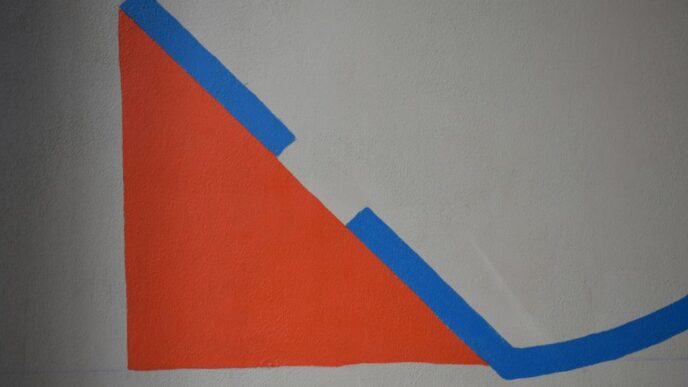

Investors are making significant moves in the stock market, rotating out of technology stocks and impacting global markets. This shift has led to mixed performances across major indices, with the Dow Jones Industrial Average rising while the tech-heavy Nasdaq Composite fell. As a result, Asian markets are reacting to these changes, with some indices showing gains and others declining.

Key Takeaways

- The Dow Jones Industrial Average rose by 0.86%, while the Nasdaq Composite fell by 0.38%.

- Asian markets showed mixed results, with Hong Kong’s Hang Seng index up 1.9% and Japan’s Nikkei 225 down 1.83%.

- Investors are closely monitoring the Indian rupee, which has weakened against the U.S. dollar.

Overview Of The Market Shift

The recent trend of investors rotating out of tech stocks has been a notable development in the financial markets. The Dow Jones Industrial Average, which includes a diverse range of industries, saw a significant increase of 358.67 points, closing at 42,297.12. This rise was largely attributed to a shift towards non-tech shares, such as Caterpillar, JPMorgan, and UnitedHealth.

In contrast, the Nasdaq Composite, which is heavily weighted towards technology companies, experienced a decline of 0.38%, closing at 19,088.10. This divergence highlights the ongoing volatility in the tech sector, which has been a major driver of market performance in recent years.

Asian Market Reactions

Asian markets reacted to the mixed performance on Wall Street, with various indices reflecting the ongoing investor sentiment:

- Hong Kong’s Hang Seng Index: Up 1.9%, marking a strong performance in the final hour of trading.

- Mainland China’s CSI 300: Increased by 2.63%, achieving its largest one-day gain since November 7.

- Japan’s Nikkei 225: Down 1.83%, continuing a four-day losing streak.

- South Korea’s Kospi: Closed up 0.31%, while the small-cap Kosdaq added 1.39%.

- Australia’s S&P/ASX 200: Rose by 0.48%, breaking a three-day losing streak.

Economic Indicators To Watch

Investors are also keeping a close eye on economic indicators that could influence market trends:

- India’s Rupee: The Indian rupee has weakened to a record low against the U.S. dollar, raising concerns about the country’s economic stability.

- Inflation Data: India reported a year-on-year inflation rate of 5.22% for December, slightly below expectations, which may lead to potential interest rate cuts.

- Consumer Confidence Index: Thailand is set to release its consumer confidence index for December, which could provide further insights into regional economic health.

Conclusion

The rotation out of tech stocks signifies a broader shift in investor sentiment, prompting mixed reactions across global markets. As investors seek opportunities in non-tech sectors, the performance of major indices will continue to be closely monitored. The economic indicators from Asia, particularly regarding the Indian rupee and inflation data, will also play a crucial role in shaping market dynamics in the coming weeks.

Sources

- Asia markets mostly rise after Wall Street’s mixed moves see investors rotate out of tech stocks – NBC New York, NBC New York.

- Asia markets mostly rise after Wall Street’s mixed moves see investors rotate out of tech stocks – NBC New York, NBC New York.

- Asia-Pacific Markets Track Mixed Performance on Wall Street as Traders Shift Away from Tech Stocks – KAOHOON INTERNATIONAL, kaohoon international.

- Stock Chart Icon, CNBC.