Alright, so 2025 is shaping up to be a pretty interesting year for mergers and acquisitions in the medical technology world. Things are always changing in healthcare, and this year is no different. We’re seeing a lot of movement driven by new tech, how people are getting older, and just the general economy. It’s a complex picture, but understanding these shifts is key if you’re involved in medical technology m&a.

Key Takeaways

- New technologies, especially AI and digital health tools, are big reasons why companies are buying others in the medical tech space.

- The way healthcare is delivered is changing, with more focus on outpatient care and consumer needs, which influences what companies are looking for in acquisitions.

- Economic factors like interest rates and private equity involvement are making deal-making more active, though companies are being careful about what they pay.

- Staying compliant with rules and having strong quality systems are becoming really important when deciding to buy another company.

- Companies are looking to make their supply chains stronger and more reliable, often through buying other businesses, to deal with disruptions and changing global trade.

Key Drivers of Medical Technology M&A in 2025

Alright, let’s talk about what’s really making the medical technology world buzz with mergers and acquisitions this year. It’s not just one thing, but a mix of big shifts that are pushing companies to either buy or be bought.

Technological Advancements Fueling Acquisitions

Technology is moving so fast, it’s almost hard to keep up. Think about AI, robotics, and how everything is getting smaller and more connected. Companies that are already big players are looking to snap up smaller firms that have these cutting-edge tools. It’s like they want to grab the latest gadgets to stay ahead of the game. For example, some companies are buying up others specifically for their AI-driven diagnostic tools or for really precise ways to treat things like cancer. It’s all about integrating these new capabilities to make their own products better and more competitive.

Demographic Shifts and Evolving Healthcare Needs

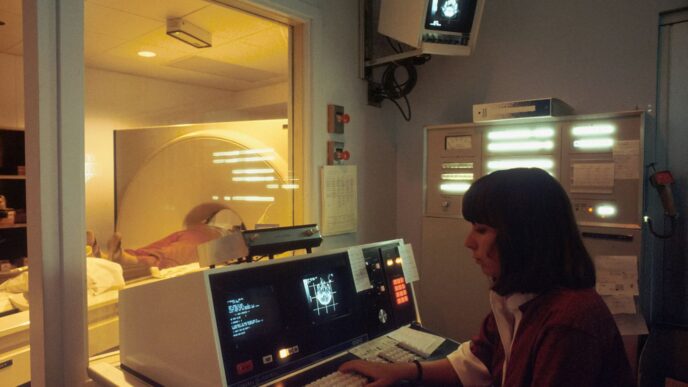

We’ve got more older people now, and with that comes more chronic health issues like heart problems or diabetes. This means there’s a bigger need for medical devices that can help manage these conditions. So, you’re seeing companies buy up others that make things like spinal cord stimulators or devices for minimally invasive surgery. Plus, more procedures are happening outside of big hospitals, in places like outpatient centers. This trend is also driving acquisitions of technologies that work well in those settings, like wearables or devices for same-day surgeries.

Market Consolidation and Portfolio Expansion

Honestly, the medical device market is still pretty spread out, with lots of smaller companies doing their own thing. This often leads bigger companies to buy up smaller ones to get more market share, make their operations more efficient, and basically just get bigger and stronger. They’re also looking to fill gaps in what they offer. If a company is strong in one area, say heart devices, but weak in another, like lung treatments, they might buy a company that specializes in lung tech. It’s a way to round out their product line and make sure they have something for a wider range of patient needs.

Strategic Imperatives in Medical Technology M&A

When we look at what’s really driving deals in the medical tech world these days, a few big themes pop up. It’s not just about getting bigger; it’s about getting smarter and more specialized.

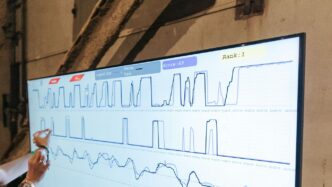

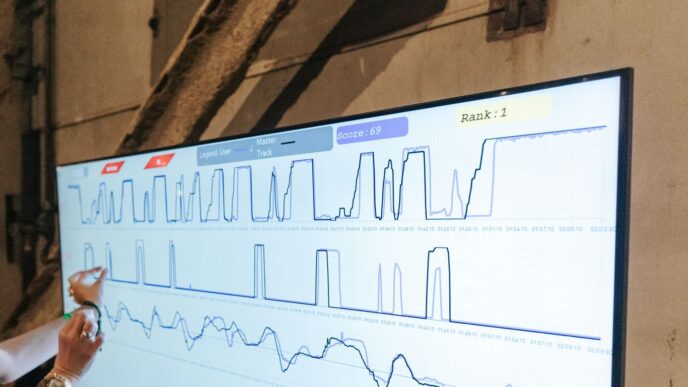

Focus on AI and Digital Health Platforms

Artificial intelligence and digital health are no longer just buzzwords; they’re becoming the backbone of modern healthcare. Companies are actively looking to buy businesses that have already built out solid AI-driven diagnostic tools or digital platforms for patient monitoring and management. Think about it: integrating these technologies can really speed up how healthcare is delivered and, hopefully, lead to better patient outcomes. It’s about getting ahead of the curve and making sure your company is part of the future, not stuck in the past. We’re seeing a lot of interest in companies that can help streamline operations and provide more personalized care through data.

Acquiring Specialized Capabilities and Innovation

Beyond the big tech trends, there’s a strong push to acquire very specific, niche capabilities. This could be anything from advanced coating technologies for medical devices to microcatheters used in complex cancer treatments. The idea here is to get your hands on unique innovations that can give you a real edge. It’s like collecting rare tools – each one does something special that can’t be easily replicated. These kinds of deals often focus on companies that have patented processes or unique material science knowledge. The goal is to bring in specialized expertise that can’t be easily developed in-house.

Filling Portfolio Gaps and Diversification

Companies are also using M&A to round out their product lines. If a company is strong in one area, say cardiology, but weak in another, like diabetes management, they might acquire a business to fill that gap. This diversification isn’t just about having more products; it’s about addressing a wider range of patient needs and reducing reliance on a single market segment. It’s a way to spread risk and tap into new growth areas. For example, a company might buy a firm that makes devices for outpatient surgery centers to tap into that growing market, or acquire a business that offers remote monitoring solutions to cater to the increasing demand for at-home care.

Economic and Financial Influences on MedTech M&A

The financial climate plays a big role in how many deals happen in the medical technology space. For 2025, things are looking pretty good for companies wanting to buy or sell. We’re seeing a more open environment for deal-making, partly because borrowing money might get a bit cheaper, and the overall market growth is settling into a more predictable rhythm. This could mean more companies are willing to take the plunge on acquisitions.

Favorable Economic Environment for Dealmaking

Analysts are pointing to a generally positive economic outlook that should support mergers and acquisitions. Think of it like this: when the economy is humming along, companies feel more confident about spending money on growth, and buying another company is a big growth move. This confidence, combined with potentially lower financing costs, creates a fertile ground for transactions. Big players like Boston Scientific and Johnson & Johnson are expected to stay active, looking for opportunities to expand their reach and product lines. It’s a good time to be looking for a deal, whether you’re the buyer or the seller.

Private Equity’s Growing Role in Transactions

Private equity firms are definitely a major force to watch. They’ve got a lot of capital ready to invest, and they’re actively looking for good opportunities in the MedTech sector. We’ve seen some pretty significant deals where PE firms have bought out entire divisions of larger companies, like Carlyle Group’s big purchase from Baxter International. This shows they’re not just dabbling; they’re making substantial moves to acquire and grow businesses. Their involvement can speed up deals and bring a different kind of strategic focus to the companies they acquire. It’s interesting to see how they reshape the market, sometimes by buying and then selling off parts of a business later on.

Navigating Valuations and Strategic Tuck-Ins

Valuations for publicly traded companies can sometimes get a bit high, which might make big acquisitions seem less attractive. However, companies are getting smarter about how they grow. Instead of massive, expensive takeovers, many are focusing on ‘strategic tuck-ins.’ These are smaller acquisitions that fit neatly into what the company already does, filling specific gaps in their product offerings or adding a new technology without breaking the bank. Medtronic, for example, has been leaning into these smaller, more targeted deals. It’s a way to grow and innovate without the huge price tag and integration challenges of a mega-merger. This approach allows companies to stay agile and focused on specific market needs, like acquiring new wearable device technology.

Here’s a quick look at how these factors might play out:

- Economic Stability: A steady economy encourages investment in R&D and M&A.

- Financing Costs: Lower interest rates make borrowing for acquisitions more affordable.

- PE Activity: Private equity firms provide capital and strategic direction, often accelerating growth.

- Valuation Strategy: Companies are balancing high public valuations with the cost-effectiveness of smaller, strategic tuck-in acquisitions.

Regulatory Landscape and Its Impact on Medical Technology M&A

The rules and regulations surrounding medical technology are always changing, and this definitely affects who buys what and why in 2025. Companies have to keep a close eye on this stuff.

Anticipated Regulatory Shifts Accelerating Deals

It looks like the regulatory environment might become a bit more open in the US next year. This could speed up deals because companies might feel more confident about getting approvals. Think about it, if the path to market is clearer, it makes buying another company that much more appealing. We saw how strict rules could slow things down before, so any easing up is a big deal for M&A activity. It’s like the government is giving a subtle nod to more business.

Compliance and Quality Management as Acquisition Criteria

When one company looks to buy another, they’re not just checking the tech. They’re really digging into how well the target company follows all the rules. Having solid compliance and quality control systems in place is becoming a major selling point. If a company has a history of good practices and can show they meet standards like ISO 13485, that makes them a much more attractive purchase. It means the buyer doesn’t have to spend as much time and money fixing potential problems after the deal is done. It’s all about reducing risk.

Navigating Stringent International Standards

Getting products into different countries means dealing with a whole host of different rules. Companies looking to expand globally through acquisitions need to make sure the target company can handle these international standards. This includes things like FDA requirements in the US, but also rules in Europe and Asia. If a company has already figured out how to meet these varied demands, that’s a huge plus. It can make a deal much smoother and open up new markets faster. Basically, a company that’s already good at playing by global rules is worth more.

Supply Chain Resilience and Consumer-Driven Healthcare Trends

It’s no secret that the past few years have really shaken up how we think about getting things made and delivered. For medical tech companies, this means a big push to make sure their supply chains are tough and can handle whatever comes their way. We’re seeing a lot of interest in companies that can help with manufacturing closer to home, or ‘nearshoring,’ to cut down on those long shipping times and potential disruptions. Think about it: if a key component has to travel halfway around the world, a lot can go wrong. Acquiring facilities or expertise in these areas is becoming a smart move.

Beyond just making sure products get made, there’s also this huge shift towards healthcare that’s more focused on the person using it – the consumer. People are more involved in their own health than ever before, partly thanks to all the gadgets out there. Wearable tech, like smartwatches that track your heart rate or sleep patterns, is a prime example. These devices give people direct insights into their well-being, and companies are looking to buy into this space to offer more direct-to-consumer solutions. It’s about giving people tools to manage their health proactively. This trend is really changing how medical technology is developed and sold, moving away from just doctor-to-patient to include more patient-to-product interaction. For instance, companies are looking at how to integrate data from devices like the Apple Watch into broader health records to help with prevention and recovery [b403].

Here’s a quick look at what’s driving this:

- Boosting Manufacturing: Companies are buying others to get better control over their production, especially for critical items.

- Bringing Production Closer: Nearshoring is a big deal, aiming to reduce reliance on distant factories and shorten lead times.

- Direct Access to Users: There’s a growing market for selling health tech directly to people, bypassing some traditional channels.

- Data Integration: Connecting data from consumer devices with medical records is seen as a way to improve overall health management.

This focus on resilience and consumer needs means M&A activity is likely to stay strong in areas that support these goals. It’s not just about the next big medical breakthrough anymore; it’s also about how reliably and directly that technology can reach the people who need it.

Emerging Themes in Health Industry M&A

Value-Based Care Reshaping Transaction Strategies

So, the whole idea of paying for health outcomes instead of just doing stuff is really starting to change how companies buy and sell in the medical tech world. It’s not just about having the latest gadget anymore; it’s about how that gadget actually helps patients get better and keeps costs down. Companies are looking for targets that can prove they fit into this new payment model. Think about it: if you can show your device reduces hospital readmissions or helps manage chronic conditions more effectively, you’re way more attractive to buyers. This shift means acquisitions are less about just adding to a product list and more about integrating solutions that deliver measurable results. It’s a big change from the old days.

Divestitures Creating New Acquisition Opportunities

Sometimes, big companies decide to sell off parts of their business that don’t quite fit their main focus anymore. This can actually be a really good thing for other companies looking to grow. When a large corporation divests a division, it often comes with established products, customer bases, and sometimes even manufacturing capabilities. For a smaller or mid-sized company, buying one of these divested units can be a fast track to expanding their market reach or filling gaps in their own product lines. It’s like finding a shortcut to growth. We’re seeing this happen across different areas of medtech, from specialized equipment to software platforms. It’s a smart way for companies to get what they need without having to build it all from scratch.

Cybersecurity as a Critical Due Diligence Factor

This one’s becoming a really big deal. With so much patient data and connected devices out there, a company’s cybersecurity posture is no longer an afterthought; it’s front and center when deals are being considered. Buyers are digging deep into how well a target company protects sensitive information. A data breach or a weak security system can be a massive red flag, potentially derailing a deal or at least significantly lowering the price. It’s not just about avoiding fines; it’s about maintaining patient trust and operational continuity. So, if you’re looking to sell or buy, making sure your digital defenses are solid is absolutely key. It’s like checking the foundation of a house before you buy it – you need to know it’s secure.

Looking Ahead

So, as we wrap up our look at medical tech mergers and acquisitions for 2025, it’s clear things are really shifting. We’re seeing a big push for new tech, especially anything involving AI and digital health. Plus, companies are trying to get bigger in certain areas and make their product lines stronger. It’s not just about the big players either; private equity is definitely in the mix, making strategic buys. Keep an eye on how these deals play out, because they’re shaping how healthcare will work for all of us down the road.