The world of energy is changing fast, and so are the ways companies buy and sell each other. In 2026, expect a lot of action in energy acquisitions. Things like AI are making us need more power than ever, and everyone wants to make sure they have enough energy and can rely on it. This means companies are looking to buy others to get bigger, more stable, and ready for whatever comes next. We’re seeing big shifts in power, oil, gas, mining, and chemicals, all driven by new demands and how the world trades.

Key Takeaways

- Power and utility companies are making more acquisitions in 2026 because energy demand is up and reliability is a big deal. They’re looking at all kinds of energy sources, including natural gas, nuclear power, and ways to store energy.

- Oil and gas deals are picking up again, especially around natural gas and LNG. Companies are buying to get bigger and make their operations smoother, fitting into a changing global market.

- Mining and metals companies are focusing on buying up businesses to secure their supply chains and get their hands on important minerals. It’s all about getting the best resources for the future.

- In the chemical industry, companies are simplifying their operations and focusing on special materials needed for the energy transition and AI. The middle market is becoming more active, and some companies are restructuring to deal with too much supply and high costs.

- Companies are creating value in energy acquisitions by partnering up and building platforms. They’re also looking for assets connected to the grid and those with contracts, while keeping an eye on what’s happening in different regions.

Navigating Energy Acquisitions Amidst Shifting Global Dynamics

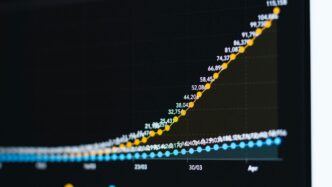

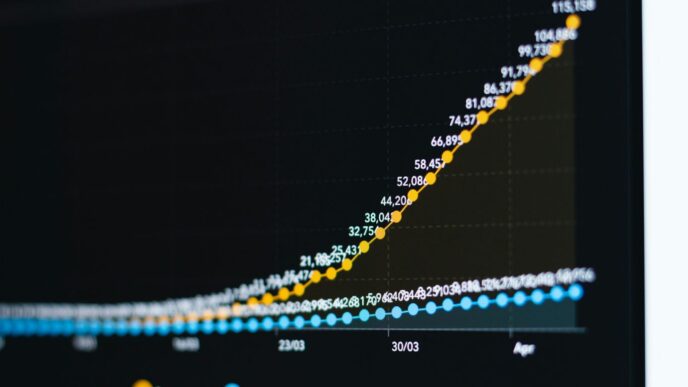

The energy world is really changing, and it’s making companies think differently about buying and selling assets. A big part of this is the massive jump in energy demand, largely thanks to AI and all the data centers popping up. This isn’t just a small bump; it’s a fundamental shift that’s making everyone rethink their strategies.

The AI Energy Nexus: Driving Unprecedented Demand

Artificial intelligence is a game-changer for energy consumption. Think about all those massive data centers needed to train AI models and run complex computations – they need a ton of reliable power, 24/7. This surge in demand is pushing companies to look for more capacity, faster. It’s creating new opportunities, especially for those who can provide stable, large-scale power sources. We’re seeing deals happen that are directly tied to supplying these AI hubs, which is a pretty new development.

Resilience and Scale: Pillars of 2026 Energy Acquisitions

Because of this new demand and the general uncertainty in the world, companies are really focused on two main things: resilience and scale. They want assets that can keep running no matter what, and they need to be big enough to make a real difference. This means looking at a mix of energy sources, not just one. It’s about having a robust portfolio that can handle fluctuations and meet large-scale needs. Acquisitions in 2026 are heavily favoring assets that are already connected to the grid and have contracts in place, offering predictable income.

Here’s a quick look at what’s getting attention:

- Grid-connected assets: Power plants that are already up and running and hooked into the electricity network.

- Contracted power: Projects with long-term deals, like Power Purchase Agreements (PPAs), that guarantee a buyer for the energy.

- Virtual Power Plants (VPPs): These are becoming more interesting as they can aggregate smaller energy sources to act like a big one, offering flexibility.

Strategic Realignment in a New Global Trade Era

Global trade is also in a different place now, and that affects where companies are investing. Geopolitics plays a bigger role, and there’s a strong push to secure supply chains, especially for critical minerals needed for the energy transition. Companies are looking at deals that give them more control and reduce risk. This might mean buying assets closer to home or in regions that offer more stability. It’s a complex puzzle, but getting the strategy right is key to success in the coming years.

Power and Utilities: Meeting Escalating Energy Demands

The ‘All of the Above’ Imperative for Capacity and Resilience

The energy world is really busy right now, trying to keep up with how much power everyone needs. It’s not just about having enough electricity; it’s also about making sure the lights stay on even when things get tough, and doing it all without wrecking the planet too much. This is why companies are looking at all sorts of energy sources, not just one or two. Think of it as a "kitchen sink" approach to power generation.

This means traditional power plants, like those running on natural gas, are still super important. They provide a steady stream of power when solar or wind isn’t available. Natural gas, in particular, has found its footing again as a bridge fuel. We’re seeing a lot of investment in the infrastructure to support it, like liquefied natural gas (LNG) facilities, which help make sure we have a reliable supply.

But it’s not just about burning fuel. Energy storage is becoming a huge deal. Batteries, especially big ones that can power a whole neighborhood or a large industrial site, are getting a lot of attention. This is partly because demand is getting spikier, and partly because big tech companies building data centers need a constant, stable power supply right where they are. These data centers are power hogs, and they’re driving a need for localized energy solutions.

Renewables like solar and wind are still growing, but sometimes they hit snags. Policy changes or just the difficulty of connecting them to the grid can slow things down. Meanwhile, nuclear power is making a comeback. It’s seen as a reliable, carbon-free source of power, and there’s renewed interest in new technologies like small modular reactors (SMRs). It feels like a strategic move for many companies looking for long-term, stable energy production.

Here’s a quick look at what’s driving these decisions:

- Diversified Portfolios: Mixing traditional generation, renewables, storage, and grid assets.

- Capacity and Flexibility: Ensuring enough power is available, especially during peak demand or when other sources are down.

- Grid Stability: Keeping the electricity network running smoothly despite increasing complexity.

- Decarbonization Goals: Meeting environmental targets while still powering the economy.

Nuclear and Advanced Technologies: A Strategic Resurgence

It’s kind of surprising, but nuclear power is getting a second look. After years of being a bit sidelined, it’s back on the table as a serious contender for providing large amounts of clean energy. This isn’t just about the big, traditional nuclear plants either. There’s a lot of buzz around newer, smaller designs, like small modular reactors (SMRs). These are seen as more flexible and potentially easier to build than the massive plants of the past.

Why the change? Well, the need for reliable, carbon-free power is pretty intense. Nuclear fits that bill perfectly. It can run 24/7, regardless of the weather, and it doesn’t produce greenhouse gases during operation. This makes it attractive for utilities and investors who are trying to meet both energy demand and climate goals. We’re seeing more partnerships forming to explore these technologies, with companies looking to get a piece of the action in developing and deploying advanced nuclear solutions.

Grid Modernization and Storage: Essential Infrastructure Investments

Our electricity grids are, frankly, getting old. They were built for a different era of power generation and consumption. Now, with more renewable energy coming online and demand patterns changing – especially with things like electric vehicles and those massive data centers – the grid needs a serious upgrade. Think of it like trying to run the latest video game on a 20-year-old computer; it just doesn’t work well.

So, there’s a big push to modernize the grid. This involves everything from upgrading old transmission lines to installing smart technologies that can better manage the flow of electricity. It’s about making the grid more resilient, more efficient, and capable of handling the complex mix of energy sources we’re using today.

And then there’s energy storage. This is where batteries come in, and not just the ones in our phones. We’re talking about grid-scale battery systems that can store excess energy generated during sunny or windy periods and then release it when demand is high or when renewable sources aren’t producing. This is absolutely key to making renewable energy more reliable and to balancing the grid. Without better storage, we can’t fully take advantage of solar and wind power. It’s a massive investment area, and it’s going to be critical for meeting future energy needs.

Oil and Gas: Natural Gas and LNG Regain Strategic Momentum

It feels like just yesterday everyone was talking about how oil and gas were on their way out, but things are changing fast. With all the new data centers popping up and the push for more digital stuff, the demand for reliable power is just shooting up. And guess what? Natural gas is stepping back into the spotlight. It’s the go-to for providing power when solar and wind just can’t keep up, especially for those massive digital operations. Companies are snapping up cheap gas fields to make sure they have enough fuel for their LNG exports. Plus, investors are eyeing up all the pipes and processing plants that are close to these big industrial and data hubs.

LNG Infrastructure: Supporting Scalable and Reliable Supply

Building out LNG infrastructure is becoming a really big deal. Think about it: you need solid ways to get that liquefied natural gas from where it’s produced to where it’s needed, and you need it to be dependable. This means more investment in terminals and the ships to move it. It’s all about making sure there’s enough supply that can be scaled up quickly when demand spikes. Projects like the Golden Pass LNG terminal on the US Gulf Coast, a huge collaboration, show just how serious companies are about turning existing sites into major export centers.

Midstream Integration: Enhancing Efficiency and Reach

Companies are really looking to connect the dots in the midstream sector. This means buying up gathering systems, processing facilities, and pipelines. The goal is to make the whole process smoother, from getting the gas out of the ground to getting it ready for export or use. It’s about cutting out the middle steps and making things more efficient. This kind of integration helps companies control more of the supply chain, which is great for reliability and can lead to better profits.

Transition Fuel Strategies in Evolving Markets

Natural gas is really finding its footing as a ‘transition fuel.’ It’s cleaner than coal but still provides that steady power that renewables sometimes struggle with. This is especially true in places like Canada, where they’re looking at expanding gas-fired power plants and pipelines. Buyers from all over are interested in getting a piece of these gas and LNG operations, especially those with a global reach. It’s a smart move for companies that want to be part of the energy mix for years to come, even as the world shifts towards greener options.

Mining and Metals: Securing Critical Resources for the Future

The mining and metals sector is really heating up when it comes to mergers and acquisitions, and it makes sense. We’re talking about the stuff that powers pretty much everything new – from electric cars to all those data centers humming away. It’s not just about digging up more; it’s about making sure we have a steady, reliable supply of these key materials.

Consolidation and Supply Chain Security

Companies are looking to get bigger and more secure. Think about it: if you control more of the supply chain, from the mine to the processing plant, you’re less likely to get caught out by global disruptions. We’re seeing a lot of this happen, especially with metals like copper, which is basically essential for electrification. Deals are being made to create larger, more robust companies that can handle the ups and downs of the market and geopolitical shifts. It’s all about building resilience.

- Gold continues to be a big player, partly because prices have been good and companies have access to funding. It’s seen as a safe bet.

- Copper is a major focus because it’s needed for all the new infrastructure and the shift to electric power.

- Critical minerals like gallium and germanium are getting more attention because their supply chains are a bit fragile, and governments are stepping in to help secure them.

Investment in High-Quality Critical Mineral Assets

It’s not just about quantity anymore; it’s about quality. Companies and investors are really zeroing in on assets that are known to be rich in the minerals we need and that can be mined for a long time. This means looking at deposits that are easier to get to, have fewer environmental hurdles, and are in stable regions. The goal is to find those long-term, reliable sources that can meet future demand without a ton of extra risk or cost.

| Mineral Group | Key Drivers | M&A Focus Areas |

|---|---|---|

| Precious Metals (Gold) | Elevated prices, safe-haven demand | Volume-driven deals, capital access |

| Base Metals (Copper) | Electrification, infrastructure development | Consolidation, securing large-scale operations |

| Critical Minerals | Energy transition, defense, digital transformation | Supply chain security, government incentives, niche assets |

Geopolitical Drivers of Resource Acquisition

Let’s be honest, where a mine is located matters a lot these days. With all the talk about trade policies and international relations, countries are getting serious about controlling their own supply of important minerals. This means we’re seeing more government involvement, whether it’s through direct investment, offering incentives, or making deals to secure resources from friendly nations. This geopolitical angle is becoming just as important as the economics of a deal. It’s a complex dance, trying to balance national security needs with the global demand for these vital materials.

Chemicals: Portfolio Simplification and Specialty Materials

Alright, let’s talk about the chemicals sector and what’s shaking up mergers and acquisitions in 2026. It feels like a lot of companies are really looking to clean up their act, so to speak. We’re seeing big players, like BASF and BP, getting rid of parts of their business that aren’t really core anymore. Think of it as decluttering their closets. They’re spinning off divisions or selling them off entirely. Buyers are definitely interested, especially if these pieces are large and fit well with what they already do. But, and this is a big ‘but’, making these deals work is tricky. Companies need to be ready to operate independently right away, manage costs that might get left behind, and have a solid plan for how everything will fit together. It’s not just about buying; it’s about making it work afterwards.

Focus on Specialty Materials for Energy Transition and AI

Now, where is the real excitement? It’s in specialty chemicals. These are the ingredients that are becoming super important for new technologies. We’re talking about stuff that helps with the energy transition – making renewable energy work better, for example – and also for the booming AI world. Think about what goes into making data centers run smoothly. That means chemicals for water treatment, filtration, and cooling systems. Also, advanced materials for things like computer chips, solar panels, and batteries are hot tickets. We’re seeing a lot of smaller companies, especially in areas like battery chemicals and water treatment, getting bought up by larger ones. It’s like building blocks for the future, and everyone wants a piece.

Restructuring Plays Amidst Oversupply and Cost Pressures

On the flip side, some parts of the chemicals industry are really feeling the pinch. Especially in Europe, companies that make basic, commodity chemicals are struggling. They’re up against tough competition from overseas, energy costs are high, and demand isn’t always there. This is leading to a lot of companies having to rethink their operations, sell off plants, or even shut them down. When there’s too much product and not enough demand, prices get squeezed, and profits shrink. So, instead of looking to buy other companies, many are focused on cutting costs, making their factories more efficient with automation, and investing in new technology to stay afloat. It’s more about survival and efficiency than big expansionary moves right now.

The Reawakening Middle Market in Chemicals M&A

Interestingly, the middle market in chemicals M&A is starting to wake up. While the big players are busy simplifying their portfolios and some commodity producers are struggling, there’s a growing interest in mid-sized companies. These might be businesses that are doing well in niche areas, perhaps supplying those specialty materials we talked about, or companies that have a solid distribution network. Private equity firms and strategic buyers are looking at these opportunities, especially if they can be combined with other similar businesses to create a larger, more competitive entity. It’s a bit of a different game than the mega-deals, focusing on building scale through smaller, smarter acquisitions. It seems like a good time for these mid-sized players to either sell or grow.

Value Creation Strategies in Energy Acquisitions

So, how do you actually make money when buying into the energy sector these days? It’s not just about picking up assets; it’s about smart moves. A big trend we’re seeing is companies teaming up or building out "platforms." Think of it like buying a solid foundation and then adding specialized pieces. This could mean buying a power plant that’s already connected to the grid and has long-term contracts, or even setting up virtual power plants that can manage energy flow from various sources. It’s all about getting assets that can start producing right away and have predictable income.

The focus is really shifting towards assets that are ready to go and already hooked up to the grid. Transmission lines are still a bit of a headache, so a lot of money is going into improving those and figuring out how to get projects connected faster. Assets with steady, regulated income are getting a premium because, well, you know what you’re getting.

We’re seeing this play out with some big deals. For instance, Constellation Energy bought Calpine, basically creating a giant power generator. And NRG Energy picked up a bunch of natural gas plants along with a virtual power plant system to serve their customers better. These moves show a clear strategy: get capacity, get it connected, and get it generating revenue.

Here’s a quick look at how different regions are approaching this:

- Middle East: Lots of investment from government funds and national companies, especially in renewables. They’re also looking at natural gas as a bridge fuel and exploring new areas like hydrogen and carbon capture.

- Asia Pacific: Japan is investing heavily in both renewables and nuclear to keep up with demand from digital growth. Australia, on the other hand, is seeing a lot of opportunities in renewables and battery storage as they phase out coal.

It’s a complex picture, but the common thread is finding ways to create real value through smart acquisitions, partnerships, and a keen eye on what’s needed now and in the near future.

Looking Ahead to 2026

So, as we wrap up our look at energy deals for 2026, it’s clear things are really picking up speed. The demand for energy, especially with all the new tech like AI popping up, means companies are going to be busy buying and selling. We’re seeing a big push for everything from regular power plants and gas infrastructure to new stuff like storage and critical minerals. It’s not just about getting bigger; it’s about being smart, flexible, and ready for whatever comes next. Companies that can figure out how to get the right assets, manage tricky supply chains, and use new ways to fund deals will be the ones to watch. It’s going to be an interesting year for anyone involved in energy deals.