Money20/20 Europe 2025 is just around the corner, and it’s shaping up to be a big one. This event is pretty much *the* place for anyone in payments and fintech to be. It’s happening in Amsterdam from June 3rd to 5th, and it’s where all the big players gather to talk about what’s next. Whether you’re looking to make deals, learn about new tech, or just connect with people, this is where it’s at. Expect a lot of talk about AI, how money fits into everything we do online, and how open banking is becoming the norm.

Key Takeaways

- AI is moving beyond just helping out; we’re seeing a rise in ‘agentic AI’ that can make decisions and handle transactions on its own, changing how we interact with financial services online.

- Embedded commerce means financial services are popping up everywhere, especially in apps and social media, making transactions smoother but also bringing new challenges for security and fraud.

- Open banking is no longer new; it’s becoming a standard way to pay, with more partnerships and better tech making it easier for businesses and customers.

- The startup scene will be buzzing, with new companies showing off fresh ideas in areas like decentralized identity, climate tech investing, and smarter ways to manage risk using AI.

- Money20/20 Europe is the go-to spot for networking and finding business partners, offering a chance to connect with leaders and discover new tools that can help your business grow.

Key Themes Shaping Money20/20 Europe 2025

Alright, so Money20/20 Europe 2025 is just around the corner, and if you’re in the fintech world, you know this is where the big conversations happen. This year, a few topics are really standing out, shaping how we think about money and payments.

AI-Driven Innovation and Agentic Systems

Artificial intelligence isn’t new, but it’s definitely evolving. We’re moving past just using AI to make things a bit faster or more secure. The real buzz is around ‘agentic AI.’ Think of it as AI that can actually do things on its own – manage transactions, handle customer chats, and make decisions across the whole buying process. Companies like Mastercard and Visa are showing off what these ‘payment agents’ could look like. It’s a big shift from AI just helping us out to AI actively participating in financial stuff. It’s pretty wild to imagine AI agents handling your shopping or payments without you needing to lift a finger.

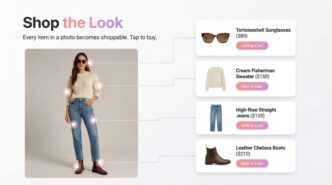

Embedded Commerce Redefining Consumer Interactions

This one’s all about making financial services just disappear into the background. You know, like when you buy something online, and the payment just happens without you really thinking about it? That’s embedded commerce. It’s about putting payments and other financial tools right where people are already shopping or interacting online. This makes things super convenient for customers, but it also means businesses need to figure out how to offer these services smoothly. It’s changing how we expect to buy things and how companies interact with us financially.

Open Banking’s Transition to Mainstream Adoption

Open banking has been talked about for a while, but it feels like it’s finally hitting its stride. It’s not just a niche thing anymore; it’s becoming a standard way for different financial apps and services to talk to each other. This means more competition, more innovation, and hopefully, better services for all of us. We’re seeing it move from a concept to something that’s actually being used by a lot more people and businesses. It’s making the whole financial system more connected and, in a way, more accessible.

Spotlight on Emerging Technologies and Startups

This year’s Money20/20 Europe is really shining a light on the up-and-coming companies that are shaking things up. It’s not just about the big players anymore; the Startup Media Session is where you’ll find the real game-changers. These are the folks tackling tough problems with fresh ideas, from making payments easier in places that need it most to using new tech for tracking investments in green projects.

Transformative Solutions from Startup Media Session

The Startup Media Session is always a highlight, and 2025 is no different. Eight companies got to show off what they’ve been working on, and let me tell you, the solutions are pretty wild. We saw everything from ways to manage digital identities to tools that help businesses deal with changing currency values. It’s clear that innovation is happening everywhere, not just in the usual tech hubs. One company, Sinpex, even won the pitch competition for their work on automating Know Your Business (KYB) processes, which is a big deal for compliance. It’s a great chance to see how these startups are trying to make finance work better for everyone. You can find out more about the event’s focus on innovation at Money20/20 offers a premier platform.

Decentralized Identity and Climate Tech Investing

Two areas that really stood out were decentralized identity and climate tech. Companies are exploring how to give people more control over their digital information, which could change how we log in to accounts or even make payments. On the climate tech side, platforms are popping up to make it easier for people to invest in companies that are trying to solve environmental problems. It’s interesting to see how finance is being used to support these important causes. Think about it:

- Decentralized Identity:

- Better control over personal data.

- New ways to verify who you are online.

- Potential for more secure transactions.

- Climate Tech Investing:

- Making green investments more accessible.

- Directing capital towards sustainable solutions.

- Helping investors align their money with their values.

AI-Powered Risk Management and Compliance

Artificial intelligence is popping up everywhere, and risk management and compliance are no exception. Startups are developing smart tools that can look at data in real-time to spot potential problems before they get big. This is a huge shift from older methods that were slower and less effective. Companies are using AI to:

- Automate compliance checks.

- Make faster, smarter decisions about risk.

- Improve fraud detection.

It’s all about using technology to make the financial world safer and more efficient. The focus is on building systems that can adapt quickly, which is exactly what you need in today’s fast-paced environment.

Networking and Business Opportunities at Money20/20 Europe

Money20/20 Europe isn’t just about listening to talks; it’s a prime spot for making real connections and finding new business. Think of it as a giant marketplace for ideas and partnerships in the fintech world. This is where deals get made and the future of money gets discussed face-to-face.

Connecting with Industry Leaders and Innovators

Walking the halls, you’ll bump into people who are actually running things – the CEOs, the heads of product, the big thinkers. It’s a chance to chat with them, maybe grab a coffee, and get their take on what’s happening. You might even meet the folks behind those cool new apps you’ve been hearing about. It’s less about formal meetings and more about those spontaneous conversations that can lead to something big.

Exploring Partnership Opportunities

Looking for someone to work with? Maybe you need a new payment processor, or perhaps your startup needs a financial backer. Money20/20 Europe is packed with companies of all sizes, from established banks to brand-new startups. You can find potential partners for all sorts of things:

- Technology Integrations: Link up with companies that offer services you need to make your product better.

- Market Expansion: Find partners who can help you enter new regions or reach new customer groups.

- Investment: Connect with venture capitalists and other investors looking for the next big thing.

Discovering New Financial Providers and Tools

It’s easy to get stuck using the same old tools. This event is your chance to see what’s new. You’ll find companies showcasing everything from advanced fraud detection systems to new ways to manage money across different currencies. For example, you might discover a company like Genome, which offers multi-currency accounts and dedicated IBANs, helping businesses manage their finances more smoothly across borders. Seeing these tools in action and talking to the people who built them can really open your eyes to new possibilities for your own business.

Driving the Future of Payments and Commerce

This section of Money20/20 Europe is all about what’s new and what’s next in how we pay for things and how businesses handle transactions. It’s not just about faster payments, though that’s part of it. We’re talking about the whole system getting smarter and more accessible.

Groundbreaking Innovations in Financial Infrastructure

Think about the plumbing behind all your financial dealings. This year, expect a lot of talk about making that plumbing more robust and adaptable. We’re seeing a move towards systems that can handle massive amounts of data in real-time, which is pretty important when you consider how many transactions happen every second. Companies are showing off new ways to build these systems so they can grow and change without breaking. It’s like upgrading a city’s power grid to handle way more demand, but for money.

Responsible Finance and Financial Inclusion

Beyond just the tech, there’s a big focus on making sure everyone can participate. This means looking at how financial services can reach people who might have been left out before. It’s about creating products and services that are fair and easy for everyone to use, no matter their background or where they live. We’ll hear about initiatives aimed at helping small businesses get the funding they need and making sure people can manage their money better. It’s a push to make the financial world work for more people.

Real-Time Data and Advanced Fraud Prevention

Speed is key, but so is safety. The discussions here will highlight how businesses are using real-time data to not only speed up transactions but also to catch bad actors. Imagine getting an alert about a suspicious transaction the moment it happens, not days later. This involves smarter algorithms and better ways to share information securely between different companies. The goal is to make payments faster and more secure by using data more effectively. We’ll see new tools and strategies that aim to stay one step ahead of fraudsters, protecting both consumers and businesses.

Amsterdam as the Epicenter for Fintech Discussions

The Premier Event for the Payments and Fintech Industries

Money20/20 Europe is back in Amsterdam from June 3-5, 2025, and it’s shaping up to be the main event for anyone in payments and fintech. Think of it as the big yearly meetup where all the important people in the money world get together. It’s not just about listening to talks; it’s where deals get made and ideas are swapped. If you’re serious about what’s next in finance, you really can’t miss this. It’s where the future of how we handle money starts to take shape.

A Hub for Doing Business and Exchanging Ideas

This isn’t just another conference; it’s a place where real business happens. Last year, for example, companies like Shift4 used their spot to connect with clients and partners, creating a lively atmosphere right in the middle of the action. They even hosted happy hours, making it easy for people to chat and build relationships. It’s a prime spot to find new financial tools or even potential business partners. You can expect to see a lot of this again, with companies ready to show off what they’re working on and find new collaborators. It’s a melting pot of innovation and opportunity.

Setting the Course for What’s Next in Fintech

Every year, Money20/20 Europe in Amsterdam sets the agenda for the fintech industry. This year, expect a heavy focus on a few key areas:

- AI-driven personalization: How companies are using AI to tailor experiences for customers.

- Financial infrastructure: Innovations that are changing how money moves behind the scenes.

- Responsible finance: Discussions around making financial services fairer and more accessible.

- Real-time data and fraud prevention: Tools and strategies to keep transactions secure and fast.

These aren’t just buzzwords; they’re the topics that will define the financial landscape for the coming year. The event is designed to bring together the brightest minds to hash out these challenges and opportunities, making Amsterdam the go-to city for setting the direction of fintech.

Wrapping It Up

So, Money20/20 Europe 2025 in Amsterdam is shaping up to be another can’t-miss event for anyone in the payments and fintech world. We’ve seen how AI is really taking center stage, not just for making things smarter, but for creating these autonomous agents that could change how we do business online. Plus, the way financial services are getting baked right into the apps we use every day, like on social media, is a huge shift. And open banking? It’s not new, but it’s definitely moving into the mainstream, making payments faster and more direct. It’s clear that innovation, keeping customers in mind, and working together are the keys to moving forward. If you want to know what’s next, you really should be there.

Frequently Asked Questions

What is Money20/20 Europe and when is it?

Money20/20 Europe is a big event for people who work in money and technology, like banks and app makers. It’s happening in Amsterdam from June 3-5, 2025. It’s a place where important people in the money world meet to talk about new ideas and do business.

What kind of topics will be discussed at the event?

This year, they’ll talk about exciting new things like how smart computer programs (AI) can help make things better and more personal for customers. They’ll also discuss how shopping can happen right inside apps and how ‘open banking,’ where banks share information safely, is becoming more common.

Will there be new companies showing off their ideas?

Yes, definitely! A special part of the event lets new, small companies show off their cool inventions. These could be new ways to handle payments, ways to check who people are securely, or even ideas to help the environment through investing.

What’s the main goal of Money20/20 Europe?

The main goal is to bring together smart people from the finance world to share ideas, find new partners, and discover new tools and services. It’s all about figuring out how money and technology will work together in the future and making deals happen.

Why is Amsterdam a good place for this event?

Amsterdam is a great spot because it’s a major center for finance and new technology in Europe. It’s easy for people from all over to get there, and it’s a lively city that’s perfect for making connections and discussing the future of money.

What are ‘agentic systems’ they’ll be talking about?

Agentic systems are like super-smart computer helpers. Instead of just giving you information, they can actually do things on their own, like make payments or manage customer requests, to help you reach your goals. Think of them as independent digital assistants for money matters.