The world of connected devices is getting bigger, and fast. It feels like every day there’s a new gadget or system that talks to the internet. This boom means a lot of money is being poured into companies that make this possible, especially the ones that handle how all these devices connect. If you’re thinking about investing in this space, or if you run a company in it, understanding where the money is going and what’s driving it is pretty important. We’re looking at 2026, and things are moving quickly.

Key Takeaways

- Record amounts of money are going into companies that help devices connect, with a big chunk of that going to later-stage businesses that have already shown they can make money.

- Industrial IoT and cybersecurity are getting a lot of attention from investors, along with smart infrastructure and ways to analyze data quickly.

- North America and Asia-Pacific are leading the way in where the investment money is going, but Europe and the Middle East are also seeing more funding, especially for public projects.

- New technologies like 5G and new ways of building networks are changing the game, leading to more partnerships and focus on making things work together smoothly.

- To get funding, companies need to show they have real customers, focus on specific industries, and use AI to offer smart solutions that stand out.

Understanding the Internet of Things Investment Landscape

Record Capital Infusion in Connectivity Platforms

The money flowing into IoT connectivity platforms has been pretty wild lately. We’re seeing record amounts of capital being poured in, which shows a lot of confidence from investors. It seems like companies that can actually show they’re making things work in the complex world of IoT are getting a lot of attention. In the first half of 2025 alone, over $1.45 billion went into these platforms and related services. That’s a huge number, and it’s not just small change either. The average deal size is now around $91 million, meaning investors are looking for bigger opportunities and are more comfortable with later-stage companies that have proven their worth.

Projected Market Opportunity and Growth Trajectory

So, what’s the big picture? The overall IoT market is massive, with projections suggesting it could reach $11 trillion. While that number might have been a bit optimistic initially, it still points to a huge opportunity. Looking specifically at IoT connectivity platforms, the market is expected to keep growing. By 2029, it’s projected to hit $21.79 billion, growing at a solid 20.8% each year. And if you look even further out, to 2034, that number could jump to $49.17 billion. This isn’t just a short-term fad; it looks like sustained growth, making it a really interesting area for investment and new ideas. A big reason for this is the sheer number of connected devices, which is already in the billions and keeps climbing. By the end of 2025, we’re looking at around 21.1 billion connected devices, a 14% jump from the previous year. That kind of growth means platforms that can manage all these connections need to be robust and scalable.

Key Investment Volume and Average Deal Size Trends

Let’s break down where the money is going. In the first half of 2025, the focus areas for investment were pretty clear:

- Industrial IoT and Cybersecurity: This grabbed about 34% of the investment, which makes sense given how critical security is for industrial operations.

- Connectivity and Satellite Services: Coming in at 28%, this highlights the ongoing need for reliable ways to connect devices, no matter where they are.

- Smart City/Building Intelligence: This area attracted 22% of the funds, showing a big push towards making our cities and buildings smarter.

- AI-Driven Analytics: Rounding out the top areas, 16% went into using artificial intelligence to make sense of all the data being generated.

We’re also seeing some big names making moves. For instance, Terminus Technologies secured $276 million for its smart city AI work, and Armis Security raised $200 million to boost its industrial IoT cybersecurity. These kinds of large rounds, especially at the growth stage, show where investors are placing their bets for the future of connected technology. It’s clear that investors are looking for solutions that address real-world problems with advanced technology.

Strategic Focus Areas for Internet of Things Investment

When looking at where the money is going in the Internet of Things space for 2026, a few key areas are really standing out. It’s not just about connecting devices anymore; it’s about making those connections smart, secure, and useful.

Industrial IoT and Cybersecurity Dominance

This is where a big chunk of the investment is landing, and for good reason. Think factories, supply chains, and critical infrastructure. Companies are pouring money into making these industrial operations more efficient and safer through connected devices. The need for robust cybersecurity in these sensitive environments is paramount, driving significant funding towards solutions that protect against breaches and ensure operational continuity. We’re seeing a lot of focus on platforms that can monitor equipment in real-time, predict maintenance needs, and automate processes. It’s about making industries run smoother and with fewer risks.

Connectivity, Satellite Services, and Smart Infrastructure

Beyond the factory floor, investment is also flowing into the backbone of IoT: connectivity. This includes everything from advanced cellular networks like 5G to the growing world of satellite services, which are opening up connectivity to remote areas. Smart city initiatives are also a major draw. This means funding for projects that make our cities more livable and efficient, like smart grids, intelligent transportation systems, and connected public safety tools. It’s all about building the infrastructure for a more connected future, both in urban centers and beyond.

AI-Driven Analytics and Real-Time Insights

Having all these connected devices generates a mountain of data. The real value, though, comes from making sense of it. That’s where Artificial Intelligence and machine learning come in. Investors are keen on companies that can take raw IoT data and turn it into actionable insights, often in real-time. This could be anything from optimizing energy consumption in buildings to personalizing customer experiences. The ability to analyze data quickly and accurately is what separates a good IoT solution from a great one, and that’s where the smart money is heading.

Geographic Hotspots for Internet of Things Funding

When we look at where the money is actually going for IoT projects, a few places really stand out. It’s not just one big global rush; there are definite centers of activity.

North America and Asia-Pacific Lead Investment

These two regions are pretty much the heavy hitters right now. You’ve got the United States and China, in particular, seeing a ton of investment. Think big rounds of funding, lots of startups getting off the ground, and established companies making strategic moves. The infrastructure is already there, with strong tech sectors and a real appetite for new connected solutions. Japan and South Korea are also big players in Asia-Pacific, pushing forward with industrial and smart city applications.

Europe’s Growing Public-Private Initiatives

Europe is doing its own thing, and it’s pretty interesting. While maybe not always hitting the same massive deal sizes as North America or Asia, there’s a lot of coordinated effort happening. Governments are getting involved, often partnering with private companies to fund big projects, especially in areas like smart cities and making industries more efficient. They’re setting up innovation hubs and testbeds, which is great for getting new ideas out there and tested.

Emerging Markets in the Middle East

Don’t sleep on the Middle East, though. Places like the UAE and Saudi Arabia are putting serious money into building out their digital infrastructure. They see IoT as a key part of their future, aiming to create smarter cities and diversify their economies. This means a lot of investment is flowing into foundational technologies and large-scale deployments. It’s a region that’s really trying to leapfrog ahead.

Emerging Trends Shaping Internet of Things Connectivity

The way devices talk to each other is changing, and it’s a big deal for anyone investing in IoT. We’re seeing some major shifts that are really setting the stage for what’s next.

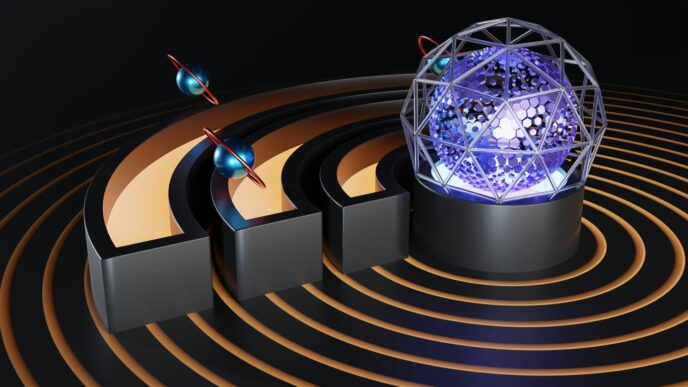

The Impact of 5G and Open RAN on Investment

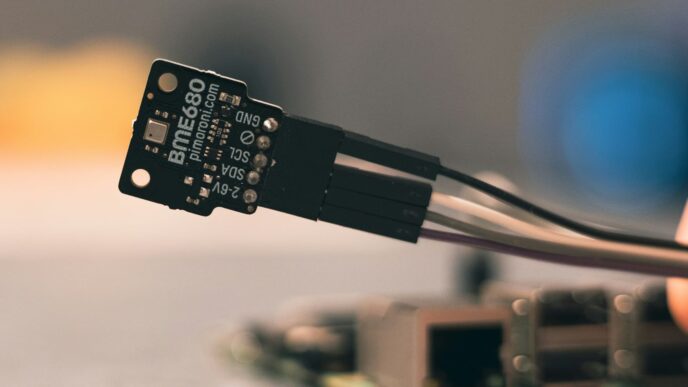

So, 5G is finally rolling out more widely, and it’s not just about faster phone speeds. For IoT, it means lower delays and the ability to connect way more devices in a smaller area. This is opening up doors for new kinds of applications that just weren’t possible before, like real-time control systems for factories or super-responsive smart city services. Alongside this, Open RAN is shaking things up in the network infrastructure world. Think of it like using standard parts instead of custom-built ones for your cell towers. This approach could make networks more flexible and cheaper to build, which is great news for investors looking for scalable solutions. Companies that can build or use these new, more adaptable networks are definitely catching attention.

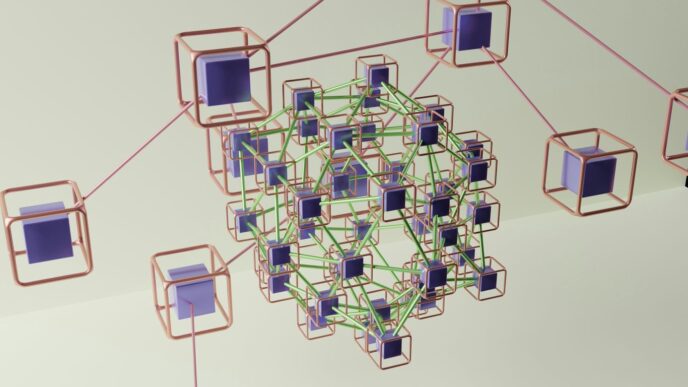

Cross-Industry Collaboration and End-to-End Solutions

Nobody operates in a vacuum anymore. We’re seeing a lot more companies, from telecom providers to software developers and hardware makers, teaming up. They’re not just selling individual pieces of the puzzle; they’re trying to offer complete packages. This means you can get a system that handles everything from the device itself, to how it connects, how it stores data, and how you analyze it. For investors, this trend points towards companies that can manage these complex partnerships and deliver a truly finished product. It simplifies things for businesses wanting to adopt IoT, and that kind of clear value proposition is attractive.

Automation-First Design and API Programmability

Setting up and managing IoT devices can be a real headache. That’s why a big trend is designing systems that are automated from the start. This means less manual work, fewer errors, and faster deployment. Think about systems that can set themselves up or fix common issues without human intervention. On top of that, making these systems programmable through APIs (Application Programming Interfaces) is key. This allows different software systems to talk to each other easily. For large companies, this programmability is a game-changer, letting them integrate IoT data into their existing operations smoothly. Companies focusing on making IoT management simpler and more automated are likely to see strong interest.

Here’s a quick look at what’s driving this:

- More Devices: Billions of new devices are coming online every year, needing better ways to connect and be managed.

- New Network Tech: 5G and Open RAN are changing the game for how networks are built and how they perform.

- Complex Needs: Businesses want more than just connected devices; they want integrated solutions that solve specific problems.

- Simpler Management: Automation and easy-to-use interfaces are becoming must-haves, not just nice-to-haves.

Navigating Market Maturity and Consolidation

So, the Internet of Things (IoT) space is really starting to grow up. It feels like just yesterday we were talking about basic connectivity, but now things are getting serious. We’re seeing bigger money flowing in, and not just to any startup. Investors are looking for companies that have already proven they can make money and operate on a global scale. It’s less about a cool idea and more about solid business.

The Rise of Growth-Stage Rounds and Larger Deals

Forget those tiny seed rounds from a few years back. The big money now is going into growth-stage funding. Think Series C, D, and beyond. Companies like Platform Science, which raised $125 million, and TRACTIAN, with $120 million, show that investors are betting on established players with clear revenue streams. This trend means that if you’re a newer venture, you’ll need to show some serious traction and a solid plan to scale before you can expect significant investment. It’s all about demonstrating that you can handle larger operations and have a clear path to profitability. The average deal size is climbing, reflecting this shift towards more mature companies.

Mergers, Acquisitions, and Strategic Influence

With more money comes more consolidation. We’re seeing larger companies buying up smaller ones to grab market share or new technology. Semtech’s purchase of Sierra Wireless is a prime example of this. It’s not just about getting bigger; it’s about getting smarter and more capable. Companies are also looking at how they structure themselves. For instance, WISeKey’s move to secure voting rights in SEALSQ shows how important strategic control is becoming. It’s about positioning yourself not just to survive, but to potentially be a target for acquisition or to be the one doing the acquiring. This is a big part of the IoT connectivity platforms funding landscape right now.

Focus on Resilience and Data Discipline

In this maturing market, just having connected devices isn’t enough. Investors are really zeroing in on companies that can prove their resilience and handle data responsibly. This means having strong security measures in place – think role-based access control and multi-tenant isolation. It also means being smart about how you manage data, especially with all the new regulations popping up. Companies that can show they’re compliant, secure, and can offer flexible billing models are the ones attracting the most attention. It’s about building trust and showing you can operate reliably in a complex, global environment.

Key Funding Strategies for Internet of Things Ventures

So, you’ve got a killer IoT idea, but how do you actually get the money to make it happen? It’s not just about having a good concept anymore; investors are looking for specific things in 2026. It feels like the market is really settling down, and only the most focused companies are getting the big checks.

Targeting Growth-Stage Investors and Demonstrating Traction

Forget trying to get a huge amount of cash when you’re just starting out. Most of the big money, like 88% of it, is going into Series C, D, and E rounds. This means you really need to show that your business is working. What does that look like? It means having solid proof that customers want what you’re selling and that you’re making money. Think about showing clear market fit, how your business can grow without breaking, and a realistic plan for becoming profitable. Investors want to see that you’ve already figured out a lot of the hard stuff.

Leveraging Strategic Partnerships for Market Access

Going it alone is tough. Smart companies are teaming up with the big players. Think about partnering with telecom companies, major cloud providers, or other leaders in your industry. These partnerships can open doors to their existing customer bases, help you get your product out there faster, and even bring in co-investment. It’s a way to speed up how quickly you can develop new features, get into new markets, and just generally look more solid to potential investors. Companies like Microsoft and Vodafone are doing this, integrating IoT with cloud services, and big names like Deutsche Telekom are backing platforms like 1NCE.

Emphasizing Vertical Specialization and AI Capabilities

Instead of trying to be everything to everyone, focus on solving a specific problem for a particular industry. Investors are really interested in IoT platforms that tackle real-world issues, whether that’s making industrial equipment more secure, managing smart city infrastructure, or handling healthcare devices. Being a specialist helps you stand out. On top of that, showing how you use Artificial Intelligence is a big plus. Platforms that can analyze data in real-time, offer insights, and do it securely, especially at the ‘edge’ (closer to where the data is generated), are getting a lot of attention. It’s about showing you can provide smart, fast, and secure solutions.

Wrapping It Up

So, looking ahead to 2026, it’s clear the Internet of Things isn’t just a buzzword anymore; it’s a massive opportunity. We’ve seen how much money is flowing into this space, especially for companies that really know how to connect devices, keep them secure, and make them work smoothly. It’s not just about having a lot of gadgets online; it’s about making them useful, safe, and profitable. The companies that are going to win are the ones focusing on specific industries, using smart tech like AI and edge computing, and building platforms that can automate a lot of the heavy lifting. Keep an eye on those big partnerships and how satellite tech is changing the game too. It’s a busy market, but for those who play it smart, the rewards could be huge.

Frequently Asked Questions

What is the Internet of Things (IoT) and why is it important for investment?

The Internet of Things, or IoT, is like a giant network where everyday objects, from your watch to factory machines, can connect to the internet and share information. This is super important because it helps businesses work smarter, makes our cities more efficient, and can even improve our health. Because so many new things are getting connected, there’s a huge opportunity for companies that provide the technology and services to make this happen, which is why investors are putting a lot of money into it.

Where is most of the money going in IoT investments right now?

Right now, a lot of the investment money is going into areas that help businesses run better and keep things safe. This includes ‘Industrial IoT,’ which is about using connected devices in factories and industries, and ‘cybersecurity,’ which is about protecting all these connected devices from hackers. Money is also being invested in better ways to connect devices, like through satellites, and in making our cities smarter with connected infrastructure. Plus, companies that use smart computer programs (AI) to understand all the data from these devices are getting a lot of attention.

Which parts of the world are getting the most investment for IoT?

The areas getting the biggest investment are North America (like the United States and Canada) and the Asia-Pacific region (including countries like China and Japan). Europe is also seeing more investment, especially when governments and companies work together on big projects like smart cities. Some places in the Middle East are also starting to invest a lot in this technology as they build new, smart cities.

What new technologies are making IoT investments exciting?

One big thing is 5G, the next generation of mobile internet, which is much faster and can connect way more devices. This opens up new possibilities for IoT. Also, companies are working together more to offer complete solutions, meaning you can get everything you need from one place, from the device to the final insight. And there’s a big push to make things ‘automation-first,’ meaning systems are designed to work on their own as much as possible, using smart programming and easy-to-use tools.

Are there any challenges or changes happening in the IoT investment world?

Yes, the market is getting more mature, which means companies are getting bigger and deals are becoming larger. This is also leading to some companies buying others to grow. Investors are looking for companies that are already doing well and have proven they can make money. They also want companies that are very good at what they do in a specific area (like industrial IoT) and can use smart technology (AI) to provide unique value. Being reliable and careful with data is also becoming very important.

What’s the best way for a new IoT company to get funding?

For a new IoT company, it’s important to show that your idea works and that people want it by getting customers and making sales. Partnering with bigger, established companies can help you reach more people and get noticed. Focusing on solving a specific problem for a particular industry, like healthcare or farming, can make you stand out. Also, showing that your technology uses AI to provide smart insights or can work efficiently at the ‘edge’ (closer to where the data is created) is very attractive to investors.