Alright, so 2026 is shaping up to be a pretty interesting year for energy prices. It feels like a lot is going on, from how the world economy is doing to what’s happening with conflicts out there. We’re seeing a lot of different forecasts, and honestly, it can be a bit much to keep track of. This article is going to break down some of the main things to watch out for, especially if you’re trying to figure out where energy prices might be headed. We’ll look at oil, gas, and even the newer energy sources, plus how taxes and global events could shake things up. Basically, we’re trying to make sense of all the noise so you can get a clearer picture of the energy price forecasts for the year ahead.

Key Takeaways

- Global economic slowdown and potential interest rate cuts will influence energy demand and commodity prices, while trade disputes could add market uncertainty.

- Ongoing geopolitical issues, including conflicts and global fragmentation, pose risks to energy supply chains and market stability.

- Oil prices are expected to face downward pressure due to increased supply from OPEC+ and non-OPEC sources, with China’s stockpiling potentially setting a price floor.

- Natural gas and LNG markets anticipate a significant price slump driven by new supply from the US and Qatar, despite potential project and demand risks.

- The growth of data centers is boosting power demand, while renewable fuels and the hydrogen sector face volatility due to policy shifts and financial incentives.

Global Economic Forces Shaping Energy Price Forecasts

Alright, let’s talk about what’s really moving the needle on energy prices in 2026. It’s not just about oil wells and gas pipelines; the bigger economic picture plays a huge role. Think of it like this: if the whole world’s economy is running a bit slow, people and businesses aren’t going to be using as much energy, right? That’s the core idea behind how global GDP growth affects demand.

Impact of Slowing Global GDP Growth on Demand

We’re looking at a slowdown in global GDP growth for 2026, maybe around 2.5%. When economies aren’t expanding as quickly, there’s just less activity overall. Factories might not be running at full tilt, fewer goods are being shipped around the world, and people might be a bit more cautious with their spending. All of this adds up to less demand for energy, whether it’s the gasoline powering trucks or the electricity lighting up offices. It’s a pretty straightforward connection: slower economy, less energy needed.

Influence of Interest Rate Cuts on Commodity Prices

Now, here’s where things get a little more interesting. Central banks, like the Federal Reserve in the US, are expected to start cutting interest rates. Why does this matter for energy? Well, when interest rates go down, it generally makes borrowing money cheaper. This can encourage businesses to invest more and consumers to spend more. For commodities like oil and gas, this can sometimes lead to higher prices because increased economic activity means more demand. Also, lower interest rates can sometimes weaken the US dollar, and since oil is priced in dollars, a weaker dollar can make oil cheaper for buyers using other currencies, potentially boosting demand.

Trade Tariffs and Their Effect on Market Dynamics

Trade tariffs are another big piece of the puzzle. These are basically taxes on imported goods. When countries slap tariffs on each other’s products, it makes international trade more expensive and complicated. This can disrupt supply chains, increase costs for businesses, and generally slow down economic activity. For energy markets, this means that the flow of oil, gas, and other energy products can be affected. It can create uncertainty and make it harder for markets to balance supply and demand smoothly. The ripple effect of these tariffs can be felt across the entire global energy landscape, adding another layer of complexity to price forecasts.

Here’s a quick look at how these factors might play out:

- Slowing GDP: Less economic activity means lower energy consumption.

- Interest Rate Cuts: Can stimulate the economy, potentially increasing energy demand and affecting the dollar’s value.

- Trade Tariffs: Increase costs, disrupt supply chains, and add uncertainty to market dynamics.

Geopolitical Tensions and Their Influence on Energy Markets

Alright, let’s talk about the big stuff happening in the world and how it’s messing with energy prices. It feels like every time we think things might calm down, something else pops up to shake things up. This isn’t just about supply and demand anymore; it’s about who’s friends with whom and where the next conflict might erupt.

Impact of Ongoing Conflicts and Supply Chain Ramifications

The war in Ukraine is still a major player, and honestly, nobody’s really sure when or how it’ll end. This ongoing situation continues to mess with shipping routes and the availability of certain resources. Think about it – when a major region is unstable, getting goods where they need to go becomes a lot harder and more expensive. We’re seeing this ripple effect across the board, not just for oil and gas, but for all sorts of materials needed to keep the energy sector running. It’s like a constant game of whack-a-mole trying to figure out where the next disruption will hit.

Global Fragmentation and Trade Blocs

It also seems like the world is splitting up into different groups. You’ve got the US and its allies on one side, and China and its partners on the other. This isn’t just about politics; it affects trade deals and how countries interact economically. When countries start forming their own little clubs, it can make it harder for others to get what they need, or it can lead to more expensive trade. This fragmentation means that energy markets, which are global by nature, have to deal with these new, sometimes tricky, trade dynamics. It’s a shift from a more open system to one with more barriers.

Sanctions and Their Effect on Oil and Gas Availability

Then there are sanctions. When countries impose restrictions on others, it directly impacts the flow of oil and gas. If a major producer is hit with sanctions, it can take a significant amount of supply off the market, or at least make it harder to get. This immediately pushes prices up because there’s less available. We’ve seen this play out before, and it’s a tool that governments can use to exert pressure. The tricky part is that these sanctions can have unintended consequences, affecting not just the targeted country but also the global supply and, ultimately, consumers everywhere. It’s a delicate balancing act, and the energy markets are often the first to feel the pinch.

Oil Market Dynamics and Price Projections for 2026

Alright, let’s talk about oil prices for 2026. It’s shaping up to be a bit of a mixed bag, and honestly, predicting where things will land feels like trying to catch smoke sometimes. We’ve got a few big forces at play that are really going to steer the ship.

OPEC+ Strategy and Non-OPEC Supply Growth

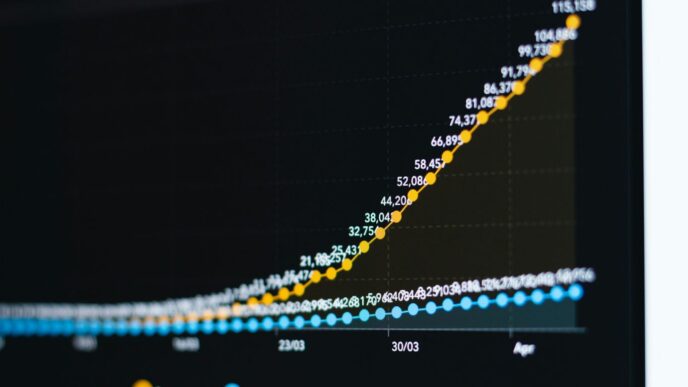

So, OPEC+ has been doing its thing, trying to manage supply to keep prices steady. Their strategy seems to be working, at least in dampening some of the non-OPEC production growth. But here’s the kicker: even with their efforts, the market is looking pretty full heading into 2026. Independent forecasts, like those from the EIA and BloombergNEF, are pointing to production growth actually outpacing demand. We’re talking about a potential surplus of a few million barrels a day, especially in the first half of the year. It’s a bit of a head-scratcher because, typically, a surplus means lower prices, right? Yet, companies are still planning to drill, maybe betting on a rebound later or just trying to keep their operations humming. It’s a delicate dance they’re doing.

Surplus Projections and Their Impact on Brent and WTI

This projected surplus is the big elephant in the room when we look at benchmarks like Brent and West Texas Intermediate (WTI). Many independent analysts are calling for prices to land in the $50s per barrel for WTI in 2026. That’s quite a bit lower than what some oil companies were expecting just a little while ago. For example, some industry surveys showed expectations around $64 a barrel, but independent forecasters are seeing the low to mid-$50s. This gap is important. It means companies, especially in North America, need to have a solid plan for what happens if prices really do stay in that lower range. Drilling new wells costs a lot, and if the price you get for the oil doesn’t cover your costs, well, that’s a problem. We’ve seen production stay surprisingly strong even when prices dipped, thanks to better tech, but there’s a limit to how long that can last if prices stay low.

China’s Strategic Stockpiling and Price Floor Influence

Now, China’s role is interesting. They’ve been strategically building up their oil reserves. While this can act as a sort of price floor, meaning they might buy more if prices drop too low, it’s not a magic bullet. Their stockpiling is part of a larger picture of global demand, which is expected to grow, but not at a super-fast pace. So, while China’s buying might offer some support, it’s unlikely to completely counteract a significant global surplus. It’s more like a steadying influence rather than a driver of big price increases. We’ll have to keep an eye on their inventory levels and purchasing patterns, as they can definitely move the needle, but they’re just one piece of this complex puzzle.

Natural Gas and LNG: Navigating a Supply Surge

Alright, let’s talk about natural gas and liquefied natural gas (LNG) for 2026. It feels like we’re looking at a bit of a supply surge, and that’s going to shake things up. The big story here is that global LNG supply is expected to jump by about 30 million tonnes. A lot of that extra gas is coming from new projects ramping up, especially in North America. The US, in particular, is really leaning into its LNG export capacity, with new terminals coming online. We’re talking about capacity reaching around 16.3 billion cubic feet per day by 2026. Major projects like Plaquemines LNG and Golden Pass LNG are big drivers of this.

So, what does this mean? Well, Asia is expected to take a good chunk of this new supply. But it’s not all smooth sailing. We’ve got to keep an eye on a few things. Project commissioning can be tricky, and weather can really mess with demand, especially during those colder months or heatwaves. Plus, there are always geopolitical issues and new environmental rules to consider. The anticipated long-duration slump in LNG prices is a real possibility, but it’s not a done deal.

Here’s a quick rundown of what to watch:

- US and Qatar’s New Supply: These two are major players, and their new projects are a big reason for the expected supply increase. This could put pressure on prices globally.

- Project Risks: Building these massive LNG facilities isn’t easy. Delays or technical issues can impact when the gas actually hits the market.

- Demand Swings: Think about how much gas people need for heating in the winter or for power generation when it’s hot. These swings can cause prices to jump around quite a bit, even with all the new supply.

- China’s Role: China’s LNG demand softened a bit recently as they planned their next five-year economic strategy. How much they buy in 2026 will be important for market balance.

It’s going to be a dynamic year for gas. While the overall trend points to more supply, which usually means lower prices, there are enough moving parts to keep things interesting. We might see some lower margins for US LNG producers sooner than folks thought. It’s a good time to be aware of these factors if you’re involved in the energy market.

The Evolving Role of New Energies and Transition Investments

Okay, so let’s talk about the new energy stuff and how it fits into everything for 2026. It’s a bit of a mixed bag, honestly. On one hand, you’ve got this massive surge in power demand, especially from things like data centers. They’re hungry for electricity, and that’s not going to change anytime soon. This means there’s a real need for more power generation, and while renewables are part of the picture, the sheer scale of demand is pushing a lot of new capacity, often gas-fired, to come online.

Growth of Data Centers and Power Demand

This whole AI boom is a big driver here. Companies are pouring money into building out AI infrastructure, and that means more and more data centers. These places use a ton of electricity, 24/7. So, even as we talk about transitioning to cleaner energy, the immediate need is for reliable power, and that’s putting pressure on existing grids and driving investment in new power plants. It’s a bit of a race to keep up.

Renewable Fuels Market Volatility and Policy Uncertainty

The renewable fuels market has been a bit of a rollercoaster. We saw some changes in regulations in Europe and North America, and then there’s the whole trade tariff situation, which just adds another layer of uncertainty. In Europe, demand for sustainable aviation fuel is ticking up because of mandates, which is good. But over in the U.S., renewable diesel prices have bounced back a little from some pretty low points, though the policy landscape is still kind of fuzzy. It makes planning tough for companies.

Hydrogen Sector Sentiment and Financial Incentives

When it comes to hydrogen, especially green hydrogen, the mood heading into 2026 is pretty subdued. A lot of the government funding that was supposed to help get things moving has been cut back, which means fewer financial incentives. Blue hydrogen, which is made using natural gas, is still holding its own on cost, which is interesting. In Europe, the rollout of new renewable energy directives is happening slowly. Member states are supposed to be putting these rules into practice, but so far, only a few have actually set up the quotas needed to really drive adoption. It feels like we’re still waiting for the big push.

Upstream Sector Challenges and Opportunities

Alright, let’s talk about the folks who actually get the oil and gas out of the ground – the upstream sector. It’s a bit of a mixed bag heading into 2026. On one hand, we’re seeing a lot of talk about belt-tightening because prices aren’t exactly soaring. Many companies are facing the reality that their current wells won’t last forever, and they need to figure out how to keep production going for the long haul.

Potential Bottlenecks Downstream Amidst Upstream Abundance

It sounds weird, right? We’ve got plenty of oil and gas being produced, but sometimes the pipes and storage facilities downstream can’t keep up. Think of it like a highway with too many cars trying to get to a single exit – traffic jams happen. This can lead to situations where even with lots of supply, getting it to where it needs to be becomes a real headache, potentially affecting prices and availability in different regions. It’s a logistical puzzle that needs solving.

Technological Advancements Improving Breakeven Prices

But here’s where things get interesting. Companies are getting smarter and more efficient. We’re seeing new tech that lets them drill longer wells, reaching more oil and gas from a single spot. This means they can produce more for less money, which is a big deal when prices are a bit shaky. It’s like finding a shortcut that saves you time and gas money.

- AI and IoT Integration: Using artificial intelligence to analyze data from sensors on equipment helps predict when something might break before it happens. This means less downtime and more consistent production.

- Advanced Drilling Techniques: Innovations like longer horizontal wells are unlocking resources that were previously too expensive to tap.

- Additive Manufacturing (3D Printing): On-site printing of parts can reduce the need for lengthy supply chains and speed up repairs.

Strategic Turning Points for Global Exploration

Looking ahead, 2026 might be a key year for deciding where to explore for new oil and gas. While there’s enough supply for now, we’ll eventually need more to meet future demand. Companies are eyeing areas like Southeast Asia and parts of Africa, while also using new methods to find resources in older, more established regions. It’s about balancing today’s needs with tomorrow’s energy requirements. The companies that invest wisely in both efficiency and strategic exploration will likely be the ones to thrive.

Energy Tax Rules and Strategic Planning for Price Uncertainty

Okay, so 2026 is shaping up to be a real head-scratcher for energy companies, especially with all the talk about fluctuating prices. On top of that, tax laws are shifting, and it’s not just a minor tweak here and there. The big picture is that some older tax breaks for fossil fuels are winding down, while incentives for cleaner energy and things like carbon capture are sticking around, thanks to legislation like the One Big Beautiful Bill Act. This means companies really need to get smart about how they plan their spending and how it all lines up with their tax situation.

Impact of New Energy Tax Legislation

This new tax landscape isn’t just about compliance; it’s a strategic tool. For businesses involved in everything from drilling to moving oil and gas, understanding these changes is key. It could mean finding new ways to fund projects or simply lowering the amount they owe in taxes. The government is clearly pushing for a transition, and the tax code is one of its main tools to encourage that. It’s like the rules of the game are changing, and you need to know them to play effectively.

Aligning Capital Planning with Tax Strategy

So, what does this mean day-to-day? It means that when a company is deciding where to put its money – whether it’s for new equipment, exploration, or investing in green tech – they can’t just look at the potential profit. They have to look at the tax implications too. Integrating tax considerations right from the start of capital planning can make a huge difference in the bottom line. It’s about making sure that the money spent today works best with the tax rules of today and tomorrow. Think of it like this:

- Reviewing existing tax credits: Are there any incentives for projects you’re already considering? Maybe carbon capture or renewable energy investments could be more attractive than you thought.

- Forecasting tax liabilities: How will changes to deductions or new credits affect your overall tax bill over the next few years?

- Structuring investments: Can you set up your investments in a way that maximizes tax benefits? This might involve timing purchases or choosing specific legal structures.

Scenario Analysis for Downside Protection and Upside Capture

Given how unpredictable energy prices can be, just having a single plan isn’t enough anymore. Companies need to be ready for different futures. What if oil prices really do dip below $55 a barrel and stay there? What if natural gas demand suddenly spikes because of a cold snap? Running through these different scenarios helps businesses see where they might be vulnerable and where opportunities might pop up.

- Low-Price Scenario: If prices drop, how does it affect your revenue? Are your costs low enough to still make a profit? Do you have enough cash reserves to ride it out?

- High-Price Scenario: If prices unexpectedly surge, are you set up to take advantage of it? Do you have the capacity to increase production or sales?

- Regulatory Shift Scenario: What if tax laws change again, or new environmental regulations come into play? How would that impact your operations and profitability?

By doing this kind of ‘what-if’ planning, companies can build strategies that protect them if things go south, but also position them to win big if the market turns in their favor. It’s all about being prepared for whatever 2026 throws at the energy sector.

Wrapping It Up: What 2026 Might Hold

So, looking ahead to 2026, it’s clear things aren’t going to be simple. We’re seeing a mix of lower oil prices than some companies expect, but also a lot of global uncertainty from politics and trade. It feels like a year where smart planning and keeping a close eye on the money side of things will be super important. Even with all the talk about new energy sources, the old ones are still going to be a big part of the picture. Basically, expect the unexpected, and be ready to adjust your sails because the energy market is always on the move.