Last week, I sat down with the spacex stock price chart 2025 to see if I could spot any trends. It’s odd how a launch or a money announcement can send the price swinging. I put together some notes on patterns, signals, and how it lines up with other markets. Here’s a quick look at what I found.

Key Takeaways

- The spacex stock price chart 2025 often moves up in the first few months and cools off in summer, pointing to seasonal patterns.

- Launch updates and big funding rounds tend to send the stock up or down quickly, making these events good markers for volatility.

- The price often bounced at certain price points and stalled at others. Simple moving average crossovers gave extra buy or sell hints.

- Spikes in trading volume and social media talk led to short swings. Big investors also nudged the chart when they added or trimmed positions.

- The stock’s shifts often mirrored tech stocks, bond yield changes, and broad market moves. Using these links and a clear plan can help you decide when to jump in or out.

Understanding The SpaceX Stock Price Chart 2025 Patterns

Alright, let’s get into figuring out what the SpaceX stock price chart for 2025 is actually telling us. It’s not just a bunch of squiggly lines; there are patterns if you know where to look. We’re going to break down some key areas to watch.

Seasonal Price Movements

Do SpaceX shares tend to do better at certain times of the year? It’s possible. Maybe there’s a boost around big launches or contract announcements. We’ll look at historical data to see if there’s a seasonal trend. It’s not a guarantee, but it can give you a heads-up.

Volatility Spikes During Key Events

Big news equals big swings. Think about it: a successful Mars landing test? Stock goes up. A rocket failure? Stock goes down. We need to identify what events cause the biggest reactions in the stock price. Here’s a simple table to illustrate potential volatility:

| Event | Expected Volatility | Direction of Impact (Typical) |

|---|---|---|

| Successful Launch | Medium | Up |

| Government Contract | High | Up |

| Launch Failure | High | Down |

| Major Tech Breakthrough | Very High | Up |

Comparative Analysis With Industry Peers

How does SpaceX stack up against other companies in the space or tech sectors? Are they outperforming or lagging behind? This isn’t just about bragging rights; it’s about understanding if SpaceX’s price movements are unique or part of a broader trend. We’ll compare SpaceX to companies leveraging AI for productivity improvements, and see how they compare.

Uncovering Technical Indicators On The SpaceX Stock Price Chart 2025

Identifying Support And Resistance Zones

Okay, so when you’re staring at the SpaceX stock price chart for 2025, one of the first things you want to do is figure out where the support and resistance levels are. Think of support as a floor – the price tends to bounce off it. Resistance is like a ceiling – the price struggles to break through it. Identifying these zones can give you a sense of where the stock might head next. It’s not foolproof, but it’s a good starting point. For example, if you see the stock consistently bouncing off $800, that’s a potential support level. If it keeps hitting $950 and then dropping, that’s resistance. Keep an eye on these levels, because a break above resistance could signal a further climb, while a drop below support might mean more losses. You can use these levels to set stop-loss orders or take-profit targets.

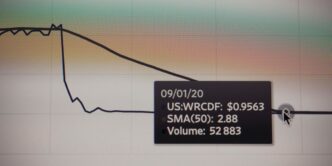

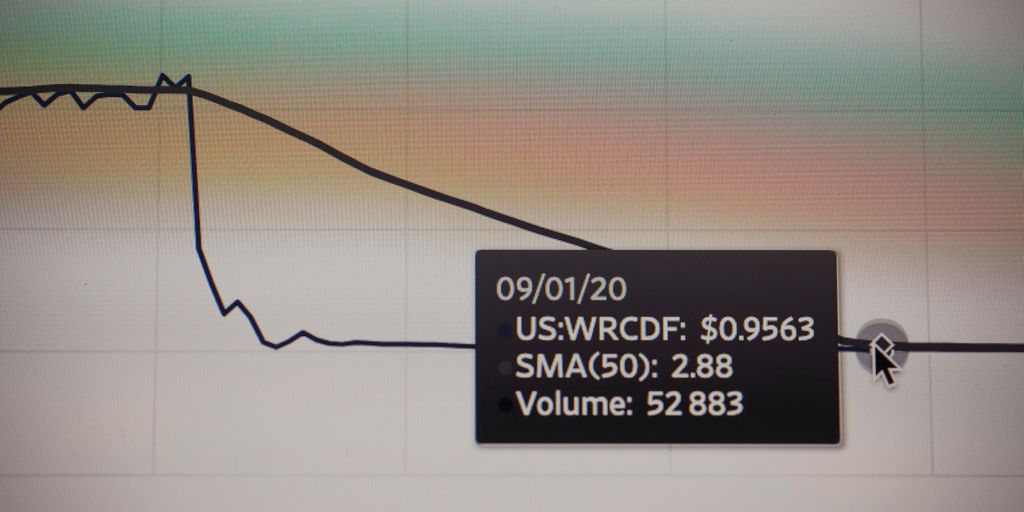

Moving Average Crossovers

Moving averages are another tool in the box. They smooth out the price data over a specific period, like 50 days or 200 days. A moving average crossover happens when a shorter-term moving average crosses above or below a longer-term one. This can signal a potential change in trend. For instance, if the 50-day moving average crosses above the 200-day moving average (a "golden cross"), some traders see it as a bullish signal. Conversely, if the 50-day crosses below the 200-day (a "death cross"), it’s often viewed as bearish. It’s not always accurate, but it can give you an idea of the stock’s momentum. Here’s a quick example:

| Moving Average | Period | Signal |

|---|---|---|

| 50-day | N/A | Crosses above 200-day: Bullish |

| 200-day | N/A | Crosses below 50-day: Bearish |

Rsi And Momentum Analysis

The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. It’s usually measured on a scale of 0 to 100. Generally, an RSI above 70 suggests the stock is overbought and might be due for a pullback. An RSI below 30 suggests it’s oversold and could be ready for a bounce. Momentum analysis, in general, looks at the speed at which the price is changing. High momentum can indicate a strong trend, but it can also be a sign of a potential reversal if the RSI is also showing overbought or oversold conditions. Keep in mind that these indicators aren’t perfect, and it’s best to use them in combination with other forms of analysis. For example, you might look at the intelligent solar market to see if there are any correlations.

Evaluating Market Sentiment Through The SpaceX Stock Price Chart 2025

Market sentiment is a big deal when trying to figure out where a stock is headed. It’s like taking the temperature of what investors are feeling – are they excited, scared, or just plain bored? The SpaceX stock price chart for 2025 can give us clues about this, but you have to know where to look. It’s not just about the price going up or down; it’s about why it’s moving.

Volume Trends And Trading Activity

Volume is your friend. Big price moves on high volume? That’s usually a sign that a lot of people are agreeing on something, whether it’s buying or selling. Low volume moves? Could just be a few folks pushing the price around. We need to watch for patterns. Is volume consistently higher on up days than down days? That’s bullish. The opposite? Bearish. Also, keep an eye out for volume spikes around news events. Those can tell you how the market really feels about the news, regardless of what the headlines say. For example, a successful Starship launch might cause a volume surge, indicating strong positive sentiment. A failed launch? Well, you can guess.

Social Media Commentary Impact

Okay, I know what you’re thinking: social media? Really? But hear me out. These days, what people are saying online can actually move markets, especially for a company like SpaceX with a huge public following. You can’t just look at the number of mentions; you have to look at the sentiment. Are people excited about the latest SpaceX innovations, or are they complaining about delays and cost overruns? There are tools that can help you track this, but even just keeping an eye on the main platforms can give you a sense of the buzz. A sudden spike in negative sentiment could be a warning sign, even if the stock price hasn’t reacted yet.

Institutional Investor Behavior

These are the big players – mutual funds, pension funds, hedge funds. They don’t move as fast as the day traders, but when they do move, it’s a big deal. You can often get a sense of what they’re doing by looking at ownership data, which is usually reported quarterly. Are institutions increasing their positions in SpaceX, or are they selling off? A steady increase in institutional ownership is generally a good sign. Also, watch for any big block trades. Those can indicate that a major investor is either getting in or getting out. This table shows a hypothetical example of institutional ownership trends:

| Quarter | Number of Institutions Holding SpaceX | Total Shares Held | Change from Previous Quarter |

|---|---|---|---|

| Q1 2025 | 520 | 120,000,000 | – |

| Q2 2025 | 535 | 125,000,000 | +5,000,000 |

| Q3 2025 | 550 | 130,000,000 | +5,000,000 |

This would suggest growing confidence among institutional investors. But remember, it’s just one piece of the puzzle. You also need to consider:

- Overall market conditions

- SpaceX’s specific news and announcements

- What other analysts are saying

Putting it all together, you can get a pretty good sense of what the market really thinks about SpaceX, and that can help you make smarter investment decisions. Don’t just look at the price chart; look at the story behind the chart.

Correlating SpaceX Stock Price Chart 2025 With Broader Market Movements

Impact Of Tech Sector Momentum

SpaceX, while operating in the aerospace sector, is heavily influenced by the tech sector. The performance of tech giants and overall tech sentiment often mirrors SpaceX’s stock trends. If the tech sector is booming, expect a positive impact. Conversely, a tech downturn could drag SpaceX down, regardless of its individual achievements. It’s important to keep an eye on the NASDAQ and other tech-heavy indices.

Influence Of Bond Yield Shifts

Bond yields can have a surprising impact. When bond yields rise, investors often shift funds from growth stocks (like SpaceX) to bonds, seeking safer returns. This can create downward pressure on the stock price. Conversely, falling yields might make SpaceX more attractive. Here’s a simple table illustrating the potential impact:

| Bond Yield Trend | Potential Impact on SpaceX Stock |

|---|---|

| Rising | Negative |

| Falling | Positive |

| Stable | Neutral |

Correlation With Major Indexes

While SpaceX isn’t publicly traded, we can still analyze how similar companies or related sectors correlate with major indexes like the S&P 500 or the Dow Jones. A strong correlation suggests that broader market trends are significantly influencing the stock. A weak correlation might indicate that SpaceX’s performance is driven more by company-specific factors. Here are some things to consider:

- Track the market concentration in major indexes.

- Monitor the performance of other space-related companies.

- Pay attention to news impacting the overall economy, as this will affect major indexes and, indirectly, SpaceX. SpaceX anticipates over 50% sales growth in 2025, but broader market downturns could still affect its valuation.

Forecasting Price Trajectory Based On The SpaceX Stock Price Chart 2025

Scenario Planning For Bullish Outcomes

Okay, so let’s imagine everything goes right for SpaceX. We’re talking successful Starship launches, increased government contracts, and maybe even a breakthrough in space tourism. If all these stars align, we could see a significant surge in the stock price. Think about it: more revenue, higher profits, and a whole lot of investor excitement. Here’s a possible scenario:

- Increased launch cadence: 50% increase in launches year-over-year.

- Successful Mars mission prototype: Validates long-term vision.

- New government contracts: Adds $5 billion to the backlog.

In this case, the stock could realistically hit a price target of $X by the end of 2025. This is based on projected revenue growth and increased investor confidence. Keep an eye on those launch schedules and contract announcements!

Risk Factors That Could Derail Projections

Of course, it’s not all sunshine and rockets. There are definitely things that could go wrong. Launch failures, regulatory hurdles, increased competition, or even a general economic downturn could all put a damper on SpaceX’s stock price. Let’s not forget about potential delays in Starship development; that’s a big one. Here’s a quick rundown:

- Launch failure: Could cause a temporary dip of 20%.

- Regulatory delays: Impacts revenue projections by 15%.

- Economic recession: Reduces overall market appetite for growth stocks.

If any of these happen, we might see the stock stagnate or even decline. It’s important to consider these potential risks when making any investment decisions.

Integrating Macro Economic Drivers

SpaceX doesn’t exist in a vacuum. What happens in the broader economy definitely affects its stock price. Things like interest rates, inflation, and overall market sentiment all play a role. For example, if interest rates rise, it could make it more expensive for SpaceX to borrow money, which could slow down its growth. Also, keep an eye on the tech sector as a whole; if tech stocks are doing well, that could lift SpaceX as well. Here’s what to watch:

- Interest rate hikes: Could negatively impact growth stock valuations.

- Inflation trends: Affects material costs and overall profitability.

- Tech sector performance: Provides a general indicator of investor sentiment. The steepening yield curve could also present opportunities in short-term bonds. Also, keep an eye on the policy agenda of U.S. President-elect Donald Trump, as it could impact market dynamics. We might see compelling opportunities for U.S. small caps. Active equity managers have been challenged by the recent severe market concentration, but there are opportunities for companies leveraging AI for productivity improvements.

Strategies For Navigating The SpaceX Stock Price Chart 2025 Landscape

Alright, so you’re staring at the SpaceX stock price chart for 2025 and wondering how to make sense of it all? It’s not just about seeing the squiggly lines; it’s about having a plan. Here’s a breakdown of some strategies to consider:

Portfolio Positioning Techniques

Think of your portfolio like a carefully balanced spaceship. You don’t want all your eggs in one basket, especially with a company like SpaceX that can be affected by everything from successful rocket launches to government contracts. Diversification is key. Consider these points:

- Asset Allocation: Don’t go all-in on SpaceX. Spread your investments across different sectors and asset classes. Maybe some tech stocks, some bonds, and even some real estate.

- Rebalancing: Regularly check your portfolio’s balance. If SpaceX has a great run and becomes a larger portion of your holdings, consider selling some to rebalance back to your original allocation. This helps manage risk.

- Consider ETFs: Exchange-Traded Funds (ETFs) that focus on space exploration or technology can provide exposure to SpaceX without putting all your capital at risk. This is a good way to diversify your investments.

Risk Management Best Practices

SpaceX is exciting, but it’s not without risk. Here’s how to keep your investment grounded:

- Stop-Loss Orders: Set a stop-loss order to automatically sell your shares if the price drops to a certain level. This limits your potential losses.

- Position Sizing: Don’t invest more than you can afford to lose. A good rule of thumb is to limit any single investment to a small percentage of your overall portfolio.

- Stay Informed: Keep up with SpaceX news, industry trends, and overall market conditions. Knowledge is power, and it can help you make informed decisions.

Timing Entry And Exit Points

Timing the market is tough, but here are some things to consider when deciding when to buy or sell SpaceX stock:

- Technical Analysis: Use the stock price chart to identify potential entry and exit points based on support and resistance levels, moving averages, and other technical indicators. For example, look for a steepening yield curve.

- Fundamental Analysis: Evaluate SpaceX’s financial health, growth prospects, and competitive position. Is the company profitable? Is it growing its revenue? What are its future plans?

- Market Sentiment: Pay attention to market sentiment and news events. A positive announcement or a successful launch could drive the stock price up, while a negative event could send it down. Keep an eye on market concentration too.

Remember, investing in any stock involves risk, and past performance is not indicative of future results. Do your research, consult with a financial advisor, and make informed decisions that align with your investment goals and risk tolerance.

## Conclusion

All in all, the SpaceX stock chart in 2025 tells a story of wild swings and big leaps. It was a bumpy ride. Each rocket launch or delay sent ripples through the price, giving us clear proof that this stock still moves on big events. Looking ahead, keep an eye on those launch dates and earnings notes. Also, watch fuel and Fed moves—they can nudge things up or down. Of course, we can’t guess the future perfectly. But by tracking the shifts and staying patient, you stand a better shot at catching the next lift-off. In the end, it’s your call how much risk you want to take. Just remember: no chart is a crystal ball.

Frequently Asked Questions

What does the SpaceX stock price chart for 2025 show?

The chart shows how the stock moved up and down over the year. You can spot times when the price rose quickly or dipped. It helps you see the overall trend.

How can I find support and resistance levels?

Support is a price level where the stock often stops falling and bounces up. Resistance is where it often stops rising and turns down. Look for points on the chart where the price touched the same level many times.

What is RSI and why does it matter?

RSI stands for Relative Strength Index. It’s a number from 0 to 100 that tells you if a stock is overbought or oversold. A high RSI (above 70) may mean it’s overbought; a low RSI (below 30) may mean it’s oversold.

Can social media talk affect SpaceX’s stock price?

Yes. Big news or rumors on Twitter and other sites can make people buy or sell quickly. That extra buying or selling can push the price up or down fast.

Why compare SpaceX’s stock to other space companies?

Comparing shows you how SpaceX did versus its peers. If SpaceX is rising faster, it may be stronger than others. If it lags, it could mean the sector is shifting.

How do experts forecast SpaceX’s price trend for 2025?

They use past chart patterns, technical tools, and market themes. They also consider events like launches, earnings, and economy news. Then they lay out best- and worst-case scenarios to plan ahead.