Thinking about electricity prices for 2026 and beyond can feel like a guessing game, right? There are so many things that can move prices up or down, from global events to how much power data centers need. This article is going to break down what we’re seeing and what might happen with electricity price forecasts, helping you get a better handle on things.

Key Takeaways

- Data centers are a big deal for electricity demand, and their growth could really push prices up. Companies are even looking at their own power solutions to keep up.

- Things like weather and global events can cause quick price swings, but there’s also a lot of focus on making the grid cleaner and more efficient, which could help stabilize costs long-term.

- In places like Ohio and Pennsylvania, electricity prices dropped a bit recently, but there are still reasons to be watchful about future costs.

- Canada looks pretty good when it comes to electricity prices compared to other countries, and they’re aiming for even more savings by shifting to clean energy.

- For anyone buying electricity, it’s smart to think about locking in prices and finding ways to use less power, especially during busy times, to manage your budget for the next few years.

Forecasting Electricity Price Trends

Figuring out what electricity prices will do in the future can feel like trying to predict the weather, but it’s super important for businesses. We’re looking at 2026 and beyond, and a lot of things are in play. It’s not just about how much electricity we use; it’s about the whole system behind it.

Analyzing Market Fundamentals for Electricity Price Forecasts

When we talk about market fundamentals, we’re looking at the basic supply and demand stuff. Think about how much natural gas is available and what it costs, because that often sets the tone for electricity prices. Right now, natural gas storage levels are a bit lower than last year, even though they’re still above the five-year average. Plus, demand is ticking up, largely thanks to all the new data centers popping up. These factors can push prices around.

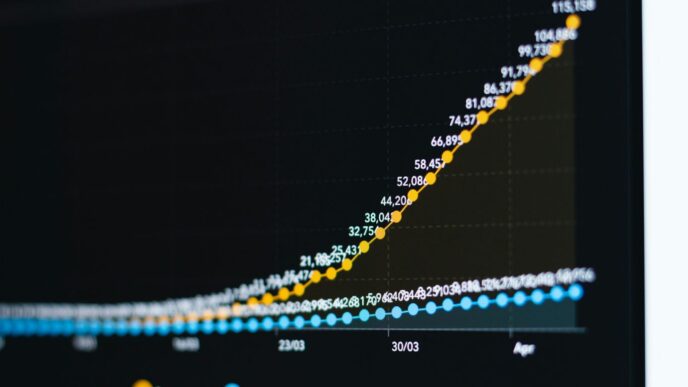

Here’s a quick look at some recent price movements:

| Region | Price (12-month) | Change |

|---|---|---|

| Ohio | $49.78/MWH | -8.43% |

| Pennsylvania | $56.05/MWH | -6.60% |

These numbers show that prices have been coming down lately, but the underlying demand from things like data centers could change that picture.

Impact of Geopolitical Factors on Electricity Prices

Things happening around the world can really shake up energy markets. Conflicts or political issues in major oil and gas producing regions can cause prices to spike unexpectedly. While there’s a good amount of spare oil production capacity out there that could help keep prices in check, any major disruption could still lead to price surges. It’s a constant balancing act.

Understanding Demand-Side Management’s Role

Demand-Side Management (DSM) is all about how we manage when and how much electricity we use. Things like making our homes and businesses more energy-efficient or shifting our electricity use away from peak times can make a big difference. These strategies help reduce the overall strain on the grid and can lead to cost savings. By using energy more wisely, we can help keep prices more stable and affordable. It’s a win-win for consumers and the grid operators.

Key Drivers Influencing Future Electricity Prices

So, what’s really going to move the needle on electricity prices in the coming years? It’s not just one thing, but a mix of big trends and smaller shifts. Let’s break down some of the main players.

The Growing Influence of Data Centers on Demand

If you’ve been paying attention, you’ve probably heard about the boom in data centers. These massive facilities, powering everything from cloud computing to AI, are hungry for electricity. Their demand is growing fast, and it’s becoming a significant factor in how much power we need overall. Think of it like adding a whole new neighborhood to the grid – it requires a lot more juice.

Technological Advancements and Grid Modernization

Technology is changing the game, and not just with data centers. We’re seeing new ways to generate and manage electricity. Things like smarter grids, better energy storage, and more efficient transmission lines are all part of the picture. Modernizing our grid infrastructure is key to handling new demands and keeping prices stable. These upgrades aren’t cheap upfront, but they can lead to more reliable power and potentially lower costs down the road by reducing waste and improving efficiency.

The Role of Energy Efficiency in Price Stability

This one might seem obvious, but it’s worth repeating: using less energy is a great way to keep prices in check. Energy efficiency measures, whether it’s better insulation in your home or more efficient appliances, all add up. When we collectively use less electricity, especially during peak times, it reduces the strain on the grid. This means we might not need to build as many expensive new power plants or upgrade infrastructure as quickly. It’s a win-win: lower bills for consumers and less pressure on the system.

Navigating Price Volatility and Risk

Okay, so electricity prices can be a bit of a rollercoaster, right? One minute they’re up, the next they’re down. It’s not just about the weather or how much power we’re using; there’s a whole lot more going on behind the scenes that can make things jump around. Understanding these ups and downs is key to not getting caught off guard.

Think about it like this: the wholesale energy market is always reacting to news. Sometimes it’s about what’s happening with oil and gas prices, which are still linked to electricity costs even as we move towards cleaner energy. Other times, it’s about how much power is available versus how much people need.

Here are a few things that really shake things up:

- Capacity Auctions: These are basically auctions where power generators bid to make sure there’s enough electricity available for a future period. In the PJM market, for instance, the auction for the 2027-2028 period hit its maximum price cap in all zones, coming in at $333.44 per megawatt-day. What’s more, this auction actually had a shortfall in capacity procurement compared to PJM’s target. This is the first time that’s happened, and it signals potential future supply issues that could keep prices higher.

- Natural Gas Prices: Natural gas is a big player in electricity generation. We saw prices jump to $4.687 per MMBtu in January 2026, up from $4.424 the month before and way higher than the $3.514 from January 2025. This jump was mostly due to forecasts of a big cold snap. When gas prices go up, electricity prices often follow.

- Geopolitical Events: Things happening around the world, like tensions in the Middle East or issues with oil-producing countries, can send energy markets into a frenzy. Even though we’re talking about electricity, these global events can still cause price spikes.

So, what can you do about it? Well, it’s not always easy to predict every little move, but there are ways to manage the risk. For example, some folks are looking at different contract types, like "Basis Only" or "NYMEX Lock" deals, to separate the gas price from the electricity delivery price. Others are using "cap and floor" structures to set limits on how high or low their prices can go if they decide to "float" their NYMEX price. It’s all about finding a strategy that fits your situation and helps you sleep at night.

Looking at the forward energy curve, it’s currently in "backwardation." This means that longer-term contracts are actually cheaper than shorter-term ones right now. Given the potential long-term issues in markets like PJM, locking in a price for the next 24 months might be a smart move, as the risk of prices going up seems higher than them dropping significantly.

Long-Term Electricity Price Outlook

Looking ahead, the electricity market is set for some big shifts. We’re talking about needing more power generation capacity than ever before, especially with things like data centers gobbling up electricity. Plus, the whole push towards a net-zero economy means we’re going to see a lot more renewable energy sources come online.

Projecting Electricity Generation Capacity Needs

It’s pretty clear we’re going to need a lot more power generation capacity in the coming years. Think about it: the demand for electricity is climbing, and not just from homes and businesses. The explosion of data centers, for instance, is a massive new load on the grid. Some reports suggest that public infrastructure timelines are just not keeping up with how fast these data centers are being built. This is leading some big tech companies to look at building their own power generation, right on-site, just to make sure they have the juice they need when they need it. This trend could really change how new power capacity gets built.

The Transition to a Net-Zero Electricity Economy

Shifting to a net-zero electricity system is a huge undertaking, but it’s happening. This means more wind turbines, more solar panels, and likely more battery storage. For consumers, especially in places like Canada, this transition could mean real savings. Studies suggest that by 2050, households could see their total energy spending drop by a good chunk, maybe around 12%, by switching to clean electricity. It’s not just about saving money, though. Relying more on clean electricity can also make our energy prices more stable, shielding us from those wild swings we sometimes see with fossil fuels. It’s a move towards a more predictable energy future.

International Comparisons of Electricity Pricing

When you look at electricity prices around the world, you see a lot of variation. It’s not a one-size-fits-all situation. Factors like how much a country relies on different energy sources, government policies, and even how efficiently the grid is run all play a role. For example, some analyses show that in a net-zero future, Canadian households might actually spend less on energy overall compared to today. This highlights how different regions are positioned to benefit from the energy transition, and how policy choices can really shape the final price tag for consumers.

Regional Electricity Price Dynamics

When we talk about electricity prices, it’s not a one-size-fits-all situation. Things can look pretty different depending on where you are. Let’s break down some of the regional trends we’re seeing, especially in North America.

Analyzing Price Trends in Ohio and Pennsylvania

Recently, we’ve seen some interesting shifts in the Ohio and Pennsylvania markets. For instance, in December, despite cold weather that usually pushes prices up, we actually saw them fall. The 12-month electricity prices in Ohio dropped by about 8.4%, and 36-month prices saw a decrease of nearly 5%. Pennsylvania followed suit, with 12-month prices down about 6.6% and 36-month prices down around 3.7%. This might seem counterintuitive, but it shows how complex market forces can be. Factors like natural gas storage levels and demand forecasts play a big role.

Canadian Electricity Pricing and Savings Potential

Canada presents a different picture. When you look at electricity prices adjusted for purchasing power, Canada often shows up as having some of the lowest rates among developed nations. For example, in 2022 data, Canada had some of the lowest residential and industrial electricity prices compared to other G7 and OECD countries. This is good news for Canadian consumers and businesses. The move towards a net-zero economy in Canada is also projected to bring savings. Studies suggest that by 2050, households could see a 12% reduction in their total energy spending. Plus, relying more on clean electricity can help shield consumers from the wild swings often seen in fossil fuel prices.

North American Electricity Market Comparisons

Comparing the broader North American market reveals some key differences and similarities. The United States, for example, often has very low industrial electricity prices, sometimes even lower than Canada’s. However, residential prices in the US can be a bit higher than in Canada, though still generally lower than many European countries like Germany or Italy.

Here’s a quick look at some 2022 data (prices in USD/kWh, adjusted for purchasing power):

| Country | Residential | Industrial |

|---|---|---|

| Canada | $0.13 | $0.10 |

| United States | $0.15 | $0.08 |

| OECD Average | $0.25 | $0.24 |

These regional differences matter a lot for businesses making energy purchasing decisions. Understanding these dynamics helps in planning and potentially finding cost savings. It’s also worth noting that major events, like the PJM capacity auction results, can have ripple effects across these markets, even if the specific pricing mechanisms differ.

Strategic Planning for Energy Buyers

Okay, so planning for your electricity costs in 2026 and beyond isn’t exactly a walk in the park. Things are shifting, and you’ve got to be smart about it. It’s not just about picking the cheapest rate today; it’s about looking ahead and making choices that make sense long-term. The energy market is getting more complex, and a solid plan is your best defense against unexpected price hikes.

Developing Robust Electricity Price Forecasts

Trying to guess electricity prices is tough, no doubt. But you can’t just wing it. You need to look at what’s happening now and what might happen. Think about things like how much electricity is being used, especially with all those new data centers popping up. They’re huge energy consumers. Also, keep an eye on the weather – extreme cold or heat can really mess with prices. And don’t forget about what’s going on in the world; geopolitical stuff can have a ripple effect on energy markets.

Here’s a quick rundown of what to consider:

- Demand Drivers: How much power are businesses and homes using? Are there big new industrial users coming online, like those data centers?

- Supply Factors: What’s the state of natural gas storage? How much renewable energy is being added to the grid? Are there any issues with existing power plants?

- Market Signals: What are the futures markets saying? Is the price for future delivery higher or lower than today’s price? This can tell you a lot about what experts expect.

- Policy and Regulation: New rules or government incentives can change the game. Keep tabs on what governments are planning.

The Importance of Peak Demand Reduction Strategies

This is a big one. When everyone uses a lot of electricity at the same time – like on a super hot summer afternoon when everyone’s running their AC – that’s peak demand. Utilities have to build and maintain enough power generation to meet these peaks, and that cost gets passed on to you. So, if you can reduce how much power you use during those high-demand times, you can actually save a good chunk of money.

Think about it like this:

- Shift Usage: Can you move some of your energy-intensive operations to off-peak hours? Maybe run certain equipment overnight or early in the morning.

- Improve Efficiency: Are your machines and lighting as efficient as they could be? Upgrading to newer, more efficient models can lower your overall usage, which also helps during peaks.

- On-Site Generation/Storage: If it’s feasible, having your own solar panels or battery storage can help you avoid buying expensive peak power from the grid.

Reducing your peak demand not only lowers your immediate electricity bill but can also lower your ‘peak load’ or ‘network service peak load’ (NSPL) tags, which can lead to lower fixed rates in the following year. It’s a win-win.

Budgeting Considerations for 2026 and Beyond

When you’re looking at your budget for the next few years, it’s probably not a good idea to expect electricity prices to drop significantly. Based on what we’re seeing with demand growth, especially from data centers, and the general state of energy markets, prices are likely to stay elevated or even creep up. For instance, capacity auctions in regions like PJM have hit their maximum allowed prices, and there’s been a shortfall in capacity procurement, which signals potential future price pressure.

Here are a few things to keep in mind for your budgeting:

- Lock in Prices When Possible: If you see a favorable forward curve, especially if it’s in backwardation (meaning future prices are lower than current ones), consider locking in a longer-term contract. While prices could go down, the risk of them going up seems higher given current market conditions.

- Factor in Volatility: Don’t budget for a single, flat price. Build in some flexibility to account for market fluctuations. Consider contracts that might pass through certain costs like capacity or transmission changes, as these can sometimes offer a lower base rate.

- Track Economic Trends: Broader economic conditions, like inflation or changes in industrial output, can influence energy demand and, consequently, prices. Keep an eye on these wider trends.

Looking Ahead: What’s Next for Electricity Prices?

So, what does all this mean for electricity prices in 2026 and beyond? It’s not a simple picture. While some analysts are predicting lower oil prices, which can influence electricity costs, there are still plenty of things that could shake things up, like global events or unexpected demand spikes, especially with things like data centers needing more power. On the flip side, efforts to boost energy efficiency and use smarter grid technology could help keep costs down. It looks like prices might stay a bit unpredictable for a while, but focusing on efficiency and planning ahead seems like the smartest move for businesses and households alike. It’s definitely a good idea to keep an eye on these trends as we move forward.