So, healthcare mergers and acquisitions, or M&A, have been pretty interesting lately. It feels like things are shifting, and not just a little bit. We’re seeing more money being spent on deals, even if there aren’t as many happening overall. Plus, the big players and private investors are still making moves, but they’re being a bit more careful. This article looks at what’s been going on with recent healthcare M&A deals and what it might mean for next year.

Key Takeaways

- The healthcare M&A scene in the first half of 2025 saw a rise in deal value despite a small drop in the number of deals. Strategic buyers were most active, and private equity firms kept investing, even with tougher money situations.

- Value-based care is really changing how deals are put together. Companies are looking to team up to share risks and get better patient results, but they have to be careful about rules.

- Digital health and AI are big draws for investment. Think AI diagnostics, telehealth, and ways to manage patient care better. These tech-focused areas are hot, but they come with their own set of rules to follow.

- Buying and selling in healthcare services, especially outpatient care like surgery centers, is picking up. Also, there’s a push to use AI more in health IT to make things run smoother.

- Buyers are looking much closer at things like cybersecurity and supply chains now. With more rules and global issues, making sure everything is solid before a deal closes is more important than ever.

Navigating The Shifting Healthcare M&A Landscape

The world of healthcare mergers and acquisitions is definitely in motion right now. It feels like things are being re-evaluated across the board, and it’s not just a small tweak here and there. We’re seeing a real strategic shift happening.

A Strategic Recalibration in Motion

It’s not just about getting bigger anymore. Companies are looking at what truly fits their long-term goals. This means some might be selling off parts that don’t quite fit, while others are actively looking to buy specific services or technologies that fill a gap. Think of it like tidying up your house – you get rid of what you don’t need and focus on keeping the good stuff that makes your life easier.

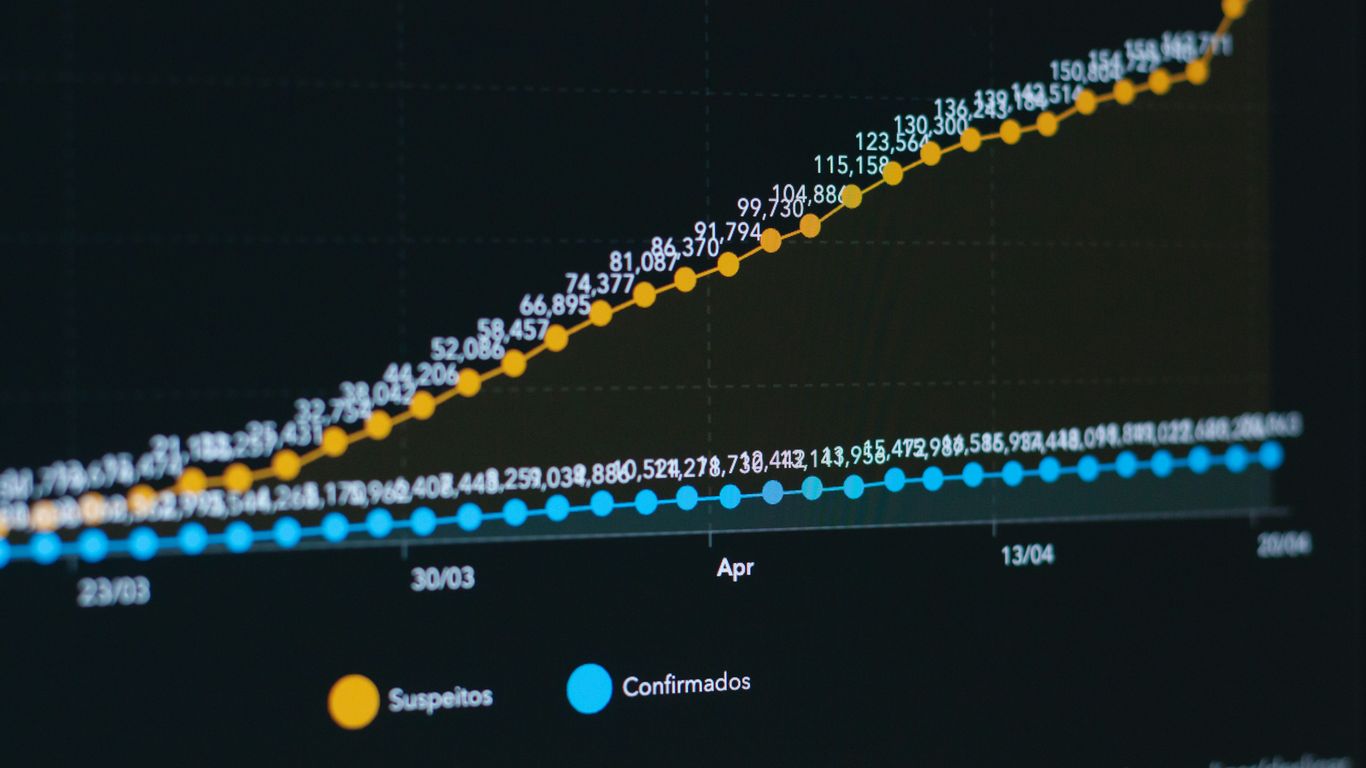

Increased Deal Value Amidst Slight Volume Decline

While the total number of deals might be a bit lower than we’ve seen in the past, the money being spent on each deal is actually going up. This suggests that when companies do decide to make a move, they’re often making a bigger, more significant investment. It’s like fewer people are going to the auction, but the ones who are there are bidding much higher for the items they really want.

Dominance of Strategic Buyers and Resilient Private Equity

When you look at who’s doing the buying, you see a lot of companies that are already in the healthcare space – these are the "strategic buyers." They know the industry inside and out and are buying to improve their existing operations or expand their reach. Private equity firms are still very much in the game, too. They might be a little more careful with their money these days, but they’re still actively investing, especially in areas that show a lot of promise for growth and efficiency.

Here’s a quick look at the buyer landscape:

- Strategic Buyers: Companies already operating in healthcare, looking to expand services, enter new markets, or acquire technology. They often have a deep understanding of the industry’s complexities.

- Private Equity (PE): Investment firms looking for scalable businesses with strong potential for operational improvements and financial returns. They are becoming more selective but remain a significant force.

- Consolidators: Groups focused on acquiring multiple smaller practices or facilities to create larger, more efficient networks, often within specific service lines like dental or home health.

This mix of buyers means different things for sellers. Strategic buyers might offer a smoother integration, while PE firms could provide significant capital but come with different expectations for growth and management.

Key Trends Driving Recent Healthcare M&A Deals

So, what’s actually moving the needle in healthcare mergers and acquisitions these days? It’s not just one thing, but a few big shifts are really shaping the landscape.

Value-Based Care’s Influence on Deal Structuring

We’re seeing a definite push towards value-based care, and it’s changing how deals are put together. Instead of just buying a company, buyers are looking for targets that can help them manage costs better, collect payments more smoothly, and really engage with patients. Think about it: with all the talk about reimbursement uncertainty and rising labor costs, finding ways to be more efficient is a big deal. This means deals are often structured to reward providers who can show they’re improving patient outcomes while keeping expenses in check. It’s a move away from just paying for services to paying for actual health results.

The Rise of AI and Digital Health Investments

Artificial intelligence and digital health are no longer just buzzwords; they’re becoming core to M&A strategies. Companies are snapping up tech firms that offer things like remote patient monitoring, AI-powered diagnostics, or digital engagement platforms. It’s all about building a more connected and data-driven healthcare system. Tech companies from outside the traditional healthcare world are also jumping in, looking for ways to integrate their wearable devices and health apps into the mix. This trend is about making healthcare more accessible and personalized through technology.

Consolidation in Healthcare Services and Outpatient Expansion

There’s a lot of consolidation happening in healthcare services, especially in the outpatient space. Providers are looking to expand their reach and gain efficiencies by acquiring smaller practices or consolidating service lines. Outpatient care is becoming a major focus because it’s often more cost-effective and convenient for patients. This means we’re seeing a lot of activity around clinics, ambulatory surgery centers, and other facilities that offer care outside of traditional hospitals. It’s a way to capture more market share and streamline operations.

Private Equity’s Evolving Role in Healthcare Transactions

Private equity firms are definitely still a big player in healthcare M&A, but things are shifting. It feels like they’re getting more selective, really zeroing in on specific areas rather than just buying up everything they can. This increased selectivity means they’re focusing more on building out strong platforms in niche markets. Instead of broad acquisitions, they’re looking for companies that can become a solid base for future growth, often through smaller, strategic add-on deals, sometimes called tuck-ins. It’s less about a quick flip and more about long-term value creation.

Increased Selectivity and Focus on Platform Building

We’re seeing PE firms really hone in on what works. They’re less interested in traditional provider groups, which can be tricky with all the regulatory changes and payment pressures. Instead, they’re leaning towards ancillary services and technology. Think revenue cycle management, back-office solutions, and anything that makes healthcare operations smoother and more efficient. It’s about finding those scalable, tech-enabled assets that can really move the needle. This approach helps them manage risk better and tap into areas with clearer growth paths. In 2025, private equity firms dominated the top 10 healthcare transactions, accounting for approximately 75% of deals, particularly in revenue-cycle management and back-office platforms. The overall number of deals remained consistent [bec1].

Shift Towards Ancillary Services and Technology

It’s pretty clear that technology is where a lot of the action is. Investments in health IT and digital health solutions are through the roof. Firms are looking for companies that can offer things like AI-driven analytics, telehealth platforms, and remote monitoring tools. These aren’t just buzzwords; they’re becoming the backbone of modern healthcare delivery. The goal is to find solutions that improve patient care, cut down on costs, and make things more accessible. It’s a smart move, honestly, because these tech-focused businesses often have more predictable revenue streams and are easier to scale compared to traditional healthcare providers.

Navigating Tighter Credit Markets and Valuation Gaps

Let’s be real, borrowing money isn’t as cheap as it used to be. Higher interest rates and a generally tighter credit market mean PE firms have to be smarter about how they finance deals. This also leads to a bit of a gap between what sellers think their company is worth and what buyers are willing to pay. Because of this, firms are looking for deals where they can really add value through operational improvements rather than just relying on financial engineering. They’re also exploring things like continuation funds, which let them keep a good asset longer and bring in new money without having to sell the whole thing. It’s all about adapting to the current economic climate and finding ways to still get good returns.

Strategic Imperatives for Dealmakers in 2025

Alright, so looking ahead to 2025, what should folks involved in healthcare mergers and acquisitions actually be focusing on? It’s not just about finding a good deal; it’s about making sure that deal makes sense in the long run, especially with how fast things are changing.

The ‘String of Pearls’ Approach in Biopharma

Big pharmaceutical companies are really leaning into this "string of pearls" idea. Think of it like collecting small, valuable gems. They’re buying up smaller companies that have promising early-stage drugs or new technologies. Why? Well, it helps them fill gaps in their own drug pipelines, especially as some of their current blockbuster drugs are about to lose patent protection. It’s a way to hedge their bets and keep innovation flowing. We’re seeing a lot of activity in areas like cancer treatments, immune system disorders, and rare diseases. For example, Sanofi picked up Blueprint Medicines for over $9 billion to get a commercialized drug and some early-stage immunology work. GSK also bought IDRx, a company with drugs in clinical trials, for up to $1.15 billion. It’s all about acquiring innovation piece by piece.

Outpatient Care as The New Battleground

If you’re looking at healthcare services, the action is definitely shifting towards outpatient settings. Think clinics, urgent care centers, and places where people get routine procedures or ongoing treatment without needing a hospital stay. Companies are consolidating in areas like home health, dental, and behavioral health. This is where a lot of the growth is happening, and it’s becoming a key area for M&A. Buyers are looking for scale and efficiency in these settings, and sellers are often looking for support with technology and back-office operations. It’s a busy space, and you can expect more deals here as providers aim to offer care wherever it’s most convenient for patients.

AI as The Core Infrastructure for Healthcare IT

Artificial intelligence isn’t just a buzzword anymore; it’s becoming the backbone of healthcare technology. For dealmakers, this means looking at companies that are actually using AI in practical ways. We’re talking about AI that can help with things like managing patient records, improving how appointments are scheduled, or even speeding up the process of getting paid. Companies that have scalable AI platforms and are ready for regulatory checks are going to be more attractive. Generative AI, in particular, is starting to show up in how deals are evaluated and how operations are run. So, if you’re looking at health tech, AI capabilities are pretty much a must-have, not just a nice-to-have.

Addressing Emerging Risks and Opportunities

So, we’ve talked a lot about the exciting trends and the big deals happening in healthcare M&A. But let’s be real, it’s not all smooth sailing. There are definitely some bumps in the road, and some new things popping up that dealmakers really need to keep an eye on. It’s like trying to assemble IKEA furniture – the instructions look simple, but then you find a piece you don’t recognize, and suddenly you’re wondering if you’re missing a step or if the whole thing is going to collapse.

Heightened Regulatory Scrutiny and Antitrust Concerns

Regulators, especially the FTC and CMS, are paying closer attention these days. They’re looking at how private equity firms are running healthcare facilities, and there’s a lot of talk about potential new laws. We’ve seen some big health systems go bankrupt recently, and states are stepping in with new rules for reviewing deals. It means that getting a deal approved might take longer and require more justification. It’s not just about the money anymore; it’s about how care is being delivered.

Supply Chain Vulnerabilities and Tariff Impacts

Remember those tariffs we heard about? They’re starting to make things complicated, especially for medical supplies and drugs. Companies are having to rethink where they get their materials from, and it could mean higher costs. This also affects how prices are set, not just in the US but globally. It’s a bit of a domino effect, and it adds another layer of uncertainty when you’re trying to plan for the future. We’re seeing companies factor these risks into their due diligence now, looking closely at intellectual property and where things are made.

Cybersecurity as a Critical Due Diligence Factor

This one’s huge. With so much sensitive patient data out there, cybersecurity isn’t just an IT issue anymore; it’s a major business risk. When you’re looking at acquiring another company, you absolutely have to dig deep into their security practices. Are they protected against breaches? What happens if their systems go down? A weak cybersecurity posture can derail a deal or lead to massive problems down the line. It’s become a non-negotiable part of the due diligence process, right up there with financial health and regulatory compliance.

Future Outlook and Considerations for Healthcare M&A

Cautious Optimism for the Second Half of 2025

Looking ahead to the latter half of 2025, the general feeling is one of cautious optimism. Sure, there are still some economic bumps in the road – think interest rates, trade rules, and a closer look from regulators. Plus, sometimes buyers and sellers just can’t agree on a price, which can slow things down. But, a lot of investors are still expecting more deals to happen next year compared to this year. People have been waiting for a while, and many are ready to make their strategic moves.

The Impact of New Legislation on Financial Dynamics

There’s a new bill, sometimes called the One Big Beautiful Bill Act (OBBBA), that could really change how healthcare companies and private equity firms handle their money. It’s designed to encourage investment in infrastructure and lower taxes for investors and the companies they own. This could make deals more attractive, especially for private equity folks who might have been sitting on the sidelines due to price disagreements or worries about regulations. It might just be the nudge needed to get more capital flowing.

The Importance of Expert Advisory and Tailored Strategies

As the healthcare M&A world keeps shifting, having the right advice is more important than ever. It’s not a one-size-fits-all situation anymore. Buyers and sellers need to really dig into the details, especially when it comes to how well a target company fits with value-based care models. Also, with all the digital health and AI stuff happening, cybersecurity needs to be a major focus during due diligence. It’s about making sure you’re not buying into a problem. Here’s a quick rundown of what to keep in mind:

- Deep Dive Diligence: With more regulatory eyes on deals and potential gaps in what buyers think a company is worth, thorough investigation is key. This means looking closely at how well things can be integrated, the technology in place, and whether the company is following all the rules.

- Value-Based Care Alignment: Buyers need to check if the companies they’re looking at are set up for value-based care, particularly in areas like primary care, mental health, and managing long-term illnesses.

- AI Integration: Artificial intelligence is changing the game for healthcare IT and services. Focus on companies that have practical uses for AI, can scale their platforms, and are ready for any regulatory hurdles. Generative AI, in particular, is expected to play a bigger role in making due diligence and daily operations smoother, which will influence how deals are valued and structured going forward.

Ultimately, success in healthcare M&A in 2025 will depend on being smart, adaptable, and getting good advice. It’s about finding the right fit and making sure the deal makes sense for the long haul.

Looking Ahead: What’s Next for Healthcare M&A?

So, what does all this mean as we wrap up our look at the first half of 2025? It’s clear the healthcare M&A scene isn’t just about buying and selling anymore. Things are shifting. We’re seeing a move towards smarter deals, focusing on value and how care is actually delivered, especially with digital tools playing a bigger role. While big money is still moving around, buyers are being more careful, really digging into the details. For anyone involved, whether you’re thinking of selling, buying, or just keeping an eye on things, staying informed and working with good advisors is key. The landscape is changing, and adapting to these new trends will be the name of the game for success moving forward.

Frequently Asked Questions

What’s happening with healthcare deals in 2025?

In the first half of 2025, the number of healthcare deals didn’t change much, but the total money spent on these deals went up a lot. This means companies are spending more on fewer deals, focusing on important areas like improving patient care and using new technology. Big companies and investment firms are still buying, but they’re being more careful about which companies they choose.

How is ‘value-based care’ affecting healthcare deals?

Value-based care, which focuses on patient health results rather than just the number of services provided, is a big deal in today’s healthcare purchases. Companies that are good at this are more attractive to buyers. Deals are being set up to reward good patient outcomes, making sure everyone involved is working towards better health for patients.

Why are companies investing so much in AI and digital health?

Artificial intelligence (AI) and digital health tools are changing how healthcare works. Companies are buying or investing in these technologies because they can help make healthcare more efficient, improve how doctors diagnose illnesses, and offer new ways to care for patients, like through telehealth. It’s seen as the future of healthcare technology.

Are investment firms still buying healthcare companies?

Yes, investment firms, also known as private equity, are still active in healthcare. However, they are being more selective. They are focusing on companies that have a strong plan for growth, especially those in areas like specialized medical services, technology, and services that help with billing and managing patient information. They are looking for businesses they can grow and improve.

What are the biggest risks for healthcare deals in 2025?

There are a few big risks. Government agencies are watching healthcare deals more closely to make sure they don’t hurt competition. Also, issues with global supply chains, like tariffs on medical supplies, can make things complicated and expensive. Protecting patient data from cyberattacks is also super important, as a data breach can cause big problems.

What should I do if my healthcare practice is considering a sale or merger?

It’s smart to get help from experts, like lawyers and financial advisors who know a lot about healthcare deals. Make sure your company’s records are in order, especially your financial and compliance information. Understand how your business fits into new trends like value-based care and digital health. Being prepared and having good advice can make a big difference in getting the best outcome.