The bloomberg asia markets are always changing, and it can be tough to keep up. This article looks at some of the big trends happening right now. We’ll talk about currency swings, what’s going on with China’s property market, and how investors are trying to make more money. We also touch on the risks and chances in places that are still growing, and how the stock and bond markets are shifting. Plus, we’ll look at how trading is becoming more electronic and what that means for everyone involved. It’s a lot to take in, but hopefully, this gives you a clearer picture of what’s happening.

Key Takeaways

- FX volatility is a big deal in Asia, especially with what the U.S. is doing with interest rates. Investors need ways to deal with these currency swings, like using derivatives.

- China’s real estate market isn’t the big driver it used to be for the region’s credit market, but consumer confidence is still important for its recovery.

- Emerging markets in Asia offer chances for growth, but you have to watch out for things like changing interest rates, global politics, and how confident people feel about the economy.

- Asia’s bond and stock markets are opening up more to foreign investors, with regulators making it easier to trade and get money in and out.

- Electronic trading is taking over, from big institutions to individual traders, changing how deals get done across the region.

Navigating Bloomberg Asia Markets: Key Trends and Insights

Alright, let’s talk about what’s really going on in the Asian markets. It’s a big place with a lot happening, and for anyone looking to invest, it can feel a bit like trying to drink from a firehose. We’ve seen some big shifts lately, and understanding them is key to making smart moves. The region is a dynamic mix of opportunities and risks, and staying on top of the details is what separates the winners from the rest.

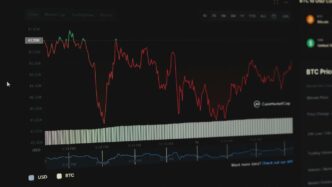

Understanding FX Volatility and Hedging Strategies

Currency swings are a big deal in Asia, especially with what’s happening with U.S. interest rates. When the Fed makes a move, you can bet it’s going to ripple through Asian currencies. Think about currencies like the Japanese yen, Korean won, Thai baht, and Malaysian ringgit – they can really move. To deal with this, investors are leaning more on hedging strategies. It’s not just about hoping for the best; it’s about using tools like currency swaps to protect against those sudden drops. It’s a way to keep your investments from getting wiped out by currency fluctuations.

Assessing the Chinese Real Estate Sector’s Impact

For a while there, the Chinese real estate sector was a huge talking point. But honestly, its influence has really faded. Most investors aren’t really focused on it anymore. The broader Asian credit market has moved on, and it’s not as dependent on Chinese property as it used to be. The real estate market’s recovery now really depends on people feeling good about spending money. Just lowering mortgage payments isn’t enough; you need consumer confidence to bounce back for things to really pick up.

Leveraging Derivatives for Investment Growth

When it comes to growing investments in Asia, derivatives are becoming more popular. Things like total return swaps are a way to get exposure to markets like China, often through Hong Kong, without having to set up shop directly there. Asian investors are also looking at structured products, like callable credit-linked notes, to try and get a bit more yield while still managing the risks involved. It’s all about finding smart ways to boost returns in a complex market.

Opportunities and Risks in Emerging Asian Markets

Alright, let’s talk about what’s happening in Asia’s emerging markets. It’s a bit of a mixed bag, honestly. You’ve got some really interesting growth potential, but you also have to keep your eyes open for the bumps in the road. It’s not as straightforward as just picking stocks and hoping for the best.

Interest Rate and Policy Volatility Dynamics

So, the big thing to watch is how interest rates move, especially in the U.S. When the Federal Reserve makes a move, it tends to ripple through Asia. If they start cutting rates, that could make things a bit easier over here. But here’s the catch: if they cut too fast, it can actually make currency values jump around more. This is where things get tricky. You’ve got currencies like the Japanese yen, South Korean won, Thai baht, and Malaysian ringgit that can be pretty sensitive to these U.S. rate changes. To keep your returns from getting eaten up by currency swings, you really need to think about hedging. It’s like buying insurance for your investments against unexpected currency moves. It’s not always fun to spend money on, but it can save you a lot of headaches.

Geopolitical Tensions and Investor Sentiment

Then there’s the whole geopolitical scene. Things between the U.S. and China, for example, can create a lot of uncertainty. And with elections coming up in the U.S., there’s always the chance that policies could shift, which can really affect how investors feel about putting their money into the region. It’s like walking on eggshells sometimes; you’re never quite sure what the next headline will bring. This kind of uncertainty can make people pull back their investments, even if the underlying economies are doing okay.

Consumer Confidence and Economic Resilience Factors

Consumer confidence is another big piece of the puzzle, especially in China. For a while now, the issues in their real estate market have really put a damper on how people feel about the economy. Even though the property sector isn’t as huge in the overall Asian credit market as it used to be, it still tells us something about how strong the economy is. If people aren’t feeling confident, they’re not spending, and that slows everything down. It’s not just about cutting mortgage payments; it’s about people feeling secure enough to open their wallets. Without that, a real recovery is tough to see.

Asia’s Evolving Bond and Equity Markets

Asia’s bond and equity markets are really changing, and it’s something investors need to pay attention to. We’re seeing a big push to make it easier for foreign investors to get into some of the key markets in the region. Central banks and regulators are actually easing up on some of the old rules for onshore FX and bond markets. The goal here is pretty simple: boost liquidity and attract more investment. It’s a trend that’s happening across both fixed income and equities.

Foreign Investor Access to Onshore Markets

Getting foreign money into local markets is a major theme right now. Think about it, many Asian countries want more global capital to help their economies grow. To make that happen, they’re opening up their doors a bit wider. This means less red tape for international players wanting to buy local bonds or stocks. It’s a big deal because it can lead to more money flowing into these markets, which is good for everyone involved. For instance, Asia local currency bonds are becoming more appealing as these markets become more accessible.

Regulatory Easing and Liquidity Enhancement

Following on from that, regulators are actively working to make things smoother. They’re easing controls, which is directly aimed at improving liquidity. When markets are more liquid, it’s easier to buy and sell assets without causing big price swings. This makes the markets more attractive to a wider range of investors, including those who might have been hesitant before. It’s a positive cycle: easier access leads to more liquidity, which in turn attracts more investors.

Market Structure Changes in Equities and FICC

These changes aren’t just happening in one corner of the market. We’re seeing shifts in both equities and what’s known as FICC – that’s Fixed Income, Currencies, and Commodities. The way trading happens is evolving, with more electronic platforms coming online. This is changing how deals get done and how prices are formed. It’s a complex area, but the main takeaway is that the plumbing of these markets is being updated to handle the demands of modern investing. It’s all about making the markets more efficient and responsive.

Investment-Grade and Frontier Market Strategies

When we look at Asia’s markets, it’s not just one big blob. There are definitely areas that are more stable, like investment-grade assets, and then there are the more adventurous frontier markets. It’s about knowing where to put your money for the best chance of a good return, while also keeping an eye on what could go wrong.

Investment-Grade Assets and U.S. Treasury Influence

Asia has a lot of investment-grade credit, and right now, the spreads are pretty tight, meaning the extra return you get over government bonds is low. A big factor here is what the U.S. Treasury is doing. Many investors are holding onto short-term bills, waiting to see if the U.S. will cut interest rates. If rates do come down, people might start looking to invest in longer-term bonds to get a better yield. It’s a bit of a waiting game, but the U.S. Treasury’s moves really set the tone for a lot of Asian markets.

Attractiveness of Asian High-Yield Assets

Now, if you’re looking for higher returns, Asian high-yield assets are looking pretty interesting. This includes parts of the frontier market scene, like Sri Lanka and Pakistan, and even some Chinese high-yield credit. Even though China’s economy is changing, some companies are still expected to do well. We’re seeing more issuance from non-bank lenders in India, which is a sign that companies are looking for different ways to get funding. Also, some Chinese state-owned companies and utility firms seem undervalued. Utilities, for example, have steady demand from customers, which makes them a bit more reliable.

Expanding Focus to the Pacific Region

Investors aren’t just sticking to the usual places anymore. There’s a growing interest in the Pacific region, and more countries are being added to indexes. This often means looking at assets that are not considered top-quality (sub-investment-grade). Adding these countries gives investors more options and spreads out the risk. It’s a way to get a more varied portfolio. Plus, with the U.S. possibly cutting rates, Asian currency bonds are becoming more appealing. The cost of hedging currency risk is looking better, especially if you want stable income. While Asian government bond yields are still lower than U.S. Treasuries, if Asian central banks start cutting rates too, it could create a good environment for these bonds. This could lead to more money flowing into the region, which is a positive sign for the medium term.

The Rise of Electronic Trading in Asia

It feels like just yesterday that most trading in Asia was done over the phone, right? But things are changing, and fast. Electronic trading has really taken off across the region, especially since 2020. We’re seeing a big shift from voice-based deals to digital platforms, and it’s changing how everyone does business.

Shift from Voice to Electronic Platforms

Even though electronic platforms and aggregators are becoming more common, a lot of trading still happens the old-fashioned way, often with brokers in the middle. But in markets that are all over the place, using aggregators and electronic systems can really help streamline things. Think about it: you can get prices all in one spot, cut down on costs, and just make the whole process smoother. For banks and brokers who used to rely on phone calls, moving to electronic systems means they can see what’s happening in real-time and manage their risks better. It’s closing gaps that have been around for ages.

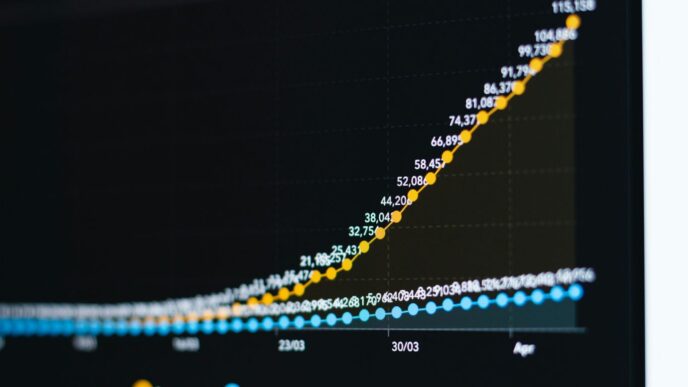

Growth Prospects for Automation and Aggregators

Automation and tools like aggregators are really starting to gain traction. We’re seeing more and more algorithmic trading, especially in things like foreign exchange (FX) and fixed income. For example, the use of algorithms for non-deliverable forwards (NDFs) in Asian currencies has jumped up significantly. These tools help manage prices automatically and find the best places to trade, even when there are lots of different trading venues. This is super helpful for making trades happen quickly and efficiently, especially when you’re dealing with big volumes. Plus, firms are using data more and more to figure out who their best trading partners are, looking at things like how often trades go through and how fast people respond to price requests. This data-driven approach helps cut down on mistakes and makes sure resources are used wisely.

Sell-Side Firm Navigation of Fragmented Markets

For the firms on the sell-side, this electronic shift presents both opportunities and some tricky challenges. They need to figure out how to use all these new automated tools and algorithms while still dealing with different rules in different countries and markets that aren’t always connected. It’s a balancing act. Some firms might start to specialize, with some focusing on the really complex trades that still need a human touch, while others go all-in on electronic channels. We’re also seeing non-bank lenders playing a bigger role, giving more options for getting trades done. It’s all about adapting to these changes to stay competitive. The future likely belongs to those who can blend technology with a smart approach to different market structures.

Unlocking High-Growth Potential in Asia

Asia’s emerging markets are really starting to grab attention, and for good reason. Investors are looking here for growth and a way to spread their money around across different types of investments and places. It’s not just one thing, either; there are opportunities in credit markets, especially for companies that might be a bit riskier but offer better returns. Think about India, for example. Its economy is really picking up steam, and that creates chances for investors. Plus, with interest rates in the U.S. expected to come down, Asian central banks might follow suit, making fixed-income investments in Asia look more appealing.

Key Opportunities in High-Yield Credit Markets

The high-yield credit space in Asia is definitely a spot to watch. We’re seeing more companies, especially non-bank financial firms in India, issuing more debt. This shows they’re finding new ways to get funding, which can be good for investors looking for those higher returns, especially with India’s economy growing. And then there’s China. Some investors think that bonds from state-owned companies and utility providers are actually priced lower than they should be. Utilities, like gas companies, tend to have steady demand from customers, which makes them a bit more stable for investors. It’s interesting because India recently got added to a big global bond index, which is bringing in more foreign money and making its government bonds easier to trade.

India’s Economic Growth Momentum

India’s economy is on a real roll. This isn’t just a small blip; it’s a sustained period of growth that’s creating a lot of buzz. This momentum means more opportunities for businesses and, by extension, for investors. We’re seeing increased consumer demand and a general sense of economic activity that’s quite different from some other parts of the world. This makes India a really attractive place to consider for investment portfolios looking for that growth element.

China’s Undervalued Utility and State-Owned Enterprises

When you look at China, some parts of its market seem to be overlooked. Specifically, the utility sector and state-owned enterprises (SOEs) are worth a closer look. Utilities, by their nature, provide essential services, so demand is usually pretty consistent, even when the broader economy is a bit shaky. This can offer a level of stability. SOEs, while sometimes seen as less dynamic, can also provide steady returns and are often backed by government support. Many investors are finding that these sectors in China are not fully reflecting their potential value right now. It’s a situation where careful research might uncover some hidden gems.

Market Structure Reforms and Investor Access

Asia’s financial markets are really changing, and it’s not just about the big economic shifts. A lot of what’s happening behind the scenes, in terms of how trades actually get done and how investors can get involved, is pretty significant. We’re seeing a push to make things smoother, especially for folks looking to invest in markets that were previously a bit tricky to access.

Korea’s Push for Developed Market Status

Korea has been working hard to get its markets recognized as developed, not just emerging. A big part of this is making trading rules more flexible. For instance, they’re looking at lifting the short-selling ban that’s been in place. This is something a lot of investors have been watching closely. It’s all about making the market feel more like the ones in places like Japan or Australia, where trading is generally more straightforward. The goal is to attract more global capital by aligning with international standards.

Vietnam’s Capital Markets Reforms for Index Inclusion

Vietnam is also making some big moves. They’re trying to get their capital markets in shape so they can be included in major global indexes. This involves some pretty substantial reforms, like changing rules around how money can be moved in and out of the country. They’re working on improving the systems for trading and what happens after a trade is done. It’s a complex process, but the idea is to make it easier for foreign investors to participate and to boost the overall liquidity of their markets. This kind of reform is a key part of Vietnam’s economic reform program.

Microstructure Dynamics in Hong Kong and India

Beyond the big country-level changes, there are also smaller, but still important, adjustments happening in how specific markets operate. Hong Kong, for example, is planning to reduce the size of price increments (tick sizes) on trades. This should help lower trading costs for everyone. In India, regulators are thinking about adding a closing auction to their stock market. It’s a bit unusual that they don’t have one already, and adding it could change how the market finishes each day. These kinds of tweaks to the market’s inner workings, or microstructure, can have a real effect on how efficiently investors can trade and manage their positions.

The Impact of Retail Electronic Trading

The way people trade in Asia has really changed, especially with electronic platforms becoming so common. It’s not just for big institutions anymore; retail investors are getting in on the action too. This shift is changing how markets work and what investors can do.

Growth of Retail Electronic Trading in APAC

Over the last decade, electronic trading has taken off across Asia, and it’s really picked up steam since 2020. We’re seeing more and more people trading things like interest rate swaps, government bonds, and FX products electronically. For example, trading in Japanese government bonds has grown a lot, partly because the trading systems have gotten better, allowing brokers to price things electronically more easily. This trend means more people can access markets and trade more frequently. It’s a big change from how things used to be, where you often had to call someone to make a trade.

Retail Investor Algorithmic Trading Strategies

Algorithmic trading, or using computer programs to make trades, is also becoming more popular with retail investors in Asia. We’ve seen a big jump in the use of these algorithms, especially for currency pairs like non-deliverable forwards (NDFs). This is partly because the systems that provide prices and execute trades have improved. These algorithms can help retail traders manage their trades more efficiently, especially when dealing with large orders or trying to get the best price in markets that might be a bit spread out. It’s about using technology to trade smarter, not just faster.

Regulatory Consultations on Retail Trader Algos

As more retail investors start using these advanced trading tools, regulators are paying attention. They’re looking into how these algorithmic strategies work and what impact they have on the market. This involves consultations to understand the risks and benefits. The goal is to make sure the markets stay fair and orderly for everyone. Regulators are considering things like:

- How to ensure retail traders understand the risks involved with algorithmic trading.

- What rules might be needed to prevent market manipulation.

- How to maintain market stability as more automated trading happens.

- The role of data and transparency in retail algorithmic trading.

It’s a balancing act, trying to allow innovation while protecting investors and the integrity of the markets.

Wrapping Up: What’s Next for Asia’s Markets

So, looking at everything we’ve talked about, it’s clear that Asia’s markets are always on the move. We’ve seen how things like U.S. interest rates and even politics can shake things up, and how important it is to have a plan for currency swings. China’s property market is still a bit of a question mark, but other areas are showing real promise. Things like structured products and electronic trading are becoming bigger deals, making it easier for investors to get involved. It’s a lot to keep track of, for sure. But by staying aware of these trends and being ready to adjust, investors can find their way through the opportunities and challenges that Asia keeps throwing our way. It’s all about being smart and staying informed.

Frequently Asked Questions

What is FX volatility and why is it important for Asian markets?

FX volatility means that the value of one country’s money compared to another’s can change a lot and quickly. This is important in Asia because changes in U.S. interest rates can cause these money values to swing, affecting how much investments are worth.

How is the Chinese real estate market affecting investments?

The Chinese real estate market has been struggling. While it used to be a big deal for investments, many investors don’t focus on it as much anymore. However, for the market to get better, people need to feel more confident about the economy and want to buy homes again.

What are some good investment opportunities in Asia?

Asia has many chances for growth. Some areas to look at include high-yield bonds, especially from companies in China that provide services like electricity or gas, and India’s economy, which is growing fast. These areas offer potential for making more money.

How are electronic trading and automation changing how people invest in Asia?

More and more trading in Asia is done using computers and automated systems instead of just talking on the phone. This makes trading faster and sometimes cheaper. Automation and special computer programs called aggregators are helping firms work more efficiently.

What are the main risks investors face in Asian emerging markets?

Investors in Asia’s developing markets face risks like changes in interest rates and government rules, and political worries between countries. Also, how confident people feel about the economy and their spending habits can impact how well investments do.

Are there any changes happening in Asian stock and bond markets?

Yes, markets in places like Korea and Vietnam are making changes to attract more foreign investors and potentially be seen as more developed markets. Also, places like Hong Kong and India are looking at new ways to make trading smoother and more efficient.