Thinking about bringing in outside money for your growing tech company? It’s a big step, and OpenView Investments is one of those firms that comes up a lot. They focus on software and internet companies that are really taking off. But getting their attention, and more importantly, getting them to invest, isn’t just about having a good idea. It’s about showing them you’ve got a solid plan, the right numbers, and that your company is a good fit for what they look for. This guide breaks down how to approach OpenView Investments and what they care about.

Key Takeaways

- OpenView Investments focuses on software and internet companies that are in their growth phase, looking for businesses that are already showing strong traction.

- They pay close attention to how efficiently a company is growing, looking at metrics like customer acquisition cost payback periods and how long it takes to become profitable.

- It’s important that your company’s vision and stage of development align with OpenView’s investment strategy; they want to see a clear match.

- Beyond just money, OpenView offers operational support through their teams and connections, which can help your company grow faster.

- Building a clear and honest relationship with OpenView from the start, including how you’ll communicate and handle problems, is key to a successful partnership.

Understanding OpenView Investments’ Strategic Focus

When you’re looking for investment, especially at the expansion stage, it’s really important to know what a firm is actually looking for. OpenView Venture Partners has a pretty clear idea about this. They’re not just throwing money around; they’re focused on companies that are already showing solid growth and are ready to scale up significantly. Think software, internet businesses, and tech-enabled companies that have a strong product and a clear path to more customers.

OpenView’s Expansion Stage Investment Thesis

OpenView’s main thing is backing companies that have moved past the startup phase and are now looking to really accelerate. They want to see that a business has a working product, a customer base, and a model that can grow. It’s about taking a company that’s already doing well and helping it reach its next big milestone. They’re not typically looking at brand new ideas with no traction; they’re more interested in businesses that have proven their concept and are ready for a significant push. This focus on expansion stage means they’re looking for companies that can benefit from their operational support to hit those next levels of growth. It’s about building on existing success, not starting from scratch. You can find investors who focus on different stages by filtering through criteria such as investment stage and check size.

Focus on High-Growth Technology Sectors

Their investment sweet spot is really in the technology world. This includes a lot of software-as-a-service (SaaS) companies, internet businesses, and anything that uses technology to deliver its product or service. They like sectors where innovation is constant and there’s a big market opportunity. It’s not just about the technology itself, but how that technology is being used to solve a real problem for customers and how it can scale quickly. They’re looking for companies that are leaders or have the potential to become leaders in their specific niche within these tech sectors. This means they’re often looking at markets that are growing fast and where technology plays a key role in that growth.

Leveraging Operational Expertise for Portfolio Growth

What sets OpenView apart is their emphasis on operational support. They have a team of people who have actually worked in these kinds of companies before. They understand the challenges of scaling a business, from building out the sales team to refining the product and managing operations. So, when they invest, they bring this practical experience to the table. They help their portfolio companies improve their product development, get their go-to-market strategies right, and build strong organizational structures. It’s like having a group of experienced advisors who are deeply invested in your success, helping you implement best practices to grow faster and more efficiently. This hands-on approach is a big part of their strategy for helping companies succeed.

Navigating Investment Criteria with OpenView

When you’re looking for investment, especially from a firm like OpenView that focuses on expansion-stage software companies, they’re not just throwing money at the wall to see what sticks. They have a pretty clear set of expectations, and understanding these can make a big difference in whether you get a check or not. It’s all about showing them you’re on the right track and that your business is built for sustainable growth.

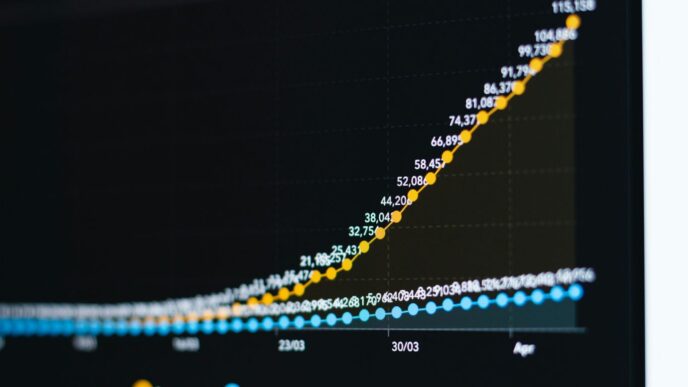

Evaluating Efficient Growth Metrics

OpenView really cares about how efficiently your company is growing. It’s not just about how fast you’re adding revenue, but how much it costs you to get that revenue. They want to see that you’re not spending a fortune to acquire customers and that your growth is sustainable over the long haul. Think about metrics that show you’re getting more bang for your buck.

- Revenue Growth Rate: How quickly is your top line increasing year-over-year or quarter-over-quarter?

- Customer Acquisition Cost (CAC): How much does it cost, on average, to bring in a new paying customer?

- Lifetime Value (LTV) to CAC Ratio: This is a big one. It shows how much value a customer brings in over their lifetime compared to what you spent to get them. A ratio of 3:1 or higher is generally seen as healthy.

- Net Revenue Retention (NRR): For software companies, this is key. It measures the revenue retained from existing customers after accounting for churn and expansion. A number over 100% means your existing customers are spending more over time.

Understanding CAC Payback Periods

This ties directly into efficient growth. OpenView wants to know how long it takes for you to earn back the money you spent acquiring a customer. If your CAC payback period is too long, it means you’re tying up a lot of capital just to get customers in the door, which can be a risky position to be in. They’re looking for companies that can recoup their acquisition costs relatively quickly, ideally within 12 months or less, depending on the business model.

A shorter CAC payback period indicates a healthier, more capital-efficient business model.

Assessing Profitability Timelines

While OpenView invests in high-growth companies, they’re not ignoring profitability. They want to see a clear path to becoming profitable, even if you’re not there yet. This means having a solid plan for how you’ll manage costs and scale your operations to eventually generate positive earnings. They’ll look at your gross margins, operating expenses, and your overall financial projections to gauge when you can realistically expect to turn a profit. It’s about demonstrating that your growth isn’t coming at the expense of long-term financial health.

Identifying Strategic Alignment with OpenView

Matching Investment Thesis and Vision

So, you’ve got a great company, and you’re looking for funding. That’s awesome. But before you even think about sending over your pitch deck, it’s super important to make sure your company’s goals and OpenView’s investment focus actually line up. It’s not just about getting money; it’s about finding a partner who gets what you’re trying to do. OpenView has a pretty clear idea of what they look for – expansion stage software, internet, and tech-enabled businesses. If your company fits that mold, you’re already on the right track.

Think about it this way: have they invested in companies similar to yours? Do their past investments suggest they understand your market? Looking at their portfolio is a good start. If they’ve backed a lot of companies in the B2B SaaS space, for example, they likely have a good handle on the challenges and opportunities there. It’s like trying to find a mechanic who specializes in your car model; they’ll just get it faster. Finding an investor whose stated thesis aligns with your company’s vision is key to a successful partnership. It means they’re not just investing in a spreadsheet, but in your long-term plan.

Analyzing Portfolio Complementarity

Beyond just the thesis, it’s worth looking at OpenView’s existing portfolio. Are there companies in their stable that could actually help yours grow? Maybe they have a company that’s a potential customer, or a partner, or even just a company that’s figured out a problem you’re currently wrestling with. This kind of synergy can be incredibly powerful. It’s not uncommon for venture capital firms to encourage their portfolio companies to work together. This can lead to some really interesting collaborations and open up new avenues for growth that you might not have found on your own. It’s like being part of a club where everyone’s trying to help each other succeed.

Consider this: if OpenView has invested in companies that operate in adjacent markets, they might be able to make introductions that could lead to new business opportunities. For instance, if you’re building a product-led growth (PLG) tool, and they have other PLG companies in their portfolio, they can connect you with folks who have navigated similar growth paths. This kind of network effect is a big part of what makes working with a firm like OpenView so attractive. It’s not just about the capital; it’s about the ecosystem they provide.

Assessing Stage Appropriateness and Check Size

This is where things get a bit more practical. OpenView focuses on expansion stage companies. That means they’re generally looking for businesses that have already found some product-market fit and are ready to scale significantly. If you’re still in the very early idea phase, or if you’re a mature public company, you might not be the right fit for their current strategy. It’s important to be realistic about where your company is in its lifecycle.

Then there’s the check size. OpenView has a certain range of investment amounts they typically deploy. You need to make sure your funding needs align with what they usually invest. If you need $500,000 and they typically write checks for $5 million or more, it’s probably not going to work out. Conversely, if you’re looking for $20 million and they usually invest $2 million, that’s also a mismatch. Doing your homework on their typical investment size, based on their past deals, is a smart move. It saves everyone time and avoids potential disappointment down the road.

Maximizing Value-Add Capabilities from OpenView

So, you’ve got the investment from OpenView. That’s great, but what happens next? It’s not just about the money, right? OpenView is known for bringing more to the table than just capital. They have a whole team dedicated to helping their portfolio companies actually grow, not just exist. Think of them as a built-in operational support system.

Leveraging Operational Support Teams

OpenView has these folks, often called operating partners or advisors, who have actually done this before. They’ve run companies, built teams, and figured out how to scale. They can step in and help with pretty much anything – product development, sales strategies, marketing plans, even hiring the right people. It’s like having a seasoned mentor available whenever you hit a roadblock. They don’t just give advice; they roll up their sleeves and help implement solutions. For instance, they might help you refine your go-to-market strategy or optimize your sales processes. This hands-on approach is a big part of why companies choose OpenView.

Accessing Industry Connections for Growth

Beyond the internal team, OpenView has a pretty extensive network. This means they can connect you with potential customers, strategic partners, and even other investors. Imagine needing to get in front of a major enterprise client; OpenView might have a direct contact who can make that introduction. These aren’t just random names; they’re often people they’ve worked with or know well, making the introduction much more effective. This can seriously speed up your customer acquisition efforts and open doors that would otherwise remain shut.

Utilizing Talent Acquisition Networks

Finding and hiring top talent is tough, especially for fast-growing tech companies. OpenView understands this. They have dedicated networks and resources focused on talent acquisition. This can range from helping you define the roles you need to fill to actively sourcing candidates for key positions. They might have a database of pre-vetted candidates or connections with specialized recruiters. Getting the right people on board quickly is critical for scaling, and OpenView’s support in this area can be a game-changer for your team’s capabilities and overall growth trajectory.

Building Relationships with OpenView Venture Partners

So, you’ve got the green light from OpenView. That’s awesome! But here’s the thing: the investment is just the start. Building a solid working relationship with your new partners is super important for making sure everything goes smoothly from here on out. It’s not just about the money; it’s about having a team that’s genuinely invested in your success.

Setting Expectations Post-Investment

Right after the deal closes, it’s a good idea to sit down and have a chat. Think of it like a kickoff meeting for your new partnership. What do you both expect from each other over the next few years? Getting this out in the open early can prevent a lot of headaches down the road. It’s about making sure you’re both on the same page about goals, how decisions will be made, and what success looks like.

- Define Roles and Responsibilities: Who does what? Clarify who is responsible for what decisions and actions.

- Outline Key Performance Indicators (KPIs): What metrics will you track together? Agree on the most important numbers that show the company is moving in the right direction.

- Discuss Communication Preferences: How often will you talk, and how? Email, calls, in-person meetings? Figure out what works best for everyone.

Establishing Communication Cadence and Format

Once you know what you expect, you need to set up how you’ll actually talk to each other. This isn’t just about random check-ins; it’s about having a regular rhythm. Think about how often you’ll share updates and what kind of information will be included. A predictable communication schedule helps everyone stay informed and aligned.

Here’s a possible structure:

- Weekly Updates: Short email or Slack message covering key wins, challenges, and immediate next steps.

- Monthly Performance Reviews: A more detailed meeting to go over KPIs, discuss progress against goals, and address any emerging issues.

- Quarterly Board Meetings: Formal sessions to review strategy, financials, and make significant decisions.

Constructively Navigating Challenges

Let’s be real, not everything will go perfectly. There will be bumps in the road. When challenges pop up, it’s how you handle them that really matters. The best founder-investor relationships are built on trust and open communication, especially when things get tough. Don’t wait until a problem is huge to mention it. Bringing issues to OpenView’s attention early, even if they seem small, allows them to offer support and advice before things get out of hand. They’ve seen a lot, and their experience can be a lifesaver when you’re facing a tough spot. It’s about working together to find solutions, not pointing fingers.

The OpenView Investment Decision Process

So, you’ve put together a killer pitch, your metrics are looking sharp, and you think you’ve found the right VC partner. But how does a firm like OpenView actually decide to invest? It’s not just about a gut feeling, though that plays a part. They have a structured way of looking at things, and understanding it can really help you align your own presentation.

Understanding Consensus vs. Conviction

Different investment firms operate with different internal dynamics. Some VCs operate on a consensus model, meaning most partners need to be on board for a deal to move forward. This can sometimes mean a slower decision-making process, as you’re trying to get a broad group of people to agree. Others, however, empower individual partners to make decisions based on strong conviction. This can lead to quicker moves, especially if a partner is really passionate about your company’s potential. Knowing which approach a firm leans towards can help you tailor your conversations and manage your expectations. It’s about understanding their internal gears.

Addressing Perceived Risks Preemptively

No investment is without risk, and OpenView, like any smart investor, will be looking for potential red flags. The best founders don’t wait to be asked about these risks. They bring them up themselves, explain what they are, and, most importantly, detail their plan to mitigate them. This shows you’ve done your homework and are thinking critically about your business. It’s better to present a clear plan for handling potential issues than to have investors uncover them themselves. Think about it like this:

- Market Shifts: How will you adapt if the market changes unexpectedly?

- Competitive Threats: What’s your strategy if a new competitor emerges?

- Execution Challenges: What are your contingency plans for operational hurdles?

The Role of Founder Vision in Securing Funding

While solid numbers and efficient growth metrics are absolutely vital, OpenView also looks for something a bit more intangible: founder vision. They invest in people as much as they invest in businesses. Your ability to articulate a compelling, long-term vision for your company, and how you plan to get there, is incredibly important. This isn’t just about the next quarter or the next year; it’s about painting a picture of the future you’re building. This vision needs to be grounded in reality, of course, but it should also inspire confidence and demonstrate a deep understanding of the market’s potential. It’s about showing them you’re not just running a business, but building something significant. This is where you can really differentiate yourself, especially when evaluating investment opportunities that might seem similar on the surface.

OpenView Investments in the Current Market

Adapting to Evolving Investor Expectations

Things have definitely shifted in the investment world lately. It feels like investors are a lot more careful about where their money goes. They’re not just throwing cash at any "hot" company anymore. Instead, they’re really digging into the details, looking for businesses that have a solid plan and can show they’re growing in a smart way. This means companies need to be super clear about their numbers and how they plan to make money long-term. It’s not enough to just have a cool idea; you’ve got to prove it can work in the real world, especially with how things are today.

The Importance of Sustainable Business Models

Back in the day, a lot of companies focused on just getting big, fast, even if it meant losing money for a while. Now, that’s not really cutting it. Investors want to see that a business can stand on its own two feet. They’re looking for companies that aren’t just burning through cash but are building something that can last. This means having a clear path to making a profit, not just chasing growth at any cost. Think about it: a company that can manage its expenses and still grow is a much safer bet.

Here’s what investors are really paying attention to:

- Profitability Timelines: When can the company actually start making money? Investors want to see a realistic plan for this.

- Efficient Growth: How much does it cost to get a new customer, and how quickly do you make that money back? They’re looking for smart spending.

- Scalability: Can the business grow without costs going through the roof? A business that can handle more customers without needing a huge increase in spending is gold.

Securing Capital in a Selective Funding Environment

Getting funding right now isn’t like it used to be. It’s tougher, and you really need to bring your A-game. Companies that are doing well are the ones that have done their homework. They know their market inside and out, they have a product that people actually want and need, and they can show how they’re different from everyone else. It’s about having a strong story backed up by solid facts. If you can show investors you’ve got a well-thought-out plan and a business that’s built to last, you’ve got a much better shot at getting the capital you need to keep growing.

Wrapping It Up

So, we’ve gone through a lot about how companies work with investors like OpenView. It’s not just about getting money; it’s about finding the right partners who get what you’re trying to do and can actually help you grow. Picking the right investor, understanding what they want, and keeping them in the loop, especially when things get tough, makes a huge difference. It’s a lot to think about, but getting this part right can really set your company up for success down the road.

Frequently Asked Questions

What kind of companies does OpenView Investments like to invest in?

OpenView likes to invest in fast-growing tech companies, especially those that work with software or the internet. They look for businesses that are ready to grow bigger and have a lot of potential to succeed.

How does OpenView help the companies they invest in?

OpenView doesn’t just give money. They have a team of experienced people who help the companies they invest in get better at making their products, selling them, and running their business smoothly. It’s like having extra coaches to help the team win.

What makes a company a good fit for OpenView?

A good fit means the company’s goals line up with OpenView’s goals. OpenView wants to see that the company is growing well, has a clear plan for the future, and is the right size for the amount of money OpenView invests.

What are the most important things OpenView looks at when deciding to invest?

OpenView pays close attention to how fast a company is growing compared to how much it costs to get new customers. They also want to know how long it will take for the company to start making a good profit.

How does OpenView make investment decisions?

Sometimes, OpenView’s partners discuss and agree on investments together. Other times, a partner might strongly believe in a company and make the decision. It’s important for founders to show they have a strong vision and plan.

Is it still a good time to get investments from firms like OpenView?

Yes, but investors are being more careful now. They want to see companies that are not just growing fast but are also building solid businesses that can make money steadily. Having a clear plan for making profits is more important than ever.