So, 2025 is here, and the crypto market is really heating up. It’s exciting to see those prices climb, but if you’re holding onto your digital assets, you’ve probably started thinking about taxes. Specifically, the crypto long term capital gains tax. It can feel a bit confusing, right? Like, how long do you actually have to hold something for it to count as ‘long term’? And what’s the deal with those tax rates? We’re going to break it all down, keeping it simple so you can figure out what you need to know for this year.

Key Takeaways

- For crypto, long-term capital gains apply to assets held for over one year, leading to lower tax rates than short-term gains.

- Calculating your crypto cost basis is tricky due to multiple exchanges, frequent trades, and crypto-to-crypto swaps.

- The 2025 long-term capital gains tax rates are 0%, 15%, or 20%, depending on your overall taxable income.

- Your filing status and state tax laws significantly influence your total crypto long term capital gains tax.

- Using tax software or consulting a tax professional can help manage accurate record-keeping and tax calculations for crypto.

Understanding Crypto Long Term Capital Gains Tax for 2025

Alright, let’s talk about crypto taxes for 2025, specifically the long-term capital gains part. It sounds complicated, and honestly, it can be, but breaking it down makes it much more manageable. The IRS treats crypto like property, similar to stocks, which means when you sell it for more than you paid, you’ve got a capital gain. The big difference for long-term gains is how long you held onto that digital asset before selling.

Defining Long-Term Capital Gains in the Crypto Context

So, what exactly counts as a long-term capital gain in the crypto world? It’s pretty straightforward, really. If you’ve held a cryptocurrency for more than one year before selling it, any profit you make is considered a long-term capital gain. This is different from short-term gains, which apply to assets held for a year or less and are taxed at your regular income rate. Think of it like this: the longer you hold, the better the tax treatment usually is. Selling cryptocurrency held for over a year results in long-term capital gains taxes. This applies whether you’re selling for fiat currency, trading one crypto for another, or even using crypto to buy goods and services.

The Impact of Holding Duration on Your Tax Liability

The amount of time you hold your crypto directly affects how much tax you’ll owe. Short-term gains are taxed at your ordinary income tax rates, which can be as high as 37% for some people. Long-term gains, on the other hand, get a much friendlier tax treatment. For 2025, the rates are:

- 0%: For single filers with taxable income up to $48,350, and married couples filing jointly up to $96,700.

- 15%: For single filers with taxable income between $48,351 and $533,400, and married couples filing jointly between $96,701 and $600,050.

- 20%: For single filers with taxable income over $533,400, and married couples filing jointly over $600,050.

As you can see, holding your crypto for over a year can significantly reduce your tax bill. It’s a pretty big incentive to be patient with your investments.

Navigating the 2025 Tax Landscape for Digital Assets

The year 2025 is shaping up to be interesting for crypto investors. With the market showing signs of a bull run, many people are looking to cash in on their gains. However, the IRS is also paying closer attention to digital assets. They’ve introduced new forms, like the Form 1099-DA, to make reporting easier, but it also means more transparency. Understanding these changes and how they apply to your specific situation is key. It’s not just about the federal taxes either; some states have their own rules regarding crypto gains, so you’ll need to factor that in too. Staying informed about these evolving regulations is important for any serious crypto investor.

Calculating Your Crypto Long Term Capital Gains Tax

Figuring out how much tax you owe on your crypto gains can feel like a puzzle, especially when you’re dealing with long-term holdings. It’s not as straightforward as just looking at your bank account. The IRS treats crypto like property, similar to stocks, which means every time you sell or trade, it’s a taxable event. But unlike stocks, which often have simpler transaction histories, crypto can get messy really fast.

The Challenge of Determining Cost Basis for Crypto

This is where things get tricky. Your cost basis is basically what you originally paid for your crypto, including any fees. When you sell, you subtract this cost basis from the sale price to figure out your profit or loss. The problem is, most crypto investors don’t just buy one coin at one price and hold it forever. You might have bought Bitcoin at $5,000, then again at $10,000, and maybe even more at $20,000. Then, you decide to sell a small portion. Which purchase price do you use? The IRS requires you to track this accurately, and it’s a major hurdle for many.

Strategies for Accurate Transaction Tracking

Because crypto transactions can be so varied, keeping good records is super important. Think about all the ways you might have interacted with crypto:

- Buying and Selling: This is the most obvious. You need to know the date, the amount of crypto, and the fiat currency (like USD) you paid or received.

- Crypto-to-Crypto Trades: Swapping one coin for another, like trading Ethereum for Solana, is considered a sale of the first coin and a purchase of the second. Both have tax implications.

- Receiving Crypto: If you got crypto as a reward for staking, mining, or as an airdrop, its value at the time you received it becomes your cost basis.

- Transfers: Moving crypto between your own wallets or exchanges usually isn’t a taxable event, but you still need to track it to follow the chain of ownership.

If you’ve used multiple exchanges or wallets, pulling all this data together can feel overwhelming. It’s like trying to piece together a giant jigsaw puzzle without all the pieces.

Leveraging Tools and Professional Assistance

Doing all this math manually after every single transaction is a recipe for headaches. Thankfully, there are tools designed to help. Many crypto tax software platforms can connect to your exchanges and wallets to import your transaction history. They then help calculate your cost basis and capital gains. While these tools aren’t always perfect and might require some manual adjustments, they can significantly simplify the process. For those with very complex portfolios or who just want to be absolutely sure they’re getting it right, consulting with a tax professional who specializes in cryptocurrency is a smart move. They can help ensure you’re compliant and not missing out on any potential tax savings, which is especially important when dealing with international regulations like those in Canada.

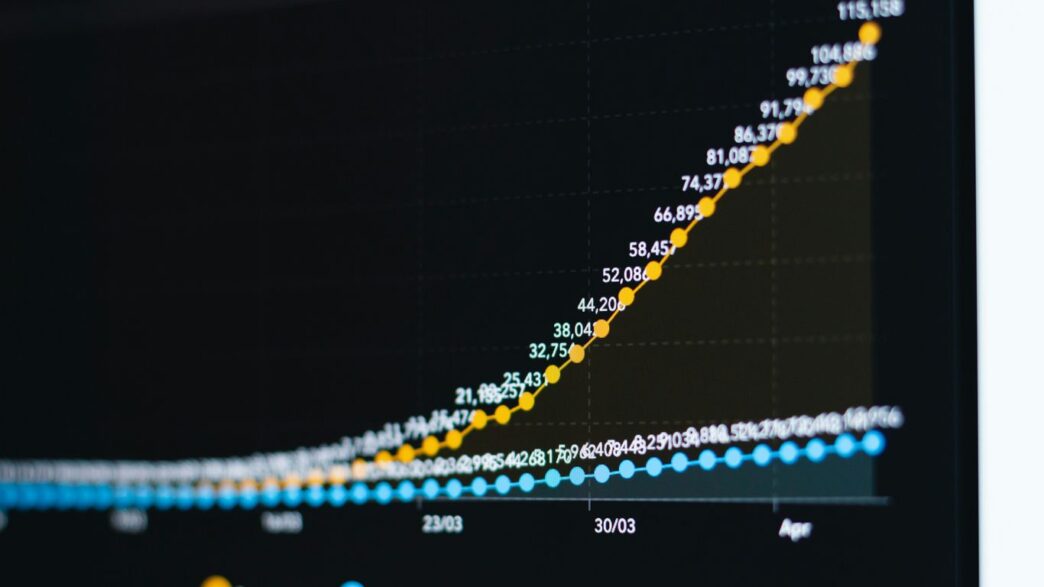

2025 Tax Rates for Long-Term Crypto Gains

Alright, let’s talk about the tax rates for those long-term crypto gains in 2025. If you’ve held onto your digital assets for over a year, you’re generally looking at more favorable tax treatment compared to short-term gains. This is where the IRS gives you a bit of a break, recognizing that you’ve been a patient investor. The key is holding your crypto for more than 365 days before you sell or trade it.

These rates are tiered, meaning the more taxable income you have, the higher the percentage you might pay. It’s not a one-size-fits-all situation. For 2025, the long-term capital gains tax rates are set at 0%, 15%, and 20%. Your specific rate depends on your overall taxable income and your filing status (like single, married filing jointly, etc.).

Here’s a general idea of how it breaks down, but remember these are estimates and can change:

Federal Long-Term Capital Gains Tax Brackets

It’s helpful to see where you might fall. Keep in mind these figures are for the taxable income after all deductions, not just your gross income. And these are for federal taxes only; state taxes are a whole other story.

| Tax Rate | Single Filers (Taxable Income) | Married Filing Jointly (Taxable Income) |

|---|---|---|

| 0% | Up to $48,350 | Up to $96,700 |

| 15% | $48,351 to $533,400 | $96,701 to $600,050 |

| 20% | Over $533,400 | Over $600,050 |

Understanding the 0%, 15%, and 20% Brackets

So, what does this mean for you? If your total taxable income for the year, including your long-term crypto profits, falls into the lower brackets, you might pay 0% tax on those gains. That’s a pretty sweet deal. For most people, the 15% rate will likely apply. If you’re in a very high income bracket, then you’ll be looking at the 20% rate.

Potential Impact of Net Investment Income Tax (NIIT)

Now, there’s a little extra something to be aware of, especially if your income is on the higher side. The Net Investment Income Tax, or NIIT, could add an extra 3.8% to your tax bill. This tax generally applies to individuals with modified adjusted gross income above certain thresholds. For 2025, these thresholds are typically:

- $200,000 for single filers

- $250,000 for married couples filing jointly

So, if your income is high enough, your long-term capital gains tax could effectively be 3.8%, 18.8%, or 23.8% instead of just 0%, 15%, or 20%. It’s definitely something to factor into your tax planning.

Key Factors Influencing Your Crypto Tax Bill

So, you’ve been holding onto your crypto, watching it grow, and now you’re thinking about taxes. It’s not just about how much you made, but also about a few other things that can really change the final number you owe. Let’s break down what makes your crypto tax bill what it is.

Your Overall Taxable Income and Filing Status

This is a big one. The IRS has different tax rates for long-term capital gains, and these rates depend on your total income for the year. If you’re in a lower income bracket, you might pay 0% on those gains. If you’re earning more, you could be looking at 15% or even 20%. Your filing status – whether you’re single, married filing jointly, or something else – also plays a role in determining which tax bracket you fall into. It’s not just about your crypto profits; it’s about your entire financial picture for the year.

The Role of State-Specific Tax Regulations

Don’t forget about your state! While federal taxes are one thing, many states also have their own income tax rules. Some states tax crypto gains just like regular income, while others might have different rules or even no state income tax at all. This can add another layer to your tax calculation, so it’s worth checking what your specific state requires. For example, some states might tax your crypto gains at their standard income tax rate, which could be higher or lower than the federal rates.

Distinguishing Between Short-Term and Long-Term Gains

This is probably the most talked-about factor. The IRS treats crypto held for one year or less differently than crypto held for more than a year. Short-term gains are taxed at your ordinary income tax rate, which can be pretty high. Long-term gains, on the other hand, get those preferential lower rates we mentioned earlier (0%, 15%, or 20%). So, knowing exactly when you acquired each piece of crypto is super important. It’s the difference between paying a small percentage and potentially a much larger chunk of your profits to Uncle Sam.

Strategies to Minimize Your Crypto Long Term Capital Gains Tax

So, you’ve been holding onto some crypto for a while, and now you’re thinking about the tax implications. It’s totally normal to want to keep as much of your hard-earned gains as possible. Luckily, there are a few smart ways to approach this, and they’re not as complicated as they might seem at first glance.

The Benefits of Holding Assets Beyond One Year

This is probably the most straightforward way to cut down on your tax bill. If you hold onto your cryptocurrency for more than a year before selling it, you qualify for the lower long-term capital gains tax rates. Think of it as a reward for your patience. Instead of paying taxes at your regular income tax rate, which can be pretty high, you’ll be taxed at those preferential rates of 0%, 15%, or 20%, depending on your income bracket. The longer you hold, the less you’ll likely owe in taxes when you finally decide to cash out. It’s a simple concept, but it makes a big difference.

Implementing Tax-Loss Harvesting Techniques

This strategy is a bit more active, but it can be really effective. Tax-loss harvesting involves selling some of your crypto assets that have gone down in value. Why would you do that? Because those losses can be used to offset any capital gains you’ve made elsewhere. So, if you sold some Bitcoin for a profit, but you also have some Ethereum that’s lost value, you can sell that losing Ethereum to reduce the taxable gain from your Bitcoin sale. You can even use up to $3,000 of these net capital losses to offset your ordinary income each year, and carry forward any remaining losses to future tax years. It’s like turning a negative into a positive for tax purposes.

Exploring Tax-Advantaged Investment Accounts

This is where things can get really interesting, though it requires a bit more setup. Some specialized retirement accounts, like certain types of IRAs or even some 401(k)s, might allow you to hold cryptocurrency. If you can invest in crypto within these accounts, your gains could grow tax-deferred or even tax-free, depending on the account type. This means you wouldn’t owe capital gains tax when you sell within the account, only when you eventually withdraw the funds in retirement. It’s not a universally available option, and you’ll need to find a provider that specifically supports crypto investments in these accounts, but it’s definitely worth looking into if you’re planning for the long haul.

IRS Reporting Requirements for Crypto Investors

So, you’ve been trading crypto, and now it’s time to think about taxes. It can feel a bit overwhelming, especially with all the forms and rules. The IRS is definitely paying attention to digital assets, and it’s important to get this right to avoid any headaches down the road. The key is to keep really good records of everything you do. If you don’t, figuring out your tax situation can become a real mess, and nobody wants that.

Let’s break down what you need to know about reporting your crypto activities to the IRS for 2025.

Understanding Form 1099-DA and Other Relevant Forms

This is where things get a bit technical, but it’s important. You might receive various forms from your crypto exchanges or brokers. The most talked-about one is the Form 1099-DA, which is specifically designed for digital asset transactions. While its full implementation and reporting thresholds might still be evolving, it’s something to keep an eye on. You might also see a Form 1099-B, which reports sales and other dispositions of property. Some platforms might also issue a Form 1099-K, though the rules around that can change. It’s worth noting that even if you don’t receive a 1099 form for a particular transaction, you’re still responsible for reporting it if it’s taxable. Think of these forms as helpful summaries, not the be-all and end-all of your reporting duties.

Here’s a quick look at some forms you might encounter:

- Form 1099-DA: Expected to report digital asset transactions.

- Form 1099-B: Reports proceeds from broker and barter exchange transactions.

- Form 1099-K: Reports payment card and third-party network transactions.

- Form 8949: Used to report sales and other dispositions of capital assets, including crypto.

- Schedule D (Form 1040): Summarizes your capital gains and losses from Form 8949.

- Schedule 1 (Form 1040): Where you’ll report other income, including certain crypto-related gains or rewards.

The Importance of Meticulous Record Keeping

Seriously, this is the big one. Without good records, calculating your cost basis (what you paid for your crypto) and your gains or losses becomes a guessing game. And the IRS doesn’t like guesswork when it comes to taxes. You need to track:

- Date of Acquisition: When you bought or received the crypto.

- Cost Basis: How much you paid for it, including any fees.

- Date of Sale or Disposition: When you sold, traded, or otherwise disposed of the crypto.

- Proceeds: How much you received from the sale or disposition.

- Type of Transaction: Was it a sale, trade, gift, or reward?

If you mined crypto, you’ll need to record its fair market value when you received it. If you received it as payment for goods or services, that’s also its fair market value at the time. For gifts, it gets a bit more complicated, and you might want to consult a tax professional. Keeping a detailed spreadsheet or using crypto tax software can make this process much more manageable. It might seem like a lot of work now, but trust me, it will save you a massive headache later.

Navigating Estimated Quarterly Tax Payments

Depending on your income situation, you might need to pay estimated taxes throughout the year, not just when you file your annual return. This is especially true if you expect to owe at least $1,000 in taxes when you file, or if your withholding and refundable credits won’t cover at least 90% of the tax you owe for the current year. Crypto gains are considered taxable income, and if you have significant profits, you could fall into this category. The IRS wants its money as it’s earned, so to speak. Making these quarterly payments helps you avoid penalties and interest charges when you file your taxes. The payment deadlines are typically April 15, June 15, September 15, and January 15 of the following year. If any of these dates fall on a weekend or holiday, the deadline moves to the next business day. It’s a good idea to check the IRS website for the exact dates each year.

Wrapping Up Your 2025 Crypto Taxes

So, we’ve gone over a lot of ground when it comes to crypto taxes for 2025. It’s definitely not as simple as just buying and selling stocks, that’s for sure. Keeping track of everything, especially with all the different ways you can use crypto these days – trading, staking, lending, you name it – can feel like a real headache. Remember, holding onto your assets for over a year can make a big difference in what you owe, and keeping good records is your best friend. If it all feels a bit much, don’t hesitate to get some help. A tax pro who knows crypto can save you a lot of stress and maybe even some money. Here’s to a smoother tax season ahead!

Frequently Asked Questions

What’s the difference between short-term and long-term crypto gains?

Think of it like this: if you hold onto your crypto for a year or less before selling it for a profit, that’s a short-term gain. If you hold it for more than a year, it’s a long-term gain. Long-term gains usually get taxed at a lower rate, which is good news for your wallet!

Why is calculating crypto taxes so tricky?

It’s complicated because crypto is treated like property by the IRS, similar to stocks. But unlike stocks, you might buy, sell, and trade crypto many times, often on different platforms. Keeping track of the exact price you paid for each piece of crypto (your ‘cost basis’) can be a real headache.

Do I have to pay taxes if I just swap one crypto for another?

Yes, unfortunately. When you trade one type of cryptocurrency for another, like swapping Bitcoin for Ethereum, the IRS sees that as selling the first one, which can trigger capital gains taxes. It’s like selling one stock to buy another.

What are the tax rates for long-term crypto gains in 2025?

The tax rates for long-term crypto gains in 2025 depend on how much money you make overall. For most people, the rates are 0%, 15%, or 20%. The more you earn, the higher the percentage you might pay, but it’s still generally lower than taxes on short-term gains.

How can I make my crypto taxes easier to handle?

A few things can help! Holding your crypto for over a year helps get you those lower long-term tax rates. You can also look into ‘tax-loss harvesting,’ which means selling some crypto that lost value to help lower your taxes on gains. Using special accounts like IRAs for crypto can also offer tax benefits, and of course, using crypto tax software or talking to a tax pro makes a big difference.

What is Form 1099-DA and do I need it?

Form 1099-DA is a new form the IRS is using specifically for crypto transactions. If you used a crypto exchange or broker, they might send you this form. It helps report your crypto sales and gains to the IRS, so it’s important to understand it and make sure your tax filings match what’s on the form.