It’s pretty wild how much the world of digital money and the stocks tied to it have exploded lately. You hear about Bitcoin and Ethereum all the time, but there’s a whole lot more going on with companies that are building this stuff or investing in it. Keeping up with blockchain stock symbols can feel like a full-time job, especially with how fast things change. This article is here to break down what’s moving the market and how you might want to think about putting your money into this space.

Key Takeaways

- The price of blockchain stocks is influenced by various factors, including cryptocurrency market movements and new technological advancements.

- Keeping an eye on major cryptocurrencies like Bitcoin and Ethereum is important for understanding related stock performance.

- Identifying promising companies and understanding the risks involved are key steps for investing in the blockchain sector.

- New regulations and how big institutions get involved can significantly shift the blockchain stock price landscape.

- Using real-time data and understanding market volatility helps in making smarter investment choices for blockchain stock symbols.

Understanding Key Blockchain Stock Symbols

When you look at stocks tied to blockchain technology, it’s easy to get excited about all the new tech. But just like any investment, figuring out what actually makes these stocks move is pretty important. It’s not just about the tech itself; a lot of different things play a role, and some might actually surprise you.

Factors Influencing Blockchain Stock Performance

Several things can really shake up the price of a blockchain-related stock. Think about it: the overall health of the economy matters, just like with regular stocks. If people are worried about money, they tend to pull back from riskier investments, and that includes newer tech sectors. Then there’s the specific news coming out about blockchain companies themselves. Did a company announce a big new partnership? Did they launch a successful product? These kinds of events can send stock prices soaring. On the flip side, negative news, like a data breach or a failed project, can cause a sharp drop. Keeping an eye on major cryptocurrencies like Bitcoin and Ethereum is important for understanding related stock performance.

Here’s a quick look at what moves these stocks:

- Technological Advancements: New breakthroughs in blockchain can boost investor confidence.

- Regulatory News: Government decisions about crypto and blockchain can have a significant impact.

- Company-Specific Developments: Product launches, partnerships, and executive changes matter.

- Market Sentiment: General investor mood towards tech and crypto plays a big part.

Market Sentiment and Blockchain Stocks

Market sentiment refers to the general attitude of investors towards a particular security or the market as a whole. For blockchain stocks, this can be heavily influenced by the price movements of major cryptocurrencies, news cycles, and even social media trends. A positive sentiment can lead to increased buying pressure, driving stock prices up, while negative sentiment can trigger sell-offs. It’s pretty wild how much the world of digital money and the stocks tied to it have exploded lately. You hear about Bitcoin and Ethereum all the time, but there’s a whole lot more going on with companies that are building this stuff or investing in it. Keeping up with blockchain stock symbols can feel like a full-time job, especially with how fast things change. This article is here to break down what’s moving the market and how you might want to think about putting your money into this space. You can find more analysis on publicly traded cryptocurrency companies here.

Regulatory News Impacting Blockchain Investments

Government regulations can significantly shape the blockchain industry. New laws or changes in existing ones can affect how companies operate, their profitability, and investor confidence. For instance, clearer regulations might encourage more institutional investment, while stricter rules could create uncertainty and volatility. It’s important to stay informed about regulatory developments as they can have a direct impact on the stock prices of companies in this sector. For example, a positive announcement about a major company adopting blockchain technology could send related stocks soaring, while a negative regulatory ruling could cause them to drop sharply.

Prominent Blockchain Stock Symbols to Watch

When you’re looking at companies involved in blockchain, it’s easy to get excited about the tech itself. But for investors, the real question is which companies are set to do well in the market. Things are moving fast, and some names are definitely standing out as we head further into 2026. It’s not just about the digital coins; it’s about the businesses building the infrastructure and finding ways to use this technology.

Coinbase Global Inc. (COIN) and Crypto Exchanges

Coinbase is a big name in the crypto world, basically acting as a marketplace where people can buy, sell, and store digital currencies. When more people get into crypto, Coinbase tends to see more activity, which can be good for its stock. Think of it like a busy airport – more flights mean more business. As digital assets become more common, exchanges like Coinbase are right in the middle of it all. Their performance is often a good indicator of how much mainstream interest there is in cryptocurrencies.

MicroStrategy Incorporated (MSTR) and Bitcoin Holdings

MicroStrategy has taken a pretty unique approach. Instead of just being a software company, they’ve decided to put a significant chunk of their corporate treasury into Bitcoin. This means their stock price can sometimes move pretty closely with Bitcoin’s own price. It’s a bit of a gamble, sure, but it also means they’re betting big on the long-term value of Bitcoin. Investors watching MSTR are often looking at both the company’s business operations and its massive Bitcoin holdings.

Mining Companies: Riot Platforms Inc. (RIOT) and Marathon Digital Holdings Inc. (MARA)

These companies are in the business of ‘mining’ cryptocurrencies, which basically means they use powerful computers to solve complex problems to verify transactions and create new coins, usually Bitcoin. It’s an energy-intensive process. Their success is tied to a few things: the price of the cryptocurrency they’re mining, the cost of electricity, and how efficient their mining equipment is. When crypto prices are high and mining is profitable, companies like Riot and Marathon can see their stock prices jump. It’s a direct play on the economics of cryptocurrency production. You can find more information on companies involved in this space on various financial news sites.

Here’s a quick look at what influences these mining stocks:

- Cryptocurrency Prices: The market value of the coins being mined.

- Operational Costs: Primarily electricity and hardware expenses.

- Network Difficulty: How hard it is to mine new coins, which changes over time.

- Regulatory Environment: Rules affecting mining operations in different regions.

Established Companies Embracing Blockchain Technology

It’s not just the crypto-native startups making moves in the blockchain space. Plenty of big, established companies you already know are jumping in, too. They’re not necessarily building new digital coins, but they’re finding ways to use blockchain to make their own businesses better. Think of it like them adopting a new, super-secure way to keep track of things or make transactions smoother.

Mastercard (MA) and Amazon (AMZN) in Blockchain

Companies like Mastercard and Amazon are looking at blockchain for practical reasons. Mastercard, for instance, is exploring how distributed ledger technology can help with things like tracking goods through supply chains or making cross-border payments less of a headache. They’re not trying to replace their core business, but rather to add a layer of security and transparency where it makes sense. Amazon, with its massive cloud infrastructure (AWS), is also providing blockchain services to other businesses, helping them build and run their own blockchain applications. It’s about using the tech to improve existing operations and customer experiences.

NVIDIA Corp (NVDA) and IBM Corp (IBM) Innovations

Then you have companies like NVIDIA and IBM. NVIDIA makes the powerful computer chips that are essential for a lot of blockchain activities, especially mining and complex computations. As blockchain tech gets more sophisticated, the demand for their high-performance hardware is likely to grow. IBM, on the other hand, has been a long-time player in enterprise solutions, and they’re actively developing and implementing blockchain platforms for businesses. They’re focused on solving real-world problems, like making supply chains more efficient or securing sensitive data in healthcare, using blockchain as the underlying technology. IBM’s strategy often involves providing the infrastructure and services that allow other companies to adopt blockchain, rather than directly dealing with cryptocurrencies.

Foundational Protocol Developers in the Blockchain Space

Beyond the big names applying the tech, there are also companies that are essentially building the roads and bridges of the blockchain world. These are the developers working on the core protocols – the foundational software that makes blockchain work. Their success is tied to how widely their particular blockchain is adopted and how well it scales. When looking at these companies, it’s important to consider:

- Technological Innovation: Are they pushing the boundaries of what’s possible with distributed ledger technology?

- Ecosystem Growth: Is a community of developers and users actively building on or using their platform?

- Security and Stability: Does their protocol demonstrate robust security measures and reliable performance?

These companies might not be as well-known to the average consumer, but their work is pretty critical for the entire blockchain ecosystem to grow and mature.

Diversifying with Blockchain ETFs

Look, trying to pick the next big blockchain stock can feel like searching for a needle in a haystack. It’s a wild west out there, and honestly, who has the time to research every single company? That’s where Exchange Traded Funds, or ETFs, come in handy. Think of an ETF as a pre-packaged basket of stocks. Instead of buying shares in just one company, you buy a piece of a fund that holds many. It’s a way to get exposure to the whole blockchain scene without having to bet on a single horse.

Amplify Transformational Data Sharing ETF (BLOK)

One popular option you’ll hear about is the Amplify Transformational Data Sharing ETF, ticker symbol BLOK. This fund isn’t just about buying Bitcoin or Ethereum. Nope, it’s focused on companies that are actually using blockchain technology to make their businesses better. We’re talking about companies that might be using blockchain for things like tracking products through a supply chain, making payments faster, or even improving how medical records are handled. BLOK aims to give you a stake in the broader growth of blockchain across different industries. It’s a way to invest in the tech itself and the companies building with it.

What kind of companies are usually in a fund like BLOK?

- Crypto Exchanges and Miners: Companies that directly deal with digital currencies, like running a trading platform or using big computers to mine new coins.

- Blockchain Tech Builders: Firms that create the actual software and infrastructure that makes blockchain work.

- Businesses Using Blockchain: Established companies in areas like finance, retail, or healthcare that are integrating blockchain to improve their services.

- Hardware Makers: Companies that produce the computer chips and other gear needed for blockchain operations.

Investing in Blockchain Without Direct Coin Ownership

So, why is this ETF approach a good idea? For starters, it spreads out your risk. The blockchain world is still pretty new and can be super unpredictable. If you put all your money into one company and it stumbles, you could lose a lot. With an ETF like BLOK, if one company in the basket doesn’t do so well, the others might still be performing, helping to cushion the blow. It lets you participate in the potential upside of blockchain innovation without the intense risk of holding a single company’s stock or, for that matter, a specific digital asset. It’s a more balanced way to play the game, especially if you’re not looking to become a crypto expert overnight.

Navigating Market Dynamics for Blockchain Stocks

Alright, so you’re looking at stocks tied to blockchain tech. It’s a wild ride, right? The prices can jump around like crazy, sometimes in just a few hours. This isn’t like picking up shares in your grandma’s favorite utility company. We’re talking about a sector that’s still pretty new and influenced by a whole bunch of things that can change on a dime.

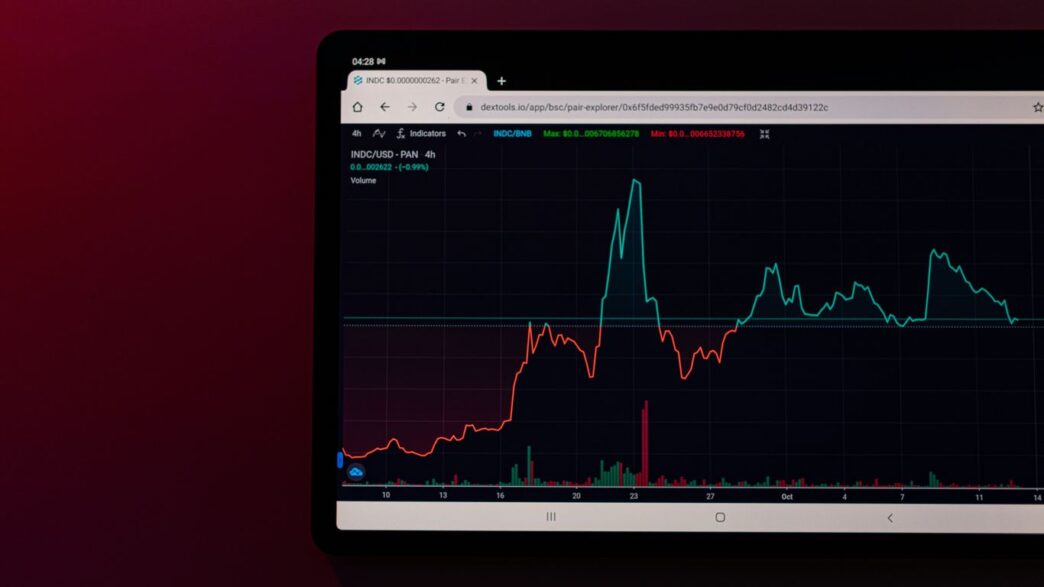

Tracking Real-Time Blockchain Stock Price Movements

If you’ve put money into blockchain stocks, you’ve got to keep an eye on what they’re doing. The market moves fast, and what looks good one minute might not the next. It’s like trying to follow a race car – you need to see where it is right now to know what’s happening.

Monitoring Key Data Points: Stock Price, Volume, and Capitalization

To make sense of all this movement, you need to look at some basic numbers. Think of these as your dashboard for understanding how a stock is performing. You can’t just guess; you need the facts.

- Stock Price: This is the most obvious one – what’s one share going for right now?

- Trading Volume: How many shares are changing hands? A big jump in volume can mean something important is happening, like a major announcement or a shift in investor interest. It’s a sign people are paying attention.

- Market Capitalization: This is the total value of the company. It gives you a sense of the company’s size in the market.

- 52-Week Range: Knowing the highest and lowest prices over the past year helps put the current price in perspective. Did it hit a new high, or is it near its low?

Keeping tabs on these numbers helps you see the immediate picture. For instance, a sudden spike in trading volume for a company like Riot Platforms Inc. (RIOT) might be tied to news about their mining operations or Bitcoin prices. It’s also smart to compare how different stocks are doing against each other. Are the big players moving together, or is one pulling ahead? This kind of comparison helps you spot trends. Remember, even established cryptocurrencies like Bitcoin saw a modest decline in 2025, so understanding these market shifts is key [94ae].

Understanding Market Volatility and Technological Obsolescence

This sector is known for its wild swings. One day a stock might be up 20%, the next it could be down 15%. This volatility comes from a mix of things – news about digital currencies, changes in how people feel about tech in general, or even just rumors. While big price swings can mean big gains, they also mean big losses can happen just as quickly. You have to be ready for that.

Then there’s the tech itself. Blockchain is still pretty new, and new ideas are popping up all the time. A company that looks like a winner today might be using tech that becomes outdated tomorrow. It’s like buying the latest gadget only to have a much better version come out a few months later. You need to think about whether the companies you’re investing in are staying ahead of the curve, developing new things, or just riding the wave of what’s popular right now. Are they building the next big thing, or just trying to cash in on the current hype? It’s a constant question in this space.

Evaluating Risk and Reward in Blockchain Investments

When you look at blockchain stocks, it’s easy to get caught up in the excitement of potentially big gains. This technology could really change how we do things, and companies that get it right might see some serious growth. But, and it’s a pretty big ‘but,’ there’s still a lot we don’t know. The tech is still growing, and the market can be unpredictable. It’s a bit like investing in a startup with a cool idea that hasn’t quite figured out how to make money yet.

Balancing High Growth Potential with Inherent Uncertainties

Investing in this space means you’re often looking at a mix of exciting future possibilities and very real, present-day risks. It’s a balancing act, for sure. You have to decide if the chance of a big payoff is worth the possibility of losing your money. This is why doing your homework is so important.

So, how do you find that balance? It often comes down to how much risk you’re comfortable with. Some companies are building the basic tech that lots of others will use. These might be a bit more stable. Others are creating direct digital currency services, which can be much more unpredictable. You need to figure out what kind of risk you’re okay with before you put your money in.

Assessing User Adoption and Monetization Strategies

Before you invest, ask yourself a few key questions about the companies you’re considering:

- Market Need: Does the service or product actually solve a real problem or meet a demand that isn’t being met?

- User Adoption: Are people actually using what the company offers? And is that number going up?

- Monetization Strategy: How does the company plan to make money from its blockchain-related activities? Is it a clear and sustainable plan?

Understanding how a company plans to make money and if people are actually using their services is key to assessing its long-term viability.

Understanding Competitive Landscapes in Blockchain

The blockchain world is getting pretty crowded. Lots of companies are trying to do similar things, so you need to see how a company stacks up against others. Are they a leader in their niche, or are they just one of many trying to get noticed? A company with a strong, unique product or service has a better chance of sticking around and succeeding. It’s also worth keeping an eye on regulatory news, as new rules can pop up without much warning and really shake things up for a company’s stock price.

Long-Term Investment Strategies for Blockchain Stocks

Investing in the blockchain space often requires a different mindset than traditional markets. Because the technology is still growing and changing fast, trying to time the market for quick gains can be a real gamble. Instead, a more measured, long-term approach usually makes more sense. This means focusing on the potential for blockchain to reshape industries over many years, rather than expecting overnight success.

Implementing Dollar-Cost Averaging for Volatile Assets

When you’re dealing with assets that can swing in price quite a bit, like many blockchain stocks, dollar-cost averaging can be a really useful tool. It’s a way to smooth out the ups and downs. Basically, you decide on a fixed amount of money you want to invest, say $100, and you commit to investing that amount on a regular schedule, like every month. The cool part is, you do this no matter what the stock price is doing. If the price is high, your $100 buys fewer shares. If the price is low, it buys more. Over time, this can help lower your average cost per share and takes some of the emotion out of investing, which is pretty helpful when prices are moving quickly.

- Set a fixed investment amount: Decide how much you want to invest regularly (e.g., $100 per month).

- Choose a consistent schedule: Pick a day each week or month to make your investment.

- Invest regardless of price: Buy shares with your fixed amount, no matter the current stock price.

- Repeat: Continue this process over an extended period.

Focusing on Underlying Value and Company Execution

It’s easy to get caught up in the hype surrounding new technology, but for long-term success, you really need to look at the actual companies. Are they building something useful? Do they have a clear plan for making money that isn’t just tied to the price of digital coins? A company with solid financials, a good management team, and a history of adapting to changes is more likely to stick around and grow. Look for companies that have:

- Clear revenue streams: They should have multiple ways of making money, not just one.

- Strong balance sheets: This means they have more assets than debts.

- A history of innovation: Have they adapted to changes before?

Think about whether the company is solving a real problem, if people are actually using their services, and how they plan to turn that into profit. This focus on practical application and solid business practices is key to weathering the inevitable storms in a developing market.

The Importance of Patience in Blockchain Investing

Blockchain technology is still pretty new, kind of like the internet was in the early days. It’s going to take time for its full potential to be realized and for companies to figure out the best ways to use it and make money from it. Trying to get rich quick in this space is usually a bad idea. You need to be prepared to hold onto your investments for several years, watching the technology mature and companies execute their strategies. It’s about believing in the long-term shift that blockchain can bring, not just chasing short-term price movements. Patience allows you to ride out the volatility and benefit from the eventual widespread adoption and innovation.

Wrapping Up: Your Blockchain Stock Journey

So, we’ve looked at some of the companies making moves in the blockchain world, and it’s clear this tech isn’t just a passing fad. It’s still pretty new, kind of like the internet was way back when. We saw how big companies are getting involved, alongside those focused on crypto itself or the tech behind it. Remember, this market moves fast, and things like new rules or tech changes can pop up. It’s really important to do your own digging into any company you’re thinking about, understand the risks, and only put in what you can afford to lose. Keep learning, stay curious, and you might just find some interesting spots in this evolving digital landscape.

Frequently Asked Questions

What exactly are blockchain stocks?

Think of blockchain stocks as owning a small piece of companies that are involved with blockchain technology. Blockchain is like a super safe digital notebook that helps things like digital money, or cryptocurrency, work. These companies might create the technology, offer services using it, or even help make new digital coins.

Are investing in blockchain stocks a good idea?

Investing in these stocks can be exciting because blockchain is a new technology with lots of potential. However, it’s also a bit risky because the technology is still developing and the market can change quickly. It’s important to do your research and understand the risks before investing.

What’s the difference between investing in Bitcoin and a blockchain stock?

Investing in Bitcoin means you’re buying the digital currency itself. Investing in a blockchain stock means you’re buying a piece of a company that might use or build blockchain technology. The company’s success depends on its business, while Bitcoin’s price depends more on what people are willing to pay for it and how it’s used.

How do I know if a blockchain company is a good investment?

To figure out if a blockchain company is a good bet, look at what they’re actually doing. Are they creating cool new products or services? Do they have a solid plan for making money? Also, check if other smart investors are putting their money into it. It’s important to see if the company is growing and has a good reputation.

Are blockchain stocks risky?

Yes, investing in blockchain stocks can be quite risky. The world of cryptocurrency and blockchain is new and changes very fast. Prices can go up and down a lot, sometimes very quickly. It’s like riding a roller coaster – exciting, but you need to be prepared for the ups and downs.

How can I keep up with blockchain stock prices?

You can follow blockchain stock prices using financial news websites, stock market apps, or specialized crypto news sources. These places often show you the current prices, how much they’ve changed, and other important details. It’s good to check them regularly to see what’s happening.