Thinking about putting your money into things that aim to do good while also making a profit? That’s where pri venture capital comes in. It’s a way for investors to look at companies and projects that are trying to solve big problems, like climate change, while still expecting a return on their investment. This guide is here to break down what that looks like, from understanding the basics to spotting opportunities and dealing with the challenges.

Key Takeaways

- Pri venture capital involves investing in companies and projects that consider environmental, social, and governance (ESG) factors alongside financial returns.

- The voluntary carbon market (VCM) offers ways to invest in carbon credits as a tool for decarbonization, but responsible procurement and integration with reduction targets are important.

- Investment opportunities exist in nature-based solutions, direct carbon projects, and companies focused on the VCM.

- Pri influences policy and encourages clear legislative guidance to support sustainable finance and investor trust.

- Challenges like systemic climate issues and the need for coordinated action remain, but Pri has a roadmap for sustainable finance, emphasizing governance and ethical standards.

Understanding Pri Venture Capital

So, what exactly is Pri Venture Capital? It’s basically about investing with a conscience, looking beyond just the money you might make. Think of it as a way to put your capital to work while also considering the bigger picture – like the environment and how companies treat people. The whole idea behind Pri, which stands for Principles for Responsible Investment, is to get investors to think about environmental, social, and governance (ESG) factors when they’re making decisions. It’s not some new, complicated thing; it’s really about being more thoughtful about where your money goes and what impact it has.

The Role of Pri In Responsible Investment

Pri plays a pretty big part in pushing for more responsible investing. It’s like a set of guidelines that encourages investors to look at ESG issues. This means thinking about things like a company’s carbon footprint, its labor practices, or how its board is structured. The goal is to encourage investments that aim for sustainable, long-term returns while also managing risks better. It’s about making sure that the companies you invest in are not just profitable but also good corporate citizens. This approach helps build a financial system that supports long-term growth and benefits everyone, not just shareholders. It’s a shift from just chasing short-term gains to building something more stable and beneficial for the future.

Origin And Purpose Of Pri

The Principles for Responsible Investment got started as a way to guide investors. It came out of a partnership between the UN Environment Programme Finance Initiative and the UN Global Compact. The main purpose was to create a global financial system that supports long-term, sustainable investments. They wanted to encourage investors to actually incorporate ESG factors into how they analyze companies and make investment choices. It’s about understanding how these factors affect investments and then acting on that knowledge. The PRI framework itself has a few key parts:

- Recognizing that ESG issues matter for investments.

- Committing to include ESG issues in investment analysis.

- Asking companies for more information on ESG topics.

- Encouraging others in the investment world to adopt these principles.

- Working to get better at putting these principles into practice.

- Reporting on what’s being done to follow the principles.

Integrating Esgs Into Investment Decisions

Integrating ESG factors into investment decisions isn’t just a trend; it’s becoming a standard way of doing business for many investors. It means looking at a company’s environmental impact, its social policies, and its governance structures alongside traditional financial metrics. For example, an investor might look at how a company manages its waste, its employee diversity policies, or the independence of its board of directors. This kind of analysis can help identify potential risks that might not be obvious from financial statements alone. It also helps spot opportunities in companies that are leading the way in sustainability. The Principles for Responsible Investment provide a framework for investors to do just that, offering practical tools and resources to help integrate these considerations effectively. It’s about making more informed choices that align with both financial goals and broader societal values.

Navigating The Voluntary Carbon Market

Okay, so let’s talk about the Voluntary Carbon Market, or VCM for short. It’s this whole system where companies and organizations can buy carbon credits to offset their emissions. Think of it as a way to balance things out when they can’t cut their emissions down to zero just yet. It’s not a free pass, though; it’s meant to work alongside actual efforts to reduce greenhouse gases.

Voluntary Carbon Credits As A Decarbonisation Tool

So, how do these credits actually help with decarbonisation? Basically, when a company buys a credit, it’s supporting a project somewhere else that’s either removing carbon dioxide from the atmosphere or preventing it from being released in the first place. These projects can be all sorts of things – planting trees, developing renewable energy, or even capturing methane from landfills. The idea is that these credits provide a financial incentive for these climate-friendly activities to happen. It’s a way to put money towards climate solutions that might not get funded otherwise. It’s important to remember, though, that this is supposed to be voluntary and additional to what companies are already doing to cut their own pollution. It’s not a replacement for that hard work.

Responsible Carbon Credit Procurement

Buying carbon credits isn’t as simple as just picking the cheapest ones. You’ve got to be smart about it. We’re talking about making sure the credits you buy are actually high-quality. What does that mean? Well, it means the emission reductions are real, they’re permanent, and they wouldn’t have happened without the credit purchase. It’s also about looking at the co-benefits – does the project help local communities? Does it protect biodiversity? A lot of people in the private markets are still getting a handle on this; surveys show that a good chunk of folks have only an average or even below-average understanding of the VCM. So, there’s a real need for clear guidance on how to do this right.

Here are a few things to keep in mind when looking to buy credits responsibly:

- Additionality: Did the project really need the carbon credit money to happen? If it would have happened anyway, it’s not additional.

- Permanence: Will the carbon removal or avoidance last for a long time? For example, a forest fire could undo the work of a tree-planting project.

- Verification: Is there a trusted third party that has checked and confirmed the emission reductions? This is super important for credibility.

- Co-benefits: What else does the project do besides reducing emissions? Think about social and environmental impacts.

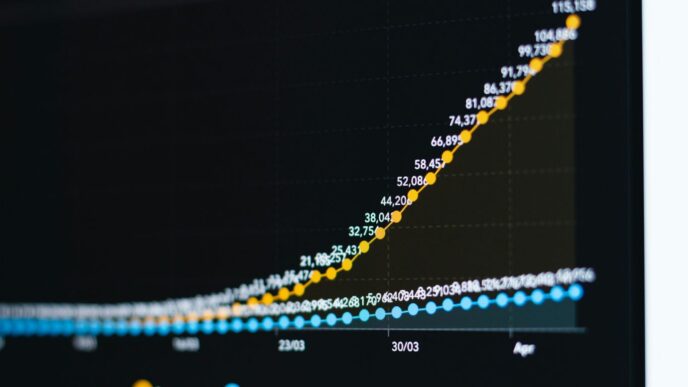

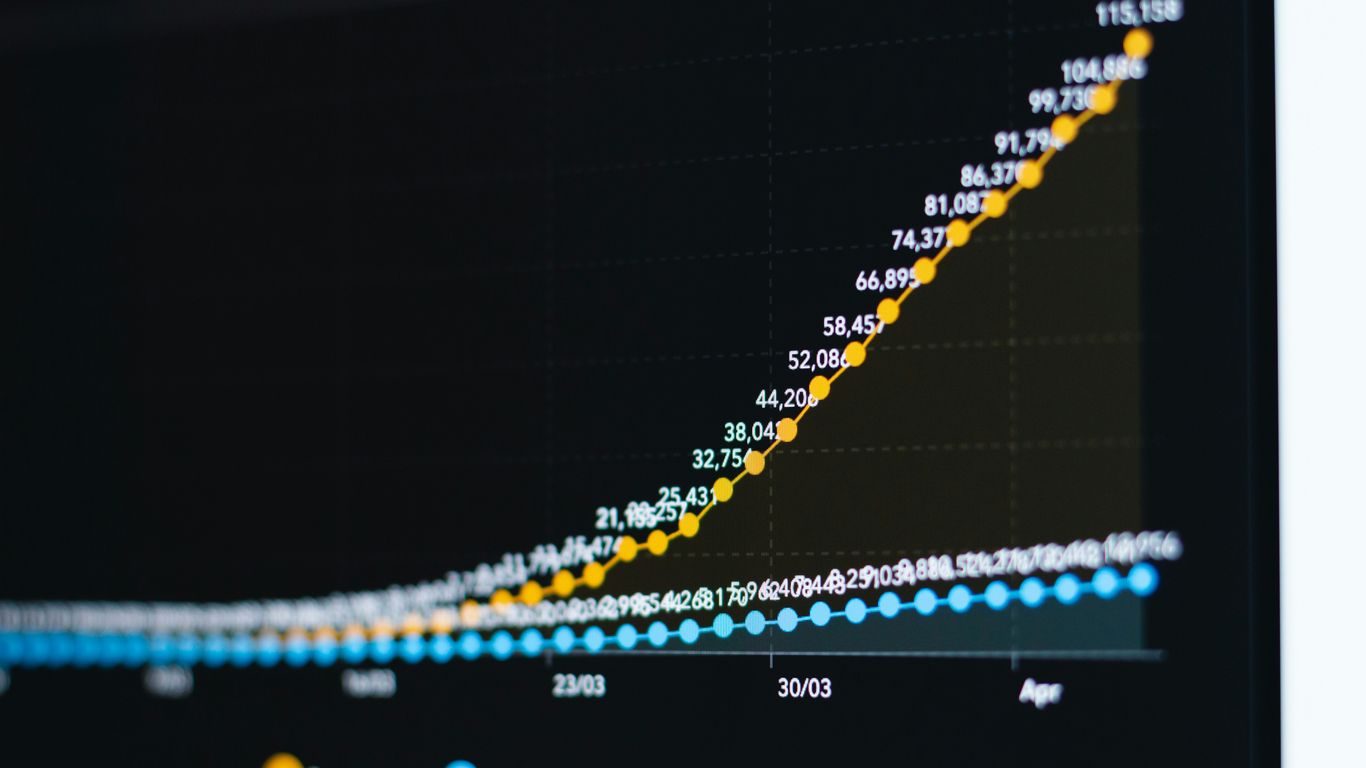

Integrating Credits With Emissions Reduction Targets

This is where it all comes together. Carbon credits shouldn’t be bought in a vacuum. They need to fit into a bigger picture, specifically a company’s overall plan to reduce its emissions. The goal is to get to net-zero, right? So, you first focus on cutting emissions from your own operations and your supply chain as much as possible. Then, for the emissions that are really hard to eliminate – the residual ones – that’s where carbon credits can come in. They act as a complementary tool. It’s about using them strategically to meet science-based targets, not as a way to avoid making tough changes internally. The market is growing fast, and projections show it could get much, much bigger in the coming years, so getting this integration right now is pretty important for the future.

Investment Opportunities In Pri Venture Capital

So, where does the money actually go when we talk about PRI venture capital? It’s not just one big pot. There are a few key areas where investors are putting their cash, aiming for both a good return and a positive impact. It’s a pretty exciting space right now, with a lot of innovation happening.

Nature-Based Investments And Nature Tech

This is a big one. Think about companies that are working directly with nature to solve problems. This could be anything from developing new ways to restore forests and wetlands to creating technologies that help us monitor biodiversity more effectively. It’s about recognizing that healthy ecosystems are actually valuable assets. We’re seeing a lot of interest in things like sustainable agriculture tech, which aims to grow food with less environmental impact, or even companies developing biodegradable materials to replace plastics. The idea is to invest in solutions that work with the planet, not against it.

Direct Investments In Carbon Projects

This is a bit more straightforward. It involves putting money directly into projects that are actively reducing or removing carbon dioxide from the atmosphere. This could be a new reforestation project, a facility that captures carbon directly from the air, or even projects that improve energy efficiency in industrial settings. These projects often generate carbon credits, which can then be sold, adding another layer to the investment.

Here’s a quick look at some common types of carbon projects:

- Afforestation/Reforestation: Planting trees where they weren’t before or restoring forests that were lost.

- Renewable Energy: Investing in solar, wind, or geothermal power generation that displaces fossil fuels.

- Energy Efficiency: Upgrading buildings or industrial processes to use less energy.

- Carbon Capture and Storage (CCS): Technologies that capture CO2 emissions from sources like power plants or industrial facilities and store them underground.

Carbon Funds And Vcm-Focused Companies

Sometimes, investing directly in projects feels a bit too hands-on, or maybe you don’t have the expertise to pick individual ones. That’s where carbon funds come in. These are like mutual funds, but instead of stocks and bonds, they invest in a portfolio of carbon reduction projects or companies involved in the voluntary carbon market (VCM). It’s a way to diversify your risk and get exposure to the VCM through a managed fund. You also have companies that are building the infrastructure or providing services for the VCM itself – think about platforms that help verify carbon credits or companies that develop software for tracking emissions. These are also becoming attractive investment targets.

Strategic Engagement And Policy Influence

PRI’s Policy Influence and Practical Tools

It’s not just about talking the talk; the Principles for Responsible Investment (PRI) actually put tools in investors’ hands. Think of it like this: they don’t just tell you to eat healthier, they give you a recipe book and a shopping list. They’ve got these databases and guides that help investors figure out how to actually put environmental, social, and governance (ESG) stuff into their investment choices. It’s all about making it easier to connect the dots between making money and doing good. They also get people talking, sharing what works and what doesn’t, which helps shape rules and practices that are better for the long haul and for the planet.

International Partnerships and Global Reach

The PRI has built a pretty big network, connecting with folks all over the world. This helps them get their message out and influence how money is invested globally. They work with governments and other financial groups to try and steer things towards a more sustainable financial system. It’s a big job because different countries have different rules and ways of doing things, so they have to be smart about how they engage in each place. They focus on things like global policy, what’s happening in specific regions, how laws can support positive impact, and what investors’ responsibilities really are.

Advocacy for Clear Legislative Guidance

Climate change is a massive problem, and it needs everyone working together. The PRI is pushing for clearer laws and rules so investors know what they’re supposed to do and how to figure out the impact of their investments. They want to make sure investors have the information they need to report on things properly. By working with policymakers, like the US Treasury, they’re helping to create a plan that guides investors through climate risks and speeds up the move to a greener economy. This coordinated effort is key to making real progress.

Challenges And Future Directions For Pri

Addressing Systemic Climate Challenges

Look, getting everyone on the same page about climate change is tough. It’s a massive, interconnected problem, and honestly, sometimes it feels like we’re just rearranging deck chairs on the Titanic. The PRI is trying to get investors to see the bigger picture, to understand that individual actions, while good, aren’t enough. We need big, coordinated efforts to really make a dent. Think of it like trying to clean up a huge oil spill – you can’t just use a sponge; you need a whole fleet of specialized ships. The same goes for climate action. Investors are starting to get this, pushing for systemic changes, but it’s a slow process. We’re talking about shifting entire economies, and that takes time, political will, and a whole lot of cooperation. The biggest hurdle is getting past short-term thinking and embracing the long game.

The Importance Of Coordinated Action

This is where things get really interesting, and frankly, a bit frustrating. We’ve got all these different groups – investors, governments, companies – all doing their own thing. It’s like a bunch of people trying to build a house, but nobody’s got the same blueprint. The PRI is all about getting everyone to work together. They’re pushing for clearer rules and guidelines so that investors know what they’re supposed to be doing and how it all fits together. Without this coordination, we risk wasting a lot of effort and money. It’s like trying to run a marathon with everyone starting at different times and in different directions – you’re not going to get anywhere fast.

Here’s what coordinated action looks like:

- Clearer Policy Roadmaps: Governments need to lay out a predictable path for businesses and investors, showing where we’re headed with climate goals.

- Standardized Reporting: Companies need to report their environmental impact in a way that’s consistent and easy to compare, so investors can make informed choices.

- International Cooperation: Climate change doesn’t respect borders, so countries need to work together on solutions, not just compete.

Pri’s Roadmap For Sustainable Finance

So, what’s next for the PRI? They’ve got a plan, of course. It’s not just about talking the talk; it’s about walking the walk. They’re looking at how to make finance truly sustainable, which means more than just slapping an ‘ESG’ label on things. It’s about fundamentally changing how money flows, making sure it supports a healthy planet and society.

Their strategy involves:

- Boosting Accountability: Making sure their members actually do what they say they’ll do regarding responsible investment.

- Improving Data and Tools: Giving investors better information and resources to make smart, sustainable choices.

- Engaging Policymakers: Working with governments to create an environment where sustainable finance can thrive.

It’s a big undertaking, and there will be bumps along the way. But the goal is clear: to build a financial system that works for everyone, not just a select few, and that doesn’t trash the planet in the process. It’s about making sure our investments today don’t mess things up for future generations. Pretty important stuff, right?

Governance And Ethical Standards In Pri

When we talk about Pri venture capital, it’s not just about the money going into green projects. It’s also about how things are run behind the scenes. Good governance and solid ethical standards are super important here. They build trust, which is kind of the whole point, right? Without it, investors won’t feel comfortable putting their cash into these initiatives, and that slows down progress.

Robust Governance For Investor Trust

Think of governance as the rulebook for how an organization operates. For Pri, this means having clear structures in place that make sure decisions are made responsibly and transparently. It’s about having oversight, like a board that actually pays attention and committees that focus on specific issues. This isn’t just about following rules; it’s about making sure the money is being used as intended and that the investment is actually working towards its sustainability goals. Strong governance is the bedrock upon which investor confidence is built. When investors see that a Pri fund or company has a solid governance framework, they’re more likely to believe in its long-term viability and its commitment to its stated mission.

Integrating Diversity, Equity, And Inclusion

Beyond just financial responsibility, ethical standards in Pri also increasingly include diversity, equity, and inclusion (DEI). This isn’t just a nice-to-have; it’s becoming a key part of how responsible investors evaluate companies. It means looking at whether the people making decisions represent a wide range of backgrounds and perspectives. It also means ensuring fair treatment and opportunities for everyone involved, from employees to the communities impacted by investments. Organizations that actively promote DEI often show better problem-solving and a stronger connection to the real-world impacts of their work.

Operationalizing Ethical Standards

So, how do you actually make these ethical standards a reality? It’s more than just writing them down. It involves putting practical tools and policies in place. This could include:

- Clear codes of conduct that everyone understands and agrees to follow.

- Mechanisms for reporting and addressing any ethical concerns or violations without fear of reprisal.

- Regular training for staff and leadership on ethical decision-making and responsible investment practices.

- Setting up processes to check that investments align with the ethical commitments made.

It’s about embedding these principles into the day-to-day operations, not just treating them as an afterthought. This makes the commitment to responsible investment genuine and effective.

Wrapping It Up

So, we’ve gone through a lot about private venture capital and the carbon market. It’s not exactly simple, and there’s a lot to think about. But the main takeaway is that these markets are growing, and there are real chances to make money while also doing some good for the planet. It’s about being smart, doing your homework on things like carbon credits, and not just jumping in without a plan. The resources out there, like the guidance we talked about, are there to help make it less confusing. Ultimately, getting involved in the right way can help businesses and the environment move forward together. It’s a big space, but with the right approach, it’s definitely manageable.

Frequently Asked Questions

What exactly is PRI in the world of investing?

PRI stands for Principles for Responsible Investment. Think of it as a set of guidelines for investors who want to make money but also care about the planet and people. It’s about making smart investments that consider environmental, social, and good leadership factors, not just profits.

Why is PRI important for investing?

PRI is important because it helps investors think about the bigger picture. By looking at things like climate change (environmental), how companies treat their workers (social), and how well they are run (governance), investors can avoid risks and find better, more sustainable opportunities for the long run.

What are ‘voluntary carbon credits’ and how do they relate to PRI?

Voluntary carbon credits are like certificates that show a certain amount of pollution has been removed or avoided. PRI supports using these credits responsibly. They can help companies reduce their carbon footprint when they can’t cut emissions directly, but they should be used alongside efforts to reduce pollution at the source.

What kinds of investments does PRI encourage?

PRI encourages investments that are good for the environment and society. This includes things like investing in projects that protect nature (like forests), companies that develop new green technologies (‘nature tech’), or funds that focus on projects that reduce carbon emissions.

How does PRI try to influence rules and policies?

PRI works with governments and other groups around the world. They share information and best practices to help create clearer rules and laws that encourage responsible investing. This helps make sure that investors have the support they need to make good choices for a sustainable future.

What are the main challenges for responsible investing?

One big challenge is getting everyone to work together. Climate change is a huge problem that needs a coordinated effort. PRI also emphasizes the need for strong ethical rules and fair practices, like making sure companies are diverse and inclusive, to build trust and ensure investments are truly beneficial.