Maxar Technologies Rebrands to Vantor and Lanteris

So, Maxar Technologies is no more. It’s a big change, and honestly, it’s a bit confusing at first. Basically, the company has split into two new entities: Vantor and Lanteris. This all happened after a private equity firm, Advent International, bought Maxar Technologies last year. They decided it was time for a fresh start, and frankly, having two companies called Maxar was probably causing some headaches.

A New Era for Spatial Intelligence

This rebranding isn’t just a name change; it’s a signal of where these companies are headed. Maxar Intelligence is now Vantor, and it’s really shifting its focus. Instead of just being known for satellite pictures and data, Vantor wants to be a leader in software and data solutions for intelligence. Think of it as moving beyond just taking photos of Earth to actually making sense of all that information using smart technology. It’s about connecting data from all sorts of places – satellites, drones, even ground sensors – to give a clearer picture of what’s happening anywhere on the planet. They’re building tools that let customers use this data in more advanced ways, not just looking at finished reports.

Understanding the Split: Vantor and Lanteris

So, what’s the deal with the split? Maxar was essentially two big parts: one focused on intelligence (imagery, data analysis) and the other on building satellites. After Advent International took over, they decided to let these two parts operate independently. Maxar Intelligence is now Vantor, and Maxar Space Systems is now Lanteris. This separation is meant to give each company its own identity and allow them to pursue their own strategies without being tied together under one name. It’s like two siblings going off to start their own businesses.

The Rationale Behind the Rebranding

Why the big change? Well, for starters, the old setup was confusing. People weren’t always sure if they were dealing with the imagery side or the satellite-building side of Maxar. By creating Vantor and Lanteris, they’re aiming for clarity. Each name now clearly points to what the company does. For Vantor, it’s about providing intelligence solutions. For Lanteris, it’s about space systems and manufacturing. This also allows each company to tailor its approach to its specific market and customers, whether that’s government agencies or commercial businesses. It’s a move to make things simpler and more focused for everyone involved.

Vantor: The Future of End-to-End Intelligence Solutions

So, Maxar Intelligence is now Vantor. This isn’t just a name change, though. They’re really shifting gears from just selling satellite pictures to offering a whole package of intelligence tools. Think of it like this: instead of just selling you a photo of a place, they’re giving you the tools to understand everything about that place, using data from all sorts of sources – satellites, drones, even ground sensors.

From Imagery Provider to Software and Data Focus

For a long time, companies like this mostly just gave you the raw data, like satellite images, and maybe some basic analysis. You’d log into a portal and see what they had. Vantor is saying, ‘Nope, we’re doing more.’ They’re taking the actual technology they built to run their own operations – things like how they task their satellites, how they combine different data types, how they create 2D and 3D maps, and how they store all this information – and they’re turning it into products. The idea is that customers can then use these building blocks to create their own, more advanced systems. It’s a big change, moving from just being a supplier to being a platform builder.

Harnessing Earth Observation Data with AI

This is where the AI part really comes in. We’re collecting so much data about Earth these days, it’s almost overwhelming. Vantor’s approach is to use artificial intelligence and machine learning to make sense of all that raw information. They’re not just looking at satellite images anymore; they’re integrating data from everywhere to get a complete picture. This allows them to provide what they call ‘end-to-end solutions.’ It means they can connect sensor data from different places – like space, air, and ground – and give you a unified view. This unified view can then become a real advantage for businesses or government agencies.

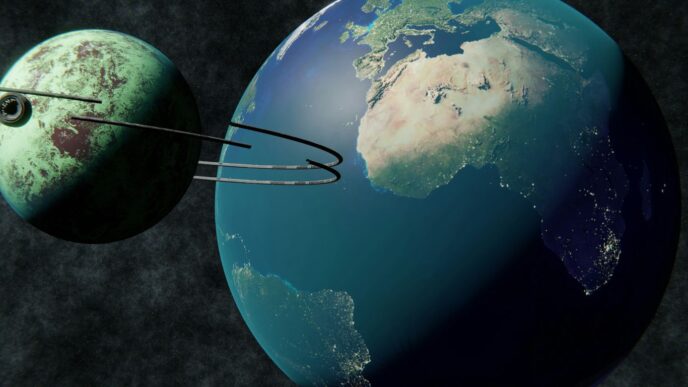

Tensorglobe: An AI-Powered Intelligence Platform

And the big announcement alongside the rebranding is Tensorglobe. This is their new AI-powered software platform. It’s pretty neat because it’s built with a digital twin of the Earth at its core. What’s really interesting is that Tensorglobe relies on having access to a satellite constellation, much like you wouldn’t use a cloud service without the servers behind it. Vantor plans to keep operating its own satellites, including the WorldView Legion constellation, but they’re also working with other companies to create a ‘virtual constellation.’ This means they can pull data from different types of sensors and space setups, making their platform even more powerful. They’re aiming to make it easier for people to understand and use Earth observation data, especially for those who might not be experts in space technology.

Lanteris: Redefining Satellite Manufacturing

Navigating the Shift from GEO to LEO

Lanteris, formerly Maxar Space Systems, is really changing how it builds satellites. For a long time, the company was all about making big geostationary orbit (GEO) satellites. These are the giants that hang out way up high, perfect for things like broadcasting TV signals. But the market has shifted, and a lot of that business dried up. Commercial companies started needing smaller satellites in low Earth orbit (LEO) for things like internet constellations. It was a tough time, with order numbers dropping and the company facing financial pressure. It’s like if your favorite pizza place suddenly only got orders for tiny appetizer portions – you’d have to rethink your whole kitchen.

Growth Strategies in Defense and Commercial Markets

So, Lanteris is now splitting its focus. They’re still building those big GEO satellites because, honestly, there’s still a need for them, especially for certain types of sensing and communication. Big rockets like SpaceX’s Starship are even opening up new possibilities for these larger spacecraft. But they’re also heavily investing in smaller satellites, including buses for missile-tracking satellites for the U.S. Space Force. This is a big deal. It means they’re not just relying on one type of customer or one type of satellite anymore. It used to be that almost all their money came from commercial clients, but now it’s a pretty even split between commercial and government work. That balance is something they haven’t had in decades, and it puts them in a much stronger position.

Innovation Roadmap for Space Infrastructure

Lanteris has a clear plan for what’s next. They’re concentrating on three main areas:

- National Security and Defense: This includes things like secure communications, building resilient satellite networks, and, as mentioned, missile tracking. It’s all about keeping the country safe.

- Space Infrastructure: Think advanced power and propulsion systems that can be used for all sorts of things – defense, energy, communications, and just general mobility in space. They’re also looking into AI-enabled systems to make things smarter.

- Connectivity and Exploration: This involves building satellites and platforms that can help us reach further, like supporting missions to the Moon and beyond, and extending global communication networks.

The company is really trying to be a key player in building the next generation of space hardware, adapting to new orbits and new customer needs. It’s a significant pivot, moving from a legacy business model to one that’s much more diversified and forward-looking.

The Strategic Vision of Vantor and Lanteris

So, what’s the big plan for Vantor and Lanteris now that they’re going their separate ways? It looks like they’re aiming to cover a lot of ground, both literally and figuratively. The main idea seems to be offering solutions that work for both government folks and regular businesses, which makes sense. They’re calling this ‘dual-use capabilities,’ and it means the tech they build for defense, for example, could also be useful for commercial clients. Think about it – better surveillance tech for national security could also help track weather patterns for agriculture or monitor infrastructure.

They’re also looking to expand their reach globally. This isn’t just about selling satellites or data to the US anymore. They want to partner up with countries around the world, helping them build their own space capabilities. This is a pretty big shift, especially for Lanteris, which used to focus mostly on big communication satellites. Now, they’re looking at smaller, more specialized satellites for defense and even for things like lunar missions. It’s all about adapting to what different customers need.

Here’s a quick look at some of their focus areas:

- National Security & Defense: Developing advanced tech for things like missile tracking and secure communications. This is a big one, and it’s expected to drive a lot of Lanteris’s business.

- Space Infrastructure: Building smarter systems for power, propulsion, and even AI-driven operations. This could apply to everything from defense satellites to energy grids.

- Connectivity & Exploration: Creating platforms for global communication and supporting missions beyond Earth, like going to the Moon.

The future for both Vantor and Lanteris involves a multi-orbit strategy, meaning they’re not just sticking to one type of satellite orbit. They’re looking at how to use satellites in low Earth orbit (LEO), geostationary orbit (GEO), and even cislunar space to provide different kinds of services. This flexibility is key to meeting diverse customer demands and staying competitive in the fast-changing space industry.

Maxar Technologies’ Historical Evolution

From MDA to Maxar Technologies

It’s kind of wild to think about how much the space industry has changed, and Maxar’s story is a pretty good example of that. It all really started back in 1969 with MacDonald, Dettwiler and Associates, or MDA, in British Columbia. They got known for some pretty cool robotics stuff, like working on the Canadarm for the Space Shuttle and later for the International Space Station. Over the years, MDA grew, moving into satellite communications and Earth observation. They picked up some key companies along the way, like Spar Aerospace. Then, in 2012, they made a big move by acquiring Space Systems/Loral (SS/L), which was a major player in building big geostationary communication satellites. Things really shifted in 2017 when MDA rebranded as Maxar Technologies and actually moved its main headquarters to the U.S. This was when they brought together MDA, SS/L, and DigitalGlobe, a company that was already a big deal in high-resolution satellite imagery. It was a significant moment, aiming to create a more unified force in the space tech world.

The Impact of the Advent International Acquisition

Things kept evolving, and in 2019, MDA itself was sold back to Canadian investors, which meant Maxar was really focusing on DigitalGlobe’s imagery business and SS/L’s satellite manufacturing. But the biggest shake-up came in 2023. A private equity firm called Advent International bought Maxar for a hefty $6.4 billion and decided to take the company private. This led to a pretty significant split: Maxar Intelligence, which handles the imagery and analytics side, and Maxar Space Systems, focused on building satellites, became two separate entities. This move was all about setting them up for their next chapter, which we’re seeing now with the rebranding to Vantor and Lanteris.

Key Milestones in Company Development

Looking back, you can see a clear path of growth and strategic shifts:

- 1969: MacDonald, Dettwiler and Associates (MDA) founded, focusing on robotics and later expanding into satellite tech.

- 2012: Acquisition of Space Systems/Loral (SS/L), strengthening satellite manufacturing capabilities.

- 2017: Rebranding to Maxar Technologies, integrating MDA, SS/L, and DigitalGlobe under one U.S.-based umbrella.

- 2019: MDA business segment sold off, sharpening Maxar’s focus on imagery and satellite production.

- 2023: Acquisition by Advent International, leading to the separation into Maxar Intelligence and Maxar Space Systems.

- 2025: The two entities are rebranded as Vantor and Lanteris, marking a new era for spatial intelligence and satellite manufacturing.

Looking Ahead

So, Maxar Technologies is no more, split into Vantor and Lanteris. It’s a big change, for sure. Vantor is really pushing into software and AI, trying to make sense of all the data we get from space, not just showing us pictures. Lanteris, on the other hand, is focusing on building satellites, especially for defense and government needs, and they seem to be finding a good balance between commercial and government work. It’s going to be interesting to see how these two new companies carve out their own paths. They’re clearly trying to adapt to what the space industry needs now, which is a lot more than just launching satellites. We’ll have to keep an eye on them.