So, you want to get serious about crypto trading in 2026? It’s not just about picking coins and hoping for the best. You need a plan, a solid crypto strategy that can actually make you money, especially when things get wild. This guide is here to break down how to build and stick to a trading approach that works, moving you from just dabbling to actually trading with purpose. We’ll cover the basics and then get into some more advanced stuff, all aimed at helping you trade smarter.

Key Takeaways

- A good crypto strategy stops you from making emotional trading mistakes and helps you perform better when the market is shaky.

- Using proven frameworks like trend following, range trading, or breakout trading can give you a structured way to approach different market conditions.

- Advanced techniques such as news trading and multi-timeframe analysis can add an edge, but they need strict rules to manage risk.

- Protecting your money is key. Diversifying your assets, managing your risk carefully, and sizing your trades correctly are non-negotiable parts of any solid crypto strategy.

- Picking the right trading platform and then testing your strategy thoroughly, both on paper and with real money, is how you go from having a plan to actually making it work.

Understanding The Evolving Crypto Landscape

The Importance of Structured Trading Strategies

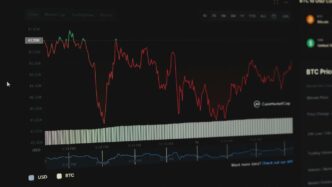

The crypto market in 2026 is a wild ride, no doubt about it. We’ve seen Bitcoin hit new highs, and while that’s exciting, it also means things can change fast. Trying to trade without a plan is like sailing without a compass – you’re just hoping for the best. That’s where having a structured trading strategy comes in. It’s not about guessing; it’s about having a set of rules that guide your decisions, especially when the market gets choppy. This helps you avoid making impulsive moves based on fear or greed, which can really mess up your account.

A well-defined strategy acts as your shield against emotional trading. It gives you a clear path to follow, no matter what the price charts are doing.

Core Benefits of Strategic Crypto Trading

So, why bother with a strategy? Well, there are some pretty good reasons:

- Keeps Emotions in Check: When you have rules, you’re less likely to panic sell or chase pumps. Your strategy tells you when to get in and out, taking the guesswork away.

- Consistent Results: Strategies help you repeat successful actions. This is key if you’re aiming for steady growth or trying to pass a trading challenge.

- Better Risk Control: You can set limits on how much you’re willing to lose on any single trade. This protects your capital, which is the most important thing.

- Adaptability: While you stick to your core plan, a good strategy allows you to adjust to changing market conditions without throwing everything out the window.

Navigating Volatility with a Defined Crypto Strategy

Volatility is the name of the game in crypto. One minute prices are soaring, the next they’re dropping. Without a strategy, this can feel overwhelming. But with one, you can actually use that volatility to your advantage. Think about it: if you have a plan for how to enter trades when a trend starts or how to exit when a price range breaks, you’re prepared. It’s about having a roadmap for different scenarios. For instance, you might have one approach for when prices are trending strongly and another for when they’re just moving sideways. This preparation means you’re not caught off guard when the market shifts gears. It’s about being ready for whatever the crypto landscape throws at you.

Proven Crypto Strategy Frameworks for 2026

Even as the market keeps surprising us, there are some crypto trading approaches that really stand out for getting consistent results, especially in 2026’s wild landscape. I’ll walk through three practical frameworks that traders are relying on this year, each with its unique edge. If you’re committed to landing funded accounts and keeping your profits steady, you need to pick and master at least one of these frameworks.

Trend Following with Confirmation Indicators

This is the bread and butter for a lot of traders right now. Trend following means you’re looking for strong market momentum—then only jumping in once you get clear, confirming signals. Think of using simple moving averages, RSI, or MACD to check if a trend is legit, not just a random blip. It feels safer because you aren’t catching falling knives or fighting against the tide.

Steps for trend following in 2026:

- Spot the trend direction on a 4-hour or daily chart

- Wait for price to test a moving average (like the 50 MA) and actually bounce

- Look for an extra confirmation—like RSI above 55 for uptrends

- Only enter once you have a confluence of signals

- Use a stop loss under the last swing low and set a target at 2-3x your risk

For more on the broader impact of digital assets today, check out emerging trends signal.

Range Trading for Sideways Markets

A lot of coins don’t trend—they just bounce around between the same price levels for weeks. Range trading is about buying at support, selling at resistance, and repeating until the range breaks. It sounds boring, but in flat markets, it can quietly rack up profits.

What’s needed to make range trading work in 2026:

- Clearly mark out your range boundaries on a chart

- Wait for price to hit those levels—don’t get impatient

- Use limit orders just inside the top and bottom of the range

- Combine with momentum oscillators like Stochastic to sharpen your entries

- Get out as price nears the middle; don’t be greedy hoping for full extension

Here’s a quick table that sums up the tools:

| Tool/Indicator | How It Helps |

|---|---|

| Horizontal Lines | Marking support/resistance |

| Stochastic Oscillator | Timing entries and exits |

| ATR (Average True Range) | Setting stop-loss distance |

Breakout Trading with Volume Confirmation

Breakouts are still one of the fastest ways to find big moves—especially on hot coins or during high news events. But, you can’t just buy every spike. Lasting breakouts almost always come with a serious surge in volume. That means scanning for consolidations, then watching both price and volume to line up.

Here’s what skilled breakout traders do:

- Identify a tight range or triangle on the chart

- Watch for at least a 50% spike in trading volume versus the average

- Only enter when both price and volume break the level

- Use tight stops—breakouts fail a lot without volume

- Target quick 1.5–2x gains, then reassess

Each of these frameworks gives you structure, confidence, and a better shot at lasting through the up and down swings of crypto in 2026. Adapt what fits your trading schedule and stick to your rules—random trades don’t cut it now.

Advanced Crypto Strategy Techniques

News-Based Trading with Strict Risk Controls

Trading around big news events can be a wild ride, but it can also be profitable if you’re careful. Think about major announcements like Federal Reserve rate changes, big crypto ETF news, or even new regulations. These events can cause prices to jump or drop fast. The trick here is to be prepared. You need to know what news is coming and what people expect to happen. Then, you can set up trades that bet on the price moving either up or down.

The key is to have really tight stop-losses. This means you decide beforehand the maximum amount you’re willing to lose on a trade, and your trade automatically closes if the price hits that point. News can be unpredictable, so limiting your losses is super important. Also, don’t hold onto these trades for too long; the big price swings often happen right after the news and then calm down quickly.

Here’s a quick rundown on how to approach it:

- Identify potential news: Look ahead 1-2 days for important economic reports or crypto-specific announcements.

- Understand expectations: See what most people think will happen with the news.

- Prepare your trades: You might place orders to buy if the price goes up and sell if it goes down, with strict limits on how much you can lose.

- Exit quickly: Take your profits as soon as you see a good move, because the volatility usually doesn’t last.

Mean Reversion in Overbought and Oversold Conditions

This strategy is the opposite of trend following. Instead of betting that a price move will continue, mean reversion bets that prices will eventually return to their average. Think of it like a rubber band – stretch it too far, and it snaps back. In crypto, this often happens when a coin’s price has gone up too much too fast (overbought) or dropped too much too fast (oversold).

Traders use tools like the Relative Strength Index (RSI) or Bollinger Bands to spot these extreme conditions. When a crypto looks really overbought, the idea is to sell, expecting the price to drop back down. Conversely, if it looks oversold, you’d buy, expecting the price to bounce back up.

It’s not foolproof, though. Sometimes, a strong trend can keep pushing prices further than expected, meaning your ‘oversold’ buy could turn into a big loss if the price keeps falling. That’s why using stop-losses is still a good idea, even with this strategy.

Multi-Timeframe Analysis for Trade Confirmation

This technique is all about getting a bigger picture before you make a trade. Instead of just looking at a 5-minute chart, you’ll look at several charts with different time scales. For example, you might check the daily chart to see the overall trend, then look at the 4-hour chart for more detail, and finally zoom into the 15-minute chart to find the exact entry or exit point.

Why do this? It helps confirm your trading ideas. If you see a buy signal on your short-term chart, but the longer-term charts show a strong downtrend, it’s a sign to be cautious or maybe skip the trade altogether. It’s like getting multiple opinions before making a big decision.

Here’s a simple way to think about it:

- Long-term view (e.g., Daily/Weekly): What’s the main direction? Is the market generally bullish, bearish, or flat?

- Medium-term view (e.g., 4-Hour/1-Hour): Where is the price within that larger trend? Are there any clear support or resistance levels forming?

- Short-term view (e.g., 15-Minute/5-Minute): This is where you’ll look for your specific entry and exit signals, but only if they align with the signals from the longer timeframes.

Building A Resilient Crypto Strategy

Okay, so you’ve got a strategy, maybe one of the ones we talked about earlier. That’s great, but what happens when the market throws a curveball? You need a strategy that can take a punch and keep going. Think of it like building a house – you don’t just slap up some walls and call it done. You need a solid foundation, good materials, and a plan for when the weather gets rough.

Diversification and Portfolio Management

This is where you spread your bets around. Putting all your crypto eggs in one basket is a recipe for disaster, especially with how fast things move. Instead, think about different types of assets. You’ve got your big players like Bitcoin and Ethereum, which are generally more stable (as stable as crypto gets, anyway). Then you have your altcoins, which can offer bigger gains but also come with way more risk. It’s about finding a mix that feels right for you. Don’t just buy random coins because someone on the internet said they’re the next big thing. Do a little digging. Look at what the project does, who’s behind it, and if it actually solves a problem.

Here’s a simple way to think about your portfolio mix:

- Core Holdings (60-70%): These are your more established cryptocurrencies, like Bitcoin and Ethereum. They tend to be less volatile and form the backbone of your portfolio.

- Growth Assets (20-30%): This is where you might put some of your more promising altcoins. They have higher potential for growth but also higher risk.

- Speculative Bets (5-10%): These are your high-risk, high-reward plays. Think very new coins or those with a lot of hype. Only invest what you can afford to lose entirely.

Essential Risk Management Rules

This is probably the most important part. Seriously. If you don’t manage your risk, you’re just gambling. The goal isn’t to hit home runs every time; it’s to avoid striking out completely. That means knowing when to get out before things get too ugly.

- Stop-Loss Orders: Always, always, always use stop-loss orders. These automatically sell your crypto if it drops to a certain price, limiting your losses. Don’t move your stop-loss further away from your entry price just because you’re hoping it will bounce back. That’s a quick way to lose more money than you planned.

- Risk Per Trade: Decide beforehand how much of your total trading capital you’re willing to risk on any single trade. For most people, this should be a small percentage, like 1-2%. If you have a $10,000 account, that means risking no more than $100-$200 on one trade.

- Emotional Control: This is tough. Fear and greed are your worst enemies in trading. If a trade is going against you, don’t let emotions keep you in it hoping for a miracle. If a trade is going really well, don’t get greedy and hold on too long. Stick to your plan.

Position Sizing and Capital Protection

This ties directly into risk management. Position sizing is all about figuring out how much of a particular crypto to buy or sell based on your stop-loss and your risk-per-trade rule. It’s not just about how much money you have; it’s about how much you’re willing to lose on that specific trade.

Let’s say you have a $5,000 trading account and you’ve decided you’ll risk a maximum of 1% ($50) on any trade. You find a coin you want to trade, and your analysis tells you to set your stop-loss 5% below your entry price. To figure out your position size, you divide your maximum risk ($50) by the percentage risk per trade (5% or 0.05). So, $50 / 0.05 = $1,000. This means you can buy $1,000 worth of the crypto for this trade. If the price moves against you by 5%, you lose $50, which is your 1% limit. This method helps protect your capital, even if you have a string of losing trades. A well-sized position ensures that a single bad trade won’t wipe out a significant portion of your account.

Optimizing Your Crypto Strategy Execution

So, you’ve got a solid crypto strategy mapped out. That’s great! But having a plan is only half the battle, right? The real test comes down to how well you can actually do it. Think of it like having a fantastic recipe – if your kitchen tools are terrible or you don’t know how to use the oven, that delicious meal might just turn into a burnt mess. Your trading platform and how you use it are your kitchen tools in the crypto world.

Choosing the Right Trading Platform

This isn’t just about picking the prettiest interface. The platform you use directly affects how quickly you can get into and out of trades, how much you pay in fees, and even which coins you can trade. For strategies that rely on speed, like catching breakouts or reacting to news, a slow platform can mean missed opportunities or getting a much worse price than you expected. It’s like trying to sprint with weights on your ankles.

Platform Features for Trading Success

What should you even look for? It can feel overwhelming, but here are a few things that really make a difference:

- Execution Speed: How fast does your order actually get filled? This is super important for strategies that need quick action. If you click ‘buy’ and it takes ages, the price might have already moved against you.

- Available Pairs: Does the platform offer the specific cryptocurrencies you want to trade? More options mean you can find opportunities even when your usual coins are quiet.

- Trading Fees: These might seem small per trade, but they add up fast, especially if you’re trading frequently. Lower fees mean more of your profits stay in your pocket.

- Leverage Options: Some strategies need leverage to be effective. Make sure the platform offers the level of leverage you’re comfortable with and that fits your strategy’s risk profile.

- Charting Tools: Good charting helps you see what’s happening with prices. Look for platforms that let you add indicators and draw lines easily.

Leveraging Institutional Partnerships

Sometimes, the best platforms aren’t just standalone apps. Many have partnerships with bigger financial institutions. What does this mean for you? Often, it translates to better pricing, more reliable execution, and access to deeper liquidity – basically, more buyers and sellers available at any given time. This is especially helpful when you’re trading larger amounts or during busy market periods. Think of it as trading on a well-established highway instead of a bumpy backroad. It makes the journey smoother and more predictable. When you’re trying to pass a trading challenge or grow a funded account, every bit of efficiency counts. Don’t underestimate how much the right infrastructure can help your strategy perform as intended.

Your Path Forward: From Strategy to Funded Trader

Getting started with crypto trading is one thing, but moving from a strategy on paper to actually earning with it—especially by earning a funded account—takes a different mindset. It’s a process full of learning, missteps, small wins, and a lot of testing.

Implementing Your Chosen Crypto Strategy

It’s tempting to think you just pick a strategy and start making money, but it almost never works that way. The move to live trading starts with putting your best-fit strategies into action. Here’s how to do it without getting lost along the way:

- Pick two or three strategies that fit your goals and your daily schedule. Don’t try every new idea you come across—focus matters a lot more than variety, especially early on.

- Record your entries, exits, and reasoning in a trading journal. This creates a feedback loop you can actually learn from.

- Make small tweaks based on your results instead of making big, sweeping changes.

For practical examples in the 2026 market, you might start with a trend-following method or a breakout system, as outlined in these 7 effective crypto prop trading strategies.

Backtesting and Forward-Testing Your Approach

A lot of people want to skip the testing phase and go right to trading live, but that’s risky—and usually expensive. Backtesting helps you see if your strategy could have worked in the past, while forward-testing (in a demo or micro account) checks if it fits the market now.

Here’s a simple breakdown of the two testing stages:

| Testing Type | Tools Commonly Used | What You Learn | Time Needed |

|---|---|---|---|

| Backtesting | Historical chart data | Expected win/loss ratios | 1-2 weeks |

| Forward-testing | Demo or paper trading | How strategy works live | 30+ trades |

A good starting point is aiming for at least 30 demo trades in forward-testing before risking real money. If you can hit your goals and avoid big errors over that stretch, you’re on the right track.

Transitioning to Funded Accounts

This part is both exciting and a bit stressful. Funded evaluations have clear rules—like hitting specific profit targets without breaching maximum drawdown. Passing these challenges is about discipline and consistency more than anything. Keep these steps in mind:

- Stick to your tested plan. Don’t improvise during the evaluation.

- Track every trade and review daily. This helps you spot mistakes fast.

- Remember that most platforms reward consistency, not homerun trades.

Platforms in 2026 now let skilled traders manage anywhere from $5,000 up to $300,000 (sometimes more), with fast payouts—often the same week you earn them. That means, as you advance through prop trading evaluations, your Tuesday profits could hit your wallet by Wednesday. And with some platforms offering up to 90% profit share, the upside is real if you can keep your edge and your cool.

In the end, the big difference between a trader who makes it to funded status, and one who stays stuck, is usually a willingness to take consistent, boring steps over and over—testing, recording, adjusting, and only scaling up once proof is there.

Wrapping It Up: Your 2026 Crypto Game Plan

So, we’ve gone over a bunch of stuff about crypto for 2026. It’s not just about picking coins and hoping for the best anymore. You really need a solid plan, whether you’re trading or just investing. Remember those strategies we talked about? They’re not magic bullets, but they give you a framework. The big thing is sticking to your plan, managing your money carefully, and not letting emotions get the better of you. The crypto world changes fast, so staying informed and being ready to adjust is key. Think of this guide as your starting point. Now it’s time to put what you’ve learned into action and build your own successful crypto journey for the year ahead.

Frequently Asked Questions

What’s the best way for someone new to crypto trading to start?

For beginners, trying strategies like following trends or trading within set ranges is a good start. These methods have clear rules for when to buy and sell. Using charts that show a few hours of activity and looking at moving averages can help you see the market’s direction.

How long does it usually take to get approved for a trading account?

Most people get approved within 15 to 45 days if they trade carefully and stick to a plan. It’s more important to make steady, smart trades than to rush and try to hit big profit goals quickly.

How much profit do trading companies want to see?

Trading companies often want you to make about 8% to 10% profit in the first stage and 5% in the second. They also have rules to protect your money, like limiting your losses to 5% in one day and 10% overall.

Can I use more than one trading strategy when I’m trying to get approved?

Yes, you can! Using two or three different strategies, like following trends and looking for breakouts, can help you find good trading chances in different market situations and through all parts of the approval process.

How much of my money should I risk on each trade?

You should only risk 1% to 2% of your total account money on any single trade. Make sure you set a stop-loss order before you enter a trade. This way, you can make over 50 trades without losing all your money if you hit the loss limits.

What happens if my trades go against me?

It’s normal to have losing trades. The key is to have rules in place, like a stop-loss, to limit how much you lose on any single trade. This helps protect your main money and keeps you in the game, which is what trading companies look for.