GE HealthCare is a big name in the medical tech world. But like any company, it’s got rivals. As we look ahead to 2025, it’s smart to see who’s out there making waves and what they’re up to. This isn’t about GE HealthCare’s own story, but about the other companies that are part of the same game. We’re talking about the competitors of GE HealthCare, the ones pushing the boundaries and vying for a piece of the market.

Key Takeaways

- Siemens Healthineers and Philips are major players, especially in imaging and diagnostics, often going head-to-head with GE HealthCare.

- Canon Medical and Fujifilm are also strong competitors, particularly in specific imaging areas, and are expanding their reach.

- The biomanufacturing and cell therapy sectors have specialized companies that challenge GE HealthCare’s offerings in this growing field.

- Newer companies using AI for diagnostics or creating point-of-care devices are emerging as potential disruptors.

- Competition is driven by new tech, global reach, smart partnerships, and how well companies support their customers.

Major Players in Medical Imaging and Diagnostics

When we talk about medical imaging and diagnostics, GE Healthcare isn’t the only big name in the room. There are several other companies that are really making waves, and it’s worth knowing who they are. These companies are constantly pushing the envelope with new tech, making things better for doctors and patients alike.

Siemens Healthineers: A Formidable Competitor

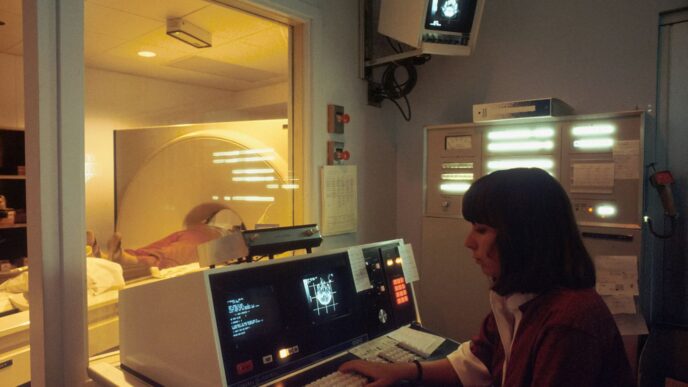

Siemens Healthineers is a giant in this space, especially when it comes to imaging and lab diagnostics. They’re known for putting a lot of effort into new ideas, like using AI and digital tools to make their equipment smarter. You’ll often find their high-end gear in major hospitals. They’ve got a solid lineup of MRI, CT, and ultrasound machines that go head-to-head with GE Healthcare’s.

Philips: Integrated Solutions and Patient Focus

Philips is another major player, offering a wide range of products that go beyond just imaging. They also do patient monitoring and connected care systems. What sets them apart is their focus on putting everything together into integrated solutions and really thinking about the patient’s experience. They often compete with GE Healthcare in areas like heart care and remote patient monitoring.

Canon Medical Systems Corporation: Strength in Specific Modalities

Canon Medical Systems Corporation might not be as broadly known as some others, but they are seriously strong in certain areas, particularly CT and ultrasound. They’ve carved out a significant presence, especially in specific regions and product categories where they really shine. Their technology is top-notch, and they’re a competitor you can’t overlook.

Fujifilm Holdings Corporation: Expanding Imaging Presence

Fujifilm, a name many associate with cameras, has also built a substantial business in medical imaging and informatics. They offer a range of products that directly compete with what GE Healthcare provides. Their growing presence means they’re becoming an increasingly important competitor in the market, bringing their own unique approach to imaging technology.

Competitors in Biomanufacturing and Cell Therapy

When we look beyond imaging and diagnostics, GE HealthCare also faces competition in the biomanufacturing and cell therapy arenas. This is a pretty specialized area, focusing on the tools, services, and materials needed to research and produce biopharmaceuticals and advanced cell-based treatments. It’s not just about having the latest gadget; it’s about reliability and cutting-edge tech.

Specialized Tools and Services Providers

Several companies are really good at providing the specific equipment and support that labs and manufacturing facilities need for these complex processes. Think of companies that make the bioreactors, the cell culture media, or the purification systems. They’re not necessarily household names like the big imaging companies, but they are vital to the entire biopharma ecosystem. GE HealthCare competes here by offering its own suite of solutions, often integrated with its broader life sciences portfolio.

Focus on Technological Specialization

This sector thrives on innovation. Competitors often differentiate themselves by focusing on a particular technology or process. For instance, one company might have a breakthrough in a novel cell expansion technique, while another excels in developing highly efficient viral vector production systems. The race is on to develop faster, more scalable, and more cost-effective methods for producing these life-saving therapies. GE HealthCare has to keep pace, investing in its own R&D to stay relevant and competitive in these fast-moving fields.

Ensuring Supply Chain Reliability

For biomanufacturing and cell therapy, a dependable supply chain is non-negotiable. Any disruption can mean significant delays and financial losses, not to mention impacting patient access to treatments. Competitors are judged not just on their products, but on their ability to consistently deliver high-quality materials and services. This includes everything from raw materials to specialized consumables and maintenance support. GE HealthCare, like its rivals, must demonstrate robust logistics and quality control to be a trusted partner in this critical industry.

Emerging Threats and Niche Innovators

It’s not just the big names you have to watch out for. The healthcare tech world is buzzing with smaller companies and new ideas that could really shake things up for GE Healthcare by 2025. These aren’t your typical competitors; they’re often focused on one specific area and doing it really well.

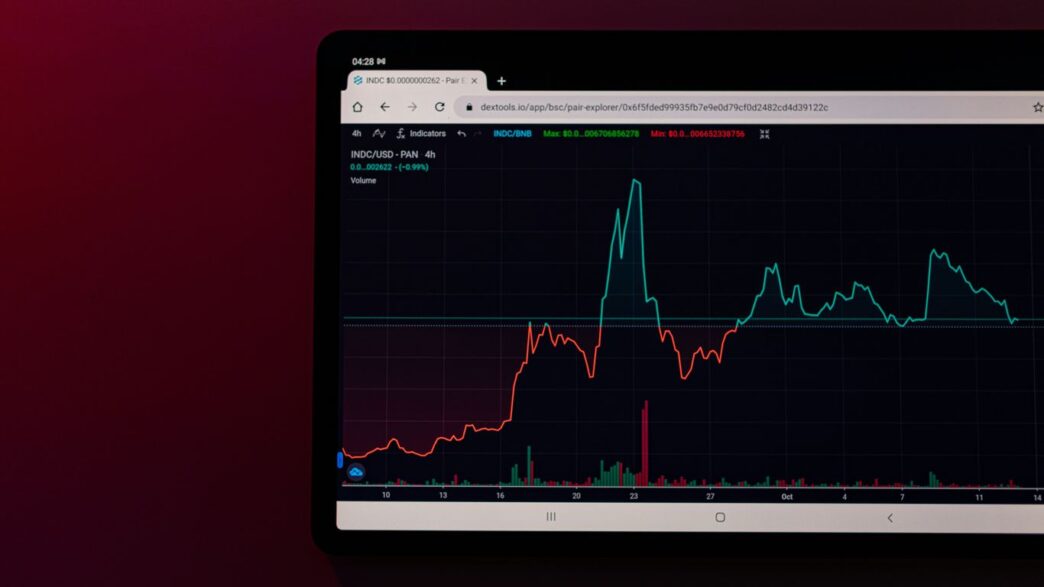

AI-Powered Diagnostic Software

Artificial intelligence is a huge deal, and it’s changing how diagnostics are done. Companies are developing AI tools that can analyze medical images, like X-rays or MRIs, faster and sometimes more accurately than humans. This could mean quicker diagnoses and better patient outcomes. The real game-changer here is the potential for AI to catch things that might be missed by the human eye, especially in high-volume settings. While there’s still some hesitancy about fully trusting AI in healthcare, its capabilities are growing fast. We’re seeing AI used for:

- Detecting early signs of diseases like cancer.

- Analyzing complex genetic data for personalized medicine.

- Predicting patient risk for certain conditions.

Point-of-Care Device Specialists

Forget waiting for results from a central lab. Point-of-care devices are designed to be used right where the patient is – in a doctor’s office, an ambulance, or even at home. Think portable ultrasound machines or rapid diagnostic tests for infections. These devices are becoming more sophisticated and affordable, making advanced diagnostics more accessible. This trend puts pressure on traditional, larger equipment providers to keep up with the demand for speed and convenience.

Disrupting Traditional Market Segments

These smaller players often find success by targeting specific niches that larger companies might overlook or find less profitable. They can be more agile, adapting quickly to new technologies and market needs. This means GE Healthcare needs to stay aware of these specialized innovations, as they can chip away at market share or even create entirely new markets that GE Healthcare might then need to enter or acquire. It’s a constant dance of innovation and adaptation in this fast-moving field.

Key Factors Driving Competition

The medical technology field is always shifting, and several big things are pushing companies like GE HealthCare to keep up. It’s not just about having good products; it’s about how you make them, sell them, and support them.

Technological Innovation and R&D Investment

Companies are pouring money into research and development. This is how new gadgets and software get made. Think about AI helping doctors read scans faster or new ways to make medicines. GE HealthCare, Siemens Healthineers, and Philips are all spending big here. They have to, or they’ll get left behind. It’s a constant race to invent the next big thing.

Global Market Presence and Regulatory Navigation

Selling medical equipment isn’t just a local thing. Companies need to be able to sell their products all over the world. This means understanding and following different rules in different countries. What’s okay in the US might not be in Europe or Asia. GE HealthCare has a big global footprint, but so do its rivals, and they’re all working to expand into new areas while dealing with these complex regulations.

Strategic Partnerships and Acquisitions

Sometimes, companies can’t do it all themselves. They team up with other businesses or buy them out to get new technology or reach more customers. We’ve seen big moves like Siemens Healthineers buying Varian Medical Systems. These kinds of deals change the game and mean GE HealthCare needs to be smart about who it works with and who it might need to acquire to stay competitive.

Customer Service and Technical Support

Even the fanciest machines need good support. When a hospital buys expensive equipment, they expect it to work, and if it doesn’t, they need help fast. This includes training staff on how to use the equipment, keeping it running smoothly, and fixing it when it breaks. Good service builds loyalty, and it’s something customers really look at when deciding who to buy from.

Competitive Advantages Shaping the Landscape

So, what really gives GE HealthCare the edge over everyone else in 2025? It’s not just one thing, but a mix of factors that have been built up over years. Think of it like a really solid foundation for a house – it makes everything else stand stronger.

Proprietary Technologies and Intellectual Property

GE HealthCare has a bunch of patents, especially for their imaging gear like MRI and CT scanners. These aren’t just random inventions; they’re the result of serious research and development. This means they can create machines that take really clear pictures and help doctors figure out what’s going on inside patients better than others. For example, their advanced CT systems are designed to give doctors more detailed views, which can make a big difference in diagnosing tricky conditions. It’s this kind of tech that sets them apart.

Extensive Global Installed Base

Imagine all the GE Healthcare machines already set up in hospitals and clinics all over the world. That’s a huge deal. It’s not just about selling the initial equipment; it’s about the ongoing service, maintenance, and supplies that come with it. This creates a steady stream of income. Plus, having so many machines out there means they collect a lot of data, which is super useful for developing new AI tools and digital health solutions. It also means hospitals are used to working with them, making it harder for competitors to break in.

Economies of Scale and Supply Chain Efficiency

Because GE HealthCare makes so much equipment, they get better prices on parts and manufacturing. This is what we call economies of scale. It helps them keep their prices competitive, which is important because hospitals are always watching their budgets. Their supply chain is also pretty dialed in, meaning they can get these big, complex machines to places all around the globe without too much fuss. This reliability is a big plus.

Brand Equity and Talent Acquisition

Even though GE HealthCare is its own company now, the GE name still carries a lot of weight. People trust it. Hospitals know what they’re getting. On top of that, they attract smart people – engineers, scientists, and other experts. These are the folks who come up with the next big ideas and keep the company moving forward. Having a strong brand and a team of talented individuals is a pretty big advantage when you’re trying to stand out in a crowded market.

Financial Strength and Market Position

When we look at GE HealthCare’s standing in 2025, it’s clear their financial muscle plays a huge role. It’s not just about having good products; it’s about having the resources to back them up and reach customers everywhere.

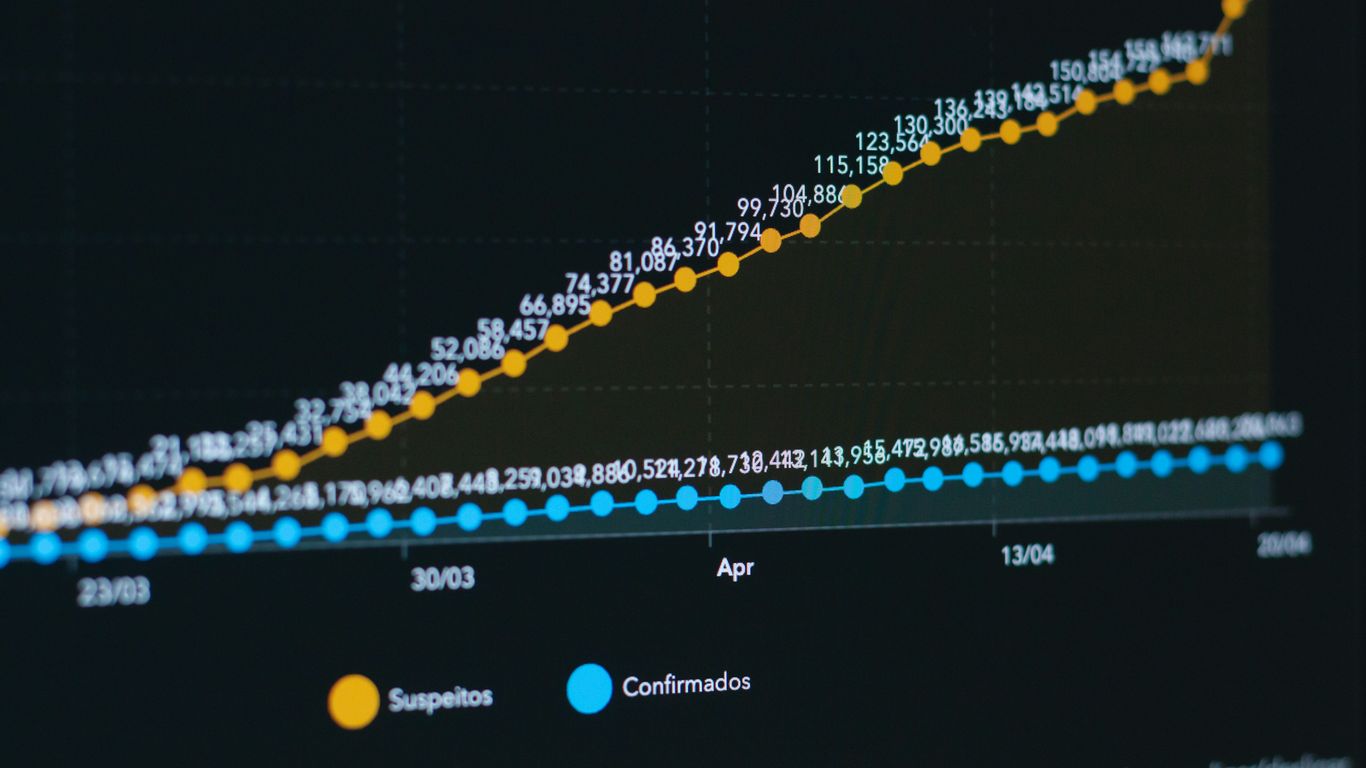

Analyzing Revenue and Financial Health

GE HealthCare brought in about $19.6 billion in revenue back in 2023. That’s a pretty big number, and it shows they’re a major player. This kind of financial stability means they can keep investing in new tech, keep their factories running smoothly, and weather any economic storms that might pop up. It’s this solid financial base that lets them compete head-to-head with other big companies in the medical tech world.

Market Share in Key Segments

It’s not just about the total money they make, but where they make it. GE HealthCare has a strong hold in several important areas, like medical imaging. Think about CT scanners, MRI machines, and ultrasound equipment – they’re right there at the top.

Here’s a quick look at where they tend to do well:

- Medical Imaging: This is a big one, covering everything from X-rays to advanced MRI.

- Patient Monitoring: Keeping tabs on patients in hospitals and ICUs is another area where they have a significant presence.

- Pharmaceutical Diagnostics: Helping drug companies test and develop new treatments is also part of their business.

Having a good chunk of the market in these areas means they have a steady stream of business and a lot of influence.

Impact of Financial Performance on Strategy

All this financial strength really shapes how GE HealthCare operates. When a company has a lot of money coming in and a healthy balance sheet, it gives them options. They can afford to spend big on research and development, which is super important for staying ahead in the fast-paced medical technology field. It also means they can make strategic moves, like buying up smaller companies that have cool new technology or expanding into new countries where they don’t have a big presence yet. Basically, their financial health directly fuels their ability to innovate and grow. It allows them to take calculated risks and pursue long-term goals without being constantly worried about making payroll next week.

Looking Ahead

So, as we wrap up, it’s clear that GE HealthCare isn’t operating in a vacuum. The medical tech world is buzzing, with giants like Siemens Healthineers and Philips constantly pushing the envelope, especially with all this new AI stuff. Plus, you’ve got smaller, super-focused companies popping up, ready to shake things up in specific areas. GE HealthCare has some serious strengths – a huge global reach, a wide range of products, and a solid financial footing. But staying ahead means they really need to keep innovating and adapting. It’s going to be interesting to see how they handle the competition and the fast-changing tech landscape in the coming years.