So, 2025 is looking like a pretty busy year for mergers and acquisitions in the medical technology world. It feels like everyone is looking to buy or sell something, trying to keep up with all the new tech and changing rules. It’s a lot to keep track of, but it seems like the big picture is about making healthcare work better and faster. We’re seeing deals happen for all sorts of reasons, from getting new gadgets to just trying to get bigger in the market. It’s definitely an interesting time to watch this space.

Key Takeaways

- Companies are buying other companies to get their hands on new tech, especially things like AI and digital health tools, to make medical devices and patient care better.

- The medical device market is seeing a lot of deals as companies want to expand their product lines, especially in areas like heart devices and surgery tools that are growing fast.

- New rules and the overall economy are playing a big role in how many deals happen and what companies are looking for when they buy or sell.

- Using technology, like AI, to make company operations smoother and cut down on paperwork is a big reason for many of these medical technology m&a deals.

- There’s a growing interest in combining life sciences, like gene therapy and diagnostics, with everyday healthcare delivery to create more personalized treatments.

Key Drivers of Medical Technology M&A Activity

So, what’s really making the medical tech world buzz with mergers and acquisitions this year? It’s a mix of things, really. Think of it like a recipe where several ingredients come together to create something big.

Technological Advancements Fueling Innovation

This is a huge one. Companies are constantly looking for the next big thing, the tech that can make treatments better or diagnostics faster. We’re seeing a lot of interest in AI, especially for things like spotting diseases early or figuring out the best treatment plan for someone. Miniaturization is also a big deal – making devices smaller and less invasive. It’s all about staying ahead of the curve.

- AI and Machine Learning: Integrating AI into devices for smarter diagnostics and personalized care.

- Robotics: Acquiring companies with advanced robotic systems for surgery and rehabilitation.

- Connectivity: Focusing on devices that can communicate data wirelessly for remote monitoring.

The pace of technological change means companies can’t afford to stand still. Buying up smaller firms with cutting-edge tech is often faster than developing it all in-house.

Addressing Evolving Healthcare Needs

Healthcare itself is changing, and M&A follows suit. The population is getting older, and more people are dealing with long-term illnesses like heart disease or diabetes. This means a bigger demand for devices that can help manage these conditions. Plus, there’s a shift towards care happening outside of big hospitals, like in outpatient centers or even at home. So, companies are buying up tech that fits these new settings, like tools for minimally invasive procedures or wearable sensors. It’s about making healthcare more accessible and fitting it into people’s lives. We’re seeing a lot of activity in areas like cardiology and neuro-modulation because of this. It’s interesting to see how companies like Boston Scientific are actively looking to fill these gaps.

Market Consolidation and Portfolio Expansion

Let’s be honest, the medical device market is pretty crowded. Lots of companies are doing similar things. To stand out and grow, many are buying up competitors or companies with complementary products. This helps them get bigger, spread out their costs, and offer a wider range of solutions to hospitals and doctors. It’s a way to grab more market share and become a more dominant player. Sometimes, it’s about filling a hole in their product lineup, like when Johnson & Johnson bought Shockwave Medical to boost their heart device offerings. It’s a strategic move to build a more complete business. The iPager, a new communication tool, is an example of how new tech is emerging, and M&A will likely follow to integrate such innovations obsev’s iPager.

| Segment | M&A Focus |

|---|---|

| Cardiology | Minimally invasive devices, pacemakers |

| Diagnostics | AI-powered imaging, genetic testing |

| Surgical Robotics | Advanced robotic platforms, specialized tools |

| Remote Monitoring | Wearables, telehealth platforms |

The Rise of Digital Health in Medical Technology M&A

Digital health is really where it’s at for medical tech mergers and acquisitions in 2025. Companies are actively looking to buy up businesses that offer virtual care services, remote patient monitoring tools, and platforms that can actually talk to each other. It’s not just about having the latest gadget; it’s about making healthcare delivery smoother and more efficient.

Acquiring Virtual Care and Remote Monitoring Platforms

There’s a big push to get companies that are good at virtual visits and keeping an eye on patients from afar. Think about it: being able to check in with someone without them having to come into the office saves everyone time and hassle. Buyers are really interested in platforms that can handle this well.

- Virtual care platforms: These allow for remote consultations and follow-ups.

- Remote monitoring devices: Wearables and sensors that collect patient data continuously.

- Data analytics for remote care: Tools that make sense of the data collected.

Enhancing Patient Engagement Through Technology

Making patients feel more involved in their own care is a huge goal. This means buying companies that have user-friendly patient portals, secure messaging systems, and apps that help people manage appointments and medications. The aim is to create a more connected and patient-centric healthcare experience.

It’s all about making it easier for people to interact with their healthcare providers and take a more active role in their well-being. This often means simplifying complex processes and providing clear, accessible information.

Interoperability and Scalability of Health IT Solutions

When a company buys another, it’s super important that the new tech can actually work with what’s already there, like electronic health records (EHRs). Nobody wants systems that don’t communicate. So, companies are looking for health IT solutions that are not only innovative but also built to scale up and integrate smoothly. This means they can grow with the business and adapt to changing needs without a massive headache.

Strategic Focus Areas in Medical Device Mergers

When we look at what’s really driving mergers and acquisitions in the medical device world for 2025, a few key areas keep popping up. It’s not just about getting bigger; it’s about getting smarter and filling specific gaps in what companies can offer.

Minimally Invasive Surgery and Cardiac Devices

There’s a lot of action happening around technologies that make procedures less invasive. Think about devices for surgery that require smaller incisions or quicker recovery times. This ties directly into the cardiac space, where advancements in treating heart conditions are constantly being made. Companies are buying up others that have developed innovative tools for things like angioplasty, stenting, or even new ways to manage heart rhythm disorders. It’s about getting access to the latest tech that can improve patient outcomes and make procedures more efficient for doctors.

- Acquiring companies with novel catheter-based technologies.

- Focusing on devices for structural heart disease.

- Investing in technologies for peripheral vascular interventions.

Specialized Capabilities in Diagnostics

Diagnostics are a huge part of the puzzle. We’re seeing a real push to acquire companies that have specialized diagnostic tools, especially in areas like molecular diagnostics and point-of-care testing. The goal here is to get a hold of new testing technologies that can be used quickly, whether in a hospital lab or even closer to the patient. This also includes platforms that use artificial intelligence to analyze diagnostic data, which can lead to faster and more accurate diagnoses. It’s all about providing more complete solutions to healthcare providers.

The drive for specialized diagnostic capabilities is about more than just identifying diseases; it’s about enabling earlier detection and more personalized treatment plans, which ultimately leads to better patient care and can reduce overall healthcare costs.

Growth in High-Growth Clinical Segments

Companies are strategically targeting segments of the market that are showing strong growth potential. This often means looking at areas where there’s a clear unmet clinical need or where patient populations are growing. For example, neuro-modulation, which deals with devices that help manage neurological conditions, is a hot area. Similarly, advancements in robotic surgery for soft tissues are attracting a lot of attention. These aren’t just niche markets; they represent significant opportunities for companies to expand their reach and offer cutting-edge solutions to a wider range of patients and healthcare providers.

Navigating the Regulatory and Economic Landscape

Adapting to Stringent Regulatory Standards

Getting a medical tech company bought or buying one yourself in 2025 means you really have to pay attention to the rules. The government, like the DOJ and FTC, is watching mergers more closely, especially when it comes to making sure there’s still fair competition. This means deal timelines can stretch out, and you need to be ready for that. It’s not just about antitrust, though. You’ve got to think about data privacy, HIPAA, and other laws that protect patient information. Companies that get ahead of these rules by doing thorough checks early on tend to have smoother transactions.

- Due Diligence Focus: Look hard for any compliance problems, especially with digital health tools and how patient data is handled. Cybersecurity is a big one.

- Integration Planning: Have plans that can bend. What happens if new rules come out after the deal closes? You need to be able to adjust.

- Legal Counsel: Having lawyers who know healthcare M&A inside and out is pretty important. They can help you spot issues before they become big problems.

Regulatory hurdles aren’t just paperwork; they can seriously impact the value and timing of a deal. Being proactive and transparent with regulators can make a big difference.

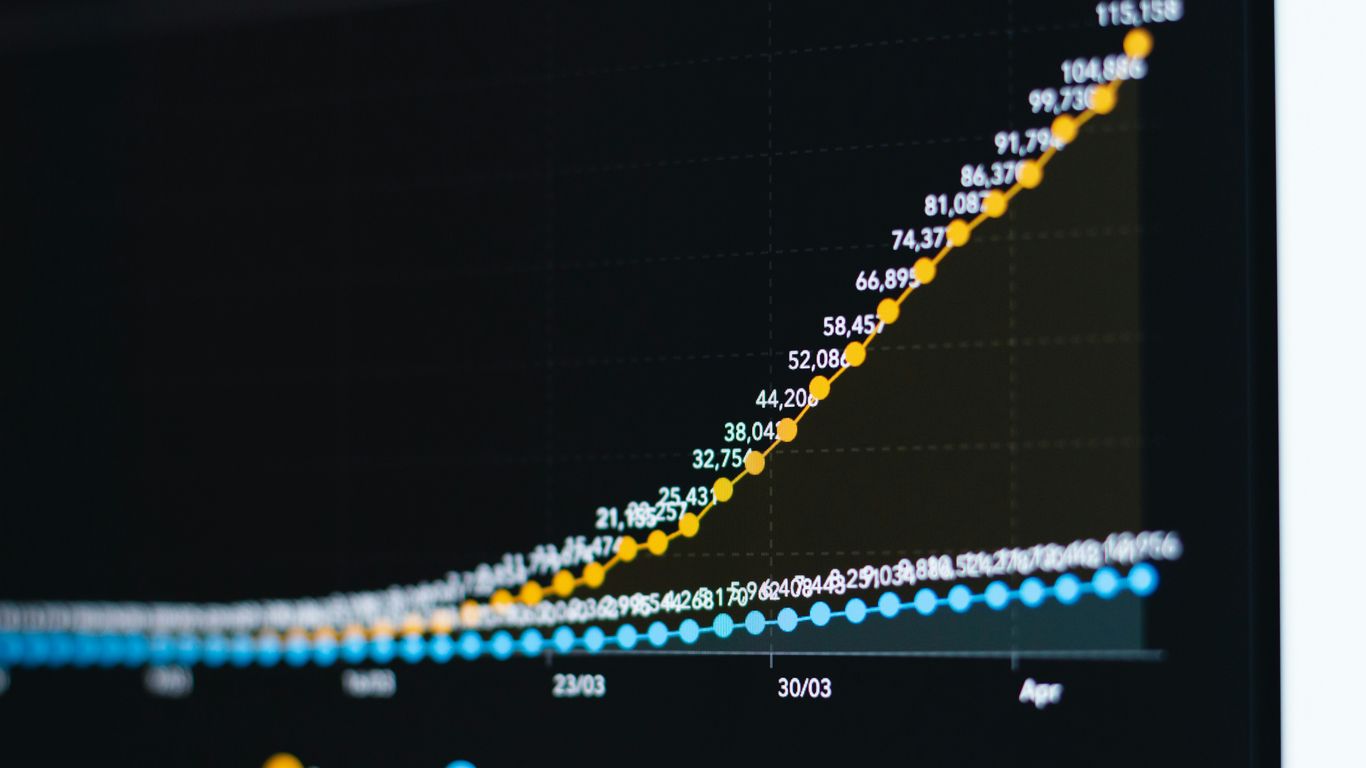

Impact of Economic Factors on Dealmaking

Money matters, of course. The overall economy, interest rates, and how much funding is available all play a role in whether deals happen and at what price. If the economy is shaky, buyers might be more cautious, wanting lower prices or more guarantees. On the other hand, if there’s a lot of cash floating around, especially from investors looking for good returns, that can drive up activity. Companies that are financially stable and have clear paths to making money are more attractive in any economic climate. Think about how reimbursement rates from insurance companies or government programs might change – that directly affects a company’s income and, therefore, its sale price.

The Role of Private Equity in Medical Technology M&A

Private equity firms are a huge part of the medical tech M&A scene. They often have deep pockets and are looking for companies that can grow. They might buy a company, help it improve its operations or expand its product line, and then sell it later for a profit. Sometimes, they’ll buy several smaller companies in the same area to create a larger, more efficient business. They’re often quicker to make decisions than public companies, which can speed up the deal process. Their focus is usually on profitability and operational improvements, so they bring a different kind of energy to the table compared to strategic buyers who might be looking to add a product to their existing lineup.

Leveraging Technology for Operational Efficiency

In 2025, getting operations running smoothly is a big deal for medical tech companies, especially when they’re merging or buying others. It’s not just about having cool new gadgets; it’s about making sure everything works together efficiently behind the scenes. Think about it – if you buy a company, you don’t want to spend months just trying to get their billing systems to talk to yours. That’s where technology really steps in to help.

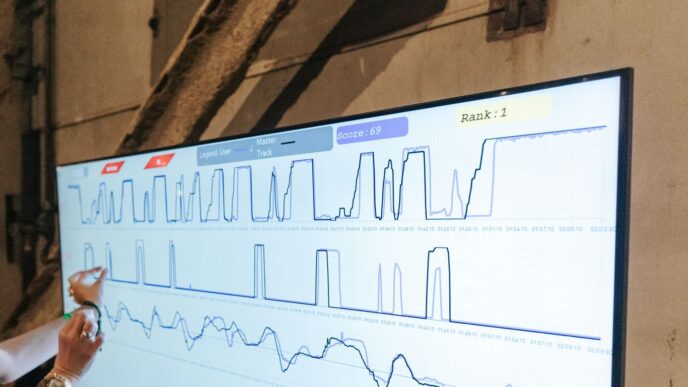

AI and Generative AI in Healthcare Dealmaking

Artificial intelligence, and especially generative AI, is changing how companies find and buy other businesses. These tools can sift through tons of data way faster than people can, spotting potential targets or even problems within a deal. They can help predict how well a merger might work out by looking at past performance and market trends. This means fewer surprises down the road and a better chance of the deal actually paying off. It’s like having a super-smart assistant that never sleeps, helping to make the whole process quicker and more informed. For example, AI can analyze patient data to improve diagnostics, which is a big draw for companies looking to acquire innovative solutions.

Automating Administrative Workflows

Let’s be honest, healthcare has a lot of paperwork and administrative tasks. Merging companies often means dealing with duplicate systems and processes, which can be a real headache. Technology, like robotic process automation (RPA) and AI-powered software, can take over many of these repetitive jobs. This could be anything from processing patient records to managing billing and insurance claims. By automating these tasks, companies can reduce errors, speed things up, and free up their staff to focus on more important things, like patient care or strategic planning. It’s about making the day-to-day operations run like a well-oiled machine.

Digital Transformation for Resource Optimization

When companies merge, they often look for ways to use their resources better. Digital transformation is key here. This means updating old systems, moving to cloud-based platforms, and making sure different software can communicate with each other. For instance, having a unified electronic health record (EHR) system across merged entities is a huge win for patient care continuity. It also helps in managing inventory, scheduling staff, and tracking performance metrics more effectively. Companies that invest in digital tools can often scale up faster and operate more leanly, which is a big plus in today’s market. It’s about building a more agile and responsive organization that can adapt to changing needs, much like how Virgin Galactic is advancing its spaceflight technology [8e6a].

Getting the technology side of a merger right isn’t just a nice-to-have; it’s becoming a must-have. It directly impacts how quickly a company can realize the benefits of a deal and how efficiently it can operate going forward. Ignoring this can lead to a lot of wasted time and money.

Here are some key areas where technology helps optimize resources:

- Data Integration: Connecting disparate data sources from acquired companies to create a single, unified view.

- Workflow Automation: Implementing tools to streamline administrative and clinical processes.

- Cloud Migration: Moving systems to the cloud for better scalability, accessibility, and cost-efficiency.

- Performance Analytics: Using digital dashboards and reports to monitor operational efficiency and identify areas for improvement.

- Cybersecurity: Strengthening digital defenses to protect sensitive patient data during and after integration.

Precision Medicine and Life Sciences Convergence

The lines between life sciences and actual healthcare delivery are getting pretty blurry these days. Companies are really looking to bring advanced diagnostics and all that life sciences innovation right into how patient care is managed. It’s about spotting diseases faster and getting treatments that are way more on the mark. Deals are often about pulling research, development, and clinical care all together under one roof.

Targeting Companion Diagnostics and Personalized Treatments

Precision medicine is definitely a big deal for M&A activity in 2025. Pharma and biotech outfits are actively seeking out targeted therapies that show real promise both in clinical trials and in the market. Investments are pouring into genomics, companion diagnostics, and treatments tailored to individuals. The main idea is to match therapies with specific patient groups based on their genetic makeup, which could lead to better results and easier approval from insurance providers.

- Genomic sequencing platforms

- AI-driven diagnostic tools

- Personalized treatment development

Integrating Life Sciences Innovation into Healthcare Delivery

We’re seeing a lot of activity in life sciences and diagnostics M&A. Companies are zeroing in on tech integration and strategic growth. Everyone wants to improve diagnostics, make research smoother, and stay ahead of the curve through mergers and acquisitions. This push is also about making sure that wearable technology, which collects health data, can be integrated more smoothly into these broader healthcare solutions.

The convergence aims to create more complete patient solutions by linking research, development, and clinical application. This integration is key for advancing personalized medicine.

Advancing Cell and Gene Therapy Platforms

Companies are particularly interested in platforms that support cell and gene therapy. These advanced therapies are seen as the future for treating a range of conditions. Buyers are looking for capabilities that give them an edge in diagnostics and life sciences tools, positioning themselves for long-term growth in a constantly changing industry. It’s a smart move to build up these tech capabilities to stay competitive.

- Acquiring companies with expertise in gene editing

- Investing in platforms for cell therapy manufacturing

- Developing integrated solutions for rare diseases

Building Resilience Through Supply Chain Acquisitions

Enhancing Manufacturing Resilience and Nearshoring

The past few years really hammered home how fragile supply chains can be. We saw shortages of everything from basic components to specialized medical devices. Because of this, companies are now looking to buy businesses that can help them make things closer to home, or at least in more stable regions. It’s not just about having enough stuff; it’s about having it reliably. Think about acquiring a company that has manufacturing plants in North America or Europe, or one that specializes in making critical parts that used to come from overseas. This move helps reduce the risk of disruptions caused by geopolitical issues or shipping problems.

Securing Advanced Manufacturing Capabilities

Beyond just having more factories, there’s a big push to acquire companies with cutting-edge manufacturing tech. This could mean getting your hands on advanced automation, specialized machinery for complex devices, or even expertise in new materials. For instance, buying a firm that’s really good at precision machining or additive manufacturing (like 3D printing for medical implants) can give a company a significant edge. It allows them to produce higher-quality products more efficiently and opens doors to creating entirely new types of medical technologies that weren’t possible before.

Ensuring Supply Chain Stability

Ultimately, the goal is to make sure that when a doctor or patient needs a medical device, it’s available. Acquisitions focused on supply chain stability often target companies that have strong relationships with raw material suppliers, robust quality control systems, and efficient logistics networks. It’s about building a more predictable and dependable flow of goods from start to finish. This might involve buying a company that handles the entire process, from sourcing raw materials to final product distribution, or one that excels in a specific, critical part of that chain. The aim is to create a more robust and less vulnerable operation.

- Supplier Diversification: Acquiring companies with multiple, reliable sources for key components.

- Logistics Optimization: Buying firms with strong distribution networks and warehousing capabilities.

- Quality Assurance Integration: Bringing in businesses with proven track records in rigorous quality management systems.

- Inventory Management: Gaining access to companies skilled in managing stock levels effectively to buffer against demand spikes or supply interruptions.

Looking Ahead: What’s Next for MedTech M&A?

So, as we wrap up our look at medical technology mergers and acquisitions for 2025, it’s clear things are moving fast. We’ve seen a big push for new tech, especially in digital health and AI, as companies try to keep up and offer better patient care. Consolidation is still a major theme, with bigger players buying up smaller ones to fill out their product lines or get into new areas like oncology and consumer health. It’s not just about getting bigger, though; it’s about getting smarter, more efficient, and ready for whatever comes next in healthcare. Keeping an eye on these trends will be key for anyone involved in this dynamic market.