Money 2020 Europe 2026 is just around the corner, and it’s shaping up to be a big one. This event is where all the action happens in the finance world, from the latest tech to how companies are dealing with new rules. We’re talking about everything from digital wallets and AI to how startups are making their mark. It’s a place to get a feel for where money and payments are headed, and honestly, it’s pretty exciting to see what’s next.

Key Takeaways

- Digital wallets and virtual cards are becoming super common, changing how we pay for things every day. Plus, open banking is making it easier for different financial apps to talk to each other.

- AI is not just a buzzword anymore; it’s actually being used to help people manage their money better and make banking smoother. It’s all about making things smarter and more personal.

- Things like real-time payments and buy now, pay later options are speeding up how we move money and buy stuff. Companies are also looking at how to make sending money across borders easier.

- Startups at Money 2020 Europe are showing off cool new ideas and figuring out how to grow in this fast-paced industry, especially in new markets.

- Banks and payment companies are working hard to go digital and keep up with changing rules. Blockchain is also popping up, especially for things like property deals.

Navigating The Evolving Fintech Landscape

The world of finance is changing fast, and keeping up can feel like a full-time job. At Money 2020 Europe 2026, it was clear that a few big ideas are really shaping how we handle our money.

The Rise of Digital Wallets and Virtual Cards

Remember when you had to dig through your purse for the right card? Those days are fading. Digital wallets and virtual cards are becoming super common. They make paying for things quicker and, honestly, a bit more secure. You can load up your favorite cards, and then just tap your phone or watch to pay. Plus, virtual cards are great for online shopping – you can create a temporary card number for a single purchase, which really cuts down on the risk of your main card details getting stolen. It’s all about making payments easier and safer for everyone.

Open Banking APIs: Revolutionizing Financial Interactions

This is a big one. Open Banking, powered by APIs, is basically letting different financial apps talk to each other. Think about it: your budgeting app could pull data directly from your bank account, or you could manage all your different accounts from one place. This interconnectedness is changing how we interact with our money, making it more accessible and manageable. It’s not just about convenience; it opens doors for new services that we haven’t even thought of yet. For financial institutions, it means they can partner up and offer more to their customers. You can see how this is a major shift in how financial services work.

Embedded Finance: Integrating Financial Services in Everyday Activities

This is where finance just sort of… disappears into the background. Embedded finance means financial services are built right into non-financial apps and websites. Buying something online and seeing a ‘Buy Now, Pay Later’ option pop up? That’s embedded finance. Or maybe a ride-sharing app letting you pay for your trip directly without opening a separate payment app. It makes financial actions feel like just another part of what you’re already doing. This trend is all about making financial tools available exactly when and where people need them, without extra steps. It’s a smart way to make financial services more useful in daily life.

AI’s Transformative Impact On Financial Services

AI and Machine Learning in Fintech: Enhancing Personal Finance Management

Artificial intelligence (AI) and machine learning (ML) are really changing the game in fintech. It’s not just about fancy tech talk anymore; these tools are making it way easier for people to manage their money. Think about apps that help you track spending, suggest budgets, or even give you tips on where to invest. These systems learn from your habits to give you advice that actually makes sense for you. It’s like having a personal finance coach, but it’s available 24/7 right on your phone.

- Personalized Budgeting: AI can look at your spending patterns and create a budget that fits your lifestyle, not some generic template.

- Investment Guidance: ML algorithms can analyze market trends and your risk tolerance to suggest investment options.

- Fraud Detection: Banks use ML to spot unusual activity on your accounts, often stopping fraud before you even notice it.

The use of AI in personal finance management is projected to significantly boost user engagement. For example, Bank of America’s virtual assistant, Erica, handles millions of customer requests, showing how much people are starting to rely on AI for everyday banking needs. It’s all about making financial tasks less of a chore and more intuitive.

Strategies for User-Friendly AI Solutions in Banking

Getting people to actually use AI tools in banking can be tricky. Nobody wants to deal with complicated systems when they’re just trying to check their balance or make a payment. The key is making these AI solutions feel natural and helpful, not like another hurdle.

- Keep it Simple: Design interfaces that are easy to understand. Avoid technical jargon. If an AI can answer a question in plain English, that’s a win.

- Show, Don’t Just Tell: Use AI to provide clear, actionable insights. Instead of just saying "you spent a lot on dining out," an AI could suggest, "You spent $200 more on dining out this month than last. Would you like to set a spending limit for next month?"

- Build Trust: Be transparent about how AI is being used and what data it accesses. Clear privacy policies and robust security measures are a must.

Banks are looking at AI to automate customer service, speed up loan approvals, and offer more tailored product recommendations. The goal is to make banking feel less like a transaction and more like a helpful service.

Augmenting Human Capabilities Through AI Innovation

AI isn’t just about replacing human jobs; it’s also about making the people who are working in finance even better at what they do. Think of AI as a super-powered assistant for financial professionals.

- Data Analysis: AI can sift through massive amounts of data way faster than any human, spotting trends and anomalies that might otherwise be missed. This helps analysts make more informed decisions.

- Risk Assessment: In areas like lending or insurance, AI can help assess risk more accurately and quickly, leading to fairer pricing and fewer bad loans.

- Customer Service Support: AI can handle routine inquiries, freeing up human agents to deal with more complex or sensitive customer issues that require a personal touch.

By taking over repetitive tasks and providing deeper insights, AI allows financial experts to focus on strategic thinking and building stronger client relationships. This collaboration between humans and AI is where the real innovation happens, pushing the industry forward and creating more efficient, responsive financial services for everyone.

Key Trends Shaping Money 2020 Europe

Alright, let’s talk about what’s really moving the needle in finance right now, based on what we saw and heard at Money 20/20 Europe 2026. It feels like things are speeding up, and not just a little bit.

Real-Time Payments: Accelerating The Speed Of Transactions

Remember when waiting a few days for a payment to clear was normal? Yeah, me neither. Real-time payments are becoming the standard, and it’s changing how businesses and people handle money. It means instant access to funds, better cash flow for companies, and a much smoother experience for everyone. Think about paying a contractor and them having the money right away, or getting paid for that freelance gig the second you finish it. It’s a big deal for day-to-day finances and for how businesses operate. This shift is really about making money move at the speed of life.

Buy Now, Pay Later: Shaping Consumer Credit

Buy Now, Pay Later (BNPL) services are still a hot topic. They’ve totally changed how people think about buying things, especially bigger purchases. Instead of saving up for months or using a credit card with high interest, folks can spread the cost over a few interest-free payments. It’s super convenient, and a lot of younger consumers are really into it. Of course, there are questions about debt and responsible lending, and regulators are definitely paying attention. But for now, BNPL is a major force in how people access credit and manage their spending. It’s a different way to approach consumer credit, for sure.

Cross-Border Payments: Expanding Market Reach

Sending money internationally used to be a headache. Slow, expensive, and full of hidden fees. But that’s changing fast. The focus now is on making cross-border payments quicker, cheaper, and more transparent. This is huge for businesses looking to sell globally and for individuals wanting to send money to family abroad without losing a big chunk to fees. We’re seeing a lot of innovation here, with new platforms and technologies making it easier than ever to connect markets. Expanding market reach through better payment systems is a top priority for many. It’s all about breaking down those financial borders and making the world feel a little smaller when it comes to moving money. This trend is directly linked to the broader push for digital transformation in finance.

Startup Success At Money 2020 Europe

Money 20/20 Europe is always buzzing with new ideas, and this year was no different. It’s where founders with big dreams meet people who can help make those dreams a reality. You see a lot of energy here, a real drive to change how we handle money.

Turning Bold Ideas Into Real-World Impact

Lots of startups at the event are focused on solving specific problems. Think about financial inclusion – making sure everyone, no matter their background, can access financial services. Or consider how to make payments easier, especially when sending money across borders. It’s not just about having a cool app; it’s about creating something that actually helps people and businesses.

- Focus on a clear problem: What pain point are you addressing?

- Build a strong team: You need people with different skills.

- Get feedback early and often: Don’t wait until your product is perfect to show it to users.

Key Strategies for Startup Growth in a Changing Industry

Growing a startup in finance isn’t easy. The rules can change, and new technologies pop up all the time. One thing that stood out was the importance of partnerships. Working with bigger, established companies can give startups a boost, opening doors to more customers and resources. It’s about finding the right balance between staying true to your vision and adapting to what the market needs.

| Area of Focus | Strategy Example |

|---|---|

| Customer Acquisition | Targeted digital marketing campaigns |

| Product Development | Iterative design based on user feedback |

| Funding | Strategic alliances with established financial players |

| Market Expansion | Piloting services in new geographic regions |

Scaling Fintech Ventures in Emerging Markets

We heard a lot about opportunities outside of the usual big markets. Places in Asia and Africa, for example, are seeing huge growth in digital finance. Startups that understand the local needs and can build solutions for those specific markets are the ones that seem to be doing well. It’s about more than just copying what works elsewhere; it’s about genuine local adaptation. The key is often understanding the unique user behaviors and regulatory environments of each new market.

The Future Of Banking And Payments

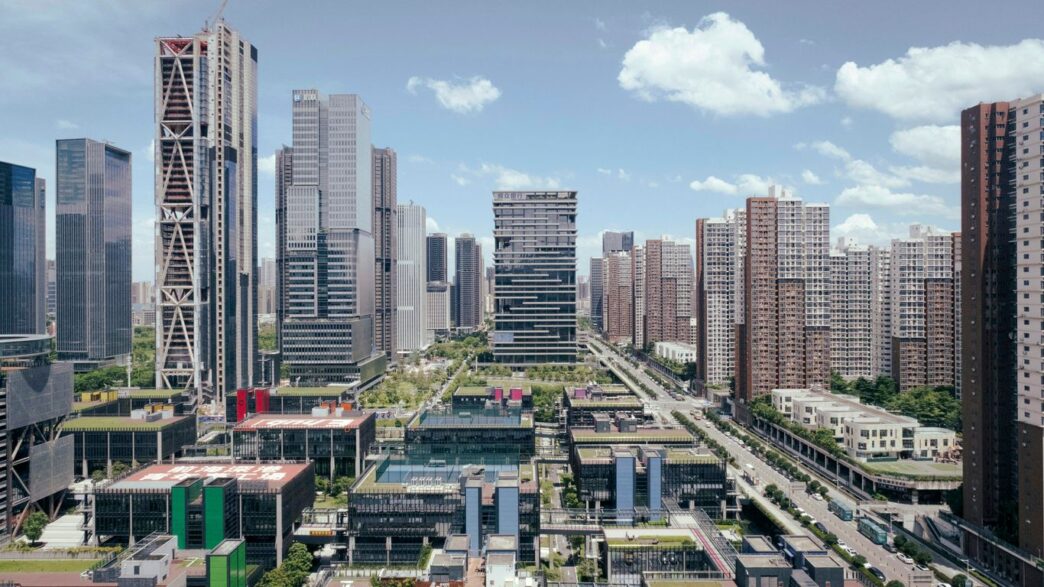

Digital Transformation Strategies for Global Banks

So, banks are really having to rethink how they do things, right? It’s not just about having a website anymore. Global banks are looking at this big digital shift and trying to figure out the best way forward. They’re talking about things like making their apps super easy to use, almost like the apps we use for social media. Think about it: you want to check your balance or send money without a whole song and dance. This means investing a lot in technology and training their staff to keep up. They’re also looking at how other companies, like those fintech startups, are doing things and trying to borrow some of that speed and innovation. It’s a huge undertaking, trying to update systems that have been around for ages.

Navigating Regulatory Shifts in Financial Services

This is a big one. The rules for banks and financial companies are always changing, and it feels like they’re changing even faster now with all this new tech. It’s like trying to hit a moving target. For example, with all the new ways people are paying and sending money across borders, governments are stepping in to make sure things are safe and fair. Banks have to be really careful to follow all these rules, or they could face some serious fines. It means they need smart people who understand both the technology and the law, which isn’t always an easy combination to find. They’re constantly trying to stay ahead of the curve, so they don’t get caught off guard.

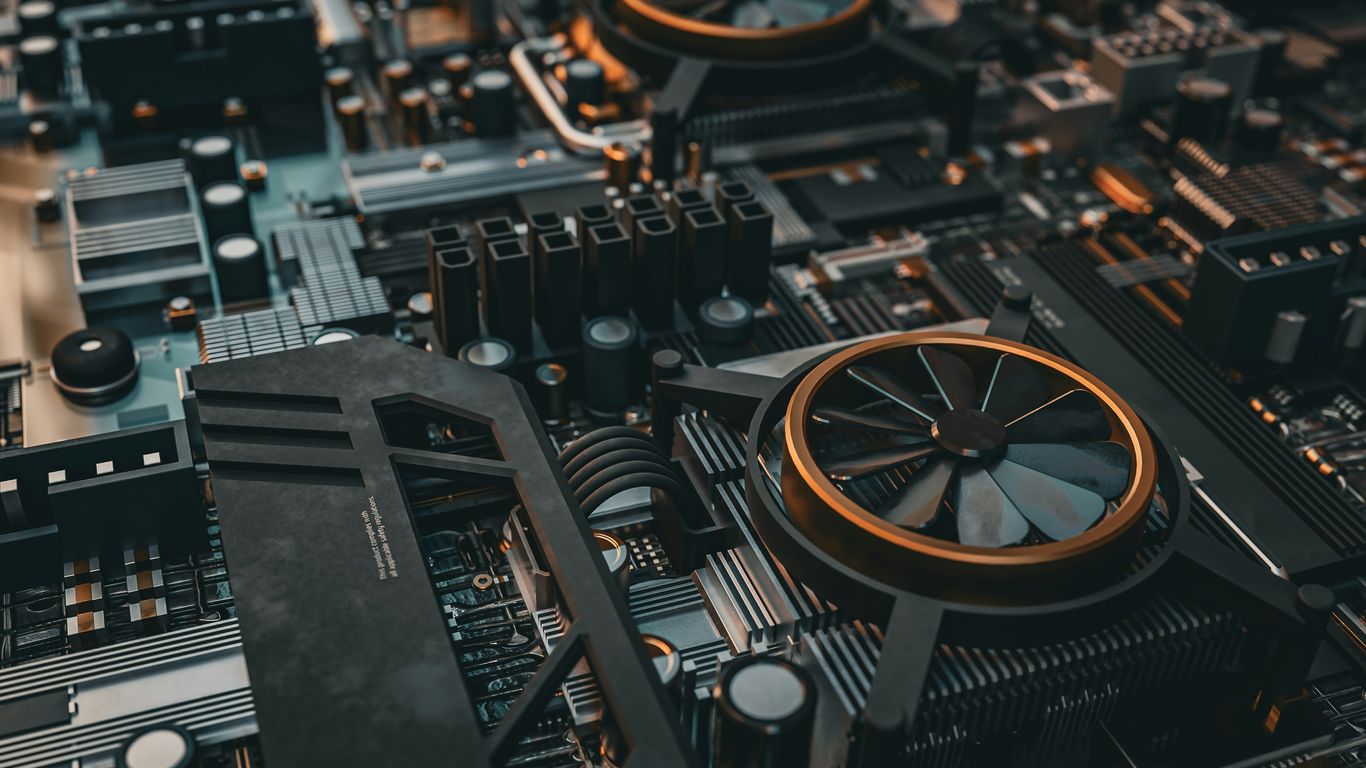

The Role of Blockchain in Property Transactions

This is a pretty interesting area. Blockchain, the tech behind cryptocurrencies, is starting to show up in other places, like buying and selling houses. Right now, buying property can be a really slow and complicated process, with tons of paperwork and middlemen. Blockchain could potentially make all of that much faster and more secure. Imagine having a digital record of who owns what that everyone can trust and see, without needing a central authority to verify it. It could cut down on fraud and make the whole thing smoother. While it’s not everywhere yet, people are definitely exploring how it could change things, especially for big, expensive purchases like real estate.

Building Trust In The Digital Age

In today’s fast-paced financial world, trust isn’t just a nice-to-have; it’s the bedrock upon which everything else is built. With so much happening online, people need to feel secure about where their money is going and how their personal information is being handled. It’s a big deal, and companies at Money 20/20 Europe were talking a lot about how to get it right.

Prioritizing Security and Privacy in Financial Services

This is probably the most talked-about aspect. When you’re dealing with money, people expect top-notch security. It’s not just about preventing hacks; it’s about making sure customer data stays private. Think about it: would you use a banking app if you weren’t sure your details were safe? Probably not. Companies are investing heavily in making their systems tough to break into and transparent about how they use data. It’s a constant race, but a necessary one.

Addressing Cyber Risks and Data Breaches

Cyber threats are a real headache. We heard stories and saw stats about how often these attacks happen. It’s scary stuff. A single data breach can ruin a company’s reputation overnight. So, what are companies doing? They’re building better defenses, training their staff, and having plans ready for when (not if) something goes wrong. It’s about being prepared and quick to respond. A good plan can make a huge difference in bouncing back.

Frictionless User Journeys for Enhanced Adoption

Here’s an interesting point: making things super secure can sometimes make them a pain to use. Nobody wants to go through ten different steps just to log in. The trick is finding that balance. The goal is to make security feel invisible to the user. Think about how easy it is to use some apps now – you barely notice the security working in the background. This smooth experience is what gets people to actually use these new financial tools. If it’s clunky, people will just stick to what they know. It’s all about making the digital financial world feel as easy and safe as possible, so more people feel comfortable using it. This is a big reason why events like Money 20/20 Europe are so important for sharing these ideas.

Sustainable Finance And Regulatory Agility

It’s becoming really clear that just making money isn’t enough for a lot of companies these days, especially in finance. People want their money to do good, too. This is where sustainable finance comes in, and it’s a big topic at events like Money 20/20 Europe. We’re talking about Environmental, Social, and Governance (ESG) initiatives, and how fintech can actually help push these forward. Think about it: fintechs can build platforms that make it easier for people to invest in green projects or support businesses with good social practices. It’s not just a nice-to-have anymore; it’s becoming a key way for companies to stand out.

Driving ESG Initiatives Through Fintech

Fintechs are finding creative ways to weave sustainability into their operations and products. For instance, some are developing apps that track the carbon footprint of your spending, while others are creating investment tools focused solely on ESG-compliant companies. This shift is driven by consumer demand; more people want to align their finances with their values. The challenge, however, lies in making these sustainable options accessible and competitive.

Here are a few ways fintechs are making ESG a reality:

- Green Investment Platforms: Offering easy access to funds and stocks focused on renewable energy, clean water, and social impact.

- Carbon Footprint Tracking: Tools that help individuals understand and reduce their environmental impact through their financial habits.

- Ethical Lending: Developing loan products that support businesses with strong social and environmental track records.

Overcoming Challenges in Financial Inclusion

Beyond just being green, finance needs to be for everyone. Financial inclusion is still a massive hurdle, and fintechs are trying to bridge that gap. It’s tough, though. Things like lack of digital know-how, poor internet access in some areas, and just the sheer difficulty of making these services profitable are big problems. We saw that around 24.6% of people struggle with digital literacy and infrastructure, and 24.4% face regulatory hurdles. It’s a complex puzzle, but companies that can crack it will find a huge market.

Adapting to Dynamic Market Conditions with Regulatory Agility

This whole fintech world moves at lightning speed, and regulations have to keep up. It’s a constant dance between innovation and making sure consumers are protected. Events like Money 20/20 Europe are where these conversations happen – how can regulators and fintechs work together? We’re seeing a move towards more collaboration, with groups trying to create clearer rules that don’t stifle new ideas. Regulatory sandboxes, where new products can be tested safely, are becoming more common. Around 73% of fintechs in these programs report getting their products to market faster. It’s all about finding that sweet spot where new tech can flourish without causing chaos. For more on how companies are adapting, you can check out this article on digital disruption. Balancing innovation with rules is key to building a trustworthy financial future.

Wrapping It Up

So, what’s the takeaway from all the buzz at Money 2020 Europe 2026? It’s pretty clear that things are moving fast in the world of money. From banks trying to keep up with new tech to startups with big ideas, everyone’s looking for an edge. We saw a lot of talk about AI, making things easier for customers, and how important it is for companies to work together. It’s not always simple, and there are definitely challenges, especially around keeping data safe. But one thing’s for sure: the way we handle money is changing, and it’s going to keep changing. Staying on top of these shifts seems like the main goal for everyone involved.

Frequently Asked Questions

What are digital wallets and virtual cards?

Think of digital wallets like your phone holding your credit and debit cards, but online. Virtual cards are like temporary card numbers you can use for shopping online to keep your real card info safe.

What is Open Banking?

Open Banking lets you securely share your bank information with other apps and companies. This means you can use different tools to manage your money better or get special offers.

How is AI changing money stuff?

AI, which is like smart computer brains, helps apps manage your money better, spots risky stuff, and makes banking easier and faster for everyone.

What are real-time payments?

These are payments that happen instantly, like sending money to a friend and they get it right away, instead of waiting for it to go through.

What’s ‘Buy Now, Pay Later’?

It’s a way to buy something today and pay for it in small chunks over time, often without paying extra interest if you pay on time.

Why is security important for online money?

Keeping your money safe online is super important. Companies need to protect your info from hackers and make sure using their services is easy and trustworthy.