The world of medical technology is always moving. New gadgets and treatments pop up constantly, and it can be a lot to keep track of. This article is about looking at some of the big changes happening now, from smart devices to how companies are making money and getting their products approved. We’ll touch on what’s new and what to keep an eye on in the medtech space.

Key Takeaways

- Artificial intelligence and digital treatments are changing how medical care is done, but getting these new ideas through testing and approved is still a big hurdle.

- After a slow period, expect more companies to buy or merge with others. Also, companies are focusing more on their own research and development.

- Keep an eye on new ways to treat heart problems, like pulsed field ablation and new devices for heart valves, as well as systems that help the heart pump.

- Getting medical devices approved by the FDA is complicated. Understanding the rules and common misunderstandings about clearances is important for success.

- How clinical trials are set up matters a lot for getting products approved and paid for. Smart, quick trial designs can help get new treatments to patients faster.

Navigating MedTech Innovations

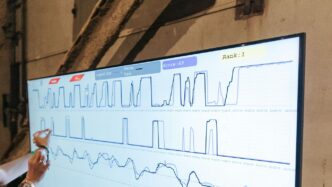

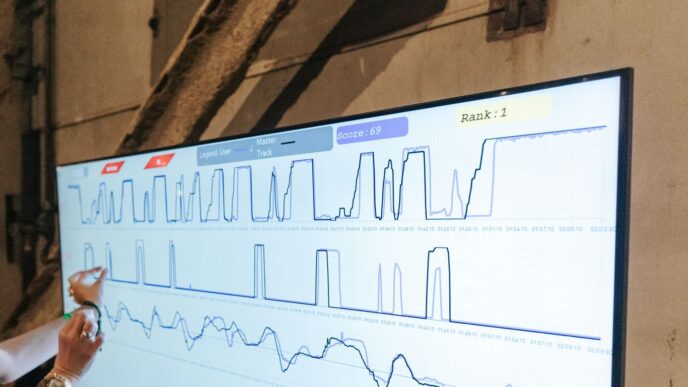

AI-Powered Devices Redefining Possibilities

Artificial intelligence is really starting to change the game in medical tech. We’re seeing devices that can do things we only dreamed of a few years ago. Think about diagnostics – AI can spot patterns in scans that might be missed by the human eye, leading to earlier and more accurate diagnoses for things like cancer or eye diseases. It’s not just about spotting problems, though. AI is also being used to personalize treatments. Imagine a device that monitors your body’s response to a medication in real-time and adjusts the dosage automatically. That’s becoming a reality.

- Early disease detection: AI algorithms analyze medical images and patient data to identify potential health issues sooner.

- Personalized treatment plans: Devices can adapt therapies based on individual patient responses.

- Robotic surgery assistance: AI enhances precision and control during complex surgical procedures.

Digital Therapeutics Emerge as Key Players

These aren’t your grandma’s pills. Digital therapeutics, or DTx, are software-based treatments that help manage or prevent diseases. They can be apps, games, or other digital tools that patients use. The idea is to provide evidence-based therapeutic interventions directly to patients. For example, there are DTx programs designed to help people manage chronic conditions like diabetes or mental health issues like depression and anxiety. They often work alongside traditional treatments, offering a more accessible and sometimes more engaging way for patients to take control of their health. The real promise here is making effective care available to more people, more easily.

Challenges in Clinical Development

Getting these amazing new technologies from the lab to patients isn’t always a smooth ride. Clinical trials are a huge part of this, and they’re getting more complicated. Developers have to figure out how to design studies that not only prove a device is safe and works but also convince regulators and insurance companies that it’s worth the cost. It’s a balancing act. You need solid data, but you also need to be smart about how you collect it to keep things moving. Plus, the regulatory hurdles are always there, and they can be pretty tough to get over. It takes a lot of careful planning to make sure a trial meets all the requirements and doesn’t end up costing a fortune or taking way too long.

MedTech Dive’s Financial Trend Analysis

Things have been pretty interesting in the world of medical technology finances lately. After a bit of a slowdown, it looks like mergers and acquisitions are picking up steam again. Big companies are starting to look around for new products and innovative smaller companies, especially since interest rates might not be as high as they were. It’s like they’re seeing a better chance to make their investments pay off.

Accelerating Merger and Acquisition Pace

We’re seeing a shift back towards more deal-making. After a quiet period, companies are getting ready to buy or merge. This is partly because:

- New products are hitting the market, especially in areas like heart repair and specialized treatments.

- Economic conditions are looking a bit more stable, making the numbers work better for these big deals.

- Valuations for some innovative companies might still be a bit low, making them attractive targets.

Tougher Financial Comparisons Ahead

While 2023 was a pretty good year for many medtech companies, with steady growth and improving business trends, this might make 2024 look a little tougher when you compare the numbers year-over-year. It’s like running a race where the previous lap was really fast – you have to push even harder to beat it. Companies that rely on procedures that were delayed during the pandemic have mostly caught up, so that boost isn’t there anymore. The focus is really shifting back to innovation and how well companies can grow their sales.

Internal R&D Spending Prioritization

Even with M&A activity on the rise, companies are still putting a lot of thought into their own research and development. It seems like a lot of firms decided to focus on building their own innovations last year, and that trend is likely to stick around. This means they’re investing in creating new technologies and improving existing ones from the inside out. However, if the perfect acquisition opportunity pops up, companies are still open to making a move.

Key Product Categories to Watch

Alright, let’s talk about what’s really making waves in the medical device world right now. It’s not just about incremental updates; some areas are seeing genuinely new approaches that could change how we treat patients.

Pulsed Field Ablation Technology Advancements

This is a big one. Pulsed field ablation (PFA) is a newer way to treat heart rhythm problems, like atrial fibrillation. Instead of using heat or cold, it uses short electrical pulses to destroy problematic tissue. Doctors are pretty excited about this because it seems to be faster and safer than older methods. Medtronic already got the first FDA okay for a PFA device, and Boston Scientific’s system is expected to get approved soon too. We’re talking about a huge market here, and PFA could really shake things up. The speed and safety profile of PFA are making it a standout technology.

Mitral and Tricuspid Repair Innovations

Problems with the heart’s valves, specifically the mitral and tricuspid valves, affect a lot of people. For a long time, surgery was the main option, which is a pretty big deal for patients. Now, there’s a lot of work going into less invasive ways to repair or even replace these valves. Think devices that can be inserted through a catheter. Companies are developing new tools and techniques to make these procedures more accessible and effective. This area is ripe for new products that can help more patients avoid open-heart surgery.

Mechanical Circulatory Support Systems

These are essentially artificial hearts or heart pumps used for people with severe heart failure. While not exactly new, the technology keeps getting better. We’re seeing smaller, more efficient, and more reliable devices. The goal is to help patients live longer and better lives, either as a bridge to a transplant or as a long-term solution. As the population ages and heart disease remains a major issue, the demand for advanced mechanical circulatory support is only going to grow. These systems are becoming more sophisticated, offering hope to patients with advanced heart conditions.

Regulatory Landscape in MedTech

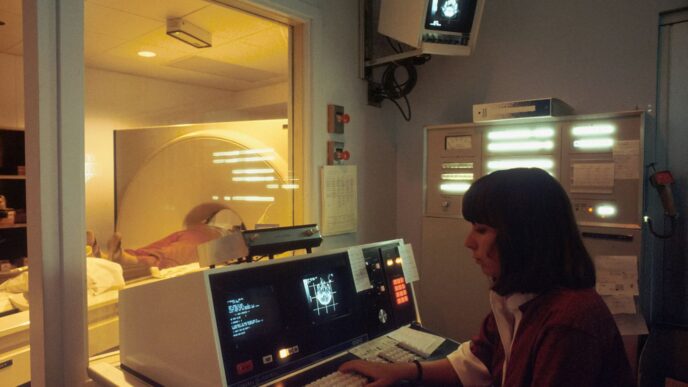

Navigating Complex FDA Approval Processes

Getting a new medical device from the lab to the patient isn’t just about brilliant engineering; it’s a whole journey through a maze of rules. The Food and Drug Administration (FDA) has a big job, and their approval process can feel like a puzzle. It’s not always a straight line from idea to market. Companies spend a lot of time and money just figuring out what paperwork is needed and what tests have to be done. This process is designed to make sure devices are safe and work like they’re supposed to, but it can definitely slow things down.

Debunking Myths About Product Clearances

There are a lot of ideas floating around about how medical devices get the green light. Some people think a "clearance" means a device is perfect and has been tested top to bottom. That’s not quite right. Different types of devices have different pathways, and "clearance" often means it’s substantially equivalent to a device already on the market. It doesn’t always mean it’s undergone the same level of rigorous testing as a brand-new, groundbreaking product that needs full premarket approval. Understanding these differences is key to knowing what a clearance actually signifies.

The Invisible Force Shaping MedTech

When you look at a medical device, you might think about the technology inside. But the rules and regulations are like an invisible hand guiding everything. They influence what gets invented, how it’s designed, and even how it’s marketed. Think about it: if a company knows a certain type of data will be required for approval, they’ll build that into their research from day one. This means regulatory requirements aren’t just hurdles to jump over; they actively shape the direction of innovation in the MedTech world. It’s a constant back-and-forth between what’s possible technologically and what’s permissible by the governing bodies.

Strategic Trial Design for MedTech Success

Getting a new medical device from the lab to the people who need it is a long road, and how you plan your clinical trials can make or break the whole journey. It’s not just about proving the device works; you also have to convince regulators it’s safe and show payers it’s worth the cost. A well-thought-out trial plan can save you a ton of headaches and money down the line.

Meeting Regulatory and Reimbursement Expectations

When you’re designing a trial, you can’t just focus on the science. You’ve got to keep the FDA and insurance companies in mind from day one. What kind of proof do they need to see? What are they looking for in terms of patient outcomes and cost-effectiveness?

- Understand the Rules: Look at what similar devices have gone through. What endpoints did they use? What did the regulators accept? This gives you a good starting point.

- Patient Voice Matters: Think about including patient-reported outcomes (PROs). These tell you how patients actually feel and function with the device, which is super important for real-world impact. Just remember, PROs are usually best used alongside other clinical measures, and it’s smart to get the FDA on board with their use early.

- Show the Value: For reimbursement, you need to demonstrate that your device not only works but also provides a benefit that justifies its price. This might mean collecting data on things like hospital stays, readmissions, or overall quality of life.

Lean and Data-Driven Trial Approaches

Nobody wants to waste time or money on a trial that’s too complicated or doesn’t give clear answers. The goal is to be smart and efficient.

- Pilot Studies are Your Friend: Before you jump into a big, expensive trial, run a smaller pilot study. This is your chance to test how the device performs, see if your chosen endpoints make sense, and figure out if the trial process itself is practical. If the device isn’t hitting the mark, you can fix it before you spend a fortune on a full trial.

- Biostatistics is Key: Get a statistician involved early. They help figure out the best endpoints, how many patients you need, and how to avoid bias. They can also help set up criteria for who can be in the trial and who can’t, which is vital for getting clear results.

- Focus on Quality Data: The more sophisticated devices get, the more important high-quality data becomes. Good data helps you set the right patient criteria, plan different trial scenarios, and pick endpoints that regulators and payers will accept. It means you’re more likely to get reliable insights the first time around.

Accelerating Time-to-Market Through Design

Every day your device isn’t on the market is a day patients aren’t benefiting. Smart trial design can speed things up.

- Clear Endpoints: Choose endpoints that are not only scientifically sound but also practical to measure and align with what regulators expect. This avoids delays caused by unclear or unaccepted measures.

- Teamwork Makes the Dream Work: Assemble a core team with diverse expertise. You’ll want a lead investigator (the medical expert), plus people who know biostatistics, reimbursement, regulatory affairs, and clinical operations. Having everyone on the same page from the start prevents missteps.

- Scenario Mapping: Use your data to ‘map out’ different trial designs. This lets you see potential challenges and how different approaches might play out, helping you pick the most efficient path forward and get your innovative device to patients faster.

MedTech Investment and Market Dynamics

VC Funding Slowdown and Recovery

So, 2023 was a bit of a mixed bag for venture capital in the medtech space. We saw a definite slowdown in funding, hitting some of the lowest points in a while. It felt like investors were taking a breath after a really active period. But, and this is a big ‘but’, there are signs things are starting to pick up again. It’s not a full-on sprint yet, but the pace is definitely picking up from where it was. People are starting to look for those promising new companies again.

Appetite for IPOs and Growth Opportunities

After a couple of quiet years, the door is starting to creak open for companies looking to go public. It’s been tough to get new medtech companies listed, but there’s a growing interest in finding new areas for growth. If interest rates keep heading down, and those smaller company stock prices start to look a bit better, we might see more companies taking the leap and exploring the IPO market. It’s all about finding those opportunities for expansion.

Impact of Weight Loss Drugs on MedTech Stocks

This is a really interesting one. The rise of popular weight loss drugs has definitely caused some waves in the medtech stock market. It’s created a bit of a roller coaster ride, with investors watching closely how these drugs might affect things like hospital volumes and the demand for certain procedures. It’s a new factor that everyone’s trying to figure out, and it’s making things a bit unpredictable for some medtech companies.

Wrapping It Up

So, that’s a look at what’s happening in the medical tech world. It’s a busy scene, with new gadgets popping up and old ones getting better. Things are moving fast, and it seems like companies are getting back to basics, focusing on making good stuff and getting it out there. Keep an eye on how these trends play out, because what happens now will shape how we get healthcare for years to come. It’s a lot to keep track of, but that’s why staying informed is so important.