The crypto market can be a wild ride, and sometimes it takes some sharp turns downhill. When a crypto market crash happens, it can feel pretty scary, especially if you’re new to this. Prices drop fast, and it’s easy to panic. But understanding what causes these crashes and having a plan can make a big difference. This guide will help you figure out what’s going on when the market takes a nosedive and what you can do about it.

Key Takeaways

- A crypto market crash can be triggered by many things, like big economic shifts, new rules, or even just a lot of people suddenly deciding to sell.

- When prices are falling fast, it’s important to stay calm and not make rash decisions based on emotions.

- Think about why you invested in the first place and if your original goals still make sense.

- Not all digital coins are affected the same way; major ones like Bitcoin might hold up better than smaller altcoins.

- Having a strategy, like investing a set amount regularly (cost-averaging), can help spread out your risk during tough times.

Understanding the Triggers of a Crypto Market Crash

Okay, so the crypto market can be a wild ride, right? Prices go up, prices go down, sometimes faster than you can blink. But what actually causes these big drops, these "crashes" everyone talks about? It’s not just one thing, usually. It’s a mix of stuff happening both inside and outside the crypto world.

Macroeconomic Influences on Digital Assets

Think about the bigger picture of the economy. When interest rates go up, or inflation is high, people tend to get a bit nervous about putting their money into riskier things, and crypto definitely falls into that category for many. If the economy feels shaky, investors might pull back from assets like crypto and move towards safer options. It’s like when things get tough at home, you might cut back on the fun stuff first. The same logic applies to how people invest their money.

Regulatory Actions and Enforcement

Governments and financial watchdogs can really shake things up. If a country decides to crack down on crypto trading, or if a major regulator like the SEC starts investigating a big project or exchange, that news alone can send prices tumbling. It creates uncertainty, and uncertainty is not something crypto investors usually like. When regulators step in, it often signals a shift in how crypto is viewed and treated, which can spook the market.

Industry-Specific Crises and Exchange Collapses

Sometimes, the problems are closer to home, within the crypto industry itself. Remember when that big exchange, FTX, went down? That wasn’t just a small blip; it had massive ripple effects. When a major player collapses, it can cause a domino effect, impacting other companies and coins they were involved with. It erodes trust, and trust is a pretty big deal in this space.

Market Sentiment and Euphoria Pullbacks

And then there’s just the psychology of the market. Crypto markets can get really hyped up. Prices shoot up, everyone’s talking about it, and it feels like free money. But often, after a period of extreme excitement and rapid price increases (what some call euphoria), there’s a natural pullback. It’s like after a big party, things quiet down. These pullbacks can sometimes turn into bigger drops if the sentiment shifts from overly optimistic to fearful.

Navigating Volatility: Strategies for Investors

Okay, so the crypto market is doing its usual rollercoaster thing, and prices are dropping. It can feel pretty wild, right? Seeing those numbers go down fast might make you want to hit the panic button, but staying calm is probably the most important first step. It’s easy to make rash decisions when your portfolio looks like it’s shrinking by the minute, but those emotional moves usually don’t end well.

Maintaining Composure Amidst Price Swings

When the market gets choppy, your first instinct might be to check your phone every five minutes. Don’t do that. Seriously. Take a deep breath. Think about why you got into crypto in the first place. Was it for a quick profit, or do you actually believe in the long-term potential of these digital assets? Understanding your original motivation can help you keep your cool when prices are swinging wildly. It’s like when you’re trying to fix something around the house and it’s not going as planned – freaking out doesn’t help, but stepping back and thinking it through does.

Re-evaluating Investment Rationale and Goals

This is a good time to look at your portfolio and ask yourself if your reasons for investing still hold up. Maybe you bought a certain coin because you thought it would skyrocket in a month. If it’s now tanking, it’s worth asking if that initial reason was solid or just hype. It’s also a chance to check if your goals have changed. Are you still aiming for that short-term gain, or has your perspective shifted towards a longer-term outlook? Adjusting your strategy based on your current situation and beliefs is key. For instance, if you’re looking for ways to manage your crypto investments, understanding how to approach market volatility is a good start.

The ‘Buy and Hold’ Approach in Downturns

Many people talk about buying low and selling high, but honestly, predicting the market is tough. That’s where the ‘buy and hold’ strategy comes in, especially during a downturn. The idea is simple: if you believe in the long-term value of an asset, you keep it, even when prices are falling. You’re not trying to time the market; you’re just riding out the storm. This approach works best if you’ve done your homework and are confident in the projects you’ve invested in. It means you don’t have to stress about every little price dip, focusing instead on the bigger picture. It’s a bit like planting a tree – you don’t dig it up every time the weather changes, you let it grow over time.

Assessing Risk and Portfolio Management During a Crash

Okay, so the market’s doing its usual roller-coaster thing, and prices are dropping. What’s a regular person supposed to do with their crypto stash? It’s easy to freak out, but let’s break down how to look at your investments when things get shaky.

Identifying Assets Most Affected by the Downturn

Not all crypto assets are created equal when the market takes a nosedive. Think of it like a storm – some boats are built tougher than others. Big names like Bitcoin and Ethereum, often called ‘blue chips’ in the crypto world, tend to be a bit more stable. They have more people trading them and more money behind them, so they might drop, but usually not as dramatically as the smaller coins.

Smaller cryptocurrencies, sometimes called altcoins, can get hit much harder. If a big coin drops 20%, a smaller one might drop 50% or even more. This is because there’s less money flowing into them, and when people start selling, there aren’t as many buyers to catch those falling prices. It’s like a domino effect, but with bigger, faster falls for the little guys.

Also, keep an eye on things like mining. If there are problems with how crypto is mined – maybe energy costs go way up or governments crack down – that can make those specific coins drop even faster. It’s all about understanding what makes each coin tick and what could make it stumble.

Leveraging Risk Management Tools

When the market’s wild, you need tools to help you stay in the game without losing your shirt. Think of these like safety nets or early warning systems for your investments.

- Stop-Loss Orders: This is a big one. You can set a price at which you’ll automatically sell a crypto if it drops to that point. It’s not foolproof, but it can stop you from losing more than you’re comfortable with. It’s like setting a limit on how much you’re willing to lose on a single trade.

- Position Sizing: Don’t put all your eggs in one basket, and definitely don’t put all your money into one crypto, especially during a crash. Decide beforehand how much of your total investment money you’re willing to risk on any single asset. If you usually invest $100 in a coin, maybe during a crash, you only put in $20.

- Diversification: This is the classic advice for a reason. Don’t just own Bitcoin. Spread your money across different types of crypto assets. Some might hold up better than others. It’s about not having all your money tied to one thing that could go south.

Understanding Liquidity’s Role in Price Amplification

Liquidity is basically how easily you can buy or sell something without messing up its price. In the crypto world, liquidity can be a bit tricky, and when it dries up, prices can go crazy.

Imagine a busy marketplace where lots of people are buying and selling. Prices tend to stay pretty steady. Now, imagine that same marketplace with only a few people. If one person suddenly wants to sell a lot of something, there aren’t enough buyers, so they have to accept a much lower price. That’s what happens with low liquidity in crypto. A big sell order can cause the price to drop much more sharply than it would if there were lots of buyers and sellers around.

This is especially true for smaller cryptocurrencies. They often have less liquidity, meaning a few big trades can cause huge price swings. So, when you see prices plummeting, low liquidity is often a big part of why the drops are so steep and fast. It amplifies the panic, making things look even worse than they might otherwise.

Distinguishing Between Major and Minor Cryptocurrencies in a Crash

When the crypto market takes a nosedive, not all digital assets react the same way. It’s like a storm hitting a forest – some trees stand firm, while others get uprooted. Understanding this difference is key for any investor trying to make sense of the chaos.

Bitcoin and Ethereum’s Relative Resilience

Think of Bitcoin (BTC) and Ethereum (ETH) as the old-growth trees in the crypto forest. They’ve been around longer, have more widespread adoption, and generally have a deeper pool of buyers and sellers (liquidity). This doesn’t mean they’re immune to price drops – far from it. They can still lose a significant chunk of their value, sometimes more than 50% in a bad downturn. However, their established presence and the sheer amount of money invested in them often mean they bounce back faster or at least don’t disappear entirely. They tend to be less volatile on a percentage basis compared to their smaller cousins when things get really rough.

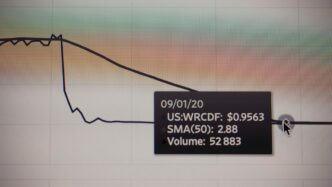

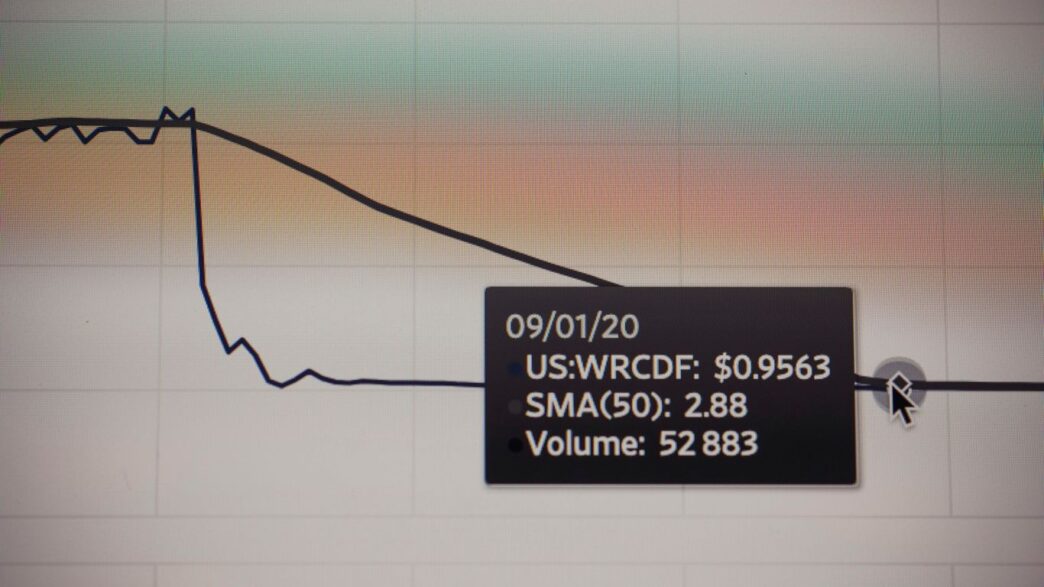

Altcoins and Amplified Percentage Losses

Now, let’s talk about the smaller trees, or altcoins. These are all the other cryptocurrencies besides Bitcoin and Ethereum. When a crash hits, altcoins often get hit much harder. Why? They usually have less liquidity, meaning fewer people are trading them at any given moment. This makes their prices more susceptible to big swings. A small sell-off can cause a much larger percentage drop because there aren’t enough buyers to absorb the selling pressure. Some altcoins might lose 80%, 90%, or even nearly all of their value. It’s not uncommon for smaller projects to simply fade away during prolonged bear markets.

Here’s a general idea of how different types of crypto might fare:

| Crypto Type | Typical Behavior in a Crash |

|---|---|

| Bitcoin (BTC) | Significant drops, but often recovers faster than altcoins. |

| Ethereum (ETH) | Similar to Bitcoin, generally more resilient than smaller coins. |

| Large-Cap Altcoins | Can experience larger percentage losses than BTC/ETH, but may recover. |

| Small-Cap Altcoins | Highly volatile, prone to extreme percentage losses, higher risk of failure. |

The Impact of Mining Sector Disruptions

Another factor that can really shake things up, especially for certain cryptocurrencies, is what happens in the mining sector. For coins like Bitcoin that rely on mining to validate transactions and create new coins, disruptions can be a big deal. Imagine if a major power source for miners suddenly shut down, or if a government decided to ban mining operations in a large region. This can reduce the network’s security (hash rate) and create uncertainty. When miners are forced to sell their holdings to cover costs or shut down operations, it adds more selling pressure to the market, potentially dragging down the price of that specific cryptocurrency even further, and sometimes affecting the broader market’s confidence.

- Energy Costs: Rising electricity prices can make mining unprofitable for some, leading to reduced network activity or miners selling off their mined coins.

- Regulatory Crackdowns: Governments banning or restricting mining can force operations to relocate or shut down, impacting network security and miner sentiment.

- Hardware Shortages: Difficulty in obtaining or the high cost of specialized mining equipment can limit the number of active miners.

These kinds of events can really highlight the underlying infrastructure risks that some cryptocurrencies face, making them more vulnerable during a market downturn.

Recognizing the Signs of a Crypto Bear Market

So, how do you know when the party’s over and the crypto market is heading south? It’s not always obvious, but there are definitely clues. Think of it like watching the weather – you can see the clouds gathering before the storm hits.

Failed Rallies and Declining Market Strength

One of the first things to look out for is when prices try to go up but just can’t seem to get there. You might see a cryptocurrency jump a bit, only to fall back down again. This happens a few times, and each time it doesn’t go as high as before. It’s like a runner trying to sprint but running out of steam way too early. When this happens, especially with low trading volume, it means big players aren’t really jumping in to push prices higher. They’re sitting on the sidelines, which is a pretty clear signal that the market’s strength is fading.

Lack of Market Bounce-Back and Downward Acceleration

Normally, crypto markets can be a bit bumpy, with prices dipping and then recovering. But in a bear market, that bounce-back doesn’t happen. Instead, prices just keep falling. What’s worse, the drops start getting faster. You might see a 5-10% drop in a single day, and the small gains that do pop up are slow and don’t last. Meanwhile, the big price slides happen quickly. You’ll notice trading volume spikes when prices are falling, but it shrinks when prices try to creep up. This is a sign that sellers are getting more aggressive, and buyers are becoming hesitant.

Institutional Investor Behavior and Sentiment Shifts

When prices start to tank, individual investors often panic and sell. This can then push larger investors and institutions to also start selling off their holdings. It’s like a domino effect. Suddenly, bad news seems to spread like wildfire, and positive updates don’t get much attention anymore. Most people who were enthusiastic about crypto might just disappear from social media and financial news sites. It’s a tough time, and many investors might feel like they’ll never invest again. It’s during these times that it’s really important to remember that bear markets don’t last forever. For those looking to invest in digital assets, it’s wise to be cautious about smaller tokens, especially those with a market cap below $5 billion, during these downturns during these downturns.

Here’s a quick rundown of what to watch for:

- Failed Rallies: Prices attempt to rise but can’t sustain the momentum.

- Low Volume on Upswings: Indicates a lack of strong buying interest.

- Accelerating Declines: Price drops become steeper and more frequent.

- Institutional Sell-offs: Large investors begin reducing their positions.

- Negative Sentiment Dominance: Bad news overshadows positive developments.

Exploring Trading Strategies During Market Declines

When the crypto market takes a nosedive, it can feel like everything is going south. But for some, these downturns aren’t just scary; they’re also opportunities. It’s not about trying to time the exact bottom, which is pretty much impossible, but about having a plan.

The Concept of Cost-Averaging for Risk Spreading

This is a pretty straightforward idea. Instead of putting a big chunk of money in all at once, you spread your investments out over time. Think of it like this: you decide to invest $100 every month, no matter if the price of Bitcoin is up, down, or sideways. If the price drops, your $100 buys more coins. If it goes up, it buys fewer. Over the long haul, this can smooth out your average purchase price and take some of the guesswork out of trying to buy at the ‘perfect’ moment. It’s a way to build a position without stressing about short-term price swings.

Short Selling as a Strategy for Falling Prices

This one’s a bit more advanced and definitely not for everyone. Short selling is basically betting that an asset’s price will go down. You borrow an asset, sell it, and then hope to buy it back later at a lower price to return it, pocketing the difference. It’s a way to potentially profit from a declining market, but it comes with significant risks. If the price goes up instead of down, your losses can be pretty substantial, and it often requires a good understanding of the market and specific trading platforms.

Opportunities in Bear Markets for Long-Term Investors

For those who believe in the long-term potential of certain cryptocurrencies, a bear market can actually be a good time to buy. When prices are low, you can acquire more of an asset for the same amount of money. If you’ve done your homework and believe in a project’s fundamentals and future, buying during a downturn is like getting it on sale. It requires patience, though. You’re not looking for a quick flip; you’re looking to hold onto the asset for an extended period, waiting for the market cycle to eventually turn around. It’s a strategy that relies on conviction in the underlying value of the digital asset.

Protecting Your Digital Assets Post-Crash

Okay, so the market took a nosedive. It happens. Now that the dust is starting to settle, it’s time to think about what you’ve got left and how to keep it safe. This isn’t just about riding out the storm; it’s about making sure your crypto is actually yours and not just a number on some exchange’s ledger.

Securing Holdings with Separate Crypto Wallets

Look, leaving all your crypto on an exchange is like keeping all your cash under your mattress. It’s convenient, sure, but it’s also risky. Exchanges can get hacked, go bankrupt, or freeze your funds for reasons you might not even understand. Moving your assets to a dedicated crypto wallet gives you direct control. Think of it as your personal digital vault.

There are a few types:

- Hot Wallets: These are connected to the internet, like mobile apps or browser extensions. They’re good for frequent trading but less secure than cold wallets.

- Cold Wallets: These are offline, often hardware devices (like a fancy USB stick) or even paper wallets. They’re the most secure option for long-term storage because they’re not accessible to online threats.

Transferring your crypto to a wallet you control is a pretty straightforward process on most exchanges. Just follow their instructions, double-check addresses, and you’ll be much better off.

The Importance of Due Diligence on Projects

When the market is booming, it’s easy to get caught up in the hype and invest in anything that looks like it’s going up. But after a crash, it’s a good time to take a step back and look at the projects you’re invested in. Are they actually building something useful? Do they have a real team behind them? Are they transparent about their development and finances?

- Check the Whitepaper: Does it still make sense? Has it been updated?

- Review the Team: Are they public? Do they have relevant experience?

- Examine the Community: Is it active and engaged, or just full of bots?

- Look at Development Activity: Are they actually coding and releasing updates?

If a project seems shaky now, it’s probably not going to magically fix itself when the next bull run comes. Be honest with yourself about whether your investments are based on solid fundamentals or just speculation.

Utilizing Trading Platforms for Flexibility

While securing your long-term holdings is key, you might also want to keep some funds accessible for trading or potential opportunities that arise during these volatile times. This is where choosing the right trading platform becomes important.

Consider platforms that offer:

- Robust Security Features: Beyond just basic login, look for two-factor authentication (2FA) and other protective measures.

- Good Liquidity: Especially after a crash, you want to be able to buy or sell without massive price slippage.

- User-Friendly Interface: You don’t want to be fumbling around trying to execute a trade when the market is moving fast.

- Clear Fee Structures: Understand exactly what you’re paying for transactions.

Having a mix of assets in a secure, self-custodial wallet and a portion on a reliable trading platform can give you both safety and the ability to react to market changes. It’s about finding that balance that works for your personal situation.

Wrapping Up: Staying Steady in the Crypto Storm

Look, crypto markets are wild. They go up fast, and sometimes they drop just as quickly, which can be pretty scary if you’re not used to it. We’ve seen this happen before, and it’ll probably happen again. The key takeaway here is to not freak out. Remember why you put your money in crypto in the first place. Was it for a quick buck, or do you actually believe in the tech for the long haul? Knowing that helps a lot. Don’t just follow the crowd or make rash decisions when prices are tanking. Do your homework, maybe move your coins to a wallet you control, and think about spreading your investments around. Using tools to watch the market or even copy what experienced traders are doing can help too, but always remember to only invest what you can afford to lose. It’s a bumpy ride, for sure, but staying informed and keeping a level head makes a big difference.

Frequently Asked Questions

What makes crypto prices drop so suddenly?

Lots of things can make crypto prices fall fast! Sometimes, big world events or changes in the economy can make people nervous about investing in risky things like crypto. Also, new rules or laws about crypto can shake things up. If a big crypto company or exchange has problems, that can cause a crash too. And sometimes, after prices go up a lot, they just naturally fall back down for a bit.

How can I keep my crypto safe if the market crashes?

It’s smart to move your crypto from the exchange where you bought it to a special crypto wallet. You can get online wallets or even offline ones that are like a super-secure USB drive. This way, if something bad happens to the exchange, your coins are still safe with you.

Should I buy more crypto when prices are falling?

This is called ‘buying the dip.’ It can be a good idea if you’ve done your homework and really believe in a crypto coin for the long run. But remember, prices could keep falling, and you should only use money you can afford to lose. Don’t just buy because everyone else is doing it.

Are all cryptocurrencies affected the same way during a crash?

Not really. Big, well-known coins like Bitcoin and Ethereum might bounce back a bit better because lots of people trade them. Smaller, newer coins, often called ‘altcoins,’ can lose way more of their value when things go south. It’s like how a big company might survive a storm better than a small startup.

What’s the best way to handle my investments when crypto prices are dropping?

First, try to stay calm! Don’t make quick decisions based on fear. Think about why you invested in the first place. Some people like to ‘buy and hold,’ meaning they keep their crypto for a long time, even through crashes, hoping it will go up later. Others might spread their risk by investing a small, set amount regularly, no matter the price.

Can I make money even if crypto prices are going down?

Yes, it’s possible, but it’s usually for more experienced traders. One way is called ‘short selling,’ where you bet that a coin’s price will fall. Another strategy is ‘cost-averaging,’ where you invest the same amount of money regularly. This way, you buy more coins when prices are low and fewer when they’re high, which can help lower your average cost over time.