Thinking about where energy prices might land in 2026? It’s a bit like looking into a crystal ball, but with more charts and a lot of global news. We’ve got world events, economic shifts, and new tech all playing a part. This article breaks down what experts are saying about oil, gas, and what it all means for companies trying to make sense of it all. Let’s get into the nitty-gritty of these energy price forecasts.

Key Takeaways

- Geopolitical events and a slowing global economy are major factors influencing energy prices, potentially leading to market fragmentation and currency swings that impact commodity values.

- Expect a potential oil surplus in 2026, with forecasts suggesting Brent and WTI prices could be lower than many companies anticipate, driven by OPEC+ strategy and increased non-OPEC supply.

- Natural gas and LNG markets are likely to see lower prices due to a significant increase in supply from the US and Qatar, impacting delivered gas prices in Europe and Japan.

- Energy companies are focusing on financial strength, efficiency, and disciplined spending rather than rapid growth, with US producers emphasizing operational improvements and defensive strategies.

- New tax rules, uncertainties around carbon capture projects, and volatility in renewable fuels markets are shaping investment decisions and requiring careful risk management and scenario planning.

Navigating Global Economic and Geopolitical Influences on Energy Price Forecasts

Alright, let’s talk about what’s really shaking up energy prices heading into 2026. It’s not just about how much oil or gas is being pumped; the world stage is playing a massive role. Think of it like a really complicated recipe where you’ve got your main ingredients, but then someone throws in a bunch of unexpected spices that change the whole flavor.

Disruptive Geopolitics and Market Fragmentation

This whole geopolitical mess is a big deal. The conflict in Ukraine isn’t exactly winding down, and that’s still a major factor. Plus, you’ve got shifts in places like Venezuela, which can really mess with global supply. It feels like the world is splitting into different camps, with the US and China leading their own groups. This kind of fragmentation makes trade trickier and can send ripples through commodity markets. Even things like elections, like the US midterms, can have a bigger impact than you might expect on everything from oil to gas.

Global Economic Slowdown and Currency Fluctuations

Economically, things are looking a bit sluggish. We’re expecting global growth to slow down a bit, partly because of those trade tariffs that are making things more expensive. It’s not the best picture, but there’s a glimmer of hope. If the US dollar weakens, which might happen as interest rates come down, that could actually give commodity prices a bit of a boost. It’s a balancing act, for sure.

Impact of Trade Tariffs on Commodity Markets

Speaking of tariffs, they’re really starting to bite. These taxes on imported and exported goods make it harder and more expensive to move commodities around the globe. This can lead to supply chain headaches and, you guessed it, higher prices for consumers and businesses. It’s another layer of complexity that forecasters have to consider when trying to figure out where energy prices are headed.

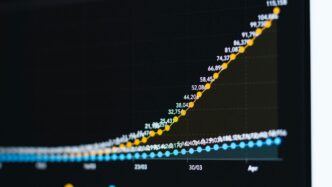

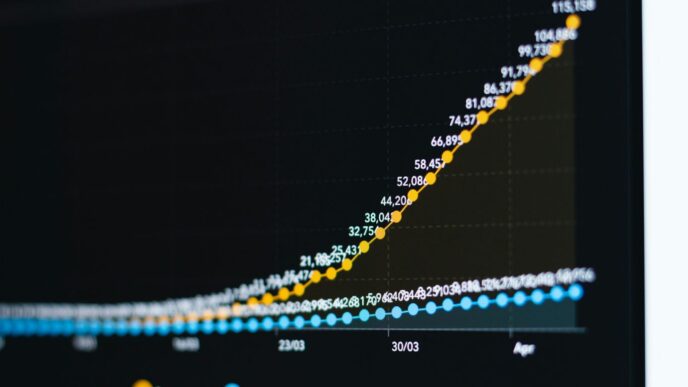

Projected Trends in Oil Market Dynamics for 2026

Alright, let’s talk oil for 2026. Things are looking a bit… full. The big story shaping up is a potential oil surplus. Forecasts from places like the EIA and the International Energy Agency are pointing to production growth outpacing demand. We’re talking about a surplus that could hit anywhere from 2.1 to 4 million barrels per day, especially in the first half of the year. Even OPEC+ seems to be acknowledging this, pausing further production increases for early 2026. It’s a far cry from the deficits some were expecting.

OPEC+ Strategy and Non-OPEC Supply Impact

OPEC+’s game plan seems to be about keeping a lid on non-OPEC supply by influencing prices. It looks like it’s working, too. The market is already pretty loaded with oil, and new volumes from places like Venezuela could add even more. While geopolitical tensions could always throw a wrench in things and maybe limit how far prices fall, the fundamental picture is one of ample supply.

Forecasted Brent and WTI Oil Price Ranges

So, what does this mean for prices? Independent forecasts are suggesting that both Brent and West Texas Intermediate (WTI) could land in a range that might make some new drilling projects tough to justify. We’re seeing projections for WTI prices in 2026 hovering somewhere between $49 and $57 a barrel. Keep in mind, the cost to drill new wells in the U.S. often sits higher than that, typically between $61 and $70. It’s not just about the immediate breakeven; these projects need big upfront cash and lots of planning.

Understanding the Growing Oil Surplus

This surplus isn’t just a blip. It’s driven by production growth that’s just chugging along faster than demand is picking up. Even with some dips in drilling rig activity when prices softened earlier this year, U.S. production managed to bounce back and hit record highs, thanks to better technology. It’s a complex situation where lower prices don’t automatically mean less oil is being pumped, at least not in the short term. The real challenge for companies in 2026 will be navigating this environment of abundant supply and potentially lower price ceilings.

Natural Gas and LNG Market Outlook for 2026

Alright, let’s talk about natural gas and LNG for 2026. Things are looking a bit different here compared to oil. We’re expecting a bit of a price bump for natural gas in the US, moving away from those really low prices we saw recently. Think Henry Hub prices averaging around $3.90 per MMBtu, which is a good jump up. This isn’t just a random guess; it’s backed by a few things.

Anticipated Slump in Global LNG Prices

Globally, though, the LNG market is set for a bit of a downturn. A huge wave of new supply is coming online, mostly from the US and Qatar. This extra gas hitting the market means prices are likely to keep falling. Delivered prices in places like Europe and Japan, which have already dropped a lot, could get cut in half again over the next few years. It’s a big shift from the super high prices we saw after the Ukraine situation.

Impact of New LNG Supply from US and Qatar

The US is really stepping up its LNG game. We’re seeing new export terminals come online, like Plaquemines LNG and Golden Pass LNG, adding a lot of capacity. By 2026, the US is set to be a major player, exporting more LNG than ever. Qatar is also adding significant capacity. This surge in supply is a big reason why global LNG prices are expected to stay low for a while.

European and Japanese Delivered Gas Prices

So, what does this mean for Europe and Japan? Well, as mentioned, they’re likely to see lower delivered gas prices. These regions were paying a premium, but with all the new LNG coming from the US and Qatar, the market is balancing out. It’s good news for consumers and industries in those areas, offering some relief from previous price spikes. However, it’s not all smooth sailing. Weather plays a big role. If the US has a warmer winter than expected, storage levels could stay high, keeping prices on the lower end. But a cold snap? That could send prices shooting up pretty quickly. So, while the overall trend points to lower prices, there’s still room for surprises.

Resilience and Strategic Positioning in the Energy Sector

Global Integrated Energy Producers’ Navigation

Big energy companies that operate worldwide are finding ways to keep steady even with oil prices being a bit shaky and global politics being, well, complicated. They’re leaning on what worked in the past few years: keeping their finances solid, not spending money wildly, and making sure they actually make money to give back to their owners. Think of it like a ship captain who knows the weather might turn rough, so they make sure the boat is in top shape and they have plenty of supplies before setting sail. They’re also watching the gas markets closely, especially with new supplies coming online. Refining, though, seems to be holding up pretty well, but you never know what might happen with world events.

US Producers’ Focus on Efficiency and Defense

Over in the United States, the companies that drill for oil and gas are getting really good at doing more with less. They’re not really trying to grow super fast anymore. Instead, they’re focusing on making their current operations as smooth and cheap as possible. This means using smarter technology, like AI, to help them work better and cutting down on any wasted money. It’s like a mechanic who tunes up an engine perfectly instead of just trying to build a bigger, more complicated one. They’re building their businesses to be tough, so they can handle whatever the market throws at them.

Embracing Balance Sheet Strength and Capital Discipline

Across the board, energy companies are realizing that having a strong financial foundation is key. This means having less debt and more cash on hand. They’re being really careful about where they put their money, making sure every dollar spent is going to work hard and bring a good return. It’s not about spending big just to spend big; it’s about smart, planned investments. This approach helps them weather the ups and downs of energy prices and keeps investors happy because they see a company that’s managed well and is built to last. This shift from ‘growth at all costs’ to disciplined, efficient operations is the new standard for success.

Innovation and Efficiency Driving Energy Production

The Shift from ‘Growth at All Costs’ to Efficiency

The days of just pouring money into projects hoping for the best are pretty much over in the energy world. Companies are now really focused on making sure every dollar spent actually does something useful, and they’re looking at how stable and scalable their operations are. It’s less about just getting bigger and more about getting smarter. With all the changes in global economics and politics, plus new tax rules, everyone’s taking a hard look at their spending. For oil and gas folks, higher costs and lower prices mean they have to be extra careful about profits. So, being disciplined with money is becoming a big deal, almost like a new way to stay strong in the market. In power and renewables, people are looking for ways to do things better, focusing on projects that are already proven, can be easily expanded, and offer different options for returns. It’s all about making capital work harder.

Digital Transformation and AI in Operations

This push for efficiency is really speeding up how the energy sector is using digital tools. Companies are changing how they work to get things done faster and cheaper. They’re also investing in tech that makes things more precise and safer. Think about smart helmets that can tell if a worker is getting too tired or spot safety issues before they become problems, which could stop production. AI and the Internet of Things (IoT) are becoming big in getting oil and gas out of the ground. They help keep equipment running longer, make production smoother, and manage costs more accurately. By using AI to look at data from IoT sensors, companies can spot problems with equipment before it breaks down. This is called predictive maintenance. It also helps them tweak how they drill and balance production across different sites. Other cool stuff includes making parts right there on-site when needed, using robots for checks and repairs, creating digital copies of equipment to test things virtually, and automating more of the drilling and production process.

Predictive Maintenance and Automation Advancements

Looking ahead, predictive maintenance is a game-changer. Instead of waiting for a pump to break or a pipeline to leak, sensors and AI can flag potential issues days or weeks in advance. This means maintenance can be scheduled during planned downtime, avoiding costly emergency repairs and production halts. It’s a huge shift from reactive fixes to proactive care. Automation is also stepping up. We’re seeing more robots used for tasks in dangerous or hard-to-reach places, like inspecting offshore platforms or performing routine maintenance in processing plants. This not only improves safety but also increases the speed and consistency of these operations. Digital twins, which are virtual replicas of physical assets, are another area gaining traction. They allow engineers to simulate different operating conditions, test upgrades, and train staff without risking actual equipment. This all adds up to a more streamlined, cost-effective, and reliable energy production system.

Regulatory and Tax Landscape Shaping Energy Investments

Okay, so let’s talk about the rules and taxes that are really changing how energy companies are making their investment decisions in 2026. It’s not just about finding oil or gas anymore; it’s about playing by a whole new set of financial and environmental guidelines. The "One Big Beautiful Bill Act" is still a big topic, you know? It’s kept some tax breaks for clean energy and carbon capture, which is good, but it’s also winding down certain deductions for older fossil fuel operations. This means companies, especially those digging stuff up or moving it through pipes, really need to rethink their spending plans. Getting this right could mean unlocking new money or at least cutting down on what they owe.

Carbon capture projects are a bit of a mixed bag. Even with those expanded 45Q tax credits, some key funding programs have ended, making things uncertain. But hey, states like Texas are jumping on board with places like Wyoming and Louisiana, trying to speed up approvals. It’s like a race to get these projects off the ground.

And then there’s the whole renewable fuels market. It’s been a bumpy ride through 2025 and into 2026. New rules in Europe and North America, plus those trade tariff worries, have kept things interesting. Europe’s pushing for more sustainable aviation fuel because of mandates, while in the US, renewable diesel prices are slowly climbing back up, even though the policy situation is still a bit fuzzy.

Here’s a quick look at what’s happening:

- New Tax Rules: Companies need to look at how the "One Big Beautiful Bill Act" affects their clean energy investments and carbon capture plans. It’s all about aligning capital spending with these new incentives and figuring out how to lower tax bills.

- Carbon Capture Development: Despite tax credits, funding gaps and state-level approval processes create a complex environment. Expect a varied pace of development across different regions.

- Renewable Fuels Volatility: Expect continued ups and downs in renewable fuels markets due to evolving regulations and global trade dynamics. Demand is growing, but policy shifts can cause price swings.

Risk Management and Scenario Planning for Energy Companies

Preparing for Multiple Price Scenarios

Look, 2026 is shaping up to be a real wild ride for energy prices. We’re talking about potential drops in oil prices that could really squeeze margins, especially if WTI dips below $55 and stays there. It’s not just about having a plan for when things go well; you absolutely need to think about what happens when they don’t. Companies that have really thought through the downside, not just the upside, are the ones that will come out ahead. It’s like packing for a trip – you bring a raincoat even if the forecast looks sunny, just in case.

Here’s a quick rundown of what to consider:

- Stress-test your budgets: Run the numbers with oil prices in the $50-$55 WTI range. See how that hits your cash flow and your ability to keep things running.

- Review your financial exposure: How much could you really lose if prices tank? Look at your hedging strategies and see if they’re still good enough.

- Identify your triggers: What specific signs would tell you it’s time to change course? Maybe it’s a sustained price drop, or a specific geopolitical event. Knowing this beforehand makes reacting much easier.

Consolidation Opportunities Amidst Price Pressures

When prices get tough, smaller players can really feel the pinch. This is where opportunities for consolidation often pop up. Companies with strong balance sheets, the ones that have been smart about their spending and kept debt in check, might find themselves in a position to buy up struggling competitors or acquire valuable assets at a discount. It’s not a pleasant thought, but for well-prepared companies, a downturn can actually be a chance to grow market share and become more efficient.

Strategic Flexibility in an Uncertain Market

Ultimately, the name of the game in 2026 is being able to adapt. The energy sector is facing a lot of moving parts – from new tax rules like the One Big Beautiful Bill Act that affect clean energy and carbon capture, to the ongoing uncertainty around renewable fuels and even hydrogen. Being able to pivot your strategy, whether it’s shifting capital allocation or exploring new business models, is key. Companies that are built for resilience, with solid finances and a focus on operational efficiency, will be the ones best placed to handle whatever comes their way. It’s about having options and not being locked into a single path.

Looking Ahead: What 2026 Might Hold

So, as we wrap up our look at 2026 energy price forecasts, it’s clear things aren’t exactly simple. We’re seeing a mix of lower oil prices predicted by many, but also a lot of global uncertainty from politics and the economy that could shake things up. Gas prices look like they might drop, which is good news for some, but electricity costs in the US are heading up, partly because of all the new tech like AI needing power. Companies that are smart about their money, keep their operations running well, and can handle surprises seem to be the ones best placed to do okay. It’s not about hitting a home run, but more about running the business steadily and being ready for whatever comes next. Planning for different possibilities is key, whether prices go up or down.