Alright, let’s talk about what’s happening with startups and their funding in 2026. It feels like every other day there’s a new company popping up, and the money seems to be flowing, especially into AI. We’re seeing some big names get even bigger, and it’s not just about having a cool idea anymore. Investors are really looking at how these companies are actually being used and if they have something solid that others can’t easily copy. So, what’s the latest on the startups funding news front? Let’s break it down.

Key Takeaways

- Autonomous AI agents and specialised vertical AI platforms are grabbing the most attention and investment, showing a clear move towards AI that does specific jobs.

- Big players like OpenAI and Anthropic continue to lead in valuations, but newer companies like xAI and Databricks are also securing significant funding, showing the market is still very active.

- Investors are shifting focus from just hype to actual product use and how difficult a startup is to replicate, meaning companies need real traction and unique tech.

- The United States is seeing a major surge in startup funding, with significant investment activity and a notable number of acquisitions happening within the ecosystem.

- Sectors like AI coding tools, AI safety, and AI applications in healthcare and law are experiencing intense funding activity, indicating where the next big growth areas are expected to be.

Key Trends Shaping Startups Funding News In 2026

Right now, the startup funding scene in 2026 is really buzzing, and it feels like there’s a clear direction things are heading. It’s not just about having a cool idea anymore; investors are looking for companies that are actually making a difference and fitting into how businesses and people work every day.

Autonomous AI Agents Lead The Charge

We’re seeing a big shift from simple chatbots to AI systems that can actually do things. These autonomous agents are starting to take on tasks that used to require a human, from managing schedules to complex data analysis. It’s pretty impressive how quickly they’re developing. This move towards AI that acts, rather than just responds, is a major theme this year. Think of them as digital assistants that can actually get work done for you, which is a huge time-saver for businesses.

Enterprise And Vertical AI Platforms Dominate Investment

It’s not just general AI anymore. A lot of the money is flowing into platforms that are built for specific industries – like healthcare, legal services, or even just for internal company workflows. These vertical AI solutions seem to be hitting the mark because they solve very specific problems that businesses are facing. They’re not trying to be everything to everyone; they’re focused on doing one thing really well, and that’s attracting serious investment. It makes sense, really – why build a general tool when you can build something perfectly suited for a particular job?

Foundation Models And Infrastructure Attract Significant Capital

Then there’s the whole area of building the AI itself. Companies that are creating the next generation of large language models, or the infrastructure needed to run them, are pulling in a lot of cash. This is the foundational stuff, the engines that power all the other AI applications we’re seeing. It’s a bit like the early days of the internet when companies building the actual web infrastructure were getting huge investments. It’s a high-stakes game, but the potential rewards are massive if you’re building the core technology.

Leading Startups Securing Major Funding Rounds

OpenAI and Anthropic Lead Valuations

It’s no surprise that the big names in AI are still commanding the highest valuations. OpenAI and Anthropic have continued to attract massive investment, solidifying their positions at the forefront of artificial intelligence development. These companies aren’t just chasing funding; they’re building the foundational models that others are now using to create their own applications. The sheer scale of capital flowing into these giants reflects a broader market belief that advanced AI capabilities are the future, and these two are leading the charge.

xAI and Databricks Secure Substantial Investment

Beyond the absolute top tier, companies like xAI and Databricks have also managed to secure significant funding rounds. This isn’t just about having a good idea; it’s about demonstrating real progress and a clear path to market. Databricks, for instance, has been a powerhouse in data analytics for years, and their pivot towards AI integration has clearly paid off. xAI, with its ambitious goals, is also drawing considerable attention and capital. It shows that even established players and ambitious newcomers can still capture investor interest if they have a compelling vision and the technical chops to back it up.

Emerging Players Achieve Unicorn Status Rapidly

What’s really interesting is how quickly some newer companies are hitting the ‘unicorn’ status – that coveted billion-dollar valuation. We’re seeing startups that are barely a few years old already valued in the billions. This rapid ascent is often driven by AI-native products that solve specific, high-value problems for businesses. Take Cursor, for example, an AI-native code editor that reached a billion-dollar valuation surprisingly fast. Or Gamma, which is making presentations and collaboration easier with generative AI. It’s a testament to how quickly innovation can move in the AI space when a company hits the right market need with a strong product.

The speed at which some of these AI startups are growing is quite something. It feels like just yesterday we were hearing about them for the first time, and now they’re already worth billions. This rapid growth isn’t just about hype; it’s often tied to real adoption by businesses looking to automate tasks and gain an edge.

Here’s a look at some of the impressive funding milestones:

- Cursor (Anysphere): Crossed $1 billion in annualized revenue within three years, a remarkable feat for an AI-native code editor.

- Gamma: Secured a $68 million Series B at a $2.1 billion valuation, showing strong traction for its generative AI presentation tools.

- Decagon: Achieved a $1.5 billion valuation after raising $131 million in its Series C, focusing on enterprise AI agents for workflow automation.

- Tala Health: Raised a $100 million seed round at a $1.2 billion valuation, highlighting the growing investment in AI for healthcare automation.

Investor Focus Shifts To Real Usage And Defensibility

It feels like just yesterday that the buzz around startups was all about the next big idea, the grand vision. But things have changed, haven’t they? In 2026, investors are looking past the shiny promises and really digging into what makes a company tick. The days of funding purely on potential are fading fast. Now, it’s all about seeing actual use cases and figuring out if a startup has something genuinely difficult for others to copy.

Beyond Hype: Prioritising Growth And Market Impact

We’re seeing a definite move away from just chasing the latest trend. Investors want to see that a product is being used, and used well, by real customers. It’s not enough to have a clever algorithm; it needs to solve a tangible problem and show clear signs of growth. This means looking at metrics that matter, like customer retention and how much revenue a company is actually bringing in, not just how much it could make.

- Demonstrable customer adoption: Are people actually using the product day-to-day?

- Clear path to profitability: How will this company make money consistently?

- Scalable business model: Can this grow without breaking the bank?

The market has matured. Investors are now more cautious, demanding evidence of real-world application and sustainable growth before committing capital. This shift is healthy, pushing startups to build more robust and customer-centric businesses.

The Importance Of Product Differentiation And Technical Foundations

What makes this startup stand out from the crowd? That’s the million-dollar question. Investors are scrutinising what makes a product unique and why it’s hard for competitors to replicate. This often comes down to the underlying technology and the team’s ability to build something truly special. Think about companies that have built a strong data advantage or a unique approach to solving a complex problem. For example, Ramblr is building a data and tooling layer for AI in the physical world, capturing and structuring real-world video and operational data. This focus on real-world data gives them a strong edge in areas like robotics and on-site operations where context and reliability are key.

Investor Quality And Backing From Tier-One Firms

Who is backing a startup can tell you a lot. Investment from well-respected venture capital firms, often called tier-one firms, acts as a strong signal. It suggests that experienced investors have done their homework and believe in the company’s long-term prospects. This kind of backing isn’t just about the money; it often comes with valuable advice and connections that can help a startup succeed. It’s a sign that the company has passed a rigorous vetting process and is seen as a solid bet for the future.

Geographical Funding Landscape For Startups

United States Sees Significant Rise In Funding

It’s pretty clear that the United States is still the big player when it comes to startup funding. We’re seeing a massive jump this year, with billions more being poured into companies compared to last year. It looks like investors are really keen on US-based ventures, especially in the AI space, which is no surprise given the innovation coming out of there.

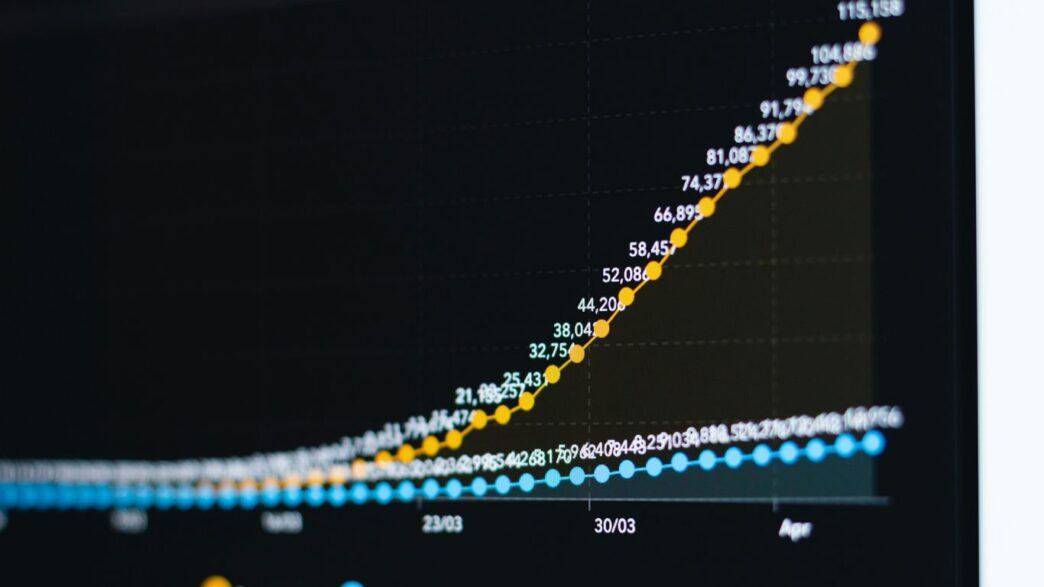

The US has seen a staggering 183.54% increase in funding by February 2026 compared to the same period in 2025. This surge is evident across numerous funding rounds, indicating a strong appetite for new and growing businesses.

Here’s a quick look at some recent funding activity:

- TRUCE Software: Secured $28.3 million in a Series B round.

- Anterior: Raised $96.2 million in its Series B funding.

- Talkiatry: Brought in a substantial $82.5 million during its Series D round.

The sheer volume of capital flowing into the US market suggests a robust ecosystem, where both established investors and newer funds are actively seeking opportunities. This concentration of funding often fuels rapid growth and can lead to quicker market dominance for startups.

Key Investors Driving Innovation Across Sectors

When we talk about who’s actually writing the cheques, a few names keep popping up. Government bodies and established venture capital firms are leading the charge. These aren’t just small amounts; we’re talking about significant investments that can really shape a company’s trajectory. It’s not just about the money, though; these investors often bring a wealth of experience and connections that are just as important.

Some of the top investors making waves include:

- HHS: Actively investing across various sectors.

- ED: Supporting a range of innovative companies.

- National Science Foundation: Backing high-potential ventures.

- U.S. Department of Transportation: Showing interest in infrastructure and related tech.

- United States Department of Agriculture: Investing in agri-tech and related fields.

Acquisition Activity In The Startup Ecosystem

It’s not all about new funding rounds; acquisitions are a huge part of the startup story too. We’re seeing a steady stream of companies being bought out, which is often a sign of a healthy, albeit competitive, market. For founders, an acquisition can be a major exit, and for larger companies, it’s a way to quickly gain new technology or market share. The numbers show a consistent level of M&A activity, with hundreds of deals happening already this year.

While the total number of acquisitions in 2026 is still building up, the trend suggests a dynamic market where consolidation and strategic buyouts are common. This activity often signals maturity in certain tech areas and provides valuable liquidity for early investors and founders.

Sectors Experiencing Intense Startups Funding Activity

AI Coding Tools Show Fastest Growth

It’s no surprise that AI coding tools are absolutely booming right now. Developers are finding these new assistants incredibly helpful, speeding up their work and catching errors before they become big problems. We’re seeing a lot of money flowing into companies that are building these smart coding partners. Think of tools that can write code, debug, and even suggest entire functions based on a simple description. The speed at which these tools are being adopted by development teams is frankly astonishing.

AI Safety And Responsible Development Gain Traction

Alongside the rapid advancement, there’s a growing focus on making sure AI is developed and used safely. Investors are starting to look more closely at companies that prioritise ethical AI, bias detection, and robust security measures. This isn’t just about avoiding bad press; it’s about building AI that people can trust. We’re seeing more funding rounds for firms working on explainable AI, privacy-preserving techniques, and systems that can be reliably controlled.

Healthcare And Legal AI Platforms See Strong Investment

Two sectors that are really benefiting from AI are healthcare and the legal industry. In healthcare, AI is being used for everything from drug discovery and diagnostics to patient management and administrative tasks. It’s helping to make healthcare more efficient and potentially more accessible. Similarly, in the legal world, AI is transforming how contracts are reviewed, research is conducted, and even how cases are prepared. These aren’t just niche applications anymore; they’re becoming core to how these industries operate.

Here’s a quick look at some of the areas attracting significant investment:

- AI Coding Assistants: Tools that write, debug, and optimise code.

- AI Safety & Ethics: Platforms focused on responsible AI deployment and risk mitigation.

- Healthcare AI: Applications for diagnostics, drug development, and patient care.

- Legal AI: Solutions for contract analysis, legal research, and case management.

The shift in funding towards these specific AI applications highlights a maturing market. Investors are moving beyond general AI platforms to back companies solving concrete problems in established industries. This focus on practical application and demonstrable value is a key theme in 2026’s funding landscape.

The Emerging Startup Opportunity And Future Outlook

Niche Problem Solvers Drive Next Wave Of Innovation

It’s fascinating to see how the startup landscape is evolving. We’re not just seeing big, broad AI platforms getting all the attention anymore. Instead, a lot of the real buzz is around smaller companies tackling very specific problems. Think about tools that help doctors with paperwork, or software that makes legal research quicker, or even apps designed to help game developers. These aren’t necessarily household names, but they’re finding real demand because they solve a clear pain point for businesses and individuals. Many of these successful ventures are built by founders who previously worked at major tech firms, bringing their experience to bear on a focused market. It’s a bit like the "great unbundling" of big tech, where specialised solutions are proving incredibly effective.

Speed To $100M ARR As A Key Metric

When investors are looking at these newer companies, they’re really zeroing in on how quickly they can grow. The metric that keeps popping up is "speed to $100 million in Annual Recurring Revenue (ARR)". Startups that hit this milestone in under two years are seen as particularly strong. It shows they’re not just building something cool; they’re building something that customers are willing to pay for, and pay for consistently. This focus on rapid, real-world revenue generation is a big shift from just chasing user numbers or theoretical potential.

Here’s a look at what investors are prioritising:

- Solving Specific Problems: Companies addressing clear, niche challenges in areas like healthcare, law, or software development.

- Demonstrating Real Usage: Evidence that customers are actively using and benefiting from the product.

- Achieving Rapid Revenue Growth: Hitting significant ARR milestones quickly.

- Building Defensible Technology: Creating unique solutions that are hard for others to copy.

Predictions For IPOs And Unicorns In The AI Space

Looking ahead, the predictions are pretty wild. We’re expecting to see a good number of AI companies going public in the next year or so – maybe five to ten. And the number of "unicorns" (companies valued at over $1 billion) is set to climb significantly, potentially over fifty. There’s even talk that we might see the first trillion-dollar AI company emerge soon, likely from the big players we already know. It’s a really dynamic time, and the pace of innovation shows no sign of slowing down.

The focus is clearly shifting from just having a good idea to proving that the idea can be a successful, growing business. Investors want to see tangible results, not just future promises. This means startups need to be laser-focused on their market, their product, and their growth strategy from day one.

Wrapping Up: What We’ve Learned

So, looking back at 2026, it’s pretty clear that money is flowing into AI startups that actually make things easier. We’re talking about companies that cut down on boring tasks, save people time, and just slot into how we already work, whether that’s in hospitals, law firms, or just building software. It’s less about flashy promises and more about showing that people are actually using these tools and that they work. We also saw a lot of smaller, newer companies pop up, proving that a good idea can quickly become a real product. The ones that are going to do well in the long run are the ones that are simple to use, solve a real problem, and grow because people want them. It’s an exciting time, and it’ll be interesting to see who keeps pushing forward.

Frequently Asked Questions

What kind of AI companies are getting the most money in 2026?

Companies making AI that can do things on its own, like helping with tasks, are getting a lot of attention. Also, AI that’s made for specific jobs or industries, like in hospitals or law firms, is a big hit with investors. Building the basic AI technology and the computer power needed for it is also attracting huge amounts of cash.

Are big, well-known AI companies still getting the most investment?

Yes, giants like OpenAI and Anthropic are still at the top, with massive company values. Newer players like xAI and Databricks are also pulling in significant funding. It seems like the biggest names continue to attract the most money, but some newer companies are growing incredibly fast to become very valuable.

What are investors looking for besides just a good idea?

Investors are now really focused on whether these AI companies are actually being used by people and businesses in a big way. They want to see real growth and a clear impact on the market. It’s also important that the companies have something special that others can’t easily copy, and that they have strong technology behind their products. Having well-known investors also helps a lot.

Where is most of the startup funding happening?

The United States is seeing a really big increase in startup funding. Many top investors are putting money into companies there, driving innovation across different areas. There’s also a lot of activity when it comes to bigger companies buying smaller ones in the startup world.

Which industries are seeing the most AI startup investment?

AI tools that help people write computer code are growing super fast. Also, companies focused on making AI safe and responsible are getting more attention. AI that helps in healthcare and law is also attracting a lot of investment, showing that AI is becoming useful in many important fields.

What’s the next big thing for AI startups?

The next wave of innovation seems to be coming from startups that solve very specific, smaller problems. A key goal for many fast-growing startups is to reach $100 million in yearly sales very quickly. People are also predicting that more AI companies will go public or become ‘unicorns’ (companies worth over $1 billion) in the near future.