So, Money20/20 Asia 2025 just wrapped up in Bangkok, and wow, what a few days. It felt like the whole fintech world descended on the city, talking about everything from sending money overseas to how AI is changing the game. It’s a lot to take in, but I managed to pull out some of the main points that seem to be shaping how we’ll all be handling our money in the near future. Think less paperwork, more tech, and a big focus on making things easier for everyone.

Key Takeaways

- Cross-border payments are getting a serious upgrade, aiming to make sending money internationally smoother and cheaper, especially for businesses trading in Southeast Asia.

- AI isn’t just a buzzword; it’s actively being used in banking to make things better for customers and help bank employees do their jobs more effectively.

- Super apps, those all-in-one platforms popular in Asia, are being looked at by Western companies, with a focus on how they build trust and get younger people, like Gen Z, interested in managing their money and investments.

- Financial inclusion is a big deal, with efforts to make wealth management tools more modern and accessible, so more people can start investing, even with small amounts.

- Regulators and fintech companies are talking more, working together on things like open banking and sustainable finance to help the industry grow responsibly.

Money20/20 Asia 2025: A Hub for Fintech Innovation

The Global Fintech Ecosystem and Its Asian Presence

Money20/20 Asia 2025 recently wrapped up in Bangkok, and it really felt like the pulse of global fintech was beating strong right there in Thailand. This event isn’t just another conference; it’s become a major meeting point for anyone serious about payments, financial services, and the tech driving it all. Since it started in the US back in 2012, Money20/20 has really spread its wings, with big events now happening across Europe, the Middle East, and of course, Asia. After a few years away, the Asia edition made a comeback in Bangkok in 2024, and it seems like it’s found its permanent home. The 2025 schedule shows just how global this thing is, with stops planned in Bangkok, Amsterdam, Riyadh, and Las Vegas.

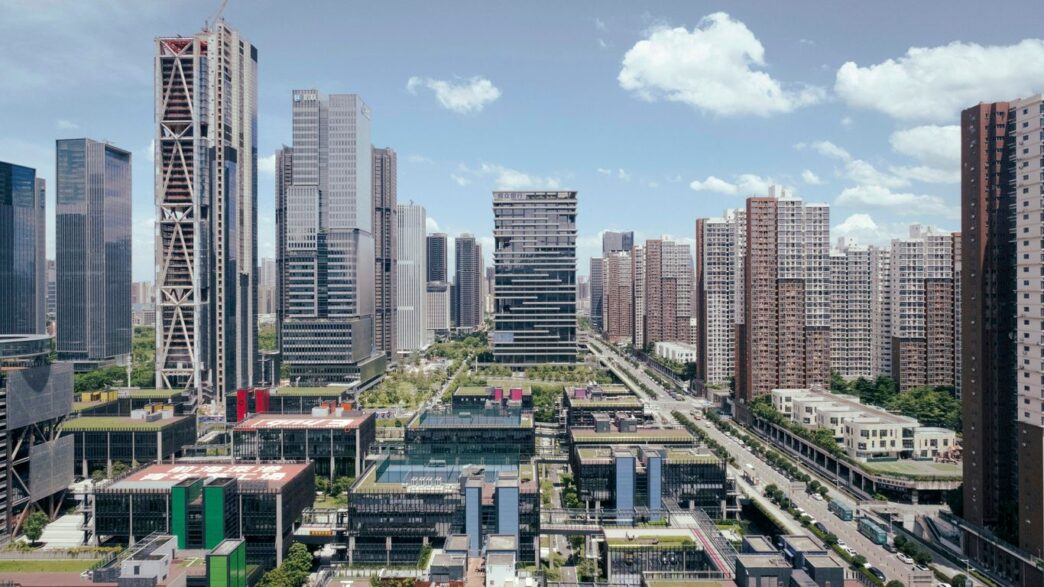

Bangkok as the Epicenter for Financial Technology

Why Bangkok? Well, it turns out Thailand’s digital economy is pretty impressive, projected to hit $50 billion by 2025. That’s a huge market, and it’s built on a solid foundation of financial innovation. The city itself is becoming a real hotspot for fintech, attracting companies and ideas from all over. It’s not just about the money, though. There’s a real focus on making financial services work better for everyone, and Bangkok seems to be leading the charge in Southeast Asia for this kind of forward-thinking approach. The event organizers clearly saw something special here, and the turnout and energy confirmed it.

Key Themes Driving the Money20/20 Asia Agenda

The main idea floating around the conference this year was about using collaboration to make fintech better for people – think secure, easy, and sustainable innovation, especially for Asia. It sounds a bit grand, but it really points to how unique the fintech scene is in this part of the world. Several big topics kept coming up:

- Cross-Border Payments: Making it easier and cheaper to send money internationally was a huge talking point. Lots of discussion about new tech to speed things up and cut down on fees, especially for businesses trading across borders.

- Artificial Intelligence (AI): AI wasn’t just a buzzword; it was everywhere. People talked about how AI is changing banking, making services smarter, and even helping people do their jobs better. The focus was on practical uses, not just futuristic ideas.

- Super Apps and Digital Wallets: The Asian model of having one app for everything, like payments, shopping, and more, is really catching on. There was a lot of talk about how Western companies are trying to copy this, but also about the importance of building trust and making these apps genuinely useful for everyday life, especially for younger generations.

- Wealthtech and Financial Inclusion: Making investing and managing money easier for everyone was another big theme. This included updating old banking systems and using digital tools to make financial advice and investment opportunities more accessible, particularly for people who haven’t had access before.

- Collaboration and Regulation: Getting regulators and businesses talking was key. The idea is to grow responsibly, especially with new ideas like open banking and making finance greener. It seems like everyone agrees that working together is the way forward.

- Startup Growth: For new companies, especially in developing markets, figuring out how to grow was a major focus. This included tips for payment companies and a special look at supporting women in tech and entrepreneurship. There were also specific lessons for Japanese fintech companies looking to expand.

Cross-Border Payments and Regional Connectivity

Innovations in Facilitating International Transactions

Moving money across borders used to be a real headache, right? It felt like sending a letter by carrier pigeon sometimes. But things are changing, and fast. At Money20/20 Asia 2025, it was clear that making international payments smoother is a huge focus. We saw a lot of talk about how Account-to-Account (A2A) payments are really stepping up. Instead of going through a bunch of middlemen, A2A lets money go straight from one bank account to another. It’s quicker and usually cheaper, which is a big deal for businesses and individuals alike.

Then there’s the whole dynamic currency conversion (DCC) thing. Think about booking a flight with Aer Lingus. DCC lets you pay in your own currency right there and then. No more guessing what the exchange rate will be later or getting hit with surprise fees. It makes the whole process way more transparent. Partnerships between companies like AIB Merchant Services and Fexco are showing how this can work really well, making travel payments less stressful.

Addressing Challenges in Southeast Asian Payments

Southeast Asia is a hotbed for fintech, but sending money around the region isn’t always easy. A lot of people and businesses find the current payment systems too complicated. Sometimes you can’t even pay in the currency you want, or there just aren’t enough payment options to cover everyone. This is where new payment architectures come in. The goal is to make things simpler, faster, and more affordable for everyone involved.

The Role of Fintech in Global Trade Facilitation

Fintech is really starting to make waves in global trade, especially for business-to-business (B2B) transactions. While consumer payments have gotten pretty slick over the last decade, B2B payments are still catching up. But that’s changing. Fintech companies that can work with bigger tech players are in a prime spot to shake things up. We’re talking about making payments more available, more efficient, and more timely. This isn’t just about moving money; it’s about making it easier for businesses to trade across borders, which helps the whole global economy grow. It’s a big shift from just simple transactions to something much more strategic for businesses.

Artificial Intelligence’s Transformative Impact on Finance

Artificial intelligence, or AI, isn’t just a buzzword anymore; it’s actively reshaping how financial services work. At Money20/20 Asia 2025, it was clear that AI is moving beyond experimental phases and into practical applications that are changing everything from customer service to risk management. The industry is really starting to see AI as a core part of its future strategy.

AI Use Cases in Banking and Financial Services

We saw a lot of discussion about how AI is being used right now. Fraud detection is a big one. By using AI to spot fake IDs or analyze suspicious transactions during customer onboarding, companies can cut down on losses and build more trust with their users. Generative AI, like chatbots, is also making waves. Banks are experimenting with these tools to automate parts of the customer experience, making interactions smoother. Think about getting quick answers to common questions or having a bot help you through a simple process – that’s AI at work.

Here are some of the ways AI is showing up:

- Fraud Detection: AI models can analyze patterns much faster than humans, identifying unusual activity that might signal fraud.

- Customer Service: Chatbots and virtual assistants powered by AI can handle a large volume of customer inquiries 24/7.

- Transaction Monitoring: AI can monitor transactions in real-time, flagging anything that deviates from normal behavior.

- Underwriting: AI can help assess risk more accurately and quickly when processing loan or insurance applications.

Strategies for User-Friendly AI Solutions

Making AI work for everyone, not just tech experts, is a major focus. It’s not enough to have powerful AI; it needs to be easy to use and understand. This means careful planning when rolling out AI across an organization. You have to think about security, making sure everything follows the rules, and building trust. For companies, this means keeping their brand’s voice consistent even when AI is handling customer interactions. It’s a balancing act, for sure.

Augmenting Human Capabilities with AI

One of the most exciting aspects is how AI can work alongside people, not just replace them. AI systems are getting better at handling complex tasks, freeing up human employees to focus on more strategic or nuanced work. The idea is to scale businesses and make human workers more effective. This requires teaching people how to use these new AI tools properly. It’s about creating a partnership where AI handles the heavy lifting or repetitive tasks, and humans provide the judgment, creativity, and empathy that AI can’t replicate. This approach is key to building a resilient and adaptable financial future, especially as we see more agentic AI that can act on behalf of customers, changing how businesses interact with their clients [964c]. Building trust in these AI agents is becoming a whole new challenge for the industry.

The Rise of Super Apps and Digital Wallets

Okay, so super apps. They’re everywhere in Asia, right? Think WeChat, Grab, Gojek. These platforms aren’t just for messaging or ordering food; they’ve become these all-in-one hubs for pretty much everything, including managing your money. At Money20/20 Asia 2025, there was a lot of talk about how Western companies are looking at these Asian models and trying to copy them. It makes sense, in a way. Who wouldn’t want a single app for payments, shopping, and maybe even investing?

Emulating Asian Super App Models in the West

It seems like the big idea is to bundle a bunch of services together. The thinking is that if people already trust an app for one thing, they’ll trust it for more. This is especially true in places where people might not have a lot of faith in individual financial services yet. The goal is to build that trust by offering a curated, reliable set of options all in one place. But, and this is a big ‘but’, just slapping a bunch of features onto an app doesn’t automatically make it a super app that works for everyone. The Asian market is pretty unique, and what works there might not fly in, say, Europe or North America. Companies need to really think about what their specific users actually want and need, not just blindly follow a trend. It’s more about fitting the local scene than forcing a global template.

Building User Trust Through Integrated Services

When you’ve got an app that handles your payments, your ride-sharing, your food delivery, and maybe even your investments, it’s a lot to manage. The key, according to many discussions, is making sure all those different parts work together smoothly and, most importantly, securely. People are handing over a lot of personal information and financial data. If there’s a glitch or a security scare, that trust can vanish pretty fast. It’s not just about having the features; it’s about the reliability and the user experience across the board. Think about how digital transformation in Malaysia is pushing for more integrated financial services, making it easier for users to manage their finances without jumping between multiple apps.

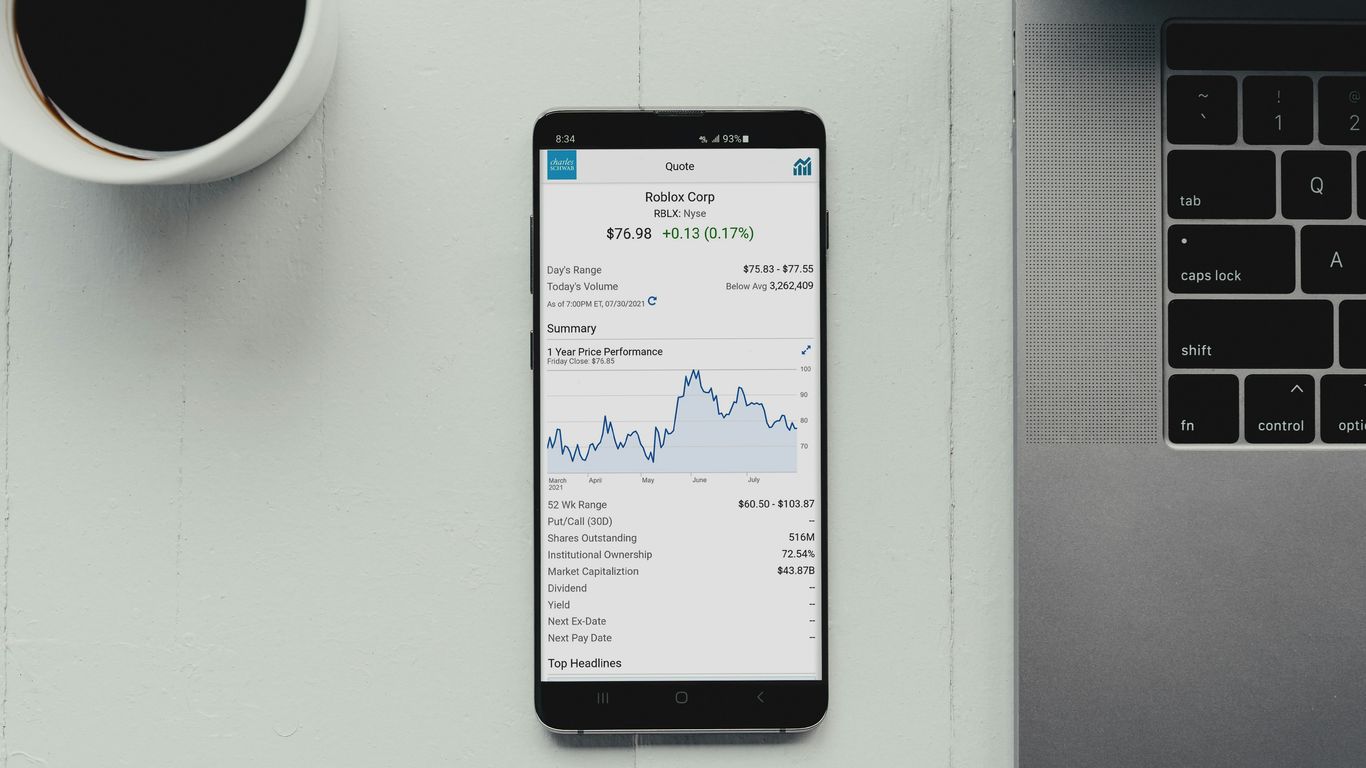

Gen Z Engagement with Integrated Financial Platforms

Here’s an interesting point: Generation Z. These younger folks are apparently more likely to get into investing if it’s right there in the apps they already use for everyday money stuff. They’re not necessarily looking to open a separate brokerage account. They want it easy, convenient, and integrated. So, if your app can handle their daily spending and also offer simple ways to start saving or investing, you’re probably going to catch their attention. It’s about meeting them where they are, with tools they’re already comfortable using. This means financial platforms need to be more than just transaction tools; they need to be lifestyle hubs.

Wealthtech and Financial Inclusion Initiatives

This year’s Money20/20 Asia really hammered home how important it is to get financial tools into more people’s hands. It wasn’t just about fancy investment platforms for the already wealthy; there was a big push to modernize how banks handle wealth management and, more importantly, how we can make investing accessible to everyone.

Modernizing Core Banking Systems for Wealth Management

We heard a lot about how older banking systems are just not cutting it anymore for wealth management. Think about it – trying to manage complex investment portfolios or offer personalized advice using systems built decades ago? It’s like trying to run the latest software on a flip phone. Companies are looking at ways to update these core systems, often through partnerships or by adopting more flexible, cloud-based solutions. The goal is to make things faster, more secure, and able to handle the kind of data needed for smart investment strategies. It’s not a quick fix, but it’s definitely a necessary step for banks that want to stay relevant.

Enhancing Customer Experience with Digital Tools

Beyond just the backend systems, a huge focus was on the customer’s end. How do people actually interact with their money and investments? We saw a lot of talk about digital tools that make managing wealth simpler. This includes things like user-friendly apps that give you a clear picture of your investments, automated advice, and easy ways to track your progress. The idea is to take the intimidation factor out of wealth management. It’s about making financial planning feel less like a chore and more like a natural part of managing your life.

Investment Accessibility for Financial Inclusion

This was perhaps the most inspiring part. Several sessions highlighted how technology can be a real game-changer for financial inclusion. For instance, in places like Indonesia, where a good chunk of the population is unbanked, apps are emerging that use learning to invest as a way to bring people into the financial system. It’s a smart approach: by teaching people about investing and letting them start small, these platforms help build financial literacy and wealth simultaneously. It’s not just about giving people access to a bank account; it’s about giving them the tools and knowledge to grow their money, no matter where they start. We saw examples of apps that allow very small initial investments, making it possible for almost anyone to start building a portfolio.

Collaboration and Regulatory Dialogue

It’s pretty clear from Money20/20 Asia 2025 that nobody in finance is an island. The big takeaway here is that progress, especially in a fast-moving sector like fintech, really hinges on different players working together and talking to regulators. It’s not just about building cool new tech; it’s about making sure that tech is safe, fair, and actually helps people.

Fostering Responsible Growth Through Regulator Engagement

Regulators are stepping up, and frankly, it’s about time. We heard a lot about how important it is for fintech companies to have open lines of communication with the people setting the rules. This isn’t about avoiding regulation, but about shaping it so it makes sense for innovation while still protecting consumers. Think about Malta being removed from the grey list – that’s a sign that when regulators and businesses work together, good things can happen. It shows a commitment to being open for business, especially in payments and fintech.

- Proactive communication: Fintechs need to be upfront with regulators about what they’re building.

- Shared understanding: Regulators need to understand the tech, and companies need to understand the risks.

- Adaptive frameworks: Rules need to be flexible enough to keep up with new developments.

Open Infrastructure and Payment Innovation

This whole idea of open infrastructure, like open banking, is a huge deal. It’s about creating systems where different financial services can talk to each other. This makes things smoother for customers and opens up new possibilities for businesses. But it also means we need clear rules, especially when it comes to things like payments. The push for a standardized backend infrastructure in Europe, for example, is all about making payments more secure, driving innovation, and increasing competition. It’s not just about making things faster, but also about making sure everyone is playing by the same, safe rules. We saw discussions about how different countries, like the UK and the US, have different approaches to open banking, which really impacts how quickly things move and how consumers are protected. It’s a complex puzzle, but getting it right means better financial services for everyone.

Sustainable Fintech and Green Finance Collaboration

Beyond just making money, there’s a growing focus on making finance sustainable. This means looking at how financial services can support environmental goals. It’s a newer area, but the conversations at Money20/20 Asia showed a real interest in how fintech can play a part in green finance. This could involve everything from tracking carbon footprints to financing renewable energy projects. The industry is starting to see that financial success and environmental responsibility aren’t mutually exclusive. It’s going to take collaboration between fintechs, traditional banks, and even environmental groups to really make a difference here. We’re still in the early stages, but the direction is clear: finance needs to be part of the solution for a greener future. This is a topic that will likely see a lot more attention in the coming years, especially with the insights from research like the 2026 Fintech Trends Whitepaper which surveyed over 130 stakeholders in the Asia-Pacific region.

Scaling Fintech Startups in Emerging Markets

So, you’ve got a killer fintech idea, and you’re looking to make waves, especially in places where traditional finance hasn’t quite caught up. That was a big topic at Money20/20 Asia 2025. It’s not just about having a good product; it’s about figuring out how to actually get it into people’s hands and make it stick, particularly in markets that are still developing their digital infrastructure. The real challenge is moving beyond just having a cool app to building a sustainable business that serves a real need.

Navigating Growth Strategies for Payment Gateways

Payment gateways are like the highways of digital commerce. For startups, especially in places like Southeast Asia, getting this right is everything. You’re not just processing transactions; you’re building trust. Think about it: if a small business owner can’t easily accept payments online or if customers are worried about their card details, that’s a huge roadblock. Many startups are focusing on making their systems super simple to integrate, even for businesses with limited tech know-how. They’re also looking at ways to cut down on fees, which can eat into profits for smaller merchants. It’s a balancing act between offering competitive pricing and making sure the tech is robust enough to handle volume. We saw a lot of talk about how these gateways need to be flexible, adapting to local payment preferences, whether that’s mobile money, bank transfers, or even cash-on-delivery options in some areas. It’s about meeting people where they are.

Empowering Women in Technology and Entrepreneurship

This was a really inspiring part of the discussions. It’s pretty clear that the fintech world, like many tech sectors, has a gender gap. But there’s a growing recognition that bringing more women into tech and leadership roles isn’t just about fairness; it’s smart business. When women are involved in building financial products, they often bring different perspectives that can lead to more inclusive solutions. Think about financial products designed for women entrepreneurs or services that address the specific needs of female-headed households. The sessions highlighted the importance of mentorship programs and creating networks where women can share experiences and support each other. It’s about breaking down barriers, whether they’re cultural or systemic, and making sure everyone has a shot at building the next big thing in finance. It’s great to see initiatives focused on this, like those aiming to increase access to financial services.

Lessons for Japanese Fintech Stakeholders

Japan has a unique financial landscape, and fintech startups there face their own set of hurdles and opportunities. At Money20/20 Asia, there was a lot of interest in how Japanese companies can learn from the rapid growth seen in other Asian markets. One key takeaway is the need for agility. Traditional Japanese businesses can sometimes be slow to adopt new technologies due to established processes and a strong emphasis on stability. However, the fintech world moves fast. Startups need to be able to pivot quickly and embrace new tech, like AI, to stay competitive. There’s also a big opportunity in looking beyond Japan’s domestic market. Many successful Asian fintechs have expanded regionally, and there’s potential for Japanese innovation to find traction elsewhere. The discussions also touched on the importance of collaboration, both with local players and international partners, to accelerate growth and bring new ideas to market. It’s about finding that sweet spot between Japan’s strengths and the dynamic pace of global fintech.

Wrapping It Up

So, Money20/20 Asia 2025 wrapped up, and it was quite the event. We saw a lot of talk about how different parts of the world are doing things with money tech, especially in Asia. Things like making payments across borders easier and how AI is changing the game were big topics. It seems like everyone’s trying to figure out how to make financial stuff simpler and more accessible for people. It’s clear that collaboration is key, and there’s a lot of innovation happening. It gives you a good sense of where things are headed in the world of finance, and it’s definitely moving fast.

Frequently Asked Questions

What is Money20/20 Asia?

Money20/20 Asia is a big yearly meeting for people who work in money and technology, like banks and new tech companies. It’s a place where they share ideas about new ways to handle money, make payments easier, and use technology to help people.

Where did Money20/20 Asia 2025 take place?

The 2025 event was held in Bangkok, Thailand. This city is becoming a major center for new money technology in the Asian region.

What were the main topics discussed at Money20/20 Asia 2025?

Key talks focused on how to send money across countries more easily, how smart computer programs (like AI) are changing money services, and how ‘super apps’ (apps with many features) are becoming popular. They also talked about new ways to invest and help people who don’t have bank accounts.

How is Artificial Intelligence (AI) changing the finance world?

AI is helping banks and money companies work better. It can be used to help customers, make services faster, and even help people do their jobs better by handling some tasks. It’s making things smarter and more efficient.

What are ‘super apps’ and why are they important?

Super apps are like one app that does many things, such as sending money, shopping, or ordering food. They are popular in Asia and are being looked at by companies in other parts of the world. They make it easy for people to manage different things all in one place.

Why is it important for companies and governments to work together in finance?

When companies and government rule-makers work together, it helps make sure new money technology grows in a safe and helpful way. It also helps create new ways for people to pay and trade things, making things smoother for everyone.