Hey everyone, let’s talk about the world of chips. It’s a huge industry, and things are always changing. We’re looking ahead to 2026 and trying to figure out which companies are going to be the big players in supplying these essential components. It’s not just about who makes the most chips, but also who’s investing smartly and adapting to what the market needs. We’ll cover the major companies, what’s driving demand, where the manufacturing is happening, and what risks are out there for everyone involved in the semiconductor suppliers scene.

Key Takeaways

- Big chip makers like TSMC and Samsung are still leading the pack, but Intel is making big moves with its investments. They’re all trying to stay on top in this fast-moving market.

- AI is a massive driver for demand, especially for advanced chips. However, things are a bit slower for consumer electronics and cars right now, while networking chips are picking up steam.

- Europe is trying to boost its own chip production with the EU Chips Act, and places like the Netherlands are seeing a rise in new tech companies. The US is also expanding its own manufacturing capabilities.

- Companies like Nvidia are really strong in AI hardware, Broadcom leads in networking, Micron is doing well with memory, and Analog Devices is important for industrial uses. These semiconductor suppliers are key.

- The industry is spending a lot on new factories and equipment, especially for packaging and testing chips. But there are risks, like companies spending too much or too little, and the market can be unpredictable.

Dominant Players Shaping The Semiconductor Landscape

The semiconductor world is a pretty intense place right now, with a few big names really calling the shots. These companies aren’t just making chips; they’re basically building the foundation for all our future tech. It’s a constant race to make things smaller, faster, and more powerful, and these giants are leading the charge.

TSMC’s Manufacturing Prowess

When you talk about who actually makes the most advanced chips, Taiwan Semiconductor Manufacturing Company (TSMC) is the name that comes up again and again. They’ve built a reputation for being incredibly good at manufacturing, especially for the really cutting-edge stuff that companies like Apple and Nvidia need. Their ability to produce chips at the most advanced process nodes is a huge advantage. It’s not just about having the machines; it’s about the know-how and the sheer scale of their operations. They’re the go-to for many companies that design chips but don’t have their own factories. This focus on manufacturing excellence has put them in a very strong position in the market.

Intel’s Strategic Investments

Intel has been a household name in computing for decades, but they’ve been going through some changes. They’re making big moves to get back into the game of manufacturing the most advanced chips, not just for their own products but for others too. This means they’re pouring a lot of money into building new factories and upgrading their existing ones. It’s a massive undertaking, and they’re trying to catch up in some areas while also pushing forward with new technologies. Their strategy involves not only improving their own chip designs but also becoming a major player in the foundry business, competing directly with companies like TSMC. It’s a bold bet, and the industry is watching closely to see if they can pull it off.

Samsung’s Market Influence

Samsung is another powerhouse in the semiconductor industry, and they do a bit of everything. They’re not only a massive manufacturer of memory chips, like DRAM and NAND flash, which are essential for pretty much all electronic devices, but they also have their own chip design business. On top of that, they’re also a foundry, meaning they make chips for other companies, similar to TSMC. This broad reach gives them a lot of influence. Their integrated approach, from memory to logic and foundry services, allows them to adapt to market shifts and capitalize on different opportunities. They’re a major competitor across multiple segments of the semiconductor market, making them a company to keep an eye on.

Emerging Trends In Semiconductor Demand

The semiconductor market in 2026 is a bit of a mixed bag, honestly. On one hand, we’re seeing a huge surge in demand for chips that power artificial intelligence. Think about all those AI servers and advanced computing systems – they need some serious processing power, and that means a lot of advanced logic and memory chips. This AI-driven growth is really the engine pushing a lot of the industry forward right now.

But it’s not all sunshine and rainbows. We’re also seeing some softness in other big areas. The consumer electronics market, for instance, isn’t bouncing back as quickly as some hoped. People aren’t buying as many new phones, laptops, or gaming consoles as they used to, which puts a damper on demand for the chips that go into them. The automotive sector is also facing some headwinds, which affects the chips used in cars. It’s a bit of a divergence, where the cutting-edge AI stuff is booming, but the more everyday electronics are a bit sluggish.

Here’s a quick look at how things are shaping up:

- AI Infrastructure: Massive growth expected, driven by data centers and advanced computing.

- Consumer Electronics: Demand remains soft for smartphones, laptops, and gaming devices.

- Automotive: Facing some challenges, impacting chip demand in vehicles.

On top of that, the networking silicon space is really taking off. As more data needs to be moved around faster, especially with all the AI activity, the demand for high-performance networking chips is climbing. This is a critical area that supports the entire digital infrastructure.

The big picture is that while AI is a major driver, it’s not the only story, and we’re seeing a split in demand across different market segments. Balancing these trends is what chipmakers are focused on as they plan for the future.

Geographical Hubs And Regional Initiatives

It’s pretty clear that the semiconductor world isn’t just one big, happy global village. Different places are really trying to make their mark, and governments are getting involved in a big way. It’s all about trying to secure supply chains and build up local know-how.

Europe’s Ambitions With The EU Chips Act

Europe’s been talking a lot about wanting a bigger slice of the chip-making pie. The EU Chips Act is their big play, aiming to get the region to produce 30% of the world’s chips by 2030. That’s a huge jump from where they are now. It’s not just about building more factories, though. They’re also looking at boosting research and development and trying to get more home-grown talent into the field. It’s a massive undertaking, and getting there will take a lot of money and smart planning.

Netherlands’ Startup Ecosystem

When you look at the Netherlands, it’s kind of surprising how many small companies are popping up in the semiconductor space. We’re talking about startups focused on everything from the chips themselves to related tech like photonics and quantum computing. There are already a good number of established firms, and then you have these newer ones adding to the mix. Groups like Invest-NL are trying to throw some cash at these ventures, but it seems like they still need more big investment, especially from outside the country, to really take off.

US Domestic Capacity Expansion

Over in the US, there’s a big push to build more chip manufacturing right here at home. A lot of government money is flowing into this, aiming to strengthen the country’s ability to make chips, assemble them, test them, and even do advanced packaging. This isn’t just about having enough chips; it’s also about having more control over the supply chain. They’re also investing in research to stay at the cutting edge of chip technology. It’s a multi-pronged approach to ensure the US remains a major player in the semiconductor game.

Key Semiconductor Suppliers To Watch

Alright, so we’ve talked about the big picture – the trends, the regions, the money flowing around. Now, let’s get down to the nitty-gritty: which companies are really making waves in the semiconductor world right now, heading into 2026? It’s not just about who makes the most chips, but who’s building the future.

Nvidia’s AI Infrastructure Leadership

When you think AI, you probably think Nvidia. And for good reason. They’ve pretty much cornered the market on the specialized chips, the GPUs, that power all those massive AI models and data centers. Their dominance in AI infrastructure is undeniable, making them a go-to for anyone building out serious AI capabilities. It’s not just about the chips themselves, but the whole ecosystem they’ve built around them – the software, the development tools. It’s a tough spot to compete in, honestly. While their stock has seen some ups and downs, reflecting market jitters, the underlying demand for their tech is still incredibly strong. They’re the engine driving a lot of the AI revolution we’re seeing.

Broadcom’s Networking Dominance

While Nvidia is grabbing headlines for AI processing, Broadcom is quietly but powerfully building the highways that connect everything. They’re huge in networking silicon – think the switches and components that keep data centers humming and networks fast. As AI workloads get bigger and more complex, the need for high-speed, reliable networking only grows. Broadcom is right there, providing a lot of that critical infrastructure. Their business in data center-specific products has been growing at a really impressive clip, showing that the demand for the plumbing behind AI is just as important as the AI chips themselves.

Micron’s High-Bandwidth Memory Strength

Memory is the unsung hero of high-performance computing, and Micron is a major player here, especially with their High-Bandwidth Memory (HBM). AI models need to access vast amounts of data incredibly quickly, and HBM is designed to do just that. Micron’s focus on this specialized memory is paying off, positioning them well in the AI supply chain. It’s a segment where performance and capacity are king, and Micron is delivering. As AI continues to expand, the demand for this kind of advanced memory is only going to climb.

Analog Devices’ Industrial Applications

Shifting gears a bit, Analog Devices (ADI) is a powerhouse in a different, but equally important, area: industrial and automotive applications. They make the analog chips that interface with the real world – sensors, power management, signal processing. Think about smart factories, advanced driver-assistance systems in cars, or sophisticated medical equipment. ADI’s chips are the brains behind a lot of that. Their steady growth in these sectors highlights the broad reach of semiconductors beyond just consumer gadgets and AI servers. They’re the backbone of a lot of critical, everyday technology that we often take for granted.

The Shifting Capital Expenditure Cycle

Okay, so the whole semiconductor world is spending a ton of money right now, and it’s not just a quick burst. We’re talking about a multi-year investment phase, driven by how much we need these chips for everything from AI to everyday gadgets. Total sales for the equipment used to make these chips are expected to hit a record $133 billion in 2025, and it looks like that number will keep climbing, maybe even reaching $156 billion by 2027. This isn’t just about AI, though that’s a huge part of it; it’s about building out the whole system.

Wafer Fab Equipment Growth

The heart of chip making, the wafer fab equipment (WFE) side, is seeing some serious growth. Think about it, building these advanced factories costs a fortune. Sales in this area are projected to jump by about 11% to over $115 billion in 2025. This is a bigger jump than some folks initially thought, showing just how much demand there is, especially for the memory and logic chips that power all those smart applications. It’s a big deal for companies that make the machines that make the chips.

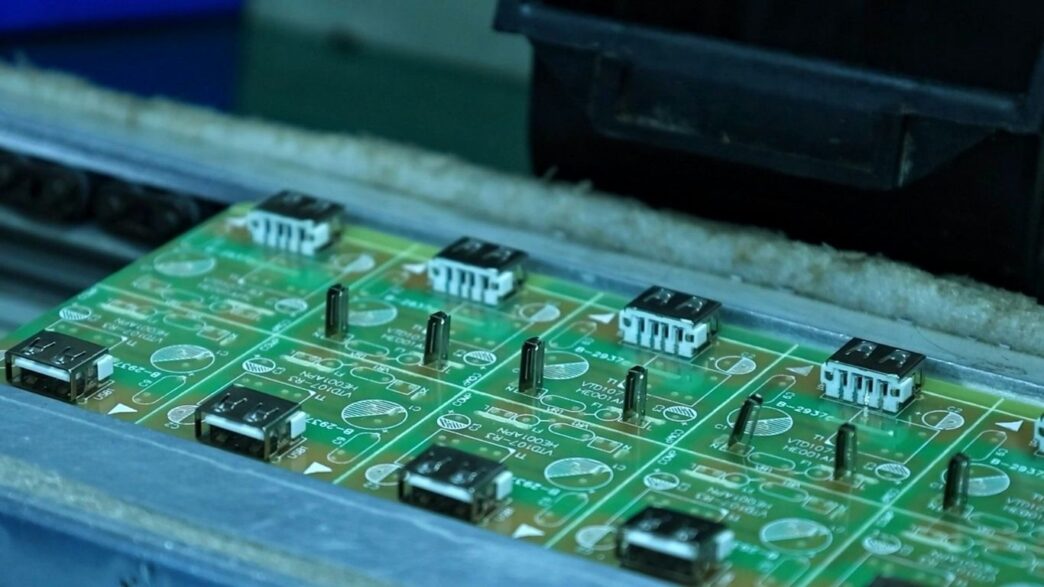

Back-End Manufacturing Expansion

But it’s not just about the front end anymore. The investment is really starting to shift towards the back end – that’s the packaging and testing part. This is where a lot of the value gets locked in, and it’s getting more complex. Sales for semiconductor test equipment alone are expected to shoot up by almost 50% to $11.2 billion in 2025. This surge highlights how critical advanced packaging is becoming to get the performance we need out of modern chips. It’s a sign that the industry is maturing and focusing on these high-value steps. This is a key area to watch for future profitability in the semiconductor industry.

Packaging And Testing Innovations

Speaking of packaging and testing, this is where some of the most exciting stuff is happening. As chips get more powerful, especially for AI, the way they’re put together and checked is changing fast. We’re seeing new techniques emerge to pack more power into smaller spaces and ensure everything works perfectly. This push for innovation in the back end is a big reason why the capital expenditure cycle is expected to keep going strong. It’s not just about making more chips, but making them better and more efficiently.

Navigating Market Volatility And Risks

Okay, so the semiconductor world in 2026 isn’t exactly a smooth ride. We’ve got a lot of moving parts, and things can change pretty fast. It’s like trying to predict the weather a month out – you can make some educated guesses, but there are always surprises.

Valuation And Execution Challenges

First off, let’s talk about how companies are valued and how well they actually pull off their plans. Some of these companies, especially those leading the AI charge, have stock prices that look pretty high. This means investors are really betting on them to hit all their targets. If they miss even a little bit, or if the competition heats up more than expected, you could see some big swings in their stock prices. It’s not just about having a good idea; it’s about actually building the stuff and selling it without messing up. We saw NVIDIA, a big player, have a decent run, but then its stock dipped a bit recently. That shows the market is watching closely, and any sign of trouble can cause a reaction. The real test is whether these companies can keep up the pace and deliver on their promises when the pressure is on.

Demand Softness Guardrails

While AI is a huge driver, it’s not the only thing happening. We’re seeing some weakness in other areas, like consumer electronics and cars. This is a bit of a problem because it means not all parts of the semiconductor market are booming. Prices for some components are going up, which makes the final products more expensive. This could make people buy less, which then slows down demand for the chips themselves. Think about smartphones or laptops – if they get too pricey, people might hold off on upgrading. So, even with all the AI excitement, we need to keep an eye on these other segments because they can act as a brake on overall growth. It’s a mixed bag out there.

Fragmented Capital Expenditure Landscape

Another thing to consider is how companies are spending their money on new factories and equipment. It’s not like everyone is investing at the same rate. Some big players, like TSMC, are planning to spend more, which is good for building out the latest technology. But others, like Intel, are actually planning to cut back. This creates a bit of an uneven playing field. The most advanced chip-making capacity is being built by a few leaders, while others are pulling back. This could lead to too much of certain types of chips down the road, or not enough of others. It’s not a synchronized, industry-wide expansion; it’s more concentrated. This makes it harder to get a clear picture of where the industry is headed overall. For more on the global semiconductor market outlook, you can check out the global semiconductor market.

Wrapping It Up

So, looking ahead to 2026, the semiconductor world is a busy place. We’ve seen how companies like TSMC, Intel, and Samsung are still big players, but there’s a lot happening beyond just the giants. Europe is trying to get more involved, and places like the Netherlands are showing off some cool new tech startups. It’s not just about making chips anymore; it’s about who’s building the machines to make them, who’s designing the really smart ones for AI, and who’s putting it all together. Things are changing fast, and keeping an eye on these different parts of the industry will be key for anyone trying to make sense of it all.

Frequently Asked Questions

What is the semiconductor industry?

Think of semiconductors as the tiny brains inside all our electronic gadgets, like phones, computers, and even cars. The semiconductor industry is all about making these super-important computer chips that power our modern world. It’s a huge business with lots of companies working hard to create the next best chips.

Who are the biggest players in the chip world?

Some of the biggest names you’ll hear about are TSMC, Intel, and Samsung. TSMC is really good at actually making the chips for other companies. Intel is also a major maker and designer, and Samsung is a giant in electronics that also makes a lot of chips. Nvidia is super important for the chips that power artificial intelligence (AI).

Why is AI so important for semiconductors?

AI is like a super-smart computer program that needs powerful chips to work. Because AI is getting so much better and used in more things, companies need to make special, very fast chips, especially for AI tasks. This means more demand for advanced computer brains.

Are all parts of the electronics market doing well?

Not exactly. While AI is booming, things like phones, computers for regular people, and cars are not selling as much right now. This means some chip companies that make chips for these things might see slower sales, even though AI chip sales are going up a lot.

What is the EU Chips Act?

The EU Chips Act is a plan by Europe to make more computer chips within its own countries. They want to build more factories and support companies so Europe doesn’t have to rely so much on chips made elsewhere. It’s a big effort to boost their own chip production.

What are the risks for semiconductor companies?

Even though the industry is growing, there are challenges. Sometimes companies spend too much building factories and then don’t have enough buyers for all the chips. Also, the value of some companies’ stocks can go up and down a lot, showing that people are worried about whether they can keep up with demand or if sales might slow down.