The power grid is a complicated thing, and keeping it running smoothly takes a lot of planning. Electricity capacity markets are a big part of that. These markets help make sure there’s enough power available when we need it, especially as we bring more renewable energy online. It’s a tricky business, with lots of moving parts, from government rules to how different technologies interact. This guide breaks down what you need to know about electricity capacity markets.

Key Takeaways

- Electricity capacity markets are designed to make sure there’s enough power generation available to meet demand, playing a key role in grid reliability.

- Integrating more renewable energy sources like solar and wind can lead to price swings and grid congestion, making market management more complex.

- Clear regulations and policy direction from bodies like FERC and the EPA are vital for utilities and investors to plan and make necessary infrastructure investments.

- Participants in electricity capacity markets face challenges in valuing assets, managing price risks, and securing financing for new projects.

- The future of these markets will likely involve more energy storage, demand response programs, and better use of data for forecasting and planning.

Understanding Electricity Capacity Markets

So, what exactly are electricity capacity markets? Think of them as a way to make sure there’s enough power generation available to meet demand, not just right now, but also in the future, especially during those peak times when everyone’s using a lot of electricity. It’s all about grid reliability, making sure the lights stay on.

The Role of Capacity Markets in Grid Reliability

These markets are pretty important for keeping the grid stable. They work by paying power generators to be ready and available to produce electricity when needed, even if they aren’t always running. This ‘readiness’ payment is key. Without it, generators might not have the financial incentive to keep older, less-used plants online or to invest in new ones that are needed for future demand. It’s a bit like having a fire extinguisher in your house – you hope you never need it, but you’re really glad it’s there if you do.

Ensuring Resource Adequacy Through Auctions

How do we figure out how much capacity is needed and who will provide it? That’s where auctions come in. Grid operators hold these auctions periodically, and power suppliers bid to offer their capacity. The market then determines the price based on supply and demand. It’s a way to get the necessary power resources at the lowest possible cost. These auctions help make sure there are enough power plants and other resources lined up to meet expected demand, plus a little extra for safety.

Here’s a simplified look at how it might work:

- Demand Forecast: Grid operators predict how much electricity will be needed in the future.

- Capacity Obligation: Generators are required to commit a certain amount of capacity.

- Auction Process: Suppliers bid to provide this capacity.

- Price Determination: The auction clears, setting a price for capacity.

Local Resource Zones and Planning

Sometimes, the grid has specific areas where it’s harder to get power to customers, maybe due to transmission line limitations. These are called Local Resource Zones (LRZs). Capacity markets often consider these zones because just having enough power generation overall isn’t enough if it can’t reach the people who need it. Planning needs to happen at a more local level to address these specific grid challenges and make sure power is available everywhere.

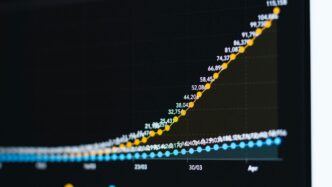

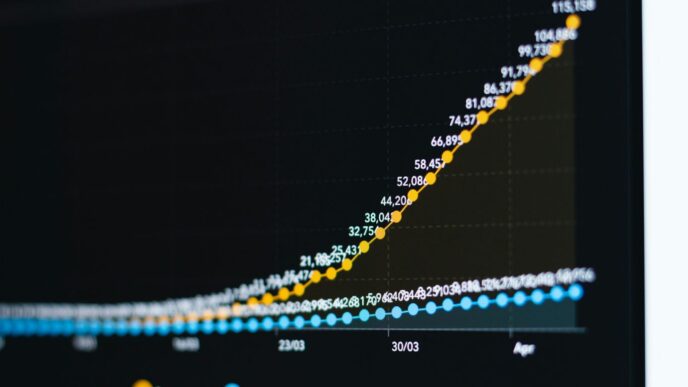

Navigating Market Dynamics and Volatility

Okay, so the electricity market isn’t exactly a calm lake. It’s more like a wild river, especially these days. You’ve got all these new renewable energy sources popping up, like solar and wind farms, and they don’t always produce power when we need it. This "intermittency," as they call it, really messes with the grid’s balance and can cause prices to swing like crazy.

Impact of Renewable Energy Integration on Capacity

Think about it: when the sun is shining bright and the wind is blowing hard, we get a ton of electricity. Great, right? But what happens when it’s cloudy and calm? Suddenly, there’s less power available. This unpredictability from renewables means capacity markets have to work harder to make sure there’s enough power available, even when these sources aren’t contributing. It’s like trying to plan a party when you’re not sure how many guests will actually show up. We’re seeing areas with lots of solar and wind, like parts of Texas, really struggle with "congestion" – basically, the power lines can’t handle all the electricity being generated. This can lead to situations where generators actually have to pay to get rid of their power, or even shut down.

Managing Price Volatility in Wholesale Markets

Because of all this, prices in the wholesale electricity markets can jump around a lot. One minute a megawatt-hour of electricity might be cheap, and the next it’s super expensive. This is a big deal for companies that own power plants or other resources. If they bid too low and prices spike, they lose money. If they bid too high and prices stay low, they also lose out. It’s a constant balancing act. To deal with this, many companies use "hedging" strategies. This is basically like buying insurance against price swings. They might use financial tools or lock in prices for future delivery. Accurate forecasting of both electricity demand and renewable generation is becoming incredibly important for making smart bidding and hedging decisions.

The Influence of Congestion on Capacity Planning

Congestion is another big headache. When too much power is trying to flow through a specific part of the grid, it gets bottlenecked. This is happening more often with the rise of renewables, which are often built in areas far from where people use the most electricity. This means that even if there’s plenty of power being generated, it can’t always reach the customers who need it. Capacity planning has to account for these "transmission constraints." It’s not just about having enough power plants; it’s also about making sure the power can actually get where it needs to go. This often means looking at where new power sources should be built and whether we need to upgrade the existing power lines, which is a whole other complicated issue.

Regulatory Frameworks and Policy Clarity

Okay, so let’s talk about the rules of the road for these capacity markets. It’s not just about the technology or the money; it’s also about what the government and regulators are saying and doing. Without clear direction, everyone involved – from the big utility companies to the folks developing new power sources – is kind of flying blind. This can lead to a lot of wasted time and money, which nobody wants.

FERC’s Strategic Vision for Grid Reliability

The Federal Energy Regulatory Commission, or FERC, plays a pretty big role here. They’re the ones setting a lot of the big-picture rules for how electricity gets bought and sold across state lines. Think of them as the referees for the wholesale electricity markets. Their goal is to make sure the lights stay on, even when demand spikes or when unexpected things happen, like a big storm knocking out power lines. They’re constantly looking at how to make the grid more resilient, especially with all the changes happening, like more renewables coming online.

EPA’s Influence on Power Sector Emissions

Then you’ve got the Environmental Protection Agency (EPA). Their focus is on, you guessed it, the environment. They set rules about pollution and emissions from power plants. This directly impacts which types of power generation are more or less attractive. If there are stricter rules on emissions, it might make older, dirtier plants more expensive to run, or even force them to shut down. This, in turn, affects the mix of power sources available and how capacity markets need to adapt to fill any gaps.

The Importance of Clear Mandates for Utilities

Utilities are the ones on the ground, actually delivering power to homes and businesses. They need to know what’s expected of them. Are they supposed to be investing in new solar farms? Battery storage? Or maybe upgrading the existing grid? Clear mandates from regulators tell them what their priorities should be. It’s like getting a clear job description. Without it, they might invest in the wrong things, or not invest enough, leading to problems down the line. It’s all about making sure everyone is working towards the same goals, like keeping the grid reliable and meeting climate targets. This often involves:

- Setting clear goals: Governments and regulators need to tell utilities what they expect in terms of reliability and environmental targets.

- Providing flexibility: While goals are important, each region is different. Mandates should allow for some wiggle room so utilities can figure out the best way to meet those goals in their specific area.

- Encouraging innovation: Rules should encourage utilities to try new things, like energy storage or demand response programs, rather than just sticking with old methods.

Basically, when the rules are clear and consistent, it makes it a lot easier for everyone to do their job and keep the electricity flowing smoothly.

Key Considerations for Capacity Market Participants

So, you’re looking to play in the electricity capacity markets? It’s not exactly a walk in the park, but understanding a few things can make a big difference. For starters, figuring out how to actually make money and manage the risks involved is pretty important. You’ve got to have a solid plan for how your assets will perform and what they’re worth.

Valuation and Profitability in Capacity Markets

This is where the rubber meets the road. How do you even put a price on your capacity? It’s not just about how much power you can generate; it’s about being available when the grid needs it most. You’ll need to look at:

- Auction clearing prices: What did capacity cost in the last auction? This gives you a baseline.

- Resource type: Are you a fast-starting gas plant, a big solar farm, or a battery? Each has different value propositions.

- Location: Where you are matters. Some areas have higher demand or more transmission constraints, which can bump up capacity prices.

- Operational costs: Don’t forget your own expenses – fuel, maintenance, staffing. These eat into your profits.

Strategies for Trading Risk and Hedging

Markets can be wild. Prices can swing wildly, especially with all the new renewables coming online. You can’t just hope for the best. You need ways to protect yourself.

- Forward contracts: Lock in prices for future capacity deliveries. This gives you some certainty.

- Financial hedges: Use derivatives to offset potential price drops. It’s like insurance for your revenue.

- Diversification: Don’t put all your eggs in one basket. Having a mix of resources or market participation can spread the risk.

Asset Development and Financing Challenges

Building new capacity or even upgrading existing stuff is a huge undertaking. Getting the money to do it and then actually getting it built on time and on budget is tough.

- Permitting: Getting all the approvals can take ages and involve a lot of paperwork.

- Supply chain issues: Sometimes, you just can’t get the parts you need when you need them.

- Financing: Banks and investors want to see a clear path to profit, and capacity markets can be unpredictable, making financing harder.

It’s a complex dance, for sure. You need to be smart about your numbers, aware of the market’s ups and downs, and realistic about the challenges of building and running these assets.

The Future of Electricity Capacity Markets

Integrating Energy Storage and Demand Response

So, what’s next for capacity markets? Well, it’s pretty clear that things are changing fast. One big shift is how we’re looking at energy storage and demand response. These aren’t just buzzwords anymore; they’re becoming real players in keeping the lights on. Think of batteries, for example. They can store power when it’s cheap and plentiful, and then release it when demand spikes or when renewables aren’t producing. This flexibility is exactly what capacity markets need to make sure there’s enough power available when it’s called upon. Demand response programs are also getting smarter. Instead of just asking people to use less power, we’re seeing more sophisticated ways to manage electricity use across many homes and businesses, almost like a virtual power plant. This helps smooth out the peaks and valleys in electricity demand, making the grid more stable and less reliant on always having big, traditional power plants ready to go.

The Role of Data and Analytics in Forecasting

Another huge piece of the puzzle is data. We’re drowning in information these days, and the trick is figuring out what’s actually useful. For capacity markets, better forecasting is key. This means using advanced analytics and even artificial intelligence to predict electricity demand and supply with more accuracy. It’s not just about guessing what tomorrow’s weather will be; it’s about understanding complex patterns, like how electric vehicle charging might affect demand or how new industrial loads will impact the grid. Getting these forecasts right helps avoid over- or under-building capacity, which saves everyone money. Accurate data also helps in managing existing assets better, figuring out when maintenance is really needed, and planning for the long-term health of power plants and grid infrastructure.

Inter-regional Collaboration and Transmission Investments

Finally, we can’t ignore the fact that electricity grids don’t stop at state or even national borders. What happens in one region can affect another. That’s why inter-regional collaboration is becoming more important. Building new transmission lines, especially those that can move large amounts of power efficiently over long distances, is a big undertaking. But it can really help balance supply and demand across wider areas. If one region has too much solar power and another needs more, better transmission can connect them. This kind of investment can reduce the need for local capacity in every single area and make the whole system more resilient. It’s about thinking bigger picture and working together to create a more reliable and affordable electricity future for everyone.

Wrapping It All Up

So, we’ve covered a lot of ground, right? Electricity capacity markets are definitely not simple. There are a bunch of moving parts, from how we value things to dealing with all the new renewable energy sources popping up. Plus, the rules keep changing, and making sure the lights stay on for everyone is a big job. It’s a constant balancing act. Figuring out how to make these markets work better, especially with all the new tech and climate goals, is going to take a lot of smart thinking and cooperation. It’s a complex puzzle, but getting it right is super important for our energy future.