Alright, let’s talk about crypto taxes for 2025. It feels like every year there’s something new to figure out, right? This year, the big buzz is about the 1099-DA form, which is basically the IRS making crypto reporting more like stock reporting. So, if you’ve been playing it fast and loose with your crypto tax filings, now’s the time to get things in order. We’ll break down what you need to know about crypto capital gains tax, how to actually calculate it, and some ways to make the whole process less painful. Think of this as your friendly guide to not getting a nasty surprise from the tax man.

Key Takeaways

- Starting in 2025, crypto exchanges will report your transactions to the IRS using the new Form 1099-DA, similar to how stock sales are reported. This means you need to make sure your tax filings match what the exchanges report.

- The IRS views crypto as property, not currency. Every time you sell, trade, or spend crypto, it’s a taxable event. You’ll need to calculate capital gains or losses based on your cost basis (what you paid for it) and the sale price.

- Be aware of the difference between short-term (held 1 year or less) and long-term (held more than 1 year) crypto gains. Short-term gains are taxed at your regular income rate, while long-term gains have lower rates.

- Income from activities like staking, mining, and airdrops is taxed when you receive it, based on its fair market value at that time. This income also establishes your cost basis for those specific assets.

- Good record-keeping is super important. Use crypto tax software to help track all your transactions, calculate gains and losses, and organize your data. If things get too complicated, don’t hesitate to ask a tax professional for help.

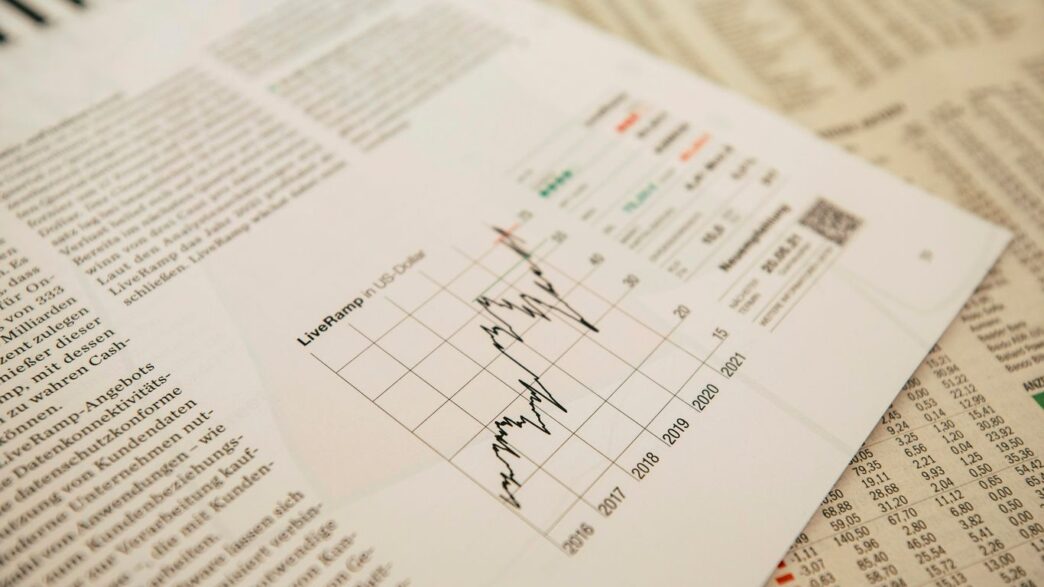

Understanding Crypto Capital Gains Tax in 2025

Alright, let’s talk about crypto taxes for 2025. It’s a big year because the IRS is really stepping up how they track digital assets. Think of it like this: for tax purposes, the IRS has always treated crypto as property, kind of like stocks or a house you might own. This means when you sell, trade, or even spend your crypto, it’s considered a taxable event. You have to figure out if you made a profit or took a loss compared to what you originally paid for it.

What is Crypto Capital Gains Tax?

Basically, crypto capital gains tax is what you owe on the profit you make from selling or trading your digital assets. If you bought some Bitcoin for $10,000 and later sold it for $15,000, that $5,000 difference is a capital gain. The IRS wants its cut of that profit. It’s not just selling, though. Trading one crypto for another, like swapping Ethereum for Solana, is also a taxable event. The same goes if you use crypto to buy something – that’s treated as a sale. The key thing to remember is that every time you dispose of crypto, you need to calculate the gain or loss.

Key Changes for 2025: The 1099-DA Form

This is the big news for 2025. You’re going to start seeing a new form called the 1099-DA. If you’ve traded stocks before, you’re familiar with the 1099-B. The 1099-DA is the crypto version. Your crypto exchange or broker will now be required to send this form not only to you but also directly to the IRS. This form will report your sales and other dispositions of digital assets. It’s a major step towards making crypto reporting more like traditional financial markets. This means the IRS will have a much clearer picture of your crypto activities, so it’s more important than ever to have your own records straight and report everything accurately. You can find more information on how this might affect you by looking into Canadian crypto tax rules.

Crypto as Property: The IRS Perspective

As mentioned, the IRS views cryptocurrency as property. This isn’t just a minor detail; it has significant tax implications. Unlike currency, which might be taxed differently, property transactions are subject to capital gains rules. This classification means:

- Sales are Taxable: Selling crypto for more than you paid results in a capital gain.

- Trades are Taxable: Swapping one crypto for another is treated as selling the first and buying the second, potentially creating gains or losses on both sides.

- Spending is Taxable: Using crypto to buy goods or services is like selling it for cash first, then using that cash to make the purchase.

- Gifts and Donations: Rules for gifting and donating property also apply to crypto, with specific thresholds and reporting requirements.

Understanding this property classification is the first step to correctly reporting your crypto taxes. It sets the stage for how gains and losses are calculated and reported each year.

Calculating Your Crypto Gains and Losses

Alright, let’s talk about the nitty-gritty of figuring out how much you owe the taxman when it comes to your crypto. It’s not always as simple as looking at your bank account, especially with digital assets. The core idea is to track what you spent versus what you got when you sold or traded.

The Basic Formula for Taxable Events

At its heart, calculating a capital gain or loss is pretty straightforward. You take the amount you received when you sold or traded your crypto (that’s your proceeds) and subtract what you originally paid for it, including any fees (that’s your cost basis). The difference is your gain or loss.

- Proceeds: What you got when you sold or traded.

- Cost Basis: What you paid initially, plus transaction fees.

- Gain/Loss = Proceeds – Cost Basis

Remember, every time you sell, trade one crypto for another, or even use crypto to buy something, it’s generally considered a taxable event. So, if you swapped Bitcoin for Ethereum, that’s a sale of Bitcoin and a purchase of Ethereum, both needing to be accounted for. It’s like selling one stock to buy another.

Defining Cost Basis for Digital Assets

This is where things get a bit tricky with crypto. Your cost basis isn’t just the dollar amount you paid. It includes all the fees you paid when you acquired the asset. For example, if you bought $1,000 worth of a coin and paid a $20 transaction fee, your cost basis is actually $1,020. This is important because a higher cost basis means a lower taxable gain. Figuring out the value of crypto-asset inventory can be complex, and so is determining your cost basis for every single transaction.

Short-Term vs. Long-Term Crypto Gains

How long you held onto your crypto before selling or trading it makes a big difference in how it’s taxed. The IRS splits these into two categories:

- Short-Term Gains: If you held the crypto for one year or less before selling, any profit is considered a short-term capital gain. These are taxed at your regular income tax rate, which can be pretty high depending on your bracket (up to 37% federally).

- Long-Term Gains: If you held the crypto for more than one year, any profit is a long-term capital gain. These get a more favorable tax treatment, with rates typically ranging from 0% to 20%, depending on your overall income.

So, if you bought some crypto and sold it a few months later for a profit, you’ll be looking at short-term rates. But if you held onto it for over a year, that same profit gets a much gentler tax hit. This holding period is key for tax planning.

Navigating Income from Crypto Activities

Beyond just buying and selling, crypto can generate income in a few different ways. The IRS generally treats these as ordinary income, meaning they get taxed at your regular income tax rate, not the potentially lower capital gains rates. It’s super important to keep good records of when you receive these kinds of crypto "earnings" and what their value was in US dollars at that exact moment. This value becomes your cost basis for those specific coins later on.

Taxation of Staking Rewards and Mining Income

If you’re involved in staking or mining, you’re essentially earning new coins for your participation in a network. When you receive these rewards, the IRS wants you to report their fair market value in USD on the day you got them. Think of it like getting paid for a job. So, if you stake your crypto and earn, say, 10 new coins, and those coins are worth $5 each when they hit your wallet, you’ve just earned $50 in taxable income. That $50 also becomes your cost basis for those 10 coins. If you later sell them for $70, you’ll have a $20 capital gain. If you sell them for $40, you’ll have a $10 capital loss.

- Record the USD value at the time of receipt. This is non-negotiable for accurate reporting. Use historical price data if needed.

- Report this income on Schedule 1 (Form 1040), line 8. You can add a description like "Staking Rewards" or "Mining Income."

- Your cost basis for these earned coins is the amount you reported as income. This is key for calculating future capital gains or losses.

Reporting Airdrops and Fork Rewards

Similar to staking and mining, airdrops and hard fork rewards are also considered taxable income by the IRS when you receive them. An airdrop is when a project sends free tokens to crypto holders, often for promotional reasons. A hard fork is a change in a blockchain’s protocol that can result in new coins. The value of these tokens in USD on the day they arrive in your wallet is what you need to report as income. Just like with staking rewards, this value also sets your cost basis for those new assets.

Let’s say you get an airdrop of 100 tokens, and at that moment, they’re worth $0.50 each. That’s $50 in income you need to report. Your cost basis for those 100 tokens is $50. If the price jumps to $1 per token and you sell them, you’ll have a $50 capital gain ($100 sale price minus your $50 cost basis).

Understanding Crypto Interest Payments

Earning interest on your crypto holdings, perhaps through a lending platform or a crypto savings account, is another form of income. The IRS generally treats this like traditional interest income. Depending on how the platform reports it to you and the IRS, you might receive a Form 1099-INT or a Form 1099-MISC. If you get a 1099-INT, you’ll report the interest on Schedule B of your Form 1040. If it’s on a 1099-MISC, it usually goes on Schedule 1, line 8, as "Other Income."

- Track the USD value of interest earned. Even if paid in crypto, its dollar value at receipt is income.

- Look out for Form 1099-INT or 1099-MISC. These forms simplify reporting but require careful checking.

- Interest income is taxed at ordinary income rates. This applies whether paid in crypto or fiat.

Strategies for Optimizing Crypto Tax Liability

Nobody likes paying more taxes than they have to, right? While you absolutely have to report what you owe, there are some smart ways to legally lower your crypto tax bill. Think of it as tax planning, not tax evasion. Here are a few ideas to consider for 2025 and beyond.

Leveraging Tax-Loss Harvesting

This is a pretty common strategy, and for good reason. Tax-loss harvesting basically means selling investments that have lost value to offset capital gains you might have from selling other assets that went up. It’s like using a loss to cancel out a gain, which can reduce the total amount of tax you owe.

Here’s a quick rundown:

- Identify losers: Look through your crypto portfolio for assets you bought that are now worth less than you paid for them.

- Sell to realize the loss: Sell these underperforming assets. This creates a capital loss.

- Offset gains: Use these realized losses to reduce any capital gains you have from selling profitable crypto. If your losses are more than your gains, you can even use up to $3,000 of the excess loss to reduce your ordinary income each year. Any remaining losses can be carried forward to future tax years.

It’s really important to keep good records of these trades. You’ll need proof of the purchase price and the sale price to show the IRS if they ask.

The Benefits of Long-Term Crypto Holdings

This one’s pretty straightforward. If you hold onto your crypto for more than a year before selling, any profits you make are considered long-term capital gains. These are taxed at much lower rates than short-term gains, which are taxed as regular income.

Let’s look at an example:

| Holding Period | Tax Rate (Example for Higher Earners) | Tax on $10,000 Gain |

|---|---|---|

| Less than 1 year (Short-Term) | Up to 37% (Ordinary Income) | Up to $3,700 |

| More than 1 year (Long-Term) | 15% or 20% (Capital Gains) | $1,500 or $2,000 |

See the difference? Holding for over a year can save you a significant amount of money, especially if you have large gains. If you believe in the long-term potential of an asset, being patient can really pay off come tax season.

Donating Appreciated Crypto Assets

This strategy is a bit more advanced, but it can be a win-win. If you donate cryptocurrency that you’ve held for more than a year (and has increased in value) to a qualified charity, you can often deduct the fair market value of the donation on your taxes. Plus, you don’t have to pay capital gains tax on the appreciation.

Think about it: you get a tax deduction, avoid paying capital gains tax on the profit, and support a cause you care about. It’s a great way to reduce your tax liability while also doing some good. Just make sure the charity is set up to accept crypto donations and that you get proper documentation for your records.

Record-Keeping and Compliance Essentials

Okay, so you’ve been trading crypto, maybe staking, maybe even mining. Now it’s time to talk about the not-so-fun part: keeping track of it all for tax purposes. Honestly, if you don’t have good records, tax season can turn into a real headache. The IRS requires you to keep good books and records to back up every single crypto transaction you make. It’s not really optional if you want to stay on the right side of the law.

Essential Records for Crypto Transactions

Think of your records as the foundation for a smooth tax filing. With the sheer number of transactions many crypto folks get into, detailed record-keeping is a must. You need to track every purchase, sale, trade, and even when you receive crypto as income. This includes:

- Purchase Details: Date, amount of crypto bought, and the fiat currency (like USD) you paid. Also, note the price you paid per coin.

- Sale Details: Date, amount of crypto sold, and the fiat currency you received. Crucially, record the price you sold it for.

- Exchange Records: Information from any exchanges you use, including transaction IDs and fees paid.

- Wallet Information: If you’re using your own wallets, keep records of transfers in and out.

- Income Records: Details on staking rewards, mining income, airdrops, or any other crypto you received as payment. Note the date received and its fair market value in USD at that time.

The IRS generally wants you to keep records for at least three years after you file your tax return, but for crypto, it’s often wise to keep them longer, especially if you hold assets for a long time. If you ever get audited, you’ll need proof of your cost basis – what you originally paid for your crypto. This is super important, especially if you moved crypto between wallets or exchanges, as the new platform might not know your original purchase price. You’ll need to show that original purchase record. You can find more information on record-keeping requirements at the IRS website.

Utilizing Crypto Tax Software

Manually tracking hundreds, or even thousands, of crypto transactions is a recipe for errors. That’s where crypto tax software comes in. These tools can connect to your exchanges and wallets, either through API keys or by importing CSV files. They then pull all your transaction history and calculate your gains and losses. It’s a huge time-saver and helps ensure accuracy. Many of these platforms can also generate the necessary tax forms for you, like Form 8949 and Schedule D. While you should always review the reports generated by the software, they can make the process much less painful. Some popular options include CoinLedger, Koinly, and CoinTracker.

Verifying Exchange-Issued Tax Forms

Starting in 2025, you’ll likely see a new form from your crypto exchanges: the Form 1099-DA. This form is supposed to report your digital asset transactions to the IRS and to you. However, it’s really important to double-check these forms. Exchanges might not have complete information, especially for crypto you acquired before using their platform or through certain DeFi activities. If the 1099-DA doesn’t accurately reflect your cost basis, you’ll need to have your own records to correct it. Don’t just blindly trust the form; compare it against your own meticulously kept records before filing your taxes.

Addressing Complex Crypto Tax Scenarios

Okay, so we’ve covered the basics, but let’s be real, crypto taxes can get messy. It’s not always as simple as buying low and selling high. Sometimes, you’re dealing with stuff that makes your head spin a little.

Handling DeFi Lending and Staking-as-a-Service

This is where things get a bit murky. When you lend your crypto out or use staking-as-a-service platforms, you’re often earning rewards. The IRS generally treats these rewards as income when you receive them. Think of it like earning interest in a bank account, but with digital assets. The tricky part is figuring out the fair market value of those rewards at the exact moment you get them. If you’re getting paid in a different crypto than what you lent out, that’s another layer of complexity because you’ve got two assets to track.

- Income Recognition: Rewards are typically taxed as ordinary income when received.

- Basis Tracking: The value of the rewards becomes your cost basis for those new coins.

- Record Keeping: You need to log the date, amount, and fair market value of every reward received.

The Nuances of Crypto-to-Crypto Trades

This is a big one for many traders. When you swap one cryptocurrency for another – say, Bitcoin for Ethereum – the IRS sees this as a sale of your Bitcoin. This means you might owe capital gains tax on any profit you made on the Bitcoin, even if you didn’t convert it to fiat currency like USD. It’s like trading one stock for another; you still have to account for the gain on the first one.

- Taxable Event: Every crypto-to-crypto trade is a potential taxable event.

- Calculate Gain/Loss: You need to determine the cost basis of the crypto you’re trading away and its fair market value at the time of the trade.

- New Basis: The fair market value of the crypto you receive becomes your new cost basis for that asset.

When to Seek Professional Tax Advice

Look, nobody wants to pay more taxes than they have to, and nobody wants to get in trouble with the IRS. If your crypto activities are getting complicated, or if the amounts involved are significant, it might be time to call in the cavalry. Trying to figure out complex DeFi strategies or thousands of transactions on your own can lead to mistakes, and those mistakes can be costly.

- High Volume of Transactions: If you have hundreds or thousands of trades, especially across multiple platforms, it’s easy to lose track.

- DeFi and Staking Complexity: If you’re deep into decentralized finance, yield farming, or complex staking arrangements, professional help is often needed.

- Large Gains or Losses: If you’re dealing with significant dollar amounts, the cost of a tax professional is usually well worth it to ensure accuracy and potentially find tax-saving strategies.

- Uncertainty: If you’re unsure how to report a specific type of transaction, a crypto-savvy tax advisor can provide clarity and help you avoid missteps. Don’t guess when it comes to taxes; get it right.

Wrapping It Up

So, 2025 is shaping up to be a big year for crypto taxes. The IRS is really starting to get a handle on things, much like they do with stocks. This means more eyes on your crypto activity, so getting your reporting right is super important. If you’ve been a bit loose with your records or missed reporting some things in the past, now’s the time to get things squared away. It might even be worth looking into amending old returns. While the new 1099-DA form is a major change, remember that the basic tax rules for crypto haven’t really changed – it’s still treated like property. Good record-keeping is your best friend here, and while tools can help, they aren’t a magic bullet. Staying informed about new rules and planning ahead will make tax season much less stressful. Ultimately, paying taxes on your crypto gains means you’ve likely made money, which is a good problem to have. Here’s to a profitable and tax-compliant 2025!

Frequently Asked Questions

What’s the biggest change for crypto taxes in 2025?

The biggest change is the introduction of Form 1099-DA. Think of it like the 1099-B you get for stocks. Your crypto exchange will send this form to the IRS, reporting your sales and other events. This means the IRS will have a much clearer picture of your crypto activity, so it’s super important to report everything accurately on your tax return.

Does the IRS treat crypto like money?

Nope! The IRS sees crypto as ‘property,’ kind of like owning a piece of art or a house. This means whenever you sell, trade, or even spend your crypto, it’s considered a taxable event. You have to figure out if you made a profit or took a loss, just like you would with stocks.

How do I figure out my crypto profit or loss?

It’s like a simple math problem for each crypto sale or trade. You take the price you sold it for and subtract the price you originally paid for it (this is called your ‘cost basis’). If you sold it for more than you paid, that’s a gain. If you sold it for less, that’s a loss. Keep good records of what you bought and when!

What’s the difference between short-term and long-term crypto gains?

It all depends on how long you held onto your crypto before selling or trading it. If you held it for a year or less, any profit is a ‘short-term’ gain, and it’s taxed like your regular income. If you held it for more than a year, it’s a ‘long-term’ gain, and those usually have lower tax rates, which is pretty sweet.

Do I have to pay taxes on crypto I earn from staking or mining?

Yes, you do. When you earn crypto through things like staking, mining, or even receiving airdrops, the IRS considers that income. You’ll need to report the value of that crypto when you received it as income for that year. That value also becomes your starting point, or ‘cost basis,’ if you decide to sell it later.

What if I made mistakes on my past crypto taxes?

Don’t panic! Since the IRS is getting more reporting tools like the 1099-DA, it’s a really good idea to get compliant. If you realize you didn’t report some crypto gains in previous years, you can often file an amended tax return to fix it. It’s usually better to come forward and pay what you owe than to wait and risk penalties later.