It feels like everyone is talking about chips lately, right? From our phones to our cars, they’re everywhere. But have you ever stopped to think about who actually makes the machines that make these tiny, powerful components? It’s a whole world of specialized companies, and they’re super important for keeping everything running. This article looks at some of the big players in the semiconductor equipment suppliers scene and what they’re up to.

Key Takeaways

- The companies that make the machines for building computer chips, known as semiconductor equipment suppliers, are really shaping what kind of technology we get.

- ASML is a major player, especially with its advanced lithography tools, which are key for making the smallest, most powerful chips.

- There’s a growing focus on making the supply chain for these chips more stable, looking at where things are made and who supplies the equipment, especially with global politics playing a bigger role.

- Different parts of the world are strong in different areas – East Asia leads in manufacturing, the US is big on research and design, and Europe is trying to build up its own capabilities.

- Looking ahead, these semiconductor equipment suppliers need to keep up with new tech, manage market ups and downs, and also think about how their operations affect the environment.

Key Semiconductor Equipment Suppliers Driving Innovation

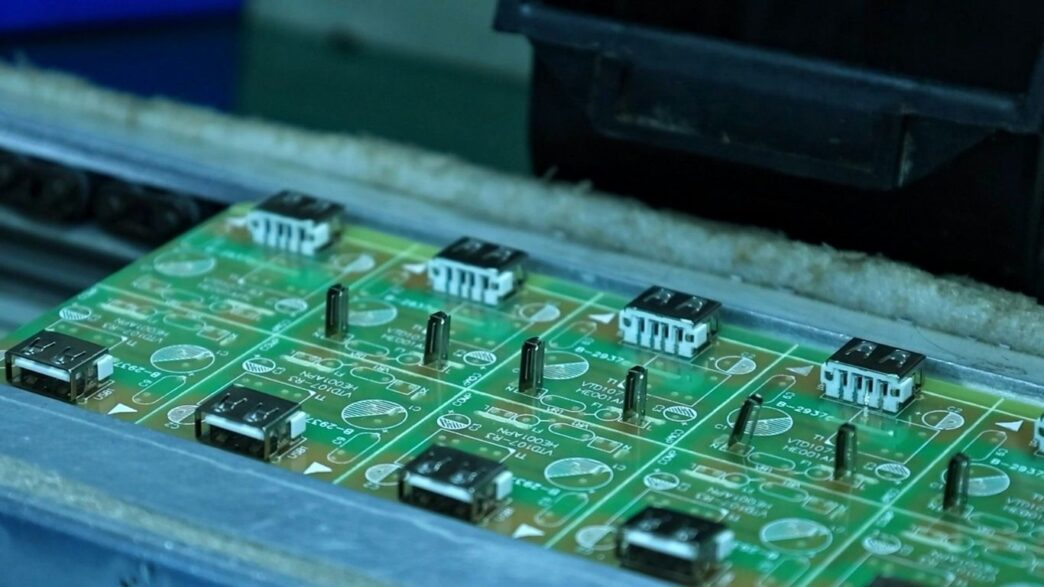

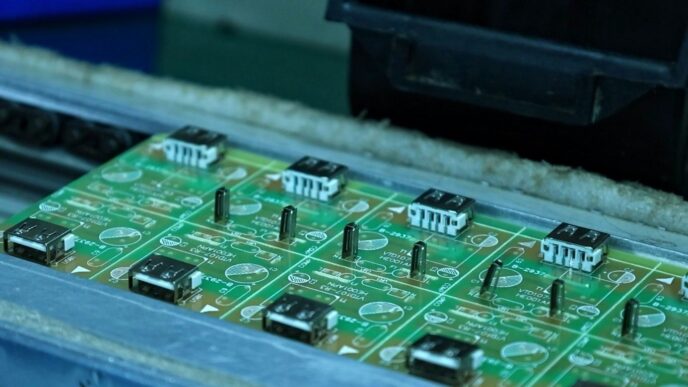

The companies that make the machines used to build computer chips are a pretty big deal. They’re the ones actually creating the tools that let us make the tiny, powerful components that run everything from our phones to supercomputers. It’s a specialized field, and a few players really stand out.

ASML’s Dominance in Lithography Advancements

When you talk about making the most advanced chips, you almost always end up talking about ASML. This Dutch company has a near-monopoly on the extreme ultraviolet (EUV) lithography machines. These machines are incredibly complex and expensive, costing hundreds of millions of dollars each. They use a special kind of light to etch incredibly fine patterns onto silicon wafers, which is how we get smaller, faster, and more efficient chips. Without ASML’s EUV technology, making the latest generation of processors and memory chips would be practically impossible. It’s a huge barrier to entry for anyone wanting to compete in this specific, high-end area of chip manufacturing equipment.

Emerging Chinese Manufacturers in the Equipment Landscape

While ASML is a giant, the semiconductor equipment world is starting to see new players. China, in particular, is investing heavily in building its own domestic semiconductor industry, and that includes making its own manufacturing equipment. Companies like SMEE (Shanghai Micro Electronics Equipment) are working on developing their own lithography machines, though they are still behind the leading edge compared to ASML. The goal is to reduce reliance on foreign technology. It’s a long road, and they face significant challenges, but the push is definitely on to build out a more self-sufficient supply chain.

Global Investment Strategies in Semiconductor Equipment

Because these machines are so critical and so expensive, investment strategies are a big part of the picture. Governments and private companies are pouring money into research and development, as well as manufacturing capacity for these tools. For example, the US and Europe are trying to bring more chip manufacturing back home, and that requires not just building fabs (the factories), but also supporting the equipment makers. This often involves:

- Government incentives: Grants, tax breaks, and funding for R&D to encourage domestic production of advanced equipment.

- Strategic partnerships: Collaborations between chipmakers, equipment suppliers, and research institutions to speed up innovation.

- Acquisitions and mergers: Larger companies buying smaller, specialized firms to gain access to new technologies or markets.

It’s a complex ecosystem, and the companies making the equipment are at the very heart of it all.

Navigating the Evolving Semiconductor Supply Chain

The way chips get made and moved around the world is getting pretty complicated. It feels like every few months, there’s a new hiccup or a shift in how things are done. This whole system is a lot more interconnected than most people realize, and when one part gets jammed up, it can cause problems everywhere.

Addressing Node Production Imbalances

Right now, there’s a bit of a weird situation with chip production. Companies are pouring a ton of money into making the newest, smallest, and most advanced chips. That makes sense, they’re the most profitable. But it means they’re making fewer of the older, larger chips. These older chips are still super important for things like cars, industrial machines, and even some everyday electronics. So, finding those older chips is becoming harder, and it’s causing headaches for manufacturers who rely on them. Plus, building new factories takes ages and costs a fortune, and all this uncertainty just adds to the supply issues.

Geopolitical Influences on Global Semiconductor Production

Politics plays a bigger role in chipmaking than you might think. Trade disputes, export rules, and general international tension can really mess with the flow of components and finished chips. It’s not just about where chips are made, but also where the materials come from and where the finished products can be sold. This uncertainty makes it tough for companies to plan ahead and can slow down new technology development. We’re seeing a push for more "onshoring" and "nearshoring" – basically, making chips closer to home – to try and get around some of these international headaches.

Diversification Strategies for Supply Chain Resilience

So, what are companies doing about all this? A big focus is on spreading things out. Instead of relying on just one or two places to get their chips or materials, they’re looking to work with more suppliers and build factories in different regions. This means looking at new locations in places like the US, Europe, and Southeast Asia. It’s all about building a more flexible system that can handle disruptions better. Think of it like not putting all your eggs in one basket. They’re also trying to find alternative materials and use digital tools to better predict and manage potential problems before they happen. It’s a big effort to make the whole supply chain tougher and less likely to break when things get shaky.

Regional Dynamics and Manufacturing Hubs

The semiconductor world isn’t really made in one place. It’s spread out, with different regions doing different things really well. Think of it like a global team effort, but with each player having their own specialty.

East Asia’s Concentration in Manufacturing

When it comes to actually making the chips, East Asia is the big player. Countries like Taiwan, South Korea, Japan, and China handle a huge chunk of the world’s chip production. This isn’t by accident; it’s built on years of investment, skilled workers, and government support. Taiwan, for instance, is a powerhouse in foundry services, meaning they make chips designed by other companies. South Korea is strong in memory chips, and Japan has a solid grip on materials and equipment needed for chipmaking. China is also ramping up its capabilities, aiming to be a major force.

- Taiwan: Leads in contract chip manufacturing (foundries).

- South Korea: Dominates memory chip production (DRAM, NAND).

- Japan: Strong in specialized materials and manufacturing equipment.

- China: Rapidly expanding its domestic manufacturing capacity.

This concentration means that a lot of the world’s chip supply relies on this region. It’s efficient, but it also means any disruption there can have a big impact everywhere else.

Europe’s Niche Strengths and Autonomy Quest

Europe might not be churning out chips in the same volume as Asia, but it’s got some serious strengths in specific areas. Think high-tech equipment and specialized components. Companies like ASML in the Netherlands are absolutely critical for the entire industry because they make the machines that print the tiny circuits onto chips. Germany, with its strong automotive sector, is pushing hard to build more chip manufacturing within its borders, attracting companies like TSMC to set up shop. The goal here is to gain a bit more independence in the chip supply chain, reducing reliance on other regions.

- Netherlands: Home to ASML, the sole supplier of advanced EUV lithography machines.

- Germany: Investing heavily in automotive chip production and R&D.

- France & Italy: Participating in EU-wide initiatives to boost chip manufacturing.

Europe’s strategy is less about mass production and more about securing key technologies and building up its own capacity for critical components.

United States’ Leadership in R&D and Design

Across the Pacific, the United States is where a lot of the brainpower behind the chips happens. They are leaders in designing the actual chips – the blueprints, if you will. Many of the companies that create the software used to design chips, and the core intellectual property that goes into them, are American. While the US used to be a manufacturing giant, its focus has shifted more towards the high-value, early stages of the semiconductor process. There’s a big push now to bring more manufacturing back, but its historical strength lies in innovation and design.

- Chip Design: Dominant market share in designing complex integrated circuits.

- EDA Tools: Leading provider of Electronic Design Automation software.

- Intellectual Property (IP): Holds a significant portion of core chip IP.

The US excels at the intellectual heavy lifting that makes modern chips possible. This R&D strength is what fuels the entire global industry, even if the physical manufacturing happens elsewhere.

Future Outlook for Semiconductor Equipment

Thinking about where the semiconductor equipment market is headed can feel a bit like trying to predict the weather – lots of moving parts and potential for surprises. But looking at the trends, we can get a pretty good idea of what’s coming.

Anticipating Future Demand Trends

Demand for chips isn’t just going to stay steady; it’s expected to climb. Companies that use chips in their own products are looking at a significant jump in their needs. This surge is largely fueled by things like artificial intelligence and the constant push for more powerful computing. It’s not just about making more chips, but also about making more advanced ones. Global semiconductor equipment sales are projected to hit a record $156 billion by 2027, showing a clear upward trajectory [cb33]. This means equipment makers will likely see a lot of business.

The Cyclical Nature of the Equipment Market

It’s important to remember that the semiconductor equipment market has always been a bit of a rollercoaster. There are boom times when everyone is investing heavily in new factories and equipment, and then there are slower periods. This cycle is often tied to broader economic conditions and the specific needs of chip manufacturers. Right now, with the push for AI and advanced computing, we’re in a strong growth phase. However, companies need to be prepared for the inevitable dips that follow.

Technological Advancements Shaping Tomorrow’s Chips

The equipment itself is also constantly evolving. New technologies are always being developed to make chips smaller, faster, and more efficient. This includes advancements in areas like lithography, where companies like ASML are pushing the boundaries. The drive for better performance in everything from smartphones to data centers means that the equipment needed to produce these chips has to keep pace. This continuous innovation cycle is what keeps the industry dynamic and exciting.

Strategic Partnerships and Supplier Diversification

Building a strong semiconductor supply chain isn’t just about having the latest tech; it’s also about who you work with and making sure you’re not putting all your eggs in one basket. Things have gotten pretty complicated out there, with global politics and trade issues making it tough to get parts when you need them. That’s why companies are really looking at how they partner up and spread out their suppliers.

Strengthening Relationships with Key Suppliers

It sounds simple, but really leaning into the suppliers you already trust can make a big difference. When you have a good working relationship, you can often get better communication, maybe even some priority when things get tight. Think of it like having a good mechanic for your car – they know your vehicle, and you know they’ll do a decent job. For chip makers, this means talking more openly with their main equipment providers, sharing roadmaps, and working together on new tech. It’s about building that trust so when a problem pops up, you can tackle it together instead of just pointing fingers.

Expanding the Partner Ecosystem

But relying only on your old favorites isn’t always the best move. The industry is seeing a push to bring in new players, especially from different regions or those focusing on niche technologies. This could mean working with smaller, specialized firms that have a unique solution or exploring partnerships in areas where manufacturing capacity is growing. For example, a joint venture like the one planned in Germany for advanced chip manufacturing shows how companies are teaming up to build capacity and share the load. It’s about creating a wider net, so if one part of the chain gets shaky, you have other options ready to go.

Mitigating Risks Through Supplier Base Diversification

This is where the rubber meets the road. A lot of companies are actively trying to reduce how much they depend on just a few suppliers. The idea is that if one supplier faces issues – maybe a natural disaster hits their factory, or trade restrictions kick in – you won’t be completely stuck. Some are looking to bring more manufacturing closer to home, increasing domestic sourcing. Others are exploring nearshoring options. It’s a strategic move to build a more stable and predictable supply line.

Here are a few ways companies are trying to diversify:

- Geographic Spread: Instead of having all your critical suppliers in one country or region, spreading them out globally can reduce risk. If one area faces political instability, others might be unaffected.

- Technology Focus: Working with suppliers who specialize in different types of equipment or materials means you have access to a broader range of solutions and aren’t tied to a single vendor’s technology.

- Tiered Sourcing: Developing relationships not just with the top-tier suppliers but also with second and third-tier providers can create backup options and a deeper understanding of the entire supply chain.

Ultimately, a more diverse and collaborative supplier network is key to weathering the unpredictable storms in the semiconductor world.

Sustainability and Energy in Semiconductor Manufacturing

Making computer chips takes a lot of power and resources. As the world pays more attention to the environment, the semiconductor industry is feeling the pressure to clean up its act. It’s not just about looking good; it’s about making sure the industry can keep going for a long time without wrecking the planet.

The Role of Renewable Energy Sources

Lots of factories that make chips use a ton of electricity. For years, that power has mostly come from burning fossil fuels. But that’s changing. Companies are starting to look at solar, wind, and other clean energy options. Switching to renewables isn’t just good for the air; it can also help companies save money in the long run and avoid problems if fossil fuel prices go up. Plus, a steady supply of clean energy means the machines can keep running without interruption, which is super important when you’re making something as complex as a microchip.

Ensuring Stable Energy Supply for Operations

Think about how many steps go into making a single chip. If the power flickers or goes out, it can mess up the whole process, leading to wasted materials and delays. That’s why having a reliable energy source is a big deal. Companies are exploring ways to make their energy supply more stable. This includes things like:

- Investing in backup power systems.

- Working with energy providers to guarantee consistent delivery.

- Exploring on-site energy generation, like solar panels on factory roofs.

- Using smart grids that can better manage energy flow.

Balancing Sustainability with Production Demands

It’s a tricky balancing act. The demand for chips keeps growing, and manufacturers need to produce more, faster. But doing that sustainably is the real challenge. It means looking at every part of the process. Are there greener chemicals we can use? Can we design chips that use less power when they’re actually in use? How can we reduce the waste generated during manufacturing? Companies are also looking at their supply chains, trying to find partners who are also committed to being more eco-friendly. It’s a big shift, and it’s going to take time and a lot of smart thinking to get it right.

Wrapping It Up

So, we’ve looked at some of the big players making the chips that run our world. It’s a complicated business, with a lot of moving parts and some serious challenges, like making sure we have enough chips and dealing with global politics. These companies are working on new ways to build things, spread out where they make stuff, and even think about the environment. It’s not just about making chips anymore; it’s about making them reliably and responsibly. The future looks like more innovation, maybe some new tech we haven’t even thought of yet, and definitely a continued focus on making sure the supply chain can keep up with demand. It’s a dynamic field, and keeping an eye on these equipment suppliers is key to understanding where technology is headed next.

Frequently Asked Questions

What are the main companies that make the machines for building computer chips?

Some of the biggest names in making chip-building machines are ASML, which is famous for its special light-bending machines called lithography tools. There are also other companies around the world, including some newer ones in China, that are working to make these important machines.

Why is it hard to get certain computer chips sometimes?

It’s tricky because companies are focusing more on making the newest, smallest chips, which are more profitable. This means they make fewer of the older, larger chips that are still needed for things like cars and everyday electronics. Also, building new factories takes a lot of time and money, and sometimes world events can slow things down.

Where are most computer chips made?

A lot of the actual chip making happens in East Asia, especially in places like Taiwan and South Korea. The United States is really good at designing chips and creating the technology for them. Europe has some special strengths, like ASML, and is trying to make more of its own chips.

What is happening with the supply chain for computer chips?

The supply chain is changing a lot. Countries and companies are trying to make sure they can get chips from different places, not just one or two. They are investing in building factories in places like the U.S. and Europe to have more options and be less dependent on others.

How are companies trying to make chip making more environmentally friendly?

Companies are looking into using cleaner energy sources, like solar and wind power, to run their factories. This helps save money in the long run and makes their energy supply more dependable, which is important because chip factories need power all the time.

What are the biggest challenges facing the computer chip industry right now?

The industry faces several big challenges. These include making sure there are enough chips for everyone (supply chain resilience), dealing with world politics that can affect trade, finding enough skilled workers, and making the manufacturing process more sustainable and less harmful to the environment.