funded during the boom years and haven’t yet found a way to exit are now looking at M&A as a viable option.

The Growing Influence Of AI On Funding

Honestly, you can’t talk about startup funding in 2026 without talking about Artificial Intelligence. AI isn’t just a buzzword anymore; it’s a driving force behind a huge chunk of investment. Companies that have AI at their core, or can clearly show how AI will be a major benefit to their operations, are attracting a lot of attention and, more importantly, a lot of capital. This is true across the board, from early-stage startups to those looking to go public.

We’re seeing a real concentration of funding going into AI-related ventures. This is leading to some pretty hefty valuations for these companies. It’s creating a bit of a dynamic where AI is not just a sector, but almost a prerequisite for significant funding rounds in many cases. This trend is so strong that it’s even influencing the IPO market, with AI-driven companies being particularly attractive to public investors right now.

The Resurgence Of The IPO Market

Optimistic Outlook For Public Market Listings

After a bit of a quiet spell, the stock market is starting to look more inviting for companies wanting to go public. Last year, we saw a decent number of new listings, way more than the year before. It feels like the door is creaking open, and folks are hopeful it’ll swing wider in 2026. It’s not just about getting listed, though; the valuations at these IPOs were pretty impressive, more than doubling from the previous year for the big ones. This suggests investors are ready to put their money into new public companies again.

AI-Driven Companies Poised For IPOs

When it comes to who’s likely to make the jump to the public markets, companies that are either all about Artificial Intelligence or can show how AI will seriously boost their business are getting a lot of attention. Think of the big names in AI that have been getting loads of private investment; they’re now looking like prime candidates for an IPO. It makes sense, right? AI is the hot topic, and investors want a piece of that action.

Fintech Unicorns Eyeing Public Offerings

Beyond AI, the financial technology sector, or fintech, is also showing strong signs of life. Several big fintech companies, often called ‘unicorns’ because they’re worth over a billion dollars, are rumoured to be getting ready for their own IPOs. They’ve been around for a while, building up their businesses, and now seems like the right time to offer shares to the public. It’s a sign that established, successful tech companies are looking for their next stage of growth on the stock exchange.

It’s worth remembering that the IPO window can be a bit unpredictable. Even when it’s open, a sudden shift in the market can close it pretty quickly. So, while the outlook is positive, companies need to be ready to move fast.

Here’s a look at what’s been happening:

- 2025 IPOs: At least 23 US companies valued over $1 billion went public.

- Valuation Jump: Total IPO valuations for these large companies more than doubled compared to 2024.

- 2026 Expectations: Experts predict continued momentum, especially for AI-focused firms.

| Company Type | 2024 IPOs (>$1B) | 2025 IPOs (>$1B) | Expected 2026 Trend |

|---|---|---|---|

| All | 9 | 23+ | Continued Growth |

Mergers And Acquisitions In The Startup Ecosystem

Accelerated M&A Activity Driven By Talent Acquisition

It looks like 2026 is shaping up to be a busy year for companies buying up other companies, especially smaller ones. A lot of the big players in tech are on the hunt for fresh talent and innovative tech, often referred to as ‘acqui-hires’. This means teams, sometimes quite small ones, are being snapped up for sums that might seem surprisingly large. It’s a way for established firms to quickly bring in new skills and ideas without having to build them from scratch. We’re seeing deals where companies with fewer than 100 employees are getting bought for over £75 million. It’s a bit of a gold rush for those early-stage teams with the right skills.

Dual-Track Strategies For Flexibility And Leverage

When startups are thinking about their next move, many are now looking at two paths at once: getting ready to go public with an IPO, and also exploring if they can be bought by another company. This ‘dual-track’ approach gives them more options. If the IPO market is looking good, they can push ahead with that. But if a really good offer comes along from a buyer, they have that option too. It puts the startup in a stronger position when they’re negotiating, whether it’s with investors for an IPO or with a potential buyer. The idea is to have the best of both worlds.

Exit Opportunities For Stalled Unicorns

Remember all those ‘unicorns’ – startups valued at over a billion pounds – that were funded a few years back during the boom? Well, some of them are finding it tough to get their IPOs off the ground. For these companies, M&A is becoming a really important way to provide an exit for their early investors and founders. Instead of waiting indefinitely for the public markets to be favourable, they’re now looking to be acquired. This is opening up opportunities for larger companies to acquire established, albeit stalled, businesses, bringing new capabilities into their own operations.

| Deal Type | Primary Driver | Typical Target Size | Notes |

|---|---|---|---|

| Acqui-hire | Talent & Tech Acquisition | Early-stage (Seed/Series A) | Often for teams < 100 employees |

| Strategic Acquisition | Market Expansion/Product Integration | Mid-stage to Late-stage | Larger companies buying for scale |

| Unicorn Exit | Investor Liquidity | Companies stalled on IPOs | Focus on established, but not yet public, firms |

The pace of mergers and acquisitions is picking up. It’s not just about big companies buying other big companies anymore. We’re seeing a real trend towards acquiring smaller, innovative teams for their talent, and also providing a way out for those larger startups that haven’t managed to go public yet. This creates a more dynamic ecosystem where different types of exits are possible.

Sector-Specific Investment Trends

AI and Robotics Lead Investment Focus

It’s pretty clear where a lot of the money is heading this year: straight into AI and anything related to robotics. Investors are really keen on companies that are building the next big thing in artificial intelligence, or those that can use AI to make robots smarter and more capable. This isn’t just about the big foundational AI models anymore; it’s about how these technologies can be applied in practical ways. Think advanced manufacturing, logistics, and even healthcare.

The focus is on companies that can demonstrate a clear path to making money with AI, not just those with a cool idea.

Here’s a quick look at what’s hot:

- AI Infrastructure: Companies providing the computing power, data storage, and specialised chips needed to train and run AI models.

- Robotics & Automation: Businesses developing robots for industrial use, service industries, and even domestic applications, often powered by AI.

- Applied AI Solutions: Software and platforms that use AI to solve specific problems in areas like drug discovery, financial analysis, or customer service.

We’re seeing a definite shift. It’s not enough to just have an AI component; companies need to show how that AI gives them a real edge and how it can be integrated into existing business processes to create tangible value. Those that can’t clearly differentiate themselves are finding it tougher to attract significant investment.

Fintech’s Strong Rebound and Future Prospects

Fintech is definitely back in the game. After a bit of a wobble, the sector is seeing renewed interest from investors. It seems like the market has figured out what works and what doesn’t, and now there’s a clearer picture of where the real opportunities lie. Areas like digital payments, especially those using AI to improve security and efficiency, are drawing a lot of attention. Stablecoins and new ways of handling payments are also on the radar.

- AI-Powered Payments: Innovations in fraud detection, transaction processing, and personalised financial advice.

- Digital Banking & Lending: Neobanks and platforms offering streamlined loan applications and account management.

- Blockchain & Crypto Innovations: While volatile, specific applications like stablecoins and tokenisation are attracting interest.

Concentration in Early-Stage and Growth Rounds

Interestingly, the money isn’t just flowing everywhere. Investors seem to be putting their chips on a few key areas, and also concentrating their investments at the very beginning of a company’s life (seed and early-stage) and when a company is already doing well and needs more cash to grow (growth rounds). This means that while there might be fewer overall deals, the ones that do happen, especially for promising startups or established players looking to scale, are often quite large. It’s a bit of a ‘go big or go home’ situation for many investors right now.

Capital Concentration And AI Bubble Concerns

Disproportionate Funding For Select Companies

It’s becoming pretty clear that a lot of the money in the startup world is going to just a few companies. Last year, we saw a massive chunk of all venture funding end up with a handful of AI businesses. We’re talking about companies like OpenAI, Scale AI, and Anthropic, each pulling in billions. It’s quite a concentration, and it makes you wonder if this is really sustainable in the long run. This trend means that while some startups are getting huge amounts of cash, many others might be struggling to get noticed or funded.

The Circular Economy Of AI Deals

There’s also this interesting, and perhaps a bit worrying, pattern emerging where big AI companies are investing in each other, or in companies that supply them with essential services. Think about Nvidia providing the chips, Oracle offering cloud services, and then OpenAI using them to build its models. It creates a sort of closed loop. While it shows how interconnected the AI ecosystem is, it also raises questions about fair competition and whether new players can easily break into this space. It’s like a self-reinforcing cycle that benefits those already at the top. We’re seeing predictions that this will continue, with capital flowing into established players and promising early-stage startups, potentially leaving the middle ground a bit bare.

Heightened Fears Of An AI Market Bubble

All this talk of massive funding rounds, sky-high valuations, and these interconnected deals naturally leads to concerns about an AI bubble. When so much money is chasing so few opportunities, or when valuations seem disconnected from current revenue, there’s a risk of a market correction. It’s not just about the AI companies themselves; a significant downturn could have knock-on effects across the entire tech sector and even the wider economy. Investors are definitely keeping a close eye on this, and the sheer scale of some of these investments, like the record-breaking rounds for OpenAI, has certainly amplified these worries. It’s a delicate balance between backing innovation and avoiding an unsustainable boom. Many are looking at how companies are differentiating themselves, especially those building on top of foundational models, to see if they have a real, lasting advantage. For instance, the growth in early-stage funding rounds is notable, with some seed rounds now reaching levels previously seen in much later stages. This shift in capital allocation is something to watch closely, especially for those seeking funding for their startups.

The concentration of capital in a few AI giants, coupled with the intricate web of investments between these major players, is creating a unique market dynamic. This environment fuels both rapid innovation and significant concerns about market sustainability and potential overvaluation. The question remains whether this intense focus on a select group of companies is a sign of a healthy, evolving market or a precursor to a more volatile period.

The Impact Of AI On The Workforce

AI-Prompted Tech Layoffs Increase

It’s becoming increasingly clear that artificial intelligence isn’t just changing how we work; it’s also changing who does the work. We’ve seen a noticeable uptick in tech companies letting people go, and a lot of this is being directly linked to AI. Companies are looking at their operations and figuring out where AI can step in, often to handle tasks that were previously done by humans. This isn’t just a small trend; it’s a significant shift that’s reshaping the job market.

Focus On Cost Cutting Through Automation

Many businesses are now prioritising efficiency and reducing overheads. Automation, powered by AI, presents a straightforward way to achieve this. Instead of hiring more staff or even maintaining current levels, companies are investing in AI systems that can perform repetitive or data-intensive tasks more quickly and, in the long run, more cheaply. This move towards automation is a key driver behind the recent layoffs. It’s about streamlining processes and making the most of technological advancements to boost the bottom line. This focus on cost reduction through AI is likely to continue as companies seek competitive advantages.

The drive for efficiency is pushing companies to re-evaluate their human resource needs. AI offers a compelling solution for tasks that are predictable and data-driven, leading to a re-allocation of capital away from traditional roles and towards technological infrastructure. This transition, while potentially beneficial for business operations, presents a significant challenge for the existing workforce.

Shifting Skill Requirements In Tech Roles

So, what does this mean for people working in tech? Well, the skills that are in demand are changing. While some roles might become less common, there’s a growing need for individuals who can develop, manage, and work alongside AI systems. Think about AI trainers, prompt engineers, or data scientists who can interpret AI outputs. The ability to adapt and learn new skills is becoming more important than ever. It’s not just about coding anymore; it’s about understanding how to integrate AI into existing workflows and how to collaborate with these new intelligent tools. The landscape of tech jobs is definitely evolving.

Here’s a look at how the skill set is changing:

- AI Development & Management: Skills in machine learning, deep learning, and AI model deployment are highly sought after.

- Data Analysis & Interpretation: The ability to make sense of the vast amounts of data AI generates is critical.

- Human-AI Collaboration: Roles focused on integrating AI into business processes and ensuring smooth interaction between humans and machines.

- Ethical AI & Governance: As AI becomes more prevalent, expertise in its responsible and ethical application is growing in importance.

Canadian Startups Funding News And Trends

Funding Declines In Early 2026 Compared To Previous Year

It’s been a bit of a mixed bag for Canadian startups looking for investment in early 2026. We’ve seen a noticeable dip in the amount of cash being raised compared to the same period last year. Specifically, funding rounds have dropped by about 22.83% up to February 2026, bringing in $1.14 billion across 26 equity rounds. This is quite a bit less than the $1.47 billion raised in the first couple of months of 2025 across 306 rounds. This slowdown suggests a more cautious approach from investors, perhaps waiting for clearer market signals. It’s definitely a tougher climate for new businesses trying to secure that initial or growth capital.

Key Funding Rounds And Acquisitions In Canada

Despite the overall dip, there have still been some significant funding activities. For instance, Brilliant Harvest secured seed funding on February 5th, and Una Software followed suit with their own seed round shortly after. Neo Financial managed to raise a substantial Series D round, bringing in $146 million with support from investors like AIMCo. Corus Ortho also saw a Series B round close, with ATB Financial participating. On the acquisition front, things have been busy too. SunOpta and ET Group were both acquired in early February 2026, with Refresco Gerber and Ricoh making moves respectively. Easy Plastic Containers found a new home with Firmapak, and Eddyfi Technologies was acquired by ESAB Corporation. It’s clear that even with fewer overall deals, important transactions are still happening.

Prominent Investors And Top Companies In The Canadian Market

When it comes to who’s backing Canadian innovation, some names keep popping up. Europa, though based in Belgium, is a major player, investing in companies like Thomson Reuters and Magna. Closer to home, BDC in Montreal has a strong portfolio including ecobee and Dialogue. The Accelerator Centre in Waterloo is also a key supporter, backing companies like Top Hat and TextNow. Looking at the big success stories, Shopify remains a titan in the e-commerce space. Other notable companies making waves include Clio, a legal tech firm, and Wealthsimple, which continues to grow its financial services platform. These companies, along with many others, show the diverse talent pool and potential within the Canadian startup scene, even as the funding landscape shifts. It’s worth keeping an eye on the Canadian startup ecosystem as it continues to evolve.

The current funding climate in Canada, while showing a year-on-year decrease in early 2026, still presents opportunities. Investors are being more selective, but strong companies with clear value propositions are still attracting capital. Acquisitions also continue to be a significant part of the ecosystem, offering exit routes for founders and valuable opportunities for larger companies looking to grow.

Wrapping Up 2026: What We’ve Learned

So, looking back at 2026, it’s clear the startup world kept moving at a pretty fast clip. We saw big money flowing, especially into AI and fintech, and a lot of companies were looking for ways to either go public or get bought. It wasn’t all smooth sailing, though; there were definitely some concerns about where all that cash was going and the impact of AI on jobs. Still, the overall picture is one of continued activity and adaptation. It’s been a busy year, and it’ll be interesting to see how these trends play out in the years to come.

Frequently Asked Questions

What’s the general mood for startup funding in 2026?

Things are looking pretty good! After a strong 2025, experts think 2026 will be another solid year for startups to get money, be bought by other companies, or even start selling shares to the public.

Are more companies going public in 2026?

Yes, it seems like the stock market is opening up for new companies. Many businesses that did well in 2025 are expected to offer their shares to the public in 2026, especially those using or talking about AI.

Why are companies buying other startups more often?

Big companies are buying smaller ones mainly to get their hands on smart people and new technology, especially things related to AI. Also, some startups that couldn’t go public are now looking to be sold.

Which industries are getting the most investment in 2026?

Artificial Intelligence (AI) and robotics are really popular right now, so they’re getting a lot of money. Financial technology (fintech) is also making a comeback, with more investment happening there too.

Is there a worry about too much money going to just a few companies?

Yes, there’s a growing concern that a lot of the investment money is ending up with only a handful of big companies, particularly those focused on AI. This has some people worried about a possible ‘bubble’ in the AI market.

How is AI affecting jobs in the tech world?

Unfortunately, AI is leading to job cuts in some tech companies as businesses look to save money by using automation. This also means that the skills needed for tech jobs are changing.