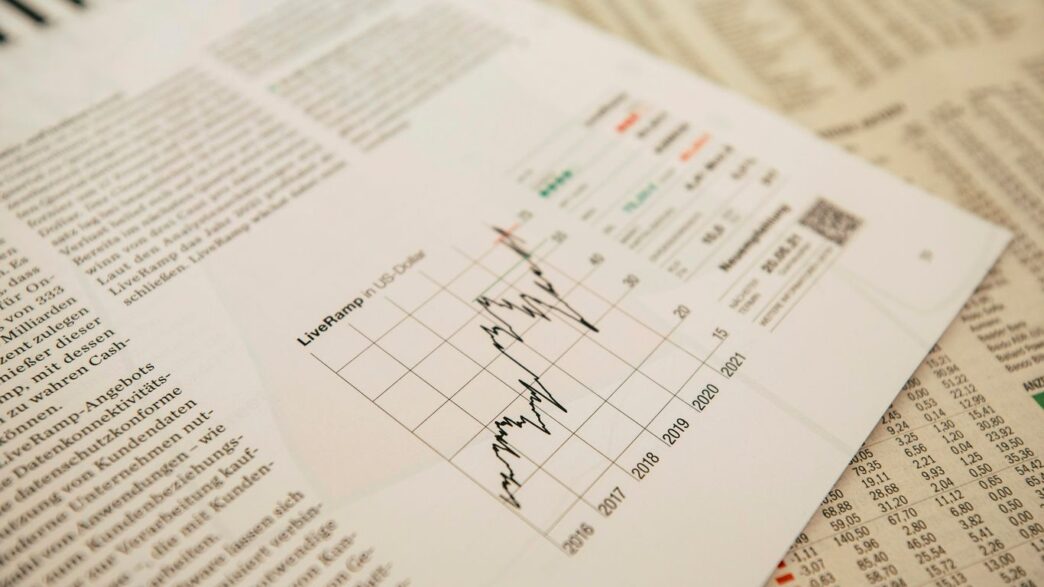

Getting ready for the stock market in 2026? Especially if you’re looking at medical technology companies, things are shaping up to be pretty interesting. After some wild ups and downs, the way companies are going public, or doing medtech IPOs, seems to be getting more sensible. It’s less about hype and more about solid business plans. We’re seeing a focus on companies that are really built to last and can actually make money, not just grow for growth’s sake. This shift means that while there are still plenty of chances, picking the right medtech IPOs will need a sharper eye on the details.

Key Takeaways

- The medtech IPO scene in 2026 is moving towards a more grounded approach, valuing practical business models and profitability over past speculative trends.

- Companies integrating AI and digital tools are gaining traction, but they need to show clear financial benefits and how their operations can scale effectively.

- Expect a rise in IPO candidates that offer essential services or products deeply embedded in healthcare systems, rather than just novelties.

- Regulatory changes and economic stability are influencing how companies are valued, pushing for more realistic market expectations for medtech IPOs.

- Private equity firms are playing a bigger role, often building up companies before they go public, which could lead to larger, more established medtech IPOs.

The Evolving Medtech IPO Landscape

Okay, so the whole Medtech IPO scene? It’s definitely not what it was a few years ago. Remember that crazy boom when money was practically free? Yeah, that’s over. We’re now in what some are calling "Rational Exuberance." It sounds fancy, but really, it just means companies can’t get away with just having a cool idea anymore. They actually have to show they can make money and that their business is built to last.

Rational Exuberance: A New Era for Medtech IPOs

This "Rational Exuberance" is all about being smart with money and proving your worth. Forget the "growth at all costs" mentality. Investors are looking for solid proof of good business sense, like making sure the numbers add up and that the technology actually works in the real world. It’s a shift from just being exciting to being genuinely valuable.

Infrastructure-Grade Businesses Take Center Stage

What’s really catching investors’ eyes now are companies that are deeply woven into the fabric of healthcare. Think of them as the plumbing and wiring of the system – essential and hard to replace. These aren’t just flashy gadgets; they’re the businesses that make the whole healthcare machine run smoother, whether it’s by handling patient records, managing billing, or integrating deeply with hospital systems. They’re the ones that offer real, measurable benefits to everyone involved, from doctors to patients.

The "Clearing Event" of 2026

Basically, 2026 is shaping up to be a big year where the market sorts itself out. A lot of companies that were maybe a bit too experimental or didn’t have a clear path to profit are either getting bought out or just fading away. The ones that are left standing and looking to go public are the ones that have proven they can scale up and actually make money. It’s like a filter, making sure only the strongest, most viable businesses make it to the public market.

Key Trends Shaping Medtech IPOs in 2026

Alright, so what’s actually moving the needle for medtech companies looking to go public in 2026? It’s not just about having a cool gadget anymore. The game has changed, and investors are looking for a lot more substance.

AI and Digital Health Integration

This is huge. Companies that can show how artificial intelligence and digital tools are baked into their core offerings are way ahead of the curve. It’s not enough to just have AI; you need to prove it actually makes things better, cheaper, or faster. Think about AI helping with diagnostics, personalizing treatments, or even just streamlining how hospitals run. The real winners will be those who can demonstrate a clear return on investment from these technologies, not just a buzzword.

Focus on Unit Economics and Scalability

Gone are the days of "growth at all costs." Today’s investors are laser-focused on the nitty-gritty: how much does it cost to make and sell one unit, and can the company actually make a lot of them without breaking the bank? This means showing solid gross margins and a clear plan for how the business can grow without its costs spiraling out of control. It’s about building a sustainable business, not just a flashy idea.

The "Delaware Flip" and Global Market Access

We’re seeing a lot of European medtech companies looking to list in the US, a move often called the "Delaware Flip." Why? The US market generally offers deeper pools of capital and often higher valuations. This isn’t just about chasing numbers, though. It’s about accessing the right investors who understand and can support the long-term growth of these innovative companies. Plus, with global markets becoming more interconnected, having a strategy for international reach from the get-go is becoming pretty standard.

Emerging Opportunities in Medtech IPOs

Okay, so what’s actually hot in the medtech IPO scene for 2026? It’s not just about having a cool gadget anymore. Companies that are really showing promise are those tackling big problems with smart tech and, importantly, have a clear way to get paid.

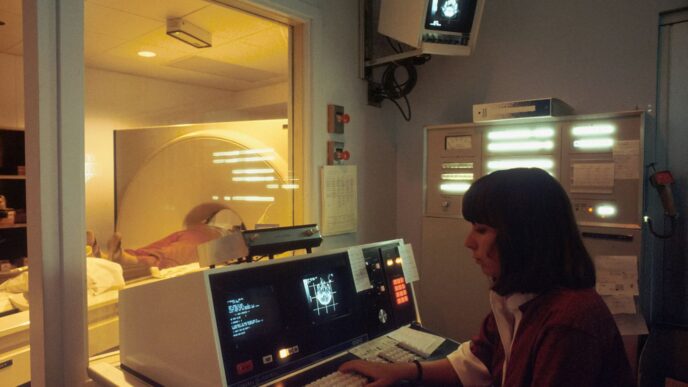

Wearable Cardioverter Defibrillators and Monitoring

Think about devices that keep an eye on your heart. Companies making wearable cardioverter defibrillators (WCDs) are definitely on the radar. These aren’t just fancy fitness trackers; they’re life-saving devices. One company, Kestra Medical Technologies, has been growing fast, seeing a 53% jump in sales recently. Even though they’re not making a profit yet, their profit margins are getting better, and that’s a good sign. This kind of tech is becoming more important as people live longer and heart issues become more common. It’s a space where innovation can really make a difference, and investors are noticing.

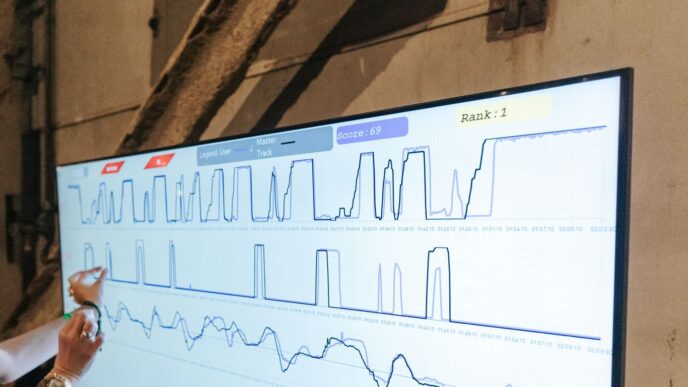

AI-Driven Diagnostics and Therapeutics

Artificial intelligence is changing everything, and medtech is no exception. We’re seeing a lot of excitement around AI that can help doctors diagnose diseases faster and more accurately. Imagine AI that can look at scans and spot problems that a human eye might miss, or AI that helps create personalized treatment plans. HistoSonics is a good example here. They’re using sound waves – yeah, sound waves – to break down tumors without surgery. They’ve already got approval for liver tumors and are looking at other areas like the kidneys. This kind of groundbreaking tech, especially when it gets regulatory nods and shows it can work, is exactly what the market is looking for. The real win here is when AI moves beyond just being a cool feature to becoming a core part of how care is delivered, making it cheaper and more effective.

Digital Therapeutics with Reimbursement Tailwinds

This is a big one. Digital therapeutics, or DTx, are basically software programs designed to treat medical conditions. For a long time, the big question was: how do these companies get paid? Well, that’s starting to change. New rules and codes from places like the CMS (Centers for Medicare & Medicaid Services) are making it possible for these digital treatments to be covered by insurance. This is huge because it means these companies have a real business model, not just a hopeful one. It validates the idea that software can be a legitimate medical treatment. Companies that can show they fit into these new payment structures are in a much stronger position to go public and succeed.

Navigating Regulatory and Economic Headwinds

Okay, so the money side of things might be looking a bit more stable, which is great news for medtech companies wanting to go public. But it’s not all smooth sailing. There are definitely some big regulatory and economic bumps in the road we need to talk about for 2026.

Pricing Controls and Their Impact on Biotech

This is a pretty big deal, especially for the biotech side of medtech. For the first time, the US government is going to start negotiating prices for some high-cost drugs covered by Medicare. Think of it like this: if the government can get a better deal on certain medications, it could put a damper on how much those single-drug companies are worth when they try to IPO. It’s not necessarily bad for everyone, though. Companies that are using tech and AI to discover drugs might actually see a boost because they can offer more efficient ways to get treatments to people, potentially at a lower overall cost.

Antitrust Scrutiny and M&A Dynamics

Another thing to keep an eye on is how the government is looking at big mergers and acquisitions. Agencies like the FTC and DOJ are really paying attention to healthcare companies buying up other companies, especially if it means one big company controls a lot of different parts of the system. This increased scrutiny might actually push more companies to consider an IPO instead of selling themselves off. If selling to a bigger player is harder, going public becomes a more attractive option for those mid-sized companies that want to stay independent and raise capital that way.

Interest Rate Stabilization and Valuation Parity

So, remember how interest rates have been all over the place? Well, it looks like they’re starting to settle down by the end of 2025. This is good news because it makes it easier to figure out what companies are actually worth, especially those that take a long time to develop their products, like many in medtech and biotech. When the cost of borrowing money becomes more predictable, investors feel more comfortable putting their money into these kinds of businesses. It also means that companies in Europe might start getting valued the same as their US counterparts, which is a big shift. This could lead to more European companies restructuring to list in the US to get access to more investment money.

The Role of Private Equity in Medtech IPOs

Private Equity’s Expanded Role in Deal Formation

It feels like private equity (PE) firms are really stepping up their game in the medtech space lately. After a bit of a quiet spell, they’ve got a ton of cash, what they call "dry powder," just sitting there, ready to be put to work. A lot of this money is tied up in companies they’ve been nurturing for a while, and now they’re looking for ways to cash out, which often means pushing those companies towards an IPO. The focus seems to be shifting from just shuffling numbers around to actually making these companies better, operationally speaking. They’re getting creative, too, setting up deals where they build a company with the intention of selling it off later, or buying smaller companies to combine them into something bigger and more attractive for public investors. Think of Zelis Healthcare, backed by Bain Capital – it’s a prime example of a big, profitable company put together by PE, now ready to hit the public market as a leader in its field.

Build-to-Buy Constructs and Platform Consolidation

This whole "build-to-buy" idea is pretty interesting. Instead of just buying a company and hoping it grows, PE firms are actively constructing businesses from the ground up, or by acquiring and integrating multiple smaller ones, with a clear exit strategy in mind, usually an IPO. They’re looking for companies that are already doing well or have the potential to become major players. This consolidation trend means we’re seeing fewer, but larger, companies emerging. The goal is to create these "platform" businesses that have the scale and market presence needed to succeed as publicly traded entities. It’s a way to de-risk the investment and create a more compelling story for public market investors who are now looking for solid, established businesses rather than just speculative growth.

Exiting Mature Assets in the Public Market

For PE firms, the public market is a key exit strategy for the mature assets they’ve been developing. With interest rates stabilizing, it’s becoming a more predictable environment for valuing these kinds of long-term investments. This stability is making it easier for PE-backed companies to go public. We’re seeing a convergence in valuations between European and US healthtech companies, partly because US PE firms are actively looking for opportunities across the pond. This means that many top European companies might need to restructure to become US-domiciled before they can tap into the larger pools of capital available through US IPOs. It’s all about finding the right moment and the right market to realize the value they’ve built.

Tier-1 Medtech IPO Candidates to Watch

Alright, so who’s actually going to make waves in the Medtech IPO scene in 2026? It’s not just about having a cool gadget anymore; investors are really looking for companies that have figured out how to make money and scale up. Think of it as moving from a science project to a real business.

Mega-Cap Listings and Their Market Validation

We’re expecting some big names to hit the public markets, and these aren’t small fries. Companies like Zelis Healthcare, which is in the healthcare payment tech space, and Medtronic MiniMed, a dedicated diabetes tech spinoff, are looking at massive valuations. Their IPOs will be a big signal to the market. If these giants can pull it off, it shows there’s serious appetite for large, profitable healthcare companies. It’s like a stamp of approval for the whole sector, saying, ‘Yeah, Medtech is a solid place to put your money.’

AI Utility Platforms Driving Cost Efficiency

Then there are the AI players, but not just any AI. The ones that are really catching eyes are those using AI as a core tool to actually cut down healthcare costs. Think companies like HeartFlow, which uses AI for heart disease, or Abridge, which is working on AI scribes for doctors. The idea here is that AI isn’t just a fancy add-on; it’s a fundamental part of how they deliver care more cheaply. Investors will be watching to see if these platforms can prove their AI is a real ‘utility’ that makes a tangible difference in the bottom line.

Specialized Medtech Innovations Poised for Growth

Beyond the giants and the AI crowd, there are some really interesting niche players. Kestra Medical Technologies is one to keep an eye on. They’re doing wearable cardioverter defibrillators, and their revenue growth has been pretty impressive. Even though they’re not profitable yet, their improving profit margins and fast growth make them a target for investors looking for that next big thing. Another one is HistoSonics, which is developing a way to destroy tumors using sound waves. They’ve got FDA clearance for liver tumors and are expanding. An IPO for them would mean they can really push their technology out to more people globally. These specialized companies show that innovation is still happening across the board, not just in the biggest tech plays.

Wrapping It Up: What to Expect in 2026

So, looking ahead to 2026, it’s clear the medtech IPO scene is shaping up to be quite different from the wild days of a few years back. Forget the hype; investors are now really focused on companies that can actually show they make money and have solid plans. We’re seeing a move towards businesses that are deeply integrated into how healthcare works, not just flashy new ideas. This means companies with proven results and clear paths to profit are the ones likely to get the green light. While there are still plenty of opportunities, especially with new tech like AI making its mark, the game has changed. It’s less about dreaming big and more about demonstrating real value. For anyone involved, staying sharp and understanding these shifts will be key to finding success in the coming year.