So, you’ve got a startup idea that you think could really go somewhere. That’s awesome! But turning that idea into a real business usually means you’ll need some cash to get things rolling. This is where seed funding for startups comes in. Think of it as the first big step in getting professional money to help your company grow. It’s not always easy, and there’s a lot to figure out, but knowing the basics can make a huge difference. We’ll walk through what you need to know to get that crucial early funding.

Key Takeaways

- Seed funding is the initial capital a startup raises to get its product developed, build a team, and start reaching customers. It’s a vital step after initial personal or friends-and-family funding.

- A strong pitch deck is your main tool for attracting investors. It needs to clearly explain your idea, your team, the problem you’re solving, and why you need the money.

- Investors want to see that your startup is already showing some signs of success, like early customers or revenue. This proves your idea has potential beyond just a concept.

- Understanding different ways to structure deals, like SAFEs or convertible notes, is important. You’ll also need to be ready for investors to look closely at your business before they invest.

- After getting seed funding, it’s important to set clear goals for what you want to achieve next and keep your investors updated on your progress. Good relationships with investors can help a lot down the road.

Understanding the Landscape of Seed Funding for Startups

So, you’ve got this brilliant idea, right? It’s more than just a good thought; it’s something you genuinely believe can become a real business. But ideas, as great as they are, don’t pay for servers or salaries. That’s where seed funding comes in. Think of it as the initial push, the first real chunk of cash that helps you move from a concept to something tangible. It’s usually the first time you’re bringing in outside money, beyond what you might have scraped together from friends, family, or your own savings.

What Seed Funding Entails for Early-Stage Ventures

Seed funding is essentially the starting capital for a startup. It’s meant to get the ball rolling, allowing you to build out your product, maybe hire a few key people, and start figuring out if people actually want what you’re selling. It’s not usually a massive amount, but it’s enough to get you to the next stage, where you can prove your concept and maybe start making some money. This initial investment is critical for validating your business model and showing potential for growth. It’s like planting a seed – you’re hoping it grows into something much bigger.

Key Phases in the Seed Funding Process

Getting seed funding isn’t just a one-step thing. It’s a process, and like most things, it has its stages:

- Finding the Right People: You can’t just ask anyone for money. You need to find investors who actually get what you’re doing and are interested in your industry. This means doing some homework on venture capital firms, angel investors, and groups that focus on early-stage companies.

- Getting Your Story Straight: You’ll need a pitch deck – a presentation that explains your business, the problem you solve, your solution, and why it’s a good investment. Investors are looking for more than just a cool idea these days; they want to see some proof that it’s working, even if it’s just early sales or user sign-ups.

- The Deep Dive: Once an investor is interested, they’ll want to look under the hood. This is due diligence. They’ll check your financials, your team, your market, and pretty much everything else to make sure you’re not hiding anything and that the business is sound.

- Making the Deal: If everything checks out, you’ll get to the negotiation part. This is where you discuss the terms of the investment – how much money you get, what percentage of your company you give up, and what expectations come with the cash.

Current Market Trends Impacting Seed Rounds

Things change fast in the startup world, and that includes how seed funding works. Right now, a couple of things are pretty noticeable:

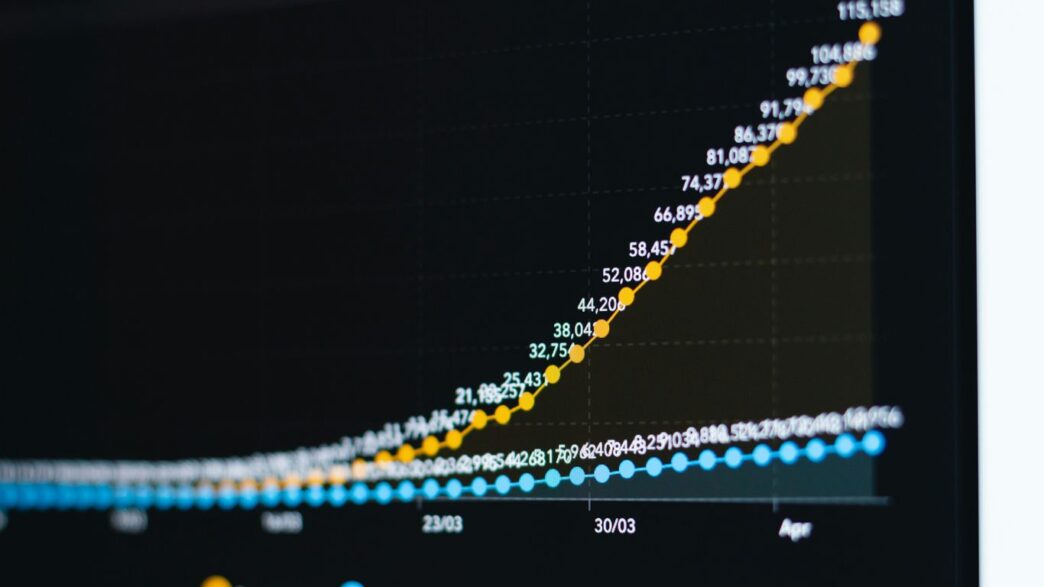

- Valuations are Up, But Deals are Fewer: It seems like investors are willing to pay more for startups at the seed stage, but they’re also being pickier. So, while the money might be there, getting it can be tougher.

- Show Me the Money (Early): Investors are increasingly expecting startups to have some revenue or at least strong signs of market traction before they even consider investing. It’s not just about a great idea anymore; you need to show it’s already gaining some steam.

- Seed and Series A are Blurring: The gap between what a seed round looks like and what a Series A round looks like is shrinking. This means startups need to grow faster and show more progress to justify the funding they’re seeking.

It’s a bit of a balancing act, but understanding these trends can help you prepare better for your own seed funding journey.

Preparing Your Startup for Seed Investment

Alright, so you’ve got this amazing idea, maybe even a prototype, and you’re thinking about getting some real money to make it happen. That’s where seed funding comes in. But before you even think about asking for a dime, you’ve got to get your ducks in a row. It’s not just about having a good idea; it’s about showing investors you’re serious and ready for their cash.

Refining Your Compelling Pitch Deck

This is your main sales tool, so it needs to be sharp. Think of it as telling the story of your company, but with data. You need to clearly explain what problem you’re solving and how your product or service is the answer. Don’t just say it’s a problem; show them why it matters. Use numbers to back up the size of the market you’re going after. Investors want to see that there’s a big opportunity here. And, of course, you need to talk about your team. Who are you, and why are you the right people to pull this off? A strong founding team can make or break an investor’s decision.

Here’s a quick rundown of what should be in there:

- The Problem: What pain point are you addressing?

- The Solution: How does your product/service fix it?

- Market Size: How big is the opportunity?

- Your Product/Service: Show it off, explain how it works.

- The Team: Why you’re the ones to do it.

- Traction: What have you achieved so far? (More on this next!)

- The Ask: How much money do you need and what will you do with it?

Don’t be afraid to tweak this deck based on feedback. What works for one investor might need a slight adjustment for another. It’s a living document.

Demonstrating Early Traction and Financial Health

This is where you prove you’re not just dreaming. Traction means showing that people actually want what you’re offering. This could be anything from early sales figures, user sign-ups, letters of intent from potential customers, or even just strong engagement metrics on your platform. The more proof you have that your idea is gaining momentum, the less risky it looks to an investor.

Alongside traction, you need to show you’re smart with money, even if you don’t have much of it yet. This means having a handle on your finances. You should be able to present:

- A simple balance sheet: What you own versus what you owe.

- An income statement: Your revenue and expenses over a period.

- Cash flow projections: Where your money is coming from and going to.

Even if these numbers are small, showing you understand them and have a plan for how the seed money will be used to grow these numbers is super important. It shows you’re thinking ahead.

Organizing Operations for Scalability

Investors aren’t just giving you money for today; they’re betting on your future. So, you need to show them you’re set up to grow. This doesn’t mean you need a huge office and hundreds of employees right now. But it does mean you’ve thought about how your business will work as it gets bigger.

Think about:

- Your team structure: Who does what? Are there key roles you need to fill with the new funding?

- Your processes: How do you make your product, serve your customers, or manage your operations? Can these processes handle more volume?

- Your technology: Is your tech stack ready to scale, or will it buckle under increased demand?

Being able to explain how you’ll handle growth, hire the right people, and manage increased complexity shows investors you’re thinking strategically and are prepared for the journey ahead. It makes them feel more confident that their investment will be put to good use and lead to a successful outcome.

Identifying and Approaching Seed Investors

Okay, so you’ve got your pitch deck polished and your financials looking good. Now comes the part where you actually find the people who might give you that seed money. This isn’t just about sending out a hundred emails and hoping for the best; it’s more like a targeted hunt. You need to figure out who these investors are and how to get them to notice you.

Researching Investors Aligned with Your Vision

First off, don’t waste your time with investors who aren’t a good fit. It’s like trying to sell ice cream in Antarctica – just not going to work. You need to find people or firms that actually invest in companies like yours. Think about your industry, your stage, and what kind of companies they’ve backed before. Are they focused on tech, healthcare, consumer goods? Do they prefer companies that are already making some money, or are they okay with just an idea and a great team? Looking at their past investments is a big clue. You can find lists of investors and see what they’re into. Sometimes, looking at Corporate Venture Capital groups within larger companies can be a good move, though they might not always lead a round.

Crafting Tailored Outreach Strategies

Once you have a shortlist, you can’t just send them a generic email. That’s a fast track to the delete folder. You need to personalize your message. Mention something specific about their past investments that relates to your company, or explain why you think your startup is a particularly good fit for their fund. A personalized approach shows you’ve done your homework and are serious.

Here’s a quick breakdown of how to approach them:

- Warm Introductions: This is gold. If you know someone who knows the investor, ask for an introduction. A referral from a trusted source is way better than a cold email.

- Networking Events: Go to industry conferences and startup meetups. It’s a chance to meet people face-to-face and make a connection.

- Online Platforms: Sites like AngelList can be useful for finding investors and sometimes even making initial contact.

- Follow-Up: If you don’t hear back after a reasonable time, a polite follow-up is okay. Don’t be a pest, though.

Leveraging Networks and Platforms for Connections

Your existing network is probably your best asset here. Think about your friends, former colleagues, mentors, and even your university alumni network. Who do they know? Sometimes, just asking around can open doors you didn’t even know existed. Beyond your personal circle, there are online communities and databases that can help. These platforms often list investors and their investment preferences, making it easier to find potential matches. It’s all about building those connections strategically, not just randomly hoping someone bites.

Navigating the Seed Funding Deal Process

So, you’ve pitched your heart out, and investors are interested. Awesome! Now comes the part where things get a bit more formal: the deal process. It’s not just about getting the money; it’s about setting up your company for future success with the right terms.

Understanding SAFEs and Convertible Notes

When you’re raising seed capital, you’ll often see two main ways investors put money in without immediately taking a slice of ownership: SAFEs (Simple Agreements for Future Equity) and Convertible Notes. Think of them as IOUs that turn into stock later. SAFEs are generally simpler and don’t accrue interest, while convertible notes are technically debt that accrues interest until it converts. Choosing the right instrument can impact your future dilution and how investors are treated. Both are popular because they let you delay setting a company valuation until you’ve proven more, which is great for early-stage companies. You can find more details on these options to help you decide what is pre-seed funding.

Preparing for Rigorous Due Diligence

Once you’ve agreed on the basic terms, investors will want to look under the hood. This is due diligence. They’ll want to see all your paperwork, understand your financials, check your customer contracts, and basically make sure everything you’ve told them is accurate. It can feel like a lot, but it’s standard. Having your documents organized beforehand makes this process much smoother. This usually involves:

- Reviewing your company’s legal structure and formation documents.

- Examining your financial records, including any existing revenue or expenses.

- Verifying intellectual property and key contracts.

- Understanding your team and operational setup.

Negotiating Favorable Funding Terms

This is where you and the investors hash out the specifics of the deal. The term sheet you receive outlines the main points, but there’s room for negotiation. Key things to consider include:

- Valuation: What your company is worth pre-investment.

- Investment Amount: How much money is being invested.

- Board Seats: Whether investors get a seat on your company’s board.

- Liquidation Preferences: How money is distributed if the company is sold or goes under.

- Protective Provisions: Certain actions the company can’t take without investor approval.

It’s important to have a good lawyer who understands startup deals to help you through this. They can spot potential issues and help you get terms that are fair and set you up for the next stage of growth.

Exploring Alternative Seed Funding Avenues

So, you’re looking for that first big chunk of cash to get your startup off the ground, but maybe the traditional VC route feels a bit… much? Or perhaps you’re just curious about what else is out there. It’s totally normal to explore different ways to get that seed capital. Not every startup fits neatly into the standard venture capital box, and that’s okay.

Considering Non-Dilutive Funding Options

This is where you get money without giving up any ownership in your company. Pretty sweet, right? It means you keep all the equity. Think grants, certain government programs, or even some competitions that offer cash prizes. It takes time to find and apply for these, and they often have specific requirements, but if you qualify, it’s a great way to get funds without future obligations to investors.

- Grants: Often from government bodies or foundations, these are usually tied to specific research, development, or social impact goals.

- Competitions & Awards: Many industry events and organizations host pitch competitions with cash prizes.

- Customer Pre-orders/Crowdfunding: If you have a product people really want, you can sometimes get them to pay upfront, essentially funding your production.

Distinguishing Angel Capital from Seed Funding

People often use

Post-Seed Funding: Managing Growth and Relations

So, you’ve done it. You’ve secured that seed funding, and now the real work of growing your startup begins. It’s exciting, for sure, but it also means you’ve got new responsibilities, especially when it comes to the people who just put their money into your venture. Keeping your investors happy and informed isn’t just good manners; it’s smart business. It sets you up for future funding rounds and builds a solid foundation for the long haul.

Setting Milestones for Future Funding Rounds

Think of your seed round as just one step on a much longer journey. To get to the next funding stage, like a Series A, you need clear goals. These aren’t just vague ideas; they’re specific, measurable achievements that show investors you’re making real progress. What kind of things should you be aiming for?

- Product Development: Hitting key development targets for your MVP or next major feature release.

- User Acquisition: Reaching a certain number of active users or customers.

- Revenue Growth: Achieving specific monthly or quarterly recurring revenue (MRR) figures.

- Team Expansion: Hiring key personnel in critical roles like engineering, sales, or marketing.

These milestones act as signposts, showing potential future investors that you’re on track and capable of executing your plan. They also give your current investors something concrete to track and feel good about.

Maintaining Transparency with Investors

This is a big one. Nobody likes surprises, especially investors. Once the money is in the bank, you need to keep the lines of communication wide open. This means sharing the good news, of course, but it also means being upfront about the challenges. Did a key hire fall through? Is a competitor making a move? Tell them. Honest, regular updates build trust, which is way more valuable than hiding bad news.

Here’s a simple way to think about your investor updates:

- Monthly Check-ins: A brief email covering key metrics, recent wins, and any immediate roadblocks.

- Quarterly Reviews: A more detailed report or a short call discussing progress against milestones, financial updates, and strategic shifts.

- Ad-Hoc Communication: Reach out immediately if something significant happens, good or bad, that could impact the business or investor confidence.

Building Strong Investor Partnerships

Your seed investors aren’t just a source of capital; they can become valuable partners. They often bring industry knowledge, connections, and advice that can be incredibly helpful. Treat them as part of your extended team. Ask for their input, especially when you’re facing tough decisions. They’ve likely seen a lot, and their perspective can be incredibly useful. Remember, these relationships are a two-way street. By keeping them informed and involved, you’re not just managing them; you’re building a collaborative relationship that can support your startup’s growth for years to come.

Wrapping It Up

So, getting that first big chunk of money, the seed funding, is a pretty big deal for any new company. It’s not just about the cash, though that’s obviously important. It’s also about getting folks who know the business world to believe in what you’re doing. We’ve gone over how to get your pitch just right, find the people who might invest, and what to expect when they start looking closely at your books. Remember, it’s a process, and sometimes it takes a few tries. But with a solid plan and a clear story about where your company is headed, you’ll be in a much better spot to get the funding you need to grow. Don’t forget to keep your investors in the loop once you’ve got the money – that builds trust for the future.

Frequently Asked Questions

What exactly is seed funding?

Seed funding is like the first big allowance a startup gets to really get its idea off the ground. It’s the money a company uses early on to build its product, hire some key people, and start telling people about their amazing idea. Think of it as planting the first seeds for a business to grow.

Who usually gives out seed funding?

Often, this money comes from people called angel investors, who are usually wealthy individuals that invest their own cash. Sometimes, it’s from special investment groups called venture capitalists (VCs) that focus on new companies. It’s like getting a boost from experienced folks who believe in your potential.

What do I need to show investors to get seed funding?

You’ll need a great story about your idea, why it’s needed, and how you’ll make money. Showing that you’ve already started building something, like a basic version of your product or a few early customers, really helps. Investors want to see you’ve got a plan and are already making moves.

How much money do startups usually get in seed funding?

It can vary a lot, but typically a startup might get anywhere from $500,000 to $3 million. The amount depends on what the company does, how big the market is, and how much the investors believe in it. It’s enough to get things rolling but not so much that you lose control.

What’s the difference between seed funding and angel investing?

Angel investors are usually individuals putting in their own money, often smaller amounts, to help a startup get started. Seed funding is often a bit larger and can come from angels or small investment firms, and it’s used to help the company grow and prove its concept before seeking bigger investments.

What happens after a startup gets seed funding?

After getting seed money, the startup works hard to grow its product, find more customers, and show it can be a successful business. The goal is to use this money wisely to reach important goals, so the company can then ask for even more money later on to keep growing.