Menlo Ventures is a name that comes up a lot when you talk about venture capital, especially for companies just getting started. They’ve been around for a while, since 1976, and have seen a lot of changes in the tech world. This article takes a look at how Menlo Ventures operates, from their early days to how they make money and what they focus on. It’s a look at a firm that’s played a big part in Silicon Valley’s story.

Key Takeaways

- Menlo Ventures, founded in 1976, is one of the older venture capital firms in Silicon Valley, focusing on early-stage technology companies.

- The firm invests in key sectors like consumer, enterprise, and healthcare technology, looking for disruptive ideas and business models.

- Menlo Ventures makes money through management fees charged to investors and carried interest, which is a share of the profits from successful investments.

- Exit strategies, such as IPOs or acquisitions, are important for Menlo Ventures to generate returns for its partners.

- Despite market ups and downs, Menlo Ventures has shown resilience by adapting its strategy and continuing to back innovative companies.

The Genesis of Menlo Ventures

Founding Vision and Early Years

Menlo Ventures got its start way back in 1976. Think about that – the personal computer was barely a thing, and the internet was just a concept for researchers. A group of folks with a knack for spotting potential saw something big brewing in technology. They decided to put their money and energy into backing companies that were just starting out, the ones with wild ideas that most people probably thought were a bit crazy. Their main goal was to find and support these early-stage tech companies that had the potential to really grow and change things. It wasn’t just about making money; it was about being part of the next wave of innovation right from the ground floor.

Pioneering Early-Stage Technology Investments

Back then, investing in brand-new tech companies wasn’t exactly common practice. Most investors stuck to more traditional businesses. But Menlo Ventures saw the future. They were willing to take a chance on companies that were developing new software, hardware, or communication tools. This meant they had to get really good at figuring out which ideas had legs and which ones wouldn’t make it. It was a lot of research, a lot of talking to founders, and a lot of gut feeling. They weren’t afraid to step into unknown territory, which is how they built their reputation for finding gems before anyone else did.

Establishing a Silicon Valley Legacy

Being in Silicon Valley from the early days gave Menlo Ventures a front-row seat to the tech explosion. They didn’t just invest; they became a part of the community. By consistently backing promising startups, they helped build the ecosystem that we know today. Many of the companies they supported went on to become household names, proving that their early bets were smart ones. This track record helped them raise more money for future investments and attract even more ambitious entrepreneurs looking for a partner who understood their vision. They became a go-to firm for anyone serious about making a mark in the tech world.

Menlo Ventures’ Strategic Investment Approach

Menlo Ventures has built a solid reputation by being smart about where and how they put their money to work. It’s not just about throwing cash at any shiny new idea; there’s a real strategy behind their investments, focusing on specific areas and stages of a company’s life.

Focus on Key Technology Sectors

Instead of spreading themselves too thin, Menlo Ventures zeroes in on a few core technology areas where they have deep knowledge and strong connections. This allows them to really understand the market dynamics and spot the companies with the most potential.

- Enterprise Software: They look for tools and platforms that help businesses run more efficiently, whether it’s cloud solutions, cybersecurity, or data management.

- Next-Generation Infrastructure: This includes the foundational technologies that power the digital world, like advanced networking and computing.

- AI/ML: Artificial intelligence and machine learning are huge, and Menlo Ventures is keen on companies developing innovative applications in this space.

This focused approach means they can offer more than just capital; they bring valuable insights and guidance to the founders they back. As noted in a recent update from Menlo Ventures, their focus includes these rapidly evolving sectors, highlighting opportunities within the Q3 2025 Anthology Fund.

Investing Across Early and Growth Stages

Menlo Ventures isn’t afraid to get in on the ground floor. They actively seek out promising companies in their early stages, often when they’re just getting started and have a lot of room to grow. This is where they can often find the best valuations and have the most impact.

But they don’t stop there. They also invest in companies that have already found some traction and are looking to scale up. This growth-stage investment provides the capital and strategic support needed to expand their market reach and solidify their position.

Identifying Disruptive Business Models

Beyond just the technology itself, Menlo Ventures is on the hunt for companies that are fundamentally changing how things are done. They want to back founders who aren’t just improving existing products but are creating entirely new markets or challenging established industries with innovative approaches. This willingness to back truly disruptive ideas is a hallmark of their investment philosophy. They look for businesses that have the potential to become leaders in their respective fields, often by leveraging technology in novel ways to solve significant problems for customers.

Navigating the Venture Capital Ecosystem

So, how does a firm like Menlo Ventures actually fit into the whole startup world? It’s not just about throwing money at new ideas. Think of venture capital firms as a bridge. On one side, you have people with money who want to see it grow – these are the limited partners, or LPs. On the other side, you have founders with brilliant, but often unproven, ideas and businesses. Venture capital firms, like Menlo, step in the middle.

The Role of Venture Capital Firms

Basically, VC firms gather money from those LPs – think pension funds, wealthy individuals, and other big institutions. They then use this big pot of cash to invest in promising startups. But it’s way more than just a bank. They bring a lot to the table.

- Capital Infusion: This is the obvious one. Startups need cash to hire people, build products, and market themselves. VCs provide this.

- Expert Guidance: Most VCs have been around the block. They’ve seen what works and what doesn’t. They offer advice on strategy, operations, and how to scale.

- Network Access: Getting introductions to potential customers, partners, or even future investors can be a game-changer. VCs have those connections.

- Credibility Boost: Just getting a VC firm to invest in your company signals to others that your business has potential.

Understanding Investor Types

It’s not all just Menlo Ventures out there. The startup funding scene has a few different kinds of players, each with their own style:

- Angel Investors: These are usually individuals, often successful entrepreneurs themselves, who invest their own money. They typically invest earlier than VCs and often provide mentorship.

- Venture Capital Firms (like Menlo): These are professional firms managing pooled money from LPs. They invest larger sums and often take board seats.

- Corporate Venture Capital (CVC): Big companies sometimes have their own investment arms to fund startups that align with their business strategy. They can offer strategic partnerships alongside capital.

- Private Equity Firms: While often focused on more mature companies, some PE firms do get involved with later-stage venture deals.

Menlo Ventures’ Position in the Industry

Menlo Ventures has been around since 1976, which is practically ancient in Silicon Valley terms. This long history means they’ve built up a ton of experience and a strong reputation. They tend to focus on specific areas, like enterprise software and consumer tech, and they’re known for getting in relatively early, often leading investment rounds. Their longevity and consistent track record in identifying and supporting successful companies is a big part of why they’re respected. They’re not just a source of cash; they’re seen as a strategic partner that can help guide companies through the often-turbulent early stages and beyond.

Revenue Generation and Exit Strategies

So, how does a firm like Menlo Ventures actually make money? It’s not just about picking winners, though that’s a big part of it. There are a couple of main ways they bring in cash, and then there’s the whole process of getting that money back out to their investors.

Management Fees and Carried Interest

First off, there are management fees. Think of this as the cost of doing business for Menlo. They charge a percentage of the total money they manage, usually paid out annually by the people who invested with them (the limited partners, or LPs). This fee helps cover the day-to-day operations – salaries, office space, all that jazz. It’s a steady income stream, regardless of how well specific investments are doing.

But the real payday, the thing everyone talks about, is carried interest. This is Menlo’s share of the profits from successful investments. If they invest $10 million in a company and it later sells for $100 million, that’s a $90 million profit. Menlo typically gets a cut of that profit, often around 20%. This profit-sharing is where venture capital firms really make their mark. It aligns their interests directly with their investors – they only make big money if their portfolio companies do well.

The Importance of Successful Exits

Now, all those fees and profit shares don’t mean much if the companies Menlo invests in don’t eventually sell or go public. That’s where exit strategies come in. An exit is basically the event where Menlo sells its stake in a company it helped grow. The two most common ways this happens are:

- Initial Public Offering (IPO): The company sells shares to the public for the first time. This can be a huge win, allowing Menlo to sell its shares on the open market.

- Acquisition: Another company buys the startup. This is also very common, and the price paid can be quite substantial.

Achieving Returns for Limited Partners

Ultimately, Menlo’s goal is to return money to its LPs, and do it with a good profit. They carefully plan these exit strategies from the beginning, even if it’s years down the line. When a company is acquired or goes public, Menlo realizes its gains. For example, if they invested $5 million in a startup and get $50 million back from an acquisition, that’s a 10x return on that specific investment. These successful exits are what allow Menlo to pay out profits to their LPs, and also take their own cut of the profits through carried interest. It’s a cycle: raise money, invest it, help companies grow, and then sell those companies to get the money back, hopefully with a lot more.

Challenges and Resilience in Early-Stage Investing

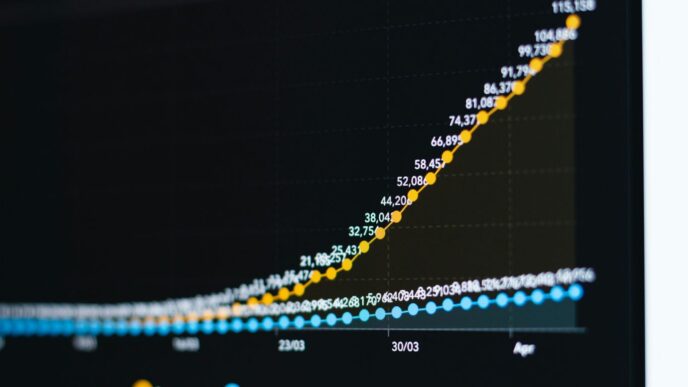

Look, investing in new companies is never a walk in the park. It’s always got its ups and downs, but lately? It feels like the roller coaster’s gone off the rails a bit. We’ve seen a definite pull-back in funding. Investors are getting pickier, and companies that just burn through cash without a clear path to making money are finding it tough.

Investment Risks and Due Diligence

So, why the shift? A big reason is the economy. Interest rates have gone up, making money more expensive to borrow. This means less cash floating around for investments. Plus, things like inflation and global instability add layers of uncertainty. It’s not just about a cool idea anymore; investors are digging much deeper. They want to see a solid plan for long-term growth, not just a flashy pitch.

- Market Volatility: Economic downturns, inflation spikes, and geopolitical events can quickly change the investment climate.

- Company Performance: Startups are inherently risky. Many fail before they ever become profitable.

- Competition: The market is crowded, and standing out requires more than just innovation.

- Regulatory Changes: New laws or policies can impact a company’s business model and profitability.

Adapting to Market Volatility

It’s easy to get spooked when the market gets choppy. Some investors just pull back entirely, which makes things harder for startups needing capital. But here’s the thing: some of the most successful companies we know, like Microsoft or Airbnb, got their start during tough economic times. The key is being able to see past the immediate noise and identify businesses that can thrive even when things aren’t perfect. This means founders need to be extra sharp about their business fundamentals and investors need to be even more rigorous in their research.

Sustaining Growth Amidst Economic Shifts

When the going gets tough, the tough get going, right? For venture capital firms like Menlo Ventures, it means being smart about where they put their money. They’re looking for companies with strong foundations, clear revenue models, and the ability to adapt. It’s not about chasing the hottest trend; it’s about backing solid businesses that can weather storms and come out stronger. This often means focusing on smaller deal sizes and companies that are already showing signs of sustainable growth, even if they aren’t the biggest players yet.

Menlo Ventures’ Impact and Future Outlook

Empowering Innovative Companies

Menlo Ventures has a long history of backing companies that go on to change how we live and work. It’s not just about writing checks; it’s about partnering with founders who have big ideas and the drive to make them happen. Think about the companies they’ve supported – many have become household names or industry leaders. This firm really seems to get what it takes for a startup to go from a small idea to something big. They provide not just money, but also guidance and connections that are super important in those early days. It’s this hands-on approach that helps these businesses grow and really make a mark.

Shaping the Future of Technology

Looking ahead, Menlo Ventures continues to focus on areas that are set to define the next wave of technological advancement. They’re not afraid to explore new frontiers, whether that’s in AI, cloud computing, or other emerging fields. Their investment strategy is all about spotting trends early and getting behind the companies that are creating the solutions of tomorrow. It’s a bit like looking into a crystal ball, but with a lot more data and experience involved. The firm’s commitment to innovation means they’re constantly evaluating new markets and technologies, aiming to be at the forefront of what’s next.

A Cornerstone of Silicon Valley’s Landscape

For decades, Menlo Ventures has been a steady presence in the venture capital world. They’ve seen market ups and downs, and through it all, they’ve maintained a consistent approach. This reliability has made them a go-to firm for entrepreneurs and a respected name among other investors. Their continued success is a testament to their ability to adapt while staying true to their core principles. As the tech industry keeps evolving, Menlo Ventures is positioned to remain a key player, helping to shape the next generation of groundbreaking companies and contributing to the ongoing story of Silicon Valley. You can see their influence in the broader global venture capital landscape and how they operate.

Wrapping It Up

So, looking back at Menlo Ventures, it’s clear they’ve carved out a solid spot in the early-stage investing world. They’ve been around since the 70s, which is pretty wild, and they’ve managed to back some big names over the years. It’s not just about throwing money at startups, though. They seem to really focus on specific areas like consumer tech and enterprise solutions, and they get involved early on. This approach, combined with how they make money through fees and a cut of the profits, seems to work for them. Even with the market being a bit shaky lately, with interest rates going up and less cash flowing around, firms like Menlo are still out there, looking for the next big thing. It just means they’re being more careful, and startups need to show they have a real plan for the long haul. It’s a tough game, for sure, but that’s venture capital for you.

Frequently Asked Questions

What is Menlo Ventures?

Menlo Ventures is like a guide for new companies. It’s a company that has been around since 1976, helping out young tech businesses that have really cool ideas. They give these companies money and advice to help them grow big and strong.

How does Menlo Ventures make money?

Menlo Ventures makes money in a couple of ways. First, they charge a small yearly fee to manage the money they invest. Second, if the companies they invest in do really well and make a lot of money, Menlo Ventures gets a share of those profits. It’s like getting a bonus when your investments pay off.

What kind of companies does Menlo Ventures invest in?

They like to invest in companies that are creating new things in areas like apps and online services people use every day (consumer tech), tools that help businesses run better (enterprise tech), and new ways to improve health and medicine (healthtech). They look for companies with fresh ideas that could change how things are done.

Why is early-stage investing risky?

Investing in new companies is risky because many of them might not succeed. It’s like planting seeds – some will grow into big trees, but others might not sprout. Menlo Ventures tries to lower this risk by doing a lot of research and using their experience to pick the most promising ones.

What happens when a company Menlo Ventures invests in becomes successful?

When a company does really well, Menlo Ventures helps it find a way to ‘exit.’ This usually means either selling the company to a bigger one or letting it sell shares to the public through something called an IPO. This is how Menlo Ventures and its investors make their money back, often with a big profit.

Does Menlo Ventures invest in companies at different stages?

Yes, Menlo Ventures likes to invest in companies when they are just starting out (early-stage) and also when they are growing and need more money to expand (growth-stage). Getting involved early lets them help shape the company’s future and potentially get the best returns.