Well, 2025 is shaping up to be a really interesting year for renewable energy markets. Things are always changing, and this year looks no different. We’ve got elections happening all over, which means policies could shift. Plus, demand for electricity is going up, partly because of things like AI and electric cars. It’s a lot to keep track of, but there are definitely some big opportunities out there if you know where to look. We’re seeing new tech pop up, and how we get our energy is changing, too. It’s a mix of challenges and chances as we move forward.

Key Takeaways

- Global elections in 2024 are likely to bring policy changes affecting renewable energy markets in 2025, especially in the US.

- Electricity demand is expected to rise significantly in 2025, with renewables like solar and wind being the main source for new power capacity.

- Technological progress, especially in energy storage and AI-driven data centers, will play a bigger role in meeting energy needs.

- Supply chain issues and potential overcapacity in manufacturing, alongside protectionist policies, could impact global energy markets.

- Despite policy uncertainties, corporate demand for clean energy and state-level support will continue to drive renewable energy development.

Navigating Geopolitical Shifts and Policy Evolutions

Alright, so 2025 is shaping up to be a bit of a wild ride when it comes to global energy. A lot of big elections happened in 2024, and now we’re seeing how those results are going to tweak energy policies everywhere. It’s not just about what happens in one country, either; it’s all connected.

Impact of Global Elections on Energy Policy

Think about it: when leaders change, their ideas about energy often change too. Some might push harder for renewables, while others might focus more on traditional energy sources or even nuclear power. This creates a ripple effect. For instance, a country that was all-in on solar might suddenly shift its focus, which can mess with global supply chains for solar panels or the demand for certain minerals. It’s like a big game of chess, but with energy.

US Administration’s Influence on Renewable Energy Markets 2025

Now, the US is a huge player, so what happens there really matters. With a new administration potentially coming in, we could see some big shifts. The US could push for more domestic oil and gas production, but also maybe speed up things like liquified natural gas (LNG) infrastructure. This could change how much energy the US exports and how it interacts with other countries on energy deals. For renewable energy, it’s a bit of a mixed bag. While there might be some policy headwinds, things like state-level commitments and big companies wanting clean power are still strong. Plus, the massive growth in electricity demand from things like AI and electric cars means we’ll need all hands on deck, no matter the source.

Geopolitical Tensions and Their Effect on Energy Supply Chains

On top of elections, we’ve got ongoing global tensions. Conflicts in places like the Middle East and Eastern Europe, plus the general friction between major powers like the US and China, are making energy supply chains pretty shaky. We’re seeing bottlenecks for things like offshore oil equipment and even overcapacity in battery and solar panel manufacturing. This can lead to higher costs for some things and make it harder to get what you need, when you need it. Protectionism, like tariffs, is also making things more complicated, forcing companies to rethink where they make their stuff. It’s a complex puzzle, and figuring out how to keep the energy flowing reliably while dealing with all this is the big challenge for 2025.

Surging Electricity Demand and the Role of Renewables

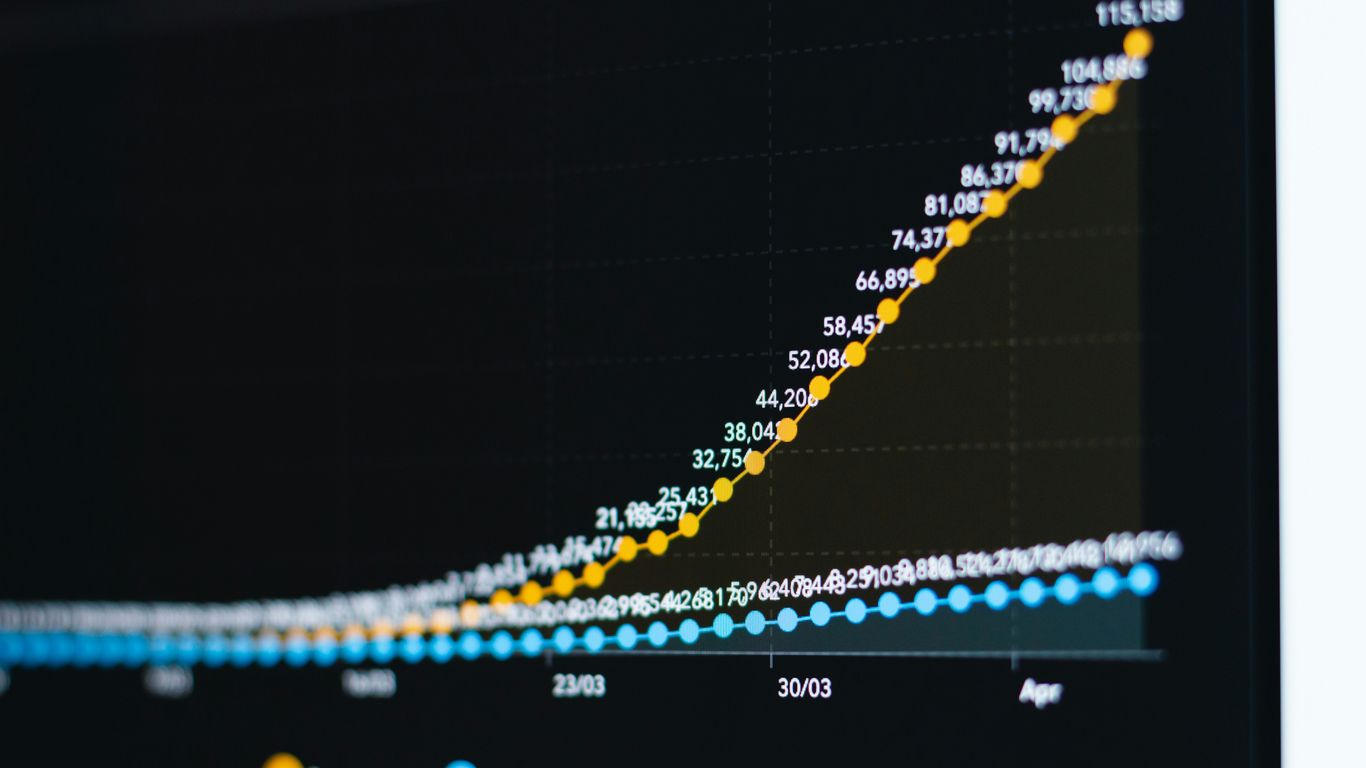

It’s pretty wild how much more electricity we’re all using these days. Global energy demand jumped up by 2.2% last year, which is way more than the usual. And get this, electricity demand specifically? That’s expected to shoot up by 4.5% in 2025 compared to 2024. Why all the extra juice? Think more electric cars, growing economies, and just needing more air conditioning in hotter places. Plus, those massive data centers popping up everywhere are huge energy hogs.

Forecasting Electricity Demand Growth in 2025

So, what does this mean for 2025? We’re looking at a significant increase in how much power we need. This isn’t just a small bump; it’s a trend that’s been building. The demand from things like electrification alone could potentially double what we use now. Add in factories coming back online and all those data centers, and you’ve got a real need for more power generation, and fast. It’s a bit of a puzzle trying to figure out exactly how much new capacity we’ll need, especially with data center demand being so unpredictable – some folks think it could add anywhere from 30 to 65 gigawatts in the next four years.

Renewables as the Primary Driver of Power Capacity Additions

When it comes to building new power sources, clean energy is still leading the pack. Last year, over 90% of all new electricity capacity added worldwide came from renewables like solar and wind. This trend is set to continue. Even with all the talk about needing more power, renewables are the main way we’re going to get it. It’s not just about meeting demand; it’s about meeting it with cleaner options.

Meeting Demand with Solar and Wind Energy Growth

Solar and wind power are really stepping up. We’re expecting a record year for adding solar and wind capacity in 2025, potentially adding close to 1,000 terawatt-hours of electricity. That’s a huge amount and will help cover a good chunk of that rising demand. While there are definitely challenges, like supply chain hiccups and policy shifts, the sheer growth in solar and wind is impressive. For instance, solar power alone is projected to add about 600 terawatt-hours in 2025, which is pretty comparable to how much oil we use annually. It’s a clear sign that these technologies are becoming a major force in how we power our world.

Technological Advancements and Emerging Energy Solutions

It feels like every week there’s some new gadget or idea popping up in the energy world. 2025 is no different, and honestly, some of these developments are pretty wild. We’re seeing a huge surge in electricity demand, and a big chunk of that is coming from places you might not expect, like data centers. These massive computing hubs are hungry for power, and their growth is really changing the game for how we think about electricity needs.

The Rise of Artificial Intelligence and Data Centers

So, AI is everywhere, right? And all those complex calculations and constant data processing need a place to happen. That’s where data centers come in. They’re basically giant warehouses filled with computers. The thing is, they use a ton of electricity. We’re talking about demand from data centers potentially doubling by the end of this decade. This means utilities and energy providers have to figure out how to keep these digital giants powered up, and that’s putting a lot of pressure on the grid. It’s a bit of a double-edged sword: AI can help optimize energy use, but the infrastructure it relies on is a massive energy consumer itself.

Innovations in Energy Storage Systems

Because we’re relying more and more on things like solar and wind power, which don’t always produce electricity when we need it, energy storage is becoming super important. Think of it like a giant battery for the grid. The technology here is getting better and cheaper, which is great news. We’re seeing advancements in:

- Lithium-ion battery improvements: Making them more efficient and longer-lasting.

- Flow batteries: These are good for longer-duration storage, which is key for grid stability.

- Mechanical storage: Like pumped hydro or compressed air, which are also getting a second look.

These storage solutions are vital for making sure the lights stay on, even when the sun isn’t shining or the wind isn’t blowing. It’s all about smoothing out the bumps in renewable energy production.

Exploring Small Modular Reactor Technologies

This one’s a bit more controversial, but it’s definitely an emerging area. Small Modular Reactors, or SMRs, are a newer take on nuclear power. They’re designed to be smaller, built in factories, and then transported to a site. The idea is that they could be safer, more flexible, and maybe even cheaper than traditional big nuclear plants. While they’re not a widespread solution yet, and there are still a lot of questions to answer about cost and waste, they represent a different path for generating reliable, low-carbon electricity. It’s definitely something to keep an eye on as the energy landscape continues to shift.

Market Dynamics and Investment Opportunities

Okay, so let’s talk about where the money is going in the energy world for 2025. It’s a bit of a mixed bag, honestly. We’re seeing a lot of investment flowing into clean energy, which is great, but there are some definite bumps in the road.

Globally, clean energy spending has been outpacing fossil fuels for a while now. Think renewables, grids, storage, efficiency – the whole clean package. While the super-fast growth we saw a couple of years ago has slowed a bit, total energy investment is still hitting record highs. In 2025, we’re looking at around $3.3 trillion globally, with a big chunk, about $2.2 trillion, going towards clean energy.

Oversupply Trends in Fossil Fuels and Renewables

This is where things get interesting. We’re actually seeing some oversupply in both fossil fuels and, surprisingly, some areas of renewables. For fossil fuels, this can lead to lower prices, which might seem good in the short term, but it doesn’t exactly help the transition to cleaner sources. On the renewable side, overcapacity in manufacturing, especially for things like solar panels and batteries, can drive down costs. That’s good for deployment, but it can also make it tough for manufacturers to stay profitable. It’s a balancing act, for sure.

EU Carbon Market Maturation and CBAM Implementation

The European Union’s carbon market is getting more mature, and the Carbon Border Adjustment Mechanism (CBAM) is starting to roll out. Basically, CBAM is designed to put a price on carbon emissions for certain imported goods. This means companies importing goods into the EU will have to account for the carbon footprint of those products. It’s a big deal because it could really change how industries operate globally, pushing them to decarbonize to avoid extra costs. It’s still early days, but expect this to shake things up.

Investment Outlook for Low-Carbon Hydrogen and CCUS

When we look at low-carbon hydrogen and Carbon Capture, Utilization, and Storage (CCUS), the investment picture is still developing. These technologies are seen as important for hard-to-abate sectors, but they often come with high costs and require significant policy support.

Here’s a quick look at what’s happening:

- Low-Carbon Hydrogen: We’re seeing a lot of pilot projects and some early-stage commercial development. Government incentives are playing a big role in making these projects financially viable. The focus is on green hydrogen (produced using renewables) and blue hydrogen (produced from natural gas with carbon capture).

- CCUS: This technology is crucial for industries like cement and steel. Investment is picking up, but the scale needed is massive. Policy support, like tax credits and regulatory frameworks, is key to unlocking more private investment.

- Challenges: Both hydrogen and CCUS face hurdles like high upfront costs, the need for new infrastructure, and public perception. However, the push for net-zero targets is creating a strong incentive for continued investment and innovation in these areas.

Addressing Supply Chain Challenges and Market Overcapacity

Bottlenecks in Offshore Oil and Gas Equipment

Things are getting pretty tight in the offshore oil and gas sector. We’re seeing major delays and cost hikes for things like floating production, storage, and offloading vessels (FPSOs) and subsea equipment. It’s not just a little bit of a squeeze; these bottlenecks are seriously impacting capital projects. On top of that, in North America, companies are really pushing for efficiency, which sounds good, but it’s actually leading to too much capacity in some areas, putting a strain on oilfield service companies’ earnings. It’s a bit of a mixed bag out there.

Overcapacity in Battery and Solar PV Manufacturing

On the flip side, the renewable energy manufacturing side is facing a different kind of problem: too much stuff. The factories churning out batteries and solar panels are producing more than the market can currently absorb. This overcapacity is naturally pushing prices down, which is good for consumers in the short term. However, this situation is complicated by rising protectionism and tariffs. These trade barriers are making it more expensive for companies to import components and are forcing a rethink about where manufacturing happens, with more talk about bringing production closer to home or spreading it out more globally. This could lead to more mergers and acquisitions as companies try to position themselves better.

Impact of Protectionism on Global Energy Supply Chains

Protectionism is really throwing a wrench into the works for global energy supply chains. When countries start putting up trade barriers and tariffs, it doesn’t just affect the price of goods; it messes with the whole flow of equipment and services needed for the energy transition. This can lead to higher costs for everyone involved and might slow down the pace of new projects. It’s forcing a lot of companies to re-evaluate their strategies, looking at where they source materials and where they build their factories. The push for more localized or regionalized supply chains is growing, but it comes with its own set of challenges and costs. Ultimately, we’re seeing a lot of companies consolidating or buying up others to get a stronger footing in this changing landscape.

Corporate Commitments and Consumer Demand for Clean Energy

Even with all the talk about policy shifts and big infrastructure projects, it’s really the companies and regular folks making choices that are shaping the clean energy scene. Big businesses are signing deals to buy clean power, and that’s a huge deal for getting new projects built. Think of it like this: when a company promises to buy a lot of solar or wind power for years to come, it makes it much easier for developers to get the money they need to build those farms in the first place.

Corporate Offtake Agreements for Carbon-Free Power

These agreements, often called Power Purchase Agreements (PPAs), are basically long-term contracts. Companies agree to buy electricity directly from a renewable energy generator at a set price. This gives both sides a lot of certainty. For the company, they lock in a price for their energy, which helps with budgeting and meeting their own sustainability goals. For the project developer, it means they have a reliable buyer, which is key for securing loans and making the project happen. We’re seeing a lot of this, especially from big tech companies and manufacturers who use a ton of electricity and have made public promises to go carbon-free.

State-Level Policy Support for Renewable Energy

While federal policies can be a bit of a rollercoaster, many states are sticking to their guns when it comes to supporting renewables. They’ve got their own goals for clean energy, and they’re putting policies in place to help meet them. This can include things like renewable portfolio standards (RPS), which require utilities to get a certain percentage of their power from clean sources, or tax incentives at the state level. This consistent support from states creates a stable environment for renewable energy development, even when the national picture is less clear.

The Growing Value of Behind-the-Meter Generation

This is where things get interesting for homeowners and businesses with their own solar panels or battery storage. ‘Behind-the-meter’ just means the generation is happening right where the energy is being used, on your property. As the grid gets more complex and electricity prices can swing wildly, especially during peak demand times, having your own power source or storage becomes more valuable. It can help reduce your electricity bills and even provide power when the main grid is struggling. We’re seeing new ways these systems can be used, like virtual power plants, where many small systems can work together to help stabilize the grid. It’s a way for consumers to play a more active role in the energy system.

The Evolving Landscape of Renewable Energy Markets 2025

Okay, so 2025 is shaping up to be a really interesting year for renewable energy. It feels like we’re at this crossroads, right? On one hand, the push for clean energy is stronger than ever, with a lot of countries and big companies making serious commitments. But then you’ve got all these other things happening – like elections changing policies, global tensions messing with supply chains, and just the sheer amount of electricity we’re going to need. It’s a lot to keep track of.

Balancing Market Fundamentals with Geopolitical Realities

It’s pretty clear that the world needs more power, and renewables are going to be a huge part of that. We’re seeing solar and wind capacity additions hitting new highs, which is great news for meeting that growing demand. But here’s the thing: global politics can really throw a wrench in the works. Think about it – if a major election shifts a country’s energy policy, that can ripple out and affect everything from investment to trade. We’re also seeing some countries lean back towards fossil fuels, which is a bit of a head-scratcher given the climate goals. It’s like trying to balance a plate on your hand while someone’s gently nudging it – you have to keep adjusting.

Opportunities Amidst Policy Headwinds in the US

In the US, things are a bit complicated. While there might be some federal policy shifts that aren’t exactly friendly to renewables, a lot of states are still pushing ahead with their own clean energy goals. Plus, big corporations are still signing deals to buy clean power. They need it to meet their own targets, and that demand isn’t going away. So, even if the national picture looks a bit murky, there are still plenty of opportunities on the ground, especially from state-level actions and corporate commitments.

The Imperative of Infrastructure Upgrades for Clean Energy

One of the biggest challenges we’re facing is making sure our power grids can handle all this new renewable energy. Solar and wind are fantastic, but they don’t produce power 24/7. This means we really need better energy storage solutions and smarter grid management. We’re talking about needing more batteries, and maybe even looking at newer technologies like small modular reactors, though those are still pretty expensive and unproven. Upgrading our infrastructure is no longer optional; it’s a necessity if we want a reliable clean energy future. Without it, all the new renewable capacity we build might not be as useful as it could be.

Looking Ahead: What 2025 Means for Energy

So, as we wrap up our look at 2025, it’s clear the energy world isn’t standing still. We’re seeing big shifts, from how countries make policy to how much electricity we all need, especially with things like AI and electric cars taking off. While there are definitely bumps in the road, like supply chain issues and changing government plans, the move toward cleaner energy sources is still a major story. It’s going to take smart planning and investment to keep up with demand and make sure we can power our future reliably and affordably. The next year looks like it’ll be a busy one for everyone involved in energy.