The healthcare world in 2025 is really changing. Things like how we pay for care, who’s investing, and using technology are all shifting. This means that mergers and acquisitions, or healthcare M&A, is becoming a big deal for everyone, from big hospital groups to smaller doctor’s offices. It’s all about finding ways to grow, work smarter, and give better care. If you’re a doctor thinking about selling your practice, or just trying to keep up, understanding these trends is pretty important right now.

Key Takeaways

- Private equity is really getting into doctor’s offices, especially in certain specialties, looking for ways to make them run more efficiently and make more money.

- How well a practice can handle paying for care based on results, not just how many services they provide, is becoming a major factor in how much it’s worth.

- Companies that have good tech, like AI or ways to monitor patients from home, are attracting a lot of buyer interest as healthcare goes more digital.

- Joining forces with other healthcare providers is becoming a common strategy to cover more areas, offer different kinds of services, and become more stable.

- Regulators are watching healthcare deals more closely, and making sure different company cultures can work together after a merger is still a big hurdle to overcome.

The Shifting Sands of Healthcare M&A in 2025

Things are really picking up in the healthcare mergers and acquisitions world this year. After a bit of a pause, deal activity is back, and it feels like everyone’s looking to make a move. It’s not just about getting bigger, though; it’s about getting smarter and more connected in how we deliver care. We’re seeing a definite surge, and it’s being driven by a few big things.

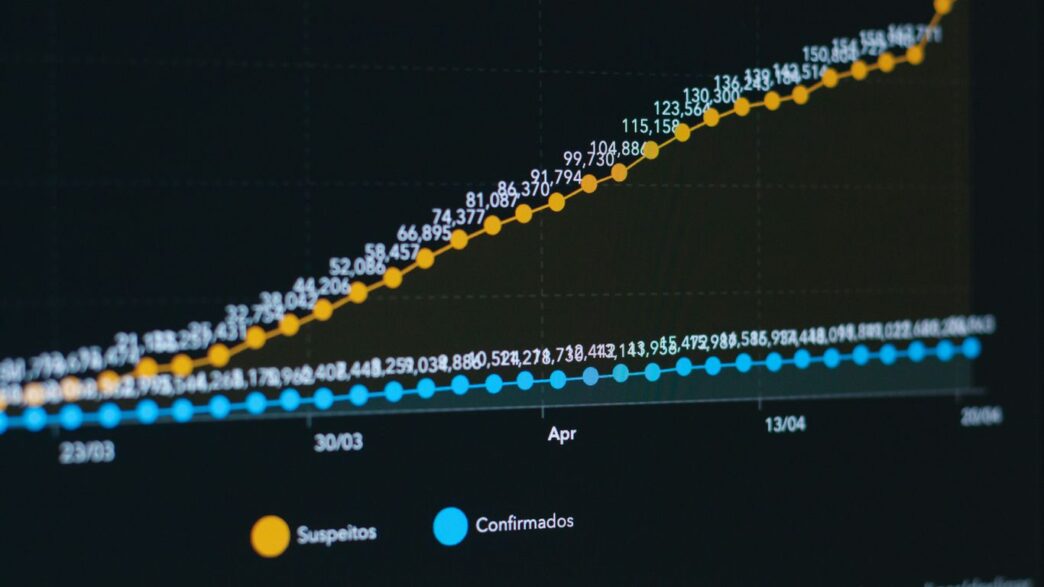

Resurgence in Deal Activity

After a period of economic uncertainty, 2025 has marked a strong comeback for healthcare M&A. Deals involving physician practices, outpatient services, and digital health platforms are leading the charge. It seems like many smaller providers are feeling the pinch from rising costs and staff shortages, pushing them to look for strength in numbers through consolidation. Plus, investors are showing renewed interest in healthcare businesses that can operate efficiently and offer high-margin services.

Key Drivers of the M&A Surge

Several factors are fueling this increase in deals. For starters, the ongoing shift towards value-based care is a major influence. Organizations that are ready for risk-based contracts and can show they manage patient outcomes well are becoming more attractive. Think about it: if you can prove you’re good at keeping people healthy and out of the hospital, that’s a big win. Also, the push for digital transformation means companies with innovative tech solutions, like AI or advanced analytics, are hot commodities. They offer a way for larger systems to speed up their own tech upgrades. Finally, there’s a strategic element at play. Many providers are looking to expand their reach, add new services, or integrate different parts of the care continuum to become more resilient.

Navigating Economic Headwinds

Now, it’s not all smooth sailing. We’re still dealing with some economic bumps. Rising interest rates and inflation can make financing deals trickier and affect how much things are worth. On top of that, regulatory bodies like the FTC are paying closer attention to healthcare deals, especially in areas where there’s already a lot of consolidation. And let’s not forget about integrating different companies – merging cultures and operations can be a real challenge. Successfully navigating these complexities requires clear strategic goals and thorough due diligence from all parties involved.

Private Equity’s Growing Influence on Physician Practices

It feels like everywhere you look in healthcare these days, private equity (PE) is involved, especially when it comes to physician practices. This isn’t exactly new, but the pace and focus have really picked up in 2025. We’re seeing a lot more PE firms looking to buy into or take over physician groups, and it’s changing how a lot of doctors run their businesses. The physician practice management (PPM) sector has seen a real surge in deals, hitting new highs. This growth is largely thanks to these PE investments, showing a lot of confidence in the market.

Targeting Specialty Physician Groups

So, which practices are catching PE’s eye? It’s often the specialty groups. Think dermatology, orthopedics, cardiology, and gastroenterology. These areas tend to have more predictable revenue streams and are ripe for consolidation. PE firms are looking to combine smaller practices into larger networks. The idea is to gain more bargaining power with insurance companies, streamline the behind-the-scenes work like billing and scheduling, and generally operate more efficiently. It’s about creating economies of scale, which is a big draw for investors.

Opportunities for Physician Owners

What does this mean for doctors who own their practices? Well, it can be a chance to get some money out of their business – a liquidity event, as they call it – without completely walking away from patient care. Many PE deals allow physicians to stay on, sometimes even in leadership roles, and often offer them a stake in the larger, combined company. This can provide access to capital for growth or new technology. However, it’s not a simple decision. Physicians really need to do their homework. It’s important to understand:

- Governance: Who makes the big decisions down the road?

- Compensation: How will doctors be paid, and how does that tie to performance?

- Exit Strategy: What happens if the PE firm decides to sell the whole thing later?

Making sure everyone’s goals align is key to a good partnership.

Due Diligence in PE Partnerships

When a PE firm comes knocking, they’re going to dig deep. And honestly, physicians should be doing the same. Buyers are looking much closer now than they used to. They want to see clean financials, well-organized patient records, and solid contracts with insurance providers. It’s also about the culture. Can the practice’s way of doing things mesh with the PE firm’s operational style? A smooth integration is way more likely if there’s a good cultural fit. So, before signing anything, make sure your practice is in order. Get your compliance programs up to date, review all your agreements, and have your financial records ready for a close look. It’s a lot of work, but it’s better to be prepared than surprised.

Value-Based Care as a Valuation Driver

Readiness for Risk-Based Contracting

So, in 2025, if you’re looking to sell your healthcare practice or hospital, or even if you’re thinking about merging with someone, how well you handle value-based care is becoming a really big deal. It’s not just a buzzword anymore; it’s actually changing how much your business is worth. Buyers are looking closely at whether you can actually manage patient health and keep costs down, especially when you’re taking on risk. If you’re already set up for things like accountable care organizations (ACOs) or Medicare Advantage plans, that’s a huge plus. It shows you’re ready for the future of how healthcare gets paid for.

The Role of Care Coordination and Analytics

This is where the rubber meets the road. Having good systems for coordinating patient care and strong data analytics is super important. It’s not enough to just say you provide good care; you need proof. Organizations that can show they’re reducing hospital readmissions, cutting down on unnecessary tests, or managing chronic conditions really well are getting noticed. They’re the ones fetching higher prices in deals. Think about it: if a buyer can see you’re already good at keeping patients healthy and out of the hospital, that’s a big win for them. It means less risk and more predictable outcomes. It’s like having a well-oiled machine that runs efficiently.

Differentiating Through Performance

Ultimately, it comes down to performance. How are you actually doing? Are you improving patient results while also managing costs? This is how you stand out. If your practice or system has a track record of success in these areas, you’re in a much stronger position. You might be a prime target for acquisition, or you could be the one leading a merger because others want to tap into your success. It’s about proving you can deliver quality care in a way that’s also financially smart. This focus on outcomes, not just the volume of services, is what’s really driving valuations these days.

Digital Health and AI: The New Frontier for Healthcare M&A

It feels like every other week there’s a new app or gadget promising to revolutionize how we get healthcare. And honestly, a lot of it is pretty exciting. In 2025, this tech boom is really starting to shake up the M&A scene. We’re seeing bigger players, like health systems and insurance companies, actively looking to buy up smaller companies that have cool digital health solutions or smart AI tools. Think telehealth platforms, remote patient monitoring systems, and anything that uses data to predict health issues before they get bad. These aren’t just nice-to-haves anymore; they’re becoming key assets.

Acquiring Innovative Technology Solutions

Startups with unique algorithms or new ways to get patients involved are finding buyers. Larger organizations want these innovations to speed up their own digital upgrades. It’s all about getting ahead of the curve and offering care that’s easier to access and more efficient. The race is on to integrate these technologies into everyday patient care.

Investor Interest in Health IT Vendors

Investors are definitely noticing. We’ve seen a big jump in money going into health IT companies. It’s not just venture capital; private equity is getting in on it too, especially with companies that help manage physician practices. Areas like telehealth and AI analytics are expected to see a lot of deal activity next year. Companies that can show they’re scalable and offer smart solutions for better, more accessible care are prime targets. It’s a good sign for innovation, but we also need to watch out for changes in how things like telehealth are paid for, as that could affect growth.

Cybersecurity as a Critical Due Diligence Factor

Now, here’s where things get a bit tricky. With all this digital stuff, cybersecurity has become a major point of focus in any deal. A data breach can completely derail a transaction or lead to huge problems down the road. If your practice uses electronic health records, telehealth, or AI tools, expect potential buyers to dig deep into your security measures. A weak security setup can seriously lower a deal’s value, or even kill it. It’s smart to get a cybersecurity audit done before you even start thinking about selling. Make sure you’re compliant with things like HIPAA, have solid data protection policies, and clearly define who owns the data and what happens if there’s a breach. This is something that The Healthcare Report 2025 also points to, highlighting how AI can improve efficiency but also the need for robust data handling.

Here’s what to keep in mind:

- Data Protection: Ensure all patient data is handled securely and in line with regulations.

- Compliance: Verify adherence to all relevant healthcare laws and standards.

- Breach Response: Have a clear plan in place for how to handle any security incidents.

It’s not just about the tech itself, but how well it’s protected. This diligence is key for a smooth transaction.

Strategic Consolidation for Enhanced Resilience

In today’s healthcare world, just being big isn’t enough. It’s about getting smarter and tougher, especially when things get shaky. Many healthcare groups are looking at mergers and acquisitions not just to grow, but to build a stronger foundation that can handle whatever comes next. Think of it like building a more robust network of care.

Expanding Geographic Reach and Patient Populations

One common way to get stronger is by spreading out. Acquiring or merging with organizations in new areas means you can serve more people and tap into different patient groups. This isn’t just about getting more patients through the door; it’s about making sure care is available where it’s needed and building a broader base of operations. It helps spread risk too – if one area has a downturn, others can help balance things out.

Diversifying Service Offerings Across Care Settings

Another big move is adding different kinds of services. Instead of just having a hospital, a group might buy or partner with places like urgent care clinics or outpatient surgery centers. This creates a more complete system for patients, guiding them through different levels of care. It also means the organization isn’t putting all its eggs in one basket. If one service line slows down, others can pick up the slack. This kind of diversification is key for staying steady when market demands shift.

Horizontal and Vertical Integration Strategies

We’re seeing a lot of different ways companies are combining. Horizontal integration means similar types of organizations are joining forces – like one group of doctors buying another group of doctors. Vertical integration is when different parts of the care chain come together, such as a hospital system working with a home health company. These strategies aim to create efficiencies, improve coordination, and gain more control over the patient journey from start to finish. Both approaches can lead to better operational flow and a more resilient business model.

Navigating Regulatory Scrutiny and Integration Challenges

So, you’ve found a great deal, maybe you’re buying a smaller practice or merging with another group. That’s exciting! But before you pop the champagne, we need to talk about the less glamorous, but super important, parts: the regulators and making sure everyone plays nice together afterward.

Increased FTC Review of Healthcare Deals

The Federal Trade Commission (FTC) is definitely paying closer attention to healthcare deals these days. They’re particularly interested in transactions that might reduce competition, especially in areas where there aren’t many providers already. Think about it – if a deal means patients in a certain town suddenly have fewer choices for their care, the FTC is going to want to know why. This means larger deals, or even smaller ones in concentrated markets, could face more questions and take longer to get approved. It’s not just about the size of the deal, but the potential impact on patients and the market. It’s wise to get a handle on potential antitrust issues early on, even before you start talking numbers.

The Pitfalls of Cultural Integration

This is where things can get really messy, and honestly, it’s often overlooked. You can have the best financial terms and the most brilliant strategic plan, but if the people involved don’t mesh well, the whole thing can fall apart. Imagine merging two doctor’s offices where one is super formal and by-the-book, and the other is more laid-back and spontaneous. The staff might clash, communication could break down, and patient care could even suffer. It’s not just about job titles; it’s about shared values, communication styles, and how decisions get made. You really need to think about how these different groups will work together day-to-day.

Here are some things to consider for smoother integration:

- Communication: Set up clear channels for information to flow between the merging entities. Regular updates, even if they’re small, help.

- Leadership Alignment: Make sure the leaders from both sides are on the same page about the vision and how to get there. If leaders are sending mixed signals, it’s confusing for everyone.

- Staff Involvement: Don’t forget the people doing the actual work. Get their input, address their concerns, and help them understand the new setup. They’re the ones who make it all happen.

Strategic Clarity for Successful Transactions

Before you even get deep into negotiations, you need to be really clear about why you’re doing this deal. What’s the end goal? Is it to grow bigger, become more efficient, offer new services, or reach more patients? Having this clarity helps you make better decisions throughout the process. It also helps you explain the deal to regulators and your own team. If you’re fuzzy on your objectives, it’s easy to get sidetracked by minor issues or agree to terms that don’t actually serve your long-term vision. Knowing your ‘why’ makes the ‘how’ much easier to figure out, and it helps avoid those surprise problems that can pop up later.

Looking Ahead

So, what does all this mean for healthcare in 2025? It’s clear that mergers and acquisitions aren’t just a passing trend; they’re a major force reshaping how care is delivered. Whether it’s big hospital systems joining forces, private equity firms investing in practices, or tech companies finding new homes, the game is changing. For anyone involved in healthcare, understanding these shifts is key. It’s not just about getting bigger, but about getting smarter and more connected to actually help patients better. Those who can adapt and plan carefully will likely find the most success in this busy market.

Frequently Asked Questions

Why are more healthcare companies merging or being bought in 2025?

Lots of reasons! Some smaller clinics and hospitals are joining forces to become bigger and stronger, especially because running a healthcare business is getting more expensive and finding staff is tough. Also, some companies that invest money, called private equity firms, see a lot of chances to help these businesses grow and make them more efficient, particularly in areas like doctor’s offices.

What does ‘value-based care’ mean for buying and selling healthcare businesses?

Value-based care means getting paid for how well you take care of patients, not just for doing lots of tests or procedures. So, when companies are looking to buy or merge, they really want to see that a business is good at keeping people healthy, managing costs, and getting good results for patients. If a business can show it does this well, it’s worth more.

How is technology like AI changing healthcare buying and selling?

Technology is a big deal! Companies that have cool new apps, ways to track patients from home, or smart computer programs (like AI) that help doctors are becoming really attractive to buyers. Larger healthcare companies want to buy these smaller tech businesses to get better and more modern, and investors are putting a lot of money into these health tech companies.

Are private investors (private equity) still interested in buying doctor’s offices?

Yes, they are! Private equity firms are especially interested in buying up groups of doctors, like those specializing in skin, bones, or heart care. They do this to make the offices run more smoothly, save money, and get better deals with insurance companies. For doctors, this can mean getting money for their practice while still being involved in patient care.

What are the biggest challenges when two healthcare companies join together?

It’s not always easy. One big challenge is making sure the two companies’ ways of doing things and their company cultures fit together. If people don’t work well together or have very different ideas about how things should be run, it can cause big problems. Also, government groups like the FTC are watching these deals more closely to make sure they don’t hurt competition.

What should a doctor or practice owner think about before selling their business?

Before selling, it’s smart to get your business in great shape. Make sure all your paperwork is organized, your computer systems are secure (especially with all the technology now), and you understand how your practice performs in terms of patient health and costs. It’s also super important to work with experts, like lawyers and financial advisors who know healthcare, to make sure you get a fair deal and avoid future problems.