The agricultural world is always changing, and 2026 looks like it’s going to be a big year for shifts. We’re seeing new tech pop up and old ways of doing things get a shake-up. For anyone watching the money side of farming – the agro stocks – it’s a good time to pay attention. Things like input costs, global trade, and new policies are all playing a part. Let’s look at some companies that might be worth keeping an eye on as things develop.

Key Takeaways

- Input costs like fertilizers are still high, making it tough for farmers to make a big profit. This cost-price squeeze is a major issue.

- New government policies, like the OB3 Act, are giving farmers a safety net. This should help keep demand steady for equipment and supplies.

- Global trade is a bit shaky. Agreements might be temporary, and countries are building different ways to trade, which can cause uncertainty.

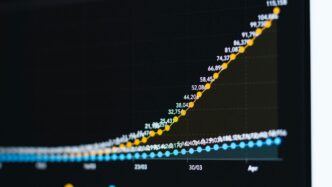

- Farming is becoming more about using technology to be precise and efficient, rather than just growing more. Companies that help farmers do more with less will likely do well.

- The agritech sector is growing, with lots of investment in areas like precision farming and drones, showing a move towards smarter, more sustainable ways to grow food.

Deere & Company

Alright, let’s talk about Deere & Company, or as most folks know them, John Deere. It feels like they’ve been around forever, right? They’re a big name in farming equipment, and heading into 2026, they’re looking at things a bit differently. The company is saying that 2026 might just be the low point for the big equipment cycle they’ve been in.

It’s not all sunshine and rainbows, though. Their projected net income for the fiscal year 2026 is looking like it’ll be somewhere between $4 billion and $4.75 billion. That’s not exactly chump change, but it’s a bit modest compared to what some might expect.

What’s interesting is how they’re planning to get past this slower period. Deere is really putting its chips on its "Precision Ag" technologies. Think smart farming stuff – GPS guidance, sensors, data analysis – all that jazz. They’re also counting on a tax break called the 100% bonus depreciation incentive from the OB3 Act. The idea is that these advanced technologies will help farmers do more with less, especially with input costs still being a headache. Plus, this bonus depreciation is supposed to make buying new, high-tech equipment more attractive, which is exactly what Deere wants. They’re hoping this combination will lead to more sales down the road, and hopefully, better profits.

Here’s a quick look at what they’re focusing on:

- Precision Agriculture: Investing heavily in smart tech to help farmers optimize their operations.

- Tax Incentives: Benefiting from the OB3 Act’s bonus depreciation to encourage equipment upgrades.

- Future Growth: Betting on technology to drive sales and profitability as the equipment cycle recovers.

Archer-Daniels-Midland

Archer-Daniels-Midland, or ADM as most folks call it, is a big player in the whole food processing and trading scene. They’re trying to steer clear of some of the rough patches in global trade. Right now, ADM is putting a lot of effort into a cost-saving plan, aiming to shave off about $300 million. They’re also shifting their focus more towards their Nutrition segment. This move is meant to help balance out the ups and downs they see in their other business areas, like crushing crops.

It seems like ADM is trying to build a more stable business, especially with all the changes happening in how countries trade food and farm products. They’re not just relying on the old ways of doing things. It’s a smart move, really, trying to find steadier ground when the global market feels a bit shaky. They’re betting that by focusing on nutrition, they can create a more predictable income stream, even when crop prices or trade routes get complicated. It’s a bit like trying to have a backup plan for your backup plan, you know?

Bunge Global

Bunge Global is playing a really interesting game right now, especially with that big Viterra acquisition they’ve been working on. They’re trying to use their huge worldwide presence to get around all the trade snags that seem to be popping up everywhere. The idea is that by the second half of 2026, things should start looking up for them, with analysts predicting a decent rebound in their operating profits as global trade routes hopefully get back to normal after everything settles down.

It’s a bit of a different path than some others. While companies like ADM are cutting costs and focusing more on their nutrition side to deal with the ups and downs of the market, Bunge is really leaning into its global network. They’re betting that their sheer size and reach will help them navigate choppy international waters.

Here’s a quick look at what they’re up against and how they’re trying to manage:

- Global Footprint: Their massive network is key to bypassing regional trade issues.

- Viterra Integration: Successfully merging with Viterra is crucial for unlocking synergies and expanding their reach.

- Trade Flow Stabilization: They’re counting on global trade to become more predictable to improve their financial performance.

- Margin Management: Keeping profits healthy in a world where trade is increasingly influenced by politics, not just supply and demand, is the big challenge.

Corteva

Corteva, a company that really focuses on seeds and crop protection, is making some big moves for 2026. They’re planning to split into two separate companies. One will handle seeds, and the other will focus on crop protection. The idea behind this is to let each part of the business do its own thing without being held back, and hopefully, this will make them more valuable on their own. It’s also a way to protect their newer, high-end biological products from being copied by competitors who might just make generic versions.

This split is happening at a time when the whole agriculture scene is changing. We’re seeing less of that old, globalized market and more of a world where countries use trade as a way to get what they want.

Here’s what to keep an eye on with Corteva:

- Focus on Innovation: The split should allow them to really zero in on developing new seed varieties and crop protection solutions.

- Protecting Biologicals: Their biological products are a big deal, and this move is designed to keep them safe from cheaper imitations.

- Market Adaptation: They’re trying to stay ahead in a world where farming is becoming more about using resources wisely, not just growing more and more.

It’s a pretty interesting strategy, and how well it plays out will be something to watch in the coming years.

Nutrien

Nutrien is making some interesting moves, really focusing on what they do best. They’re shifting their strategy to be more "North American-first," which means they’re stepping back from some of their operations in Argentina. The big idea here is to really zero in on their low-cost potash production, especially in Saskatchewan. They’re aiming to push out more product, with plans to increase sales volumes by as much as 3 million tonnes by the end of 2026. It seems like they’re trying to streamline things and capitalize on their strengths in North America. This kind of strategic pivot isn’t uncommon in the industry, especially when input costs are a big concern for farmers. By concentrating on areas where they have a cost advantage, Nutrien hopes to weather the current economic pressures and come out stronger. It’s a pretty direct approach to managing their business in a changing market.

The Mosaic Company

The Mosaic Company is a big player in the fertilizer world, focusing on phosphate and potash. They’re really trying to get their operations running smoother, especially when it comes to making things cheaper. Think of it like this: they want to get more fertilizer out the door without spending as much to do it.

They’re aiming for a significant jump in free cash flow by 2026, which is a pretty big deal for a company like this. This isn’t just wishful thinking; it’s tied to how efficiently they can produce their products. When they can cut down on the costs of turning raw materials into finished fertilizer, more money stays in the company’s pocket.

Here’s a look at what drives their business:

- Potash: Essential for plant growth, helping with water uptake and nutrient use. Mosaic is a major producer.

- Phosphate: Another key nutrient, vital for root development and flowering. They also have a strong position here.

- Operational Efficiency: The company’s main goal right now is to squeeze more value out of their existing mines and production facilities. This means better processes and smarter resource management.

Basically, Mosaic is betting on getting its house in order operationally to see better financial results. It’s a strategy that relies on making the most of what they already have, which can be a solid move when the market is a bit uncertain.

Agriculture Intelligence

When we talk about making farms smarter, Agriculture Intelligence is a name that pops up. They’re working on software and hardware that helps farmers get a better handle on what’s happening in their fields. Think of it like giving your farm a digital brain.

Their main product, Agroview, uses AI to look at data from different sensors and cameras. It then gives farmers a clearer picture of their crops. They also have a sensor called Agrosense that sits right in the field. This thing uses AI and some fancy camera tech to check on plant health, count inventory, and even guess how much you’ll harvest, all in real-time. It’s pretty neat because it can help spot problems early, cut down on costs, and hopefully lead to bigger harvests while being kinder to the environment.

Here’s a quick look at what these tools aim to do:

- Improve crop assessments: Get more accurate information about your fields.

- Reduce operational costs: Find ways to save money on farming.

- Identify diseases early: Catch problems before they spread.

- Boost yields: Grow more food from the same land.

- Increase sustainability: Farm in ways that are better for the planet.

Basically, Agriculture Intelligence is all about using smart tech, like AI and advanced cameras, to make farming more efficient and productive. It’s a big step towards the future of how we grow our food.

Orbiba Robotics

Orbiba Robotics is a Turkish startup that’s building autonomous farming robots. They’re focusing on small and medium-sized farms, which is a pretty big market. Their main product right now is a weed management robot. It uses sensors and AI to find and get rid of weeds without needing any chemicals. This is a big deal for farmers who want to cut down on herbicide use and farm more sustainably.

What’s cool about their robots is the modular design. You can swap out different tools, like plows, trailers, or even delta robot arms. This means one robot can do a lot more than just weed control. It can help with planting, moving stuff around the farm, or clearing paths. They’re also using AI to keep an eye on plant health and help farmers make better decisions. It sounds like they’re aiming to make farming more productive and also better for the environment.

Here’s a quick look at what their robots can do:

- Autonomous Weed Management: Uses AI and sensors to identify and remove weeds without chemicals.

- Modular Design: Allows for easy switching of attachments for various tasks like plowing, transport, and cultivation.

- AI-Powered Farm Monitoring: Tracks plant health and optimizes farm management for increased productivity.

- Environmental Focus: Aims to provide eco-friendly solutions for sustainable agriculture.

Robotix Japan

Robotix Japan is a Japanese startup that’s been making waves in the agricultural tech scene, particularly with their focus on drones. They’ve developed a few models designed to make farming tasks more efficient. Think of their DMTER M6, a smaller drone that’s good for applying pesticides precisely. Then there’s the DMTER M10, which can cover about a hectare in one go, and the even larger DMTER M30 with its 30-liter tank for extended spraying sessions. These drones are built to help farmers cover more ground and apply treatments more accurately, which can save on resources and potentially improve crop yields. They also have other inspection robots, but their agricultural drone line is what’s really catching attention for its practical applications in the field.

Skyka Technologies

Skyka Technologies is an Indian startup that’s been making waves with its cloud-based farm management software. Basically, it’s a platform designed to give farmers easier access to all their management tools, right from their phones or any mobile device. This means they can make decisions on the fly, which is pretty handy when you’re out in the field.

One of the cool things they offer is an analytics dashboard. It takes all the data from your farm and turns it into charts and graphs, so you can actually see what’s going on. They also have this crop life cycle management feature. It tracks everything from when you plant the seeds all the way to harvest. Plus, it can pull in data from different IoT devices you might have around the farm, giving you a more complete picture.

What’s neat is that Skyka Technologies lets you customize the platform. Farmers can tweak it to fit their specific needs, which is a nice touch. This kind of tailored approach is becoming more important as farms look to adopt new technologies without getting overwhelmed.

Here’s a quick look at what their platform helps manage:

- Crop Life Cycle: From planting to harvest, keeping tabs on every stage.

- Data Integration: Pulling in information from various farm sensors and devices.

- Real-time Insights: Using analytics to understand farm performance as it happens.

- Mobile Accessibility: Accessing all tools and data from any internet-connected device.

As we look towards 2026, companies like Skyka Technologies are important because they’re building the digital infrastructure that helps farms become more efficient and data-driven. It’s all about making farming smarter, especially with the growing pressures of feeding more people and dealing with unpredictable weather.

Looking Ahead: The Evolving Farm

So, as we wrap up our look at the agricultural scene for 2026, it’s clear things are changing fast. We’ve seen how input costs are still a big deal, and how global politics plays a larger role than ever in what happens on the farm. Companies are having to get smart, whether that’s through new tech like precision farming or by shifting their business focus. It’s not just about growing more food anymore; it’s about growing smarter and more efficiently. Keep an eye on these trends and the companies making moves, because the way we farm and eat is definitely in for some interesting times.

Frequently Asked Questions

What is the main challenge facing farmers in 2026?

Farmers are facing a “cost-price squeeze.” This means the cost of things they need, like fertilizers, is high, while the prices they get for their crops aren’t keeping up. This makes it tough to make a good profit.

How are trade issues affecting agriculture in 2026?

Trade disagreements and policies like tariffs are causing uncertainty. While there’s a temporary truce, countries are changing how they trade, and the U.S. might not be the top supplier to Asia like before. This makes global farming more unpredictable.

What is the OB3 Act and why is it important?

The OB3 Act is a new law that helps farmers by providing a safety net. It increases guaranteed income for certain programs and adds more farmland. This is meant to protect farmers from problems caused by trade disputes and helps support the demand for farm equipment and supplies.

Are new technologies important for agriculture in 2026?

Yes, technology is becoming very important. Companies are focusing on “Precision Agriculture,” which means using technology to help farmers grow more with less. This helps deal with high costs and makes farming more efficient. Think of smart machines and software that help manage crops better.

What are some examples of new agricultural technology companies to watch?

Companies like Agriculture Intelligence are developing smart software for better crop analysis. Orbiba Robotics is creating robots for tasks like weed control, and Skyka Technologies offers cloud-based tools to help farmers manage their operations from their phones.

What is the outlook for major crops like corn, soybeans, and wheat in 2026?

The outlook is mixed. Farmers might plant less corn because it’s costly to grow, and more soybeans. Wheat prices could be better because of lower global supplies and issues in the Black Sea region. However, high fertilizer costs remain a challenge for all crops.