Keeping up with Microsoft stocks today can feel a bit like trying to follow a fast-moving train. Prices shift, headlines roll in, and analysts keep changing their minds about what comes next. This October, Microsoft finds itself in the spotlight again, with its share price moving up and down, new deals in artificial intelligence, and lots of chatter about what the future holds for investors. Whether you’re holding shares or just watching from the sidelines, there’s a lot to unpack about where Microsoft stands right now and what could be around the corner.

Key Takeaways

- Microsoft stocks today are trading near the top of their 52-week range, but recent days saw a slight dip in share price.

- The company’s revenue and net income both grew over 14% year-over-year, showing steady financial strength.

- Analysts remain mostly positive on Microsoft, with several major firms raising their price targets for the stock in October 2025.

- Artificial intelligence and cloud services continue to be big growth drivers for Microsoft, with new partnerships and updates announced this month.

- Upcoming earnings reports and possible market corrections are on investors’ minds, along with ongoing regulatory and competitive pressures.

Microsoft Stocks Today: Share Price Fluctuations and Market Performance

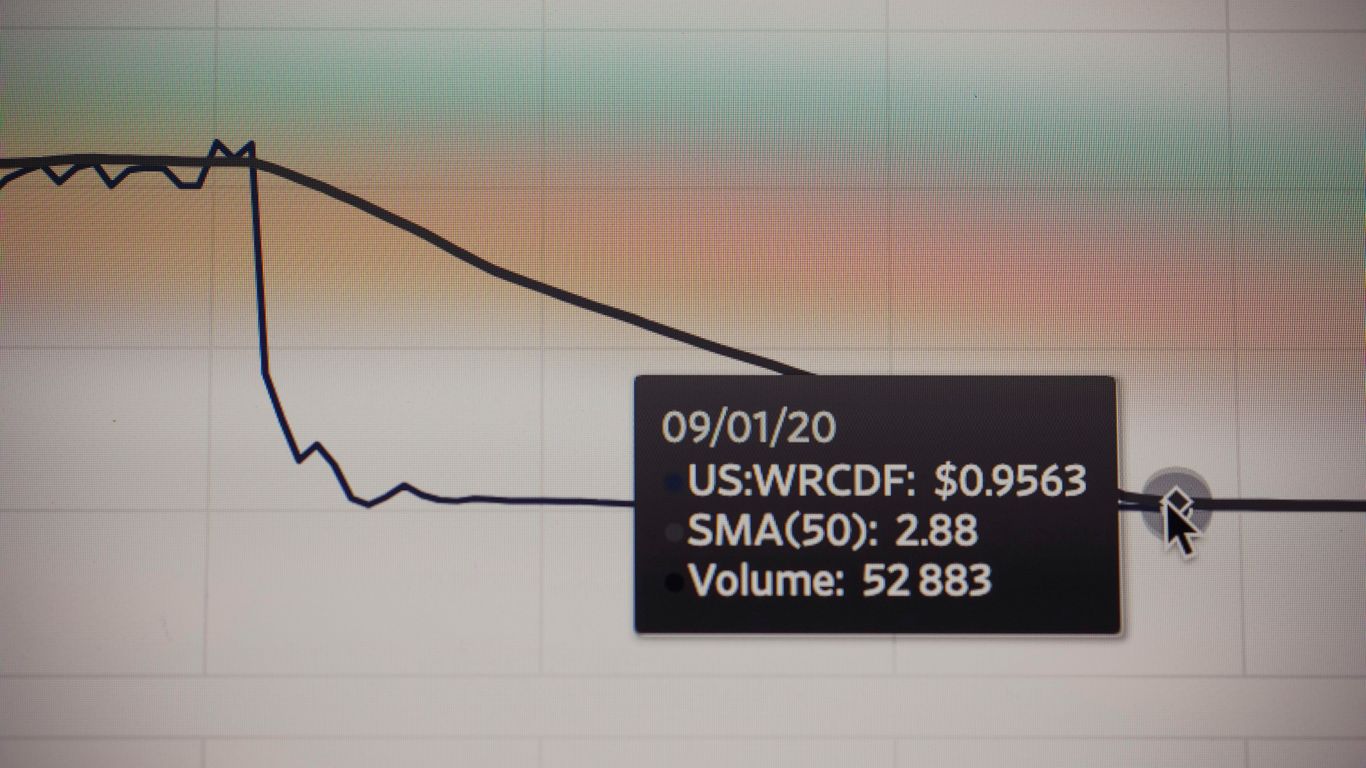

Current Share Price and Recent Trends

It’s been a bumpy ride for Microsoft shares lately. The stock recently closed at $517.35, dropping about 0.95% in the most recent session. The day opened at $522.67, which was already lower than the previous close, so it’s clear there’s been some pressure on the stock. Despite this, Microsoft is still hovering near the top level of its 52-week price range. If you’re keeping an eye on its momentum, most folks seem to think MSFT is holding up better than a lot of other tech names in 2025. Some price targets are even aiming as high as $680, pointing to a possible 31% move up from here (highest price target).

| Date | Closing Price | % Change | 52-Week Range |

|---|---|---|---|

| Oct 8, 2025 | $517.35 | -0.95% | Near 52-week high |

Volume and Price Movement Analysis

Let’s talk about what’s driving all the action. Trading volume has had its ups and downs. On heavy news days – like major AI partnerships or gaming headlines – you’ll see a quick jump in both price swings and shares traded. Days with fewer updates sometimes see the price drift sideways or edge lower.

Key factors moving Microsoft stock lately:

- News around artificial intelligence and cloud expansion

- Concerns over cybersecurity, including fresh reports of SharePoint troubles

- Marketwide chatter about potential corrections or bigger sector shifts

When volume is up and the price follows, investors generally seem confident. If volume picks up but the stock slips, that’s usually folks taking profits or reacting to some headline risk.

Comparing Microsoft’s Performance to Sector Peers

Against the backdrop of technology rivals, Microsoft’s stock usually punches above its weight. It’s got a mega-cap valuation – market cap sits north of $3.9 trillion, which is just wild. Not every tech giant can claim to be trading above their 200-day average while also holding up after so many positive and negative headlines.

Here’s a quick rundown of how Microsoft stacks up to its sector peers:

- Market capitalization above $3.9 trillion, dwarfing most in its space

- Maintains strong P/E ratios compared to direct competitors

- Investor sentiment remains optimistic, especially after AI and cloud announcements

The competition is fierce, of course, but MSFT keeps landing in the top tier for market performance in 2025. Even when the tech sector takes a breather, Microsoft holds up, largely thanks to its robust business mix and steady investor interest.

Key Financial Highlights for Microsoft Stocks Today

Revenue and Net Income Growth

If you look at Microsoft’s latest numbers, there’s been solid growth across the board. In the past year, Microsoft pulled in $281.72 billion in revenue—a 14.93% jump from the previous year. Last quarter alone saw revenues hit $76.44 billion, riding a 9.1% wave from the prior period. Net income wasn’t just tagging along; it grew to $101.83 billion over the past year, up 15.54%. The most recent quarterly figure landed at $27.23 billion, a 5.46% increase from the last quarter. That’s the kind of steady climb investors hope for.

Here’s a quick look at the key numbers:

| Metric | 1 Year | Last Quarter |

|---|---|---|

| Revenue | $281.72B | $76.44B |

| Net Income | $101.83B | $27.23B |

- Revenue is up nearly 15%, beating out a lot of its tech rivals

- Quarterly net income is up more than 5%

- Microsoft is keeping up momentum despite tighter competition

Earnings per Share Momentum

Microsoft’s earnings per share (EPS) has kept pace, supporting the impression that the core business isn’t slowing down. For the full past year, EPS hit $13.64—a year-over-year climb of 15.6%. In the most recent quarter, EPS registered at $3.65, a 5.45% rise versus the previous quarter. Investors typically use this number as a quick gut-check on overall profit efficiency.

- 15.6% EPS increase from last year

- Quarterly EPS growth just above 5%

- All EPS numbers lined up with or exceeded market predictions

Profit Margins and Cash Flow Status

Profit margins have stayed consistent—even with heavy investment in AI, cloud, and new infrastructure. Microsoft’s net profit margin has hovered above 35%, which is no small feat given its scale. The business is known for its massive market capitalization, recently closing near $3.9 trillion, and its cash reserves are just as impressive. Free cash flow remains robust, giving Microsoft a comfortable buffer for both shareholder payouts and further expansion.

- Net profit margins remain strong above 35%

- Free cash flow is solid, supporting both dividends and share buybacks

- The debt-to-equity ratio is kept in check, helping maintain financial flexibility

So, even as costs rise and the competition pushes harder, Microsoft isn’t blinking. It’s still printing strong profits quarter after quarter. For long-term investors, that’s a welcome sign heading into the remainder of 2025.

Analyst Ratings and Price Targets Update for October 2025

Tracking analyst calls this month has been kind of interesting—lots of updates, some big numbers being tossed around, and, honestly, a bunch of different opinions. Here’s a look at what Wall Street is saying about Microsoft this October, why targets keep creeping higher, and how investment shops are viewing things now.

Latest Analyst Consensus and Upgrades

In October 2025, the consensus among analysts is pretty upbeat. There’s a strong tilt toward “Buy” or “Overweight” ratings, with very few downgrades in sight.

- Multiple analysts have reiterated positive ratings, from Wells Fargo to Arete.

- Stifel Nicolaus upgraded Microsoft from "Sector Weight" to "Overweight" with a price target that’s now well above $600.

- Out of the major research notes released so far:

- Over 80% of analysts still recommend buying or holding the stock.

- Recent upgrades are backed by optimism for Microsoft’s AI and cloud growth.

You can see the effect of these revised opinions ahead of Microsoft’s earnings report, which is boosting stock price targets for Microsoft.

Notable Price Target Revisions

Big moves in price targets always grab attention, and October didn’t disappoint. The latest table below summarizes some of the louder calls:

| Analyst / Firm | Previous Target | New Target | Rating | Date |

|---|---|---|---|---|

| Wells Fargo | $650 | $675 | Overweight | 10/6/2025 |

| Arete | $640 | $640 | Buy | 10/1/2025 |

| Morgan Stanley | $700 | $710 | Buy | 9/26/2025 |

| UBS Group | $600 | $650 | Buy | 7/31/2025 |

| Barclays | $595 | $625 | Buy | 8/29/2025 |

Targets north of $700 are now showing up more in analyst notes. Some of the revisions are in response to Microsoft’s recent quarterly performance, while others seem focused on future AI gains and enterprise cloud demand.

Major Investment Firms’ Perspectives

What are the big investment shops saying overall? Here’s the gist:

-

- Wells Fargo, Morgan Stanley, and UBS have all lifted targets, reflecting faith in Microsoft’s strategy and future outlook.

- Firms are closely watching Microsoft’s next earnings, but generally still see upside—even after this year’s rally.

- A few have cautioned about the run-up in valuation, but most are convinced that recurring revenue streams (like cloud and software licenses) offer some protection if tech stock enthusiasm cools off.

If you’re following analyst chatter, the mood is steady and pretty bullish—especially compared to peers where estimates have gotten more cautious recently.

Microsoft Stocks Today: Impact of Artificial Intelligence and Cloud Expansion

Role in Generative AI Leadership

Lately, Microsoft’s spot at the top of the artificial intelligence discussion isn’t up for debate. The company keeps making headlines with its aggressive moves into generative AI (GenAI), often setting the tone for the entire tech market. Just this month, Microsoft’s collaboration with both OpenAI and new partners like Harvard Medical School for AI-focused solutions has grabbed investor attention. What stands out is how Microsoft isn’t just sticking to one AI partner—it’s balancing a packed slate of alliances so it isn’t boxed in by issues at OpenAI or any single provider. Some folks on Wall Street say this might be why Microsoft is seen as the go-to stock for AI exposure in the mega-cap space.

A few recent GenAI moves:

- Partnered with Harvard Medical School to update Copilot for medical use.

- Invested in smaller "neocloud" AI infrastructure providers, signaling it won’t rely too heavily on any one company.

- Rolled out new features on Azure AI, which are expected to attract enterprise contracts this quarter.

Cloud Services as a Growth Driver

There’s a running joke in finance that every conversation leads back to “the cloud,” and Microsoft’s numbers really drive that home. Azure, Microsoft’s cloud platform, keeps pulling in double-digit growth rates quarter after quarter. Analysts credit this mostly to two things: more companies shifting their data to the cloud, and Microsoft consistently pushing new cloud-based AI features ahead of rivals. They’re not just in competition with other cloud giants like Amazon, but also with the next wave of cloud players ramping up in this new AI-focused era. By hedging its bets—splitting $33 billion worth of contracts among up-and-coming neocloud firms like CoreWeave and Nebius—Microsoft is shoring up capacity and keeping its cloud reliable.

Here’s a quick table showing recent Azure and cloud services stats:

| Quarter | Azure Revenue Growth (YoY) | Cloud Segment Revenue | Major Cloud/A.I. Initiatives |

|---|---|---|---|

| Q3 2025 | 18% | $32.5B | GenAI updates, neocloud deals, Copilot |

| Q2 2025 | 21% | $30.8B | Enterprise AI rollouts, global expansion |

Latest AI Partnerships and Announcements

If you’re an investor, it’s tough to keep up with all the partnership news coming out of Redmond. Just in the last week, Microsoft signed deals or rolled out joint projects with institutions in healthcare, education, and gaming. And it doesn’t seem like they’re hitting the brakes any time soon. Three standouts:

- A new long-term agreement with Harvard Medical School to bring AI into patient care solutions and research tools.

- Deeper integrations between Azure AI and enterprise clients, making access to custom large language models (LLMs) more practical for ordinary businesses.

- Updates to the Xbox platform using GenAI for more accessible game development.

Bottom line: Microsoft’s rapid pace in AI and cloud isn’t just hype—it’s showing up in the numbers and grabbing Wall Street’s attention. But these moves also mean Microsoft is under a microscope. Investors will be watching closely to see if these flashy headlines actually translate into earnings next quarter.

Upcoming Catalysts and Risk Factors for Microsoft Investors

Earnings Release Date and Expectations

Microsoft has announced its next earnings report for Wednesday, October 29, 2025. This release is already circled on a lot of calendars, because investors are watching to see if Microsoft can keep up its solid run in AI and cloud revenue. After last quarter’s numbers, expectations are higher than ever. Here’s how the figures have looked recently:

| Period | Revenue (B) | Net Income (B) | EPS |

|---|---|---|---|

| Q4 2025 | $76.44 | $27.23 | $3.65 |

| Year ending | $281.72 | $101.83 | $13.64 |

If Microsoft can beat analysts’ forecasts, it will probably give the stock another short-term boost. But a miss, even a slight one, could really shake things up.

Regulatory and Competitive Challenges

There’s no way around it: Microsoft is in the spotlight, and that brings some headaches. New regulatory scrutiny is cropping up everywhere — especially around AI ethics, privacy, and competition. At the same time, rivals aren’t letting up:

- Alphabet, Amazon, and Oracle are pitching new cloud and AI tools at big enterprise clients

- Copyright issues keep popping up, especially for generative AI products

- Ongoing antitrust reviews (both in the US and abroad) mean a single misstep could result in fines or even new rules

You can read more about these tricky challenges related to AI monetization and competition Microsoft demonstrates solid AI monetization.

Market Correction Concerns from Analysts

Some well-known analysts are actually voicing concerns about a potential correction. They’re worried about:

- The high valuation of mega-cap tech (including Microsoft)

- AI hype maybe getting ahead of real, sustainable profits

- The broader stock market possibly cooling off this quarter

To sum up, while Microsoft still looks strong in many areas, investors would be wise to keep an eye on these catalysts and risk factors. The next few weeks could bring major news, and the market’s reactions might be surprising.

Comparative Overview: Microsoft Versus Other Mega-Cap Tech Stocks

Let’s dig into how Microsoft is stacking up next to other household-name tech giants right now. In 2025, there’s a lot of talk about who’s leading in the market, who’s catching up, and who’s looking a bit shaky. Honestly, it’s almost like watching a group of marathon runners trade places at the front every few miles.

Market Capitalization and P/E Ratios

Right now, there’s a real race at the top. Microsoft sits in second place by market capitalization, trailing only Nvidia, but ahead of Apple and Alphabet. Here’s how the key players measure up today:

| Company | Market Cap (Trillions) | P/E Ratio (TTM) |

|---|---|---|

| Nvidia | $4.25 | (high, reflecting AI gains) |

| Microsoft | $3.77 | ~35 |

| Apple | $3.45 | ~29 |

| Alphabet | $2.2 | ~27 |

You can dig into the full rankings on world’s largest company by market capitalization for more perspective. That’s a lot of zeroes. It shows how fierce the competition is to hold the title of most valuable company.

Performance in the AI Boom

AI is the big thing in tech right now—everyone’s got their eye on it. Microsoft’s definitely standing out by:

- Ramping up investments in generative AI, building both its own infrastructure and teaming up with new cloud partners.

- Reporting strong growth in Azure, with AI services grabbing new enterprise clients.

- Diversifying beyond just OpenAI (unlike some rivals focused on one AI partner).

Nvidia’s seeing gains from every corner thanks to its chips, but Microsoft’s wider business lines let it catch more of the benefits across cloud, software, and hardware. Apple and Alphabet are moving on AI, for sure, but their impact hasn’t punched up the numbers in the exact same way.

Competitive Positioning in the Tech Sector

Thinking about which tech giant has the edge? Here are some things folks are considering:

- Microsoft has locked down a massive base in cloud and productivity software—think Azure and Office.

- Nvidia’s got chip dominance, especially in AI, but it’s a more concentrated business; Microsoft’s spread out across lots of areas.

- Apple is steady in hardware and services, but new, game-changing growth hasn’t landed post-iPhone.

- Alphabet is still the king of search and ads, but it’s under some pressure to turn its AI projects into more cash.

To wrap up, Microsoft’s position among these high-flying companies looks solid. Its investments in AI, steady cloud growth, and big war chest have put it in second by market cap, trailing just behind Nvidia and ahead of Apple. As the AI race heats up this fall, Microsoft is in a good spot to surprise us again, especially if their latest moves pay off.

Microsoft Stocks Today: Dividend Outlook and Long-Term Returns

Dividend Yield and Payment Schedule

If you’ve been holding Microsoft (MSFT), you’re probably already aware the company has a long-standing reputation for sending quarterly dividends your way. In October 2025, Microsoft’s annual dividend yield sits just above 0.8%, which is a bit lower than average for the broader market, but not unusual for mega-cap tech names. Here’s a quick look at their current dividend breakdown:

| Dividend Per Share (Annual) | Dividend Yield | Payout Frequency | Ex-Dividend Date (2025 Q4) |

|---|---|---|---|

| $3.08 | 0.81% | Quarterly | September 12, 2025 |

Microsoft typically pays its dividends in March, June, September, and December. The payment schedule is as regular as clockwork, which makes it attractive for people who like to budget for steady income.

Sustained Dividend Growth Track Record

One feature that’s drawn in long-term investors is Microsoft’s commitment to dividend growth. Over the past decade, management has boosted the payout every year, even during turbulent times. Some points worth noting:

- Microsoft’s 5-year average annual dividend growth rate is around 10%.

- In the last quarter, the board approved a 10% bump to the quarterly dividend.

- The payout ratio remains modest, staying well below 35% of earnings, so there’s room for more hikes if profits keep rolling in.

Microsoft makes a point of balancing new dividends with investments in research and acquisitions, so the growth isn’t coming at the expense of innovation.

Evaluating Total Shareholder Return

When sizing up Microsoft’s long-term appeal, it’s not just about the dividends. Total shareholder return (TSR) also includes stock price appreciation and buybacks.

Here’s how Microsoft measures up over the last five years:

- Share price has climbed more than 120%.

- Dividends added about 9% to the total return.

- Aggressive share repurchase programs have helped dial up the earnings per share and reward patient holders.

So, if you’d bought Microsoft in 2020 and held through now, your returns would look something like this:

| Holding Period | Share Price Gain | Dividends | Buyback Impact | Total Return (approx.) |

|---|---|---|---|---|

| Oct 2020–Oct 2025 | +123% | +9% | +8% | +140% |

For folks thinking ahead a decade or more, Microsoft remains a proven choice if you want steady dividends alongside solid, compounding share growth.

Conclusion

So, that’s where things stand with Microsoft as we head through October 2025. The company is still a giant in tech, and it’s clear that AI and cloud services are driving a lot of the excitement. Even with some bumps—like the SharePoint security issues and the Game Pass price hike—analysts mostly seem upbeat about Microsoft’s future. The numbers look strong, with revenue and profits both up compared to last year. And with all the talk about AI, partnerships, and new deals, it feels like Microsoft isn’t slowing down anytime soon. Of course, the market can always surprise us, but for now, Microsoft is holding its spot near the top. If you’re following the stock, it’s probably a good idea to keep an eye on those earnings reports and any big news about AI or cloud. Things can change fast, but right now, Microsoft looks steady.

Frequently Asked Questions

What is the current price of Microsoft stock?

Microsoft’s stock price changes throughout the trading day. Most recently, it opened at $522.67, which was $2.18 lower than the previous close. The price dropped about 0.95% since the last market close.

How is Microsoft performing compared to other big tech companies?

Microsoft is doing very well among mega-cap tech stocks. Its market value is about $3.9 trillion, putting it in the top group. Microsoft is also leading in artificial intelligence and cloud services, which helps it stand out from its competitors.

What are the latest financial results for Microsoft?

Microsoft’s total revenue for the past year was $281.72 billion, up nearly 15% from last year. Net income reached $101.83 billion, and earnings per share rose to $13.64. These numbers show strong growth in both sales and profit.

What do analysts say about Microsoft stock right now?

Most analysts are positive about Microsoft. Many have given it a ‘buy’ rating and have raised their price targets, with some expecting the stock to reach as high as $710. Big investment firms like Morgan Stanley and Wells Fargo also have high hopes for Microsoft.

How does artificial intelligence impact Microsoft’s business?

AI is a big part of Microsoft’s growth. The company is a leader in generative AI and keeps making new deals, like its recent partnership with Harvard Medical School. AI and cloud services are helping Microsoft grow faster than many other tech companies.

Does Microsoft pay dividends, and what is its record for long-term returns?

Yes, Microsoft pays a regular dividend to its shareholders. The company has a strong history of increasing its dividend over time, which makes it attractive for people looking for steady income and long-term growth.