Alright, let’s talk about what’s happening with energy prices in 2026. It’s going to be a bumpy ride, that’s for sure. We’ve got a lot of big things going on globally that are going to mess with how much oil, gas, and electricity cost. Think about world events, how much stuff we’re all buying, and even what’s happening with the US dollar. Plus, this whole AI thing is really changing the game for how much power we need. It’s a lot to keep track of, so let’s break down the energy prices forecast.

Key Takeaways

- Geopolitical tensions and a slowing global economy are major factors influencing energy prices in 2026, making the market unpredictable.

- Expect a lot more liquefied natural gas (LNG) hitting the market, which could lead to lower prices for gas.

- The huge demand for power from AI and data centers is a big deal, pushing up electricity needs and potentially affecting oil prices too.

- Changes in the US dollar’s value, influenced by the Federal Reserve and trade issues, could have a noticeable impact on oil costs.

- Investment in the energy sector is shifting, with less going into traditional areas and more towards things like critical minerals and gas turbines.

Geopolitical Currents Shaping Energy Prices Forecast

Alright, let’s talk about what’s going on in the world that’s going to mess with energy prices in 2026. It’s not just about supply and demand anymore, is it? Stuff happening way over there, with leaders and countries, has a big impact right here.

Global Economic Slowdown and Commodity Market Impact

So, the world economy is looking a bit sluggish. Think about it like this: when people and businesses aren’t spending as much, they don’t need as much energy, and that tends to push prices down. We’re seeing global GDP growth slow to about 2.5% this year. Trade wars and tariffs are making things more complicated, and that’s not helping anyone. It feels like we’re hitting a bit of a low point in this economic cycle, but maybe, just maybe, things will start looking up later in the year, especially if the US dollar weakens a bit. That could give commodity prices a little boost.

Fragmented Trade Blocs and Their Market Ramifications

It feels like the world is splitting into different teams, doesn’t it? You’ve got one group leaning towards the US, and another towards China. This split makes global trade a lot trickier. When countries aren’t trading as freely, it can mess with how energy gets from where it’s produced to where it’s needed. This fragmentation means different regions might face different price pressures. It’s like everyone’s building their own little club, and that makes the big global energy market a lot less predictable.

US Elections and Their Influence on Energy Markets

This November’s US elections are a pretty big deal for energy prices. Whoever wins, and what policies they push, can really shake things up. Will they focus more on domestic production, or push harder for renewables? What about international agreements? These kinds of questions can make markets nervous. The outcome could signal a shift in how the US approaches energy production, exports, and climate policy, all of which have ripple effects worldwide. It’s not just about what happens in Washington; it’s about how those decisions play out on the global energy stage.

The Shifting Landscape of Oil and Gas Markets

Alright, let’s talk oil and gas for 2026. Things are looking pretty interesting, and honestly, a bit messy. We’ve got a lot of moving parts, and it feels like the market is trying to figure itself out.

OPEC+ Strategy and Non-OPEC Supply Dynamics

So, OPEC+ has been playing a game, trying to keep prices up by managing their own output. But here’s the thing: other countries, the non-OPEC folks, aren’t exactly sitting still. They’re still pumping out more oil, and that’s putting a bit of a lid on how high prices can go. Think of it like a tug-of-war. OPEC+ pulls one way, and the rest of the world pulls the other. It’s expected that non-OPEC countries will add over a million barrels a day to the market in 2026. This steady growth from places like Canada, Brazil, and Guyana means there’s just more oil available, which usually means prices don’t shoot up.

The Global LNG Supply Surge and Price Slump

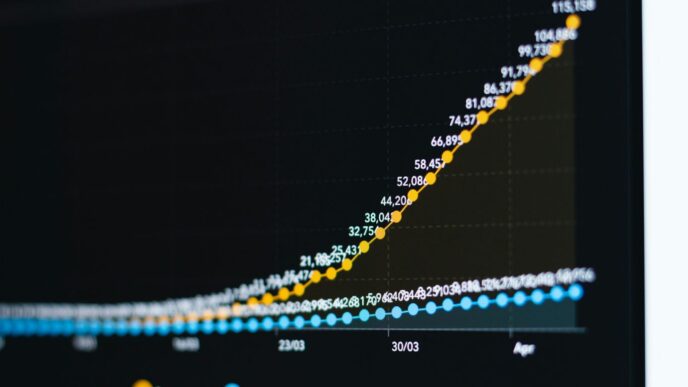

Now, let’s switch gears to natural gas, specifically Liquefied Natural Gas (LNG). Get ready, because 2026 is supposed to be the start of a massive wave of new LNG projects coming online. We’re talking about the biggest supply increase in history over the next few years. Big projects in Qatar and the US are a big part of this. What does this mean? Well, more supply generally leads to lower prices. We’re already seeing LNG prices in Europe and Asia drop significantly from their peaks a couple of years ago, and this new supply could push them down even further. It’s a big deal for gas traders and for countries that rely on imported gas.

Inventory Overhang and Potential Price Declines

Here’s where things get a bit more serious for oil prices. We’ve got a lot of oil sitting in storage right now – more than usual. This is partly because supply has been strong, and maybe demand hasn’t quite kept up. When tanks are full, it tends to push prices down. Some analysts are even talking about prices potentially dropping to levels we haven’t seen since the pandemic or the big oil price war a decade ago, especially in the first half of 2026. This "inventory overhang" is a pretty big deal. It means that even if there are some supply disruptions, the sheer amount of oil already stored could keep prices from really taking off. It’s a classic case of supply and demand, and right now, supply seems to have the upper hand, at least on paper.

Artificial Intelligence Driving Unprecedented Energy Demand

Data Center Expansion and Electricity Consumption Surge

It’s no secret that artificial intelligence is booming. We’re seeing data centers pop up everywhere, and these places are hungry for power. Think about it: all those servers crunching numbers 24/7 need a constant, massive electricity supply. This isn’t just a small bump in demand; it’s a significant surge that’s putting a real strain on our power grids. Utilities and energy companies are scrambling to keep up, facing challenges like long waits for new gas turbines and complex regulatory processes. This frantic race for power is a defining characteristic of the electricity market in 2026.

AI’s Impact on Stock Market Performance and Oil Prices

The AI craze isn’t just about electricity; it’s also shaking up the financial world. Stocks tied to AI and data centers have been carrying the broader market, making up a huge chunk of the S&P 500’s gains recently. Economists estimate that data center investments alone are contributing a noticeable amount to U.S. GDP growth. And because the stock market and oil prices often move together, this AI-driven economic activity is also influencing oil prices. So, while we’re still watching OPEC+, China, and global politics, the AI boom is a new, major player in the energy price game for 2026.

The Race for Power and Grid Resilience Challenges

Meeting this skyrocketing demand for electricity is a huge undertaking. Utilities are in a tough spot, trying to build enough new capacity while also dealing with supply chain issues and rising costs for equipment and labor. On top of that, the grid needs to be more robust to handle extreme weather events and other disruptions. This means significant investment is needed not just in generating more power, but also in making the entire system more reliable and resilient. Finding ways to protect consumers from rising electricity bills while still encouraging the necessary infrastructure upgrades is a big puzzle regulators are trying to solve.

Dollar Volatility and Its Effect on Energy Prices Forecast

Okay, so let’s talk about the dollar. It’s been a bit of a rollercoaster, and that’s going to mess with energy prices in 2026. We’re seeing forecasts that the U.S. dollar might get weaker. Why? Well, the Federal Reserve is expected to ease up on interest rates, and there’s still a lot of uncertainty around trade deals and tariffs. It’s not going to be a smooth ride, though. Things like how fast the Fed cuts rates compared to other central banks, or any surprises on the trade front, could make the dollar jump around a lot.

Federal Reserve Policy and Currency Fluctuations

The Federal Reserve’s decisions on interest rates are a big deal. If they cut rates more aggressively, it usually makes the dollar less attractive to investors looking for higher returns. This can lead to a weaker dollar. When the dollar weakens, oil and other commodities priced in dollars become cheaper for folks buying them with other currencies. This can boost demand, and you know what that means for prices.

Trade Uncertainty and its Impact on the US Dollar

Trade disputes and tariffs are still a thing, and they create a lot of noise in the currency markets. If the U.S. gets into more trade spats or if existing ones aren’t resolved, it can make businesses and investors nervous. This nervousness often leads to a weaker dollar as people pull back from U.S. assets. It’s like a constant background hum of uncertainty that can really move the currency.

Historical Correlation Between Dollar and Oil Prices

Traditionally, a weaker dollar meant higher oil prices. It’s pretty straightforward: cheaper dollars make oil a better deal for international buyers. However, things have gotten a bit mixed up lately. Sometimes, the dollar and oil prices seem to move in the same direction, which is weird. So, while a weaker dollar should be good for oil prices, we need to watch closely. Big moves in oil in 2026 might not just come from supply and demand for barrels, but from how the currency markets are behaving. Keep an eye on those currency charts, they might be just as important as the oil inventory reports!

Navigating Investment Trends in the Energy Sector

Stalled Investment Growth Amidst Geopolitical Tensions

Things are a bit shaky in the energy investment world right now. Geopolitical spats and prices for things like oil and gas taking a bit of a dip have put the brakes on the big spending spree we saw recently. Investment in energy and natural resources was climbing, hitting a record high last year, but we’re forecasting a slight drop for 2026. It’s not a huge fall, but it’s a pause. This slowdown comes at a time when we really need sustained investment to keep up with future demand and to make our energy cleaner. It seems like everyone’s being more careful with their money, waiting to see how things shake out.

Shifting Investment Towards Critical Minerals and Copper

While overall investment might be a bit flat, there’s a definite shift happening. Forget just oil and gas for a second; the real buzz is around metals, especially copper. Why? Artificial intelligence. All those data centers crunching numbers need a ton of power, and that means more demand for copper and other critical minerals. Mining companies are looking to beef up their portfolios, focusing on low-cost, large-scale mines. It’s a bit of a gold rush, but for the materials powering our digital future. Governments are also getting involved, trying to secure supplies of these vital resources. It’s a complex picture, with companies trying to balance being careful with their cash and positioning themselves for what’s next.

M&A Activity in Renewables and Gas Turbine Assets

Mergers and acquisitions are picking up, especially in the renewables and gas power sectors. In the US, there’s some uncertainty about the future of renewables, which is making companies rethink where they’re putting their money. Some are looking to reduce their exposure to the US market, while others are eyeing opportunities in places like Canada. Developers are also moving away from brand-new, risky projects towards ones that are already up and running and making money. Plus, with all the demand for power from data centers, existing gas turbine plants are suddenly looking very attractive. This is creating a good market for sellers who want to cash out and return money to their investors.

Energy Affordability and Regulatory Responses

It’s getting pretty wild out there with energy prices, and folks are feeling it. In Europe, for example, electricity consumers have been hit hard over the last few years. Gas prices shot up, and since gas often sets the price for electricity, everyone’s bills went through the roof. We’re hoping things ease up a bit in 2026 as gas prices hopefully come down.

Soaring European Power Prices and Gas Market Influence

Remember those super high European power prices? A lot of that came down to how much natural gas cost. When gas is expensive, electricity generators have to charge more. It’s a pretty direct link. But, with gas prices showing signs of cooling off, there’s a chance European economies could get a bit of a break. It’s not a guarantee, but it’s a hopeful sign after a tough stretch.

US Retail Electricity Rates and Administrative Agendas

Over in the US, the administration is really focused on the rising cost of electricity for homes. It’s a big deal. In 2025, a lot of states saw actual increases in what people pay for electricity. Why? Well, a few things are happening all at once. First, all this AI stuff and building new data centers means we need a ton more power. Utilities are scrambling to keep up and also have to spend money making the grid tougher against things like wildfires and crazy weather. Add in supply chain issues, higher costs for equipment and workers, and, yep, those rising domestic gas prices, and you’ve got a recipe for higher electricity bills. It feels like a race to keep the lights on without breaking the bank.

Innovative Tariffs for Consumer Protection and Infrastructure

So, what’s being done? Regulators, both at the state and federal levels, are under pressure to find ways to stop these retail price hikes. We’re going to need some smart new ways to charge for electricity, or ‘tariffs’ as they’re called. The goal is to protect regular customers from getting hit too hard, while still making sure we can build the new power lines and other infrastructure we desperately need. It’s a tricky balance, for sure. We need to build more, but we also need to make sure it’s affordable for everyone.

Wrapping It Up

So, looking ahead to 2026, it’s clear things aren’t going to be simple. We’ve got a lot of moving parts, from global politics to how much power all those new AI data centers are going to need. Prices for oil and gas could swing around quite a bit, and even the value of the dollar will play a role. It feels like a year where staying flexible and keeping an eye on what’s happening globally will be key. Don’t expect a totally smooth ride, but there will likely be chances to adapt and make smart moves if you’re paying attention.