Money20/20 Europe 2025 is shaping up to be a big deal for anyone watching where money is headed. We’re seeing a lot of talk about how smart tech, especially AI, is going to change how we pay and manage our money. It’s not just about new gadgets; it’s about making things work better for people and keeping everything safe. This event is a good place to see what’s real and what’s just hype in the world of finance.

Key Takeaways

- AI is moving beyond just helping out to actually doing things on its own, like managing payments, which could change how we shop online.

- Open banking is growing up, focusing more on real results and new ways for businesses to work together, not just sharing data.

- Digital ID and tokenization are getting more practical, with a focus on making them work for everyone and meeting rules.

- Paying for things inside apps or websites is becoming common, but this needs better security, like using your face or fingerprint.

- Making payments faster and more connected is a big goal, using new systems that let accounts talk to each other directly.

Navigating Embedded Intelligence at Money20/20 Europe

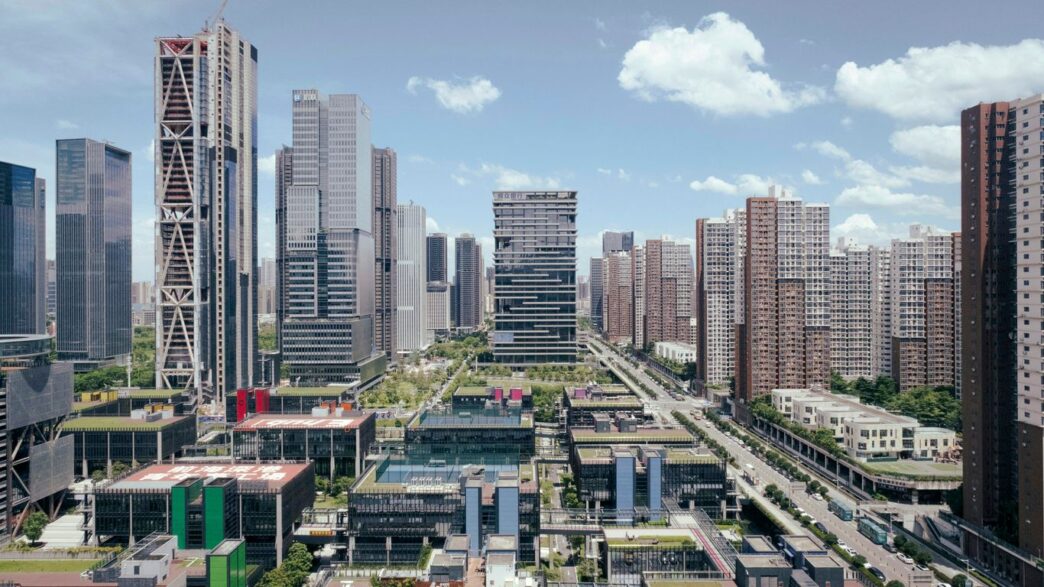

Alright, so Money20/20 Europe 2025 just wrapped up, and the big talk was all about "Embedded Intelligence." It felt like everywhere you turned, people were discussing how artificial intelligence is changing the game, especially in payments. We saw a lot of focus on what’s actually making a difference versus just the latest buzzwords.

Scrutinizing Advancements in AI and Payments

AI is definitely not new to fintech, but this year felt different. Companies like Mastercard and Worldpay were showing off how AI is being used for more than just basic stuff. Think about personalizing how you pay or even how your online order gets shipped, all based on your risk profile. They’re also using it to catch fraud right when you’re checking out. It’s clear AI is getting really good at making existing processes smoother and more secure. The real question is how we make sure these AI systems are fair and don’t create new problems.

The Critical Lens of Cybersecurity

With all this new tech, especially AI, cybersecurity was a huge topic. It’s not enough for something to be smart; it has to be safe. We heard a lot about how to look at these advancements critically. It’s about understanding the actual risks involved when we put AI into financial systems. We need to be sure that the push for innovation doesn’t leave us vulnerable.

Understanding Real Security Implications

So, what does this mean in practice? It means we need to think about the nitty-gritty details. For example, if an AI is making decisions about transactions, how do we know why it made that decision? And who’s responsible if something goes wrong? The discussions really pushed for AI that can be explained and held accountable. It’s about building trust, and that only happens when we can see how these systems work and know they’re built with real business needs in mind, not just for the sake of using AI. This is a big shift from just having AI as a helpful tool to something more active, like the agentic AI systems that can manage transactions on their own. It’s a complex area, and understanding the security side of open banking is just as important as the innovation itself.

The Future of Payments: Innovation and Consumer-Centric Design

This year’s Money20/20 Europe really hammered home a few key points about where payments are headed. It’s not just about having the latest tech; it’s about making that tech work for people and fitting it into their lives without a fuss. We saw a lot of talk about how AI is changing things, but also how important it is to build payment systems that people actually want to use. It feels like the industry is really trying to get this right.

Technological Advancement in Payments

We’re seeing a big push for new technologies to make payments faster and easier. Think about real-time settlement and account-to-account transfers. These aren’t just buzzwords anymore; they’re becoming the backbone of how money moves. Companies are focusing on building solid infrastructure that can handle these new ways of paying. It’s about making sure the pipes are strong and reliable so everything flows smoothly. For those interested in the technical side, TechBullion covers fintech news.

Seamless Integration into Digital Experiences

Payments are increasingly being tucked away inside the apps and websites we use every day. You might be scrolling through social media and buy something without ever leaving the app. This is what they call embedded commerce. It’s convenient, sure, but it also brings new challenges. How do you make sure it’s secure when people aren’t directly interacting with a merchant? Things like biometric authentication and passkeys are becoming really important to keep these transactions safe. It’s a balancing act between making things easy and keeping them secure.

Scaling Open Banking Initiatives

Open banking has moved past the experimental phase and is becoming a standard way to pay. The focus now is on making it work on a large scale and showing its real benefits. We heard a lot about partnerships between banks and fintech companies, which are key to making direct bank payments a reality for more businesses. The idea is to create new ways for money to move that are built around what the customer needs. This shift means more competition and, hopefully, better payment options for everyone.

AI-Driven Innovation: From Assistive Tools to Agentic Autonomy

Artificial intelligence has been a hot topic in fintech for a while now, and Money20/20 Europe 2025 really showed how much it’s changing things. We’re moving past AI just helping out with tasks; we’re talking about AI that can actually manage financial stuff on its own. Think of it like having a digital assistant that doesn’t just give you information, but actually takes action for you.

AI’s Growing Influence in Financial Services

AI is showing up everywhere in finance. Companies are using it to make payments more personal, like suggesting the best shipping option based on your history. It’s also getting really good at spotting fraud before it even happens, right when you’re checking out. This isn’t new, but the scale at which it’s happening is pretty impressive. It’s about making existing systems work better and keeping things secure.

Agentic AI: Managing Financial Transactions Independently

This is where things get really interesting. Agentic AI refers to systems that can act independently to handle financial transactions and talk to customers. Big names in payments are showing off what these AI agents could do. Instead of just helping you, these agents can actually make decisions and carry out actions across the whole online shopping process. It’s a big step from AI that just analyzes data to AI that actively participates in financial activities. We’re looking at a future where AI isn’t just a tool, but a participant in the financial world, like those discussed in Money20/20 Europe 2025.

Redefining AI’s Role in the E-commerce Value Chain

So, what does this mean for online shopping? Well, AI agents could manage your cash flow, handle overdrafts, or even make payments for you automatically. This is part of a bigger shift towards what some are calling ‘Embedded Finance 2.0’. It’s about making financial services so integrated that they’re proactive and adapt to your needs. The idea is that money itself becomes smarter, acting on your behalf when necessary. This move from just accessing financial solutions to embedding intelligence is a major change for how we interact with money online.

Open Banking’s Evolution: Beyond Access to Impact

The "Open Everything" Vision

Open banking is really moving past just letting people see their account info. The talk at Money20/20 Europe was about this idea of "open everything." Think about it: financial data flowing into other areas like healthcare or even how we get around. It’s not just a far-off concept anymore. Companies are already building new ways to do things, putting the user first and integrating different services. This shift means we’re looking at a future where financial services are connected to almost everything we do online.

New Value Chains and User-First Approaches

This evolution is creating entirely new ways for businesses to operate and for customers to interact with financial services. Instead of just sharing data, the focus is on building new systems where financial tools are part of everyday digital experiences. For instance, some companies are managing account-to-account payment infrastructure completely, including the risks involved. This shows how new value chains are forming, often built from the ground up with the customer’s needs at the center. It’s a big change from how things used to be done, and it’s all about making things simpler and more useful for everyone involved. We’re seeing a move towards more integrated financial services.

Collaboration Between Banks and Fintechs

It’s clear that banks and fintech companies need each other now more than ever. Banks have the established customer base and the scale, while fintechs bring the fresh ideas and the tech know-how. This partnership is key to making open banking work well for everyone. Regulators are also playing a bigger role, not just setting the rules but actively participating in shaping the future. The underlying technology, the infrastructure, is becoming the foundation for all the new financial services we’ll see in the coming years. It’s a collaborative effort to build a better financial system.

Digital Identity and Tokenization: From Potential to Implementation

It feels like we’ve been talking about digital identity and tokenization forever, right? But this year at Money20/20 Europe, the conversation felt different. It wasn’t just about what could be done; it was about what is being done. Think about EIDAS 2.0 in Europe, or how tokenized assets are slowly but surely moving from theory to actual use. People like Alisa DiCaprio from R3 and Ryan Rugg at Citi were saying pretty much the same thing: we’re making real progress, but it’s still a bit of a mess to get right.

Grounding Conversations on Digital Identity

For a long time, digital identity felt like a far-off concept. Now, it’s becoming more practical. We’re seeing a shift from just talking about the possibilities to actually building systems that work. The focus is on making sure these systems are secure and easy for people to use, which is a tough balance to strike. The real challenge is making digital identity reliable enough for everyday transactions without making it a hassle for users.

EIDAS 2.0 and Tokenized Assets

EIDAS 2.0 is a big deal for how we handle digital identity across Europe. It’s setting new rules and standards that companies have to follow. On the tokenization side, we’re seeing more and more examples of how assets like real estate or even loyalty points can be represented as digital tokens on a blockchain. This could change how we trade and manage ownership of all sorts of things.

Here’s a quick look at what’s changing:

- Digital Identity Standards: New regulations are pushing for more consistent and secure ways to verify who people are online.

- Tokenization Use Cases: Moving beyond crypto, tokenization is being explored for everything from supply chain tracking to financial instruments.

- Infrastructure Needs: Building the systems to support these new digital identities and tokenized assets requires robust and secure technology.

Delivering Compliance and User Experience

Ultimately, the companies that will succeed in this space are the ones that can figure out how to meet all the new regulations while still making things simple for the end-user. It’s not enough to just have the technology; it has to work within the existing legal frameworks and be something people actually want to use. If it’s too complicated or feels risky, people just won’t adopt it. That’s why getting both compliance and user experience right is so important.

Embedded Commerce: Reshaping Consumer Engagement

It feels like everywhere you look these days, shopping is happening in places you wouldn’t expect. Think about it – buying something directly through a social media app or a gaming platform. That’s embedded commerce in a nutshell. Instead of a business pulling customers to their website, they’re bringing the products right to where people are already spending their time online. This shift is changing how we interact with brands and make purchases.

Transactions Within Digital Platforms

This is the core idea: buying stuff without leaving the app you’re already using. It’s about making the checkout process disappear into the background of your digital life. For example, you might see a product on TikTok and buy it right there, all within the app. This makes shopping feel more natural and less like a separate task. It’s a big change from the old way of doing things, where you had to go to a specific store or website.

Elevated Risks and Security Measures

Of course, when things get easier, there are often new challenges. With transactions happening so smoothly within different apps, there’s a greater chance for fraud or issues like chargebacks. Because you’re not directly interacting with the merchant in the same way as a traditional checkout, it can be harder to verify things. This means businesses need to get smarter about security. They’re looking at ways to make sure it’s really you making the purchase and that the transaction is legitimate.

Biometric Authentication and Passkeys

So, how do companies keep these embedded transactions safe? Two big answers are biometrics and passkeys. Biometrics means using things like your fingerprint or face scan to confirm your identity. Passkeys are a newer, more secure way to log in and authorize payments, often using your device’s built-in security. These methods help make sure that only the right person can complete a purchase, even when it’s happening quickly and within another app. It’s about balancing that easy user experience with strong protection.

AI in Practice: Explainability, Accountability, and Scale

So, we’re at Money20/20 Europe 2025, and the big question on everyone’s mind, at least for us at Bobsguide, is what’s actually working in AI? After all the hype last year, the vibe is definitely more about getting things done. AI has to prove its worth, plain and simple. It’s not enough for AI to just be a buzzword; it needs to be practical, fitting into real business needs.

AI Must Earn Its Place in Fintech

Last year, the focus was on "Human x Machine," trying to bring the AI talk back down to earth. The message was clear: AI needs to be explainable and accountable. Think about customer management, checking for sanctions, or figuring out fraud – AI has to be transparent in how it does these things. It’s about building AI with actual business problems in mind, not just for the sake of using AI.

Explainable and Accountable AI Deployment

Companies like Microsoft, Nvidia, and Fenergo were talking a lot about this. They stressed that AI models need to be accurate, data needs to be managed well, and the AI has to be specific to the job it’s doing. For financial systems, this means the standards for using AI are getting higher. It’s not just about putting models out there; it’s about creating the whole system around them – the data flow, the decision-making rules, and ways to check if they’re working right. We’re looking for AI that can be understood and trusted.

Real-World Use Cases for AI at Scale

We’re keeping an eye out for AI being used in practical ways across the board. This includes:

- AI used in the background of financial systems.

- Making payments happen in real-time and managing them smartly.

- Using tokenization in ways that go beyond just trying it out.

- Partnerships between different industries that help new products get to market faster.

It’s about seeing AI move from just ideas to actual, working solutions that make a difference. The event in Amsterdam, from June 3-5, 2025, is a great place to see these trends unfold. We’re particularly interested in how AI is being used to automate things like customer onboarding without messing up the "Know Your Customer" rules, or how real-time fraud detection is being put into practice on a large scale. And, of course, who has the compliance setup to back it all up? It’s a big shift from just having the tech to actually making it work reliably and responsibly within financial services.

We’re also seeing a lot of talk about "agentic AI." This is where AI systems can manage financial tasks and talk to customers all by themselves. It’s a big step up from AI just helping out. Think of AI agents that can handle transactions independently. This could really change how we do things in online shopping and payments, moving AI from just analyzing data to actively participating in financial processes.

Payment Modernization and Infrastructure Maturity

Real-Time Settlement and Open Banking Rails

So, payments are getting faster. It’s not just a buzzword anymore; it’s actually happening. We’re seeing a big push for real-time settlement, which basically means money moves instantly, not after a few days. This is a huge deal for businesses, especially smaller ones, because it helps with cash flow. Open banking is a big part of this, too. Think of it like opening up the bank’s systems so other companies can connect to them, securely of course. This allows for things like direct bank payments to pop up when you’re checking out online. It’s all about making payments smoother and quicker.

Account-to-Account Infrastructure

This ties right into the real-time settlement idea. Instead of going through old card networks, money can move directly from one bank account to another. It’s like a direct line. This cuts out a lot of the middlemen, which can make things cheaper and faster. Companies are building the plumbing for this, the actual infrastructure, so it’s reliable and can handle lots of transactions. It’s not just about the tech, though; people need to trust it and the rules around it have to make sense. It’s a big shift from how things used to be done.

Orchestrating Complex Payment Flows

Now, imagine you’re a big company, or even a growing startup, and you’re dealing with payments in lots of different places – maybe online, in an app, or even for business-to-business deals. It gets complicated fast. You need systems that can manage all these different ways of paying and receiving money, making sure everything is tracked correctly and securely. This is where orchestration comes in. It’s about making all these different payment pieces work together smoothly, like a conductor leading an orchestra. The companies that are doing well are the ones that offer easy-to-use tools, with good controls, that developers can actually build with. The future is about making these complex payment journeys simple for everyone involved.

Looking Ahead: What We Learned at Money20/20 Europe

So, after all the talks and meetings at Money20/20 Europe, it’s pretty clear that the future of money is all about making things smarter and simpler. We saw a lot of focus on AI, not just as a buzzword, but as a real tool to make payments work better and be more secure. Embedded finance is also a big deal, meaning financial services will pop up right where we already are online, like in social media apps. And open banking is moving from being new and exciting to just being a normal part of how things work. It seems like the companies that will do well are the ones that can actually put these new ideas into practice, making them work for everyday users and keeping everything safe. It’s going to be interesting to see how all this plays out in 2025.

Frequently Asked Questions

What is ‘Embedded Intelligence’ and why is it important at Money20/20 Europe?

Embedded Intelligence means putting smart technology, like AI, right into everyday tools and services. At Money20/20 Europe, it’s a big topic because it shows how AI can make payments and other money tasks easier and smarter, right where you need them.

How is AI changing the way we pay for things?

AI is making payments smarter by helping to prevent fraud, offer personalized deals, and even manage transactions on its own. Think of it like having a helpful assistant that can handle some money tasks for you automatically.

What does ‘Open Banking’ mean, and how is it changing?

Open Banking lets different financial companies share your money information securely, with your permission. It’s moving beyond just sharing data to creating new ways for services to work together, making things more user-friendly and connected.

Why is ‘Digital Identity’ a key topic for the future of money?

Digital Identity is about proving who you are online safely. It’s important for making sure transactions are secure and for making online processes smoother, especially with new rules and technologies like digital tokens.

What is ‘Embedded Commerce’ and how does it affect shopping?

Embedded Commerce means you can buy things directly within apps or websites you’re already using, like social media. This makes shopping easier but also brings new challenges for security, which is why things like fingerprint scans are becoming more common.

What makes AI ‘explainable’ and ‘accountable’ in finance?

Explainable AI means we can understand how an AI makes its decisions, and accountable AI means someone is responsible for it. In finance, this is crucial so we can trust that AI is being used fairly and safely, and that it’s truly helping businesses.