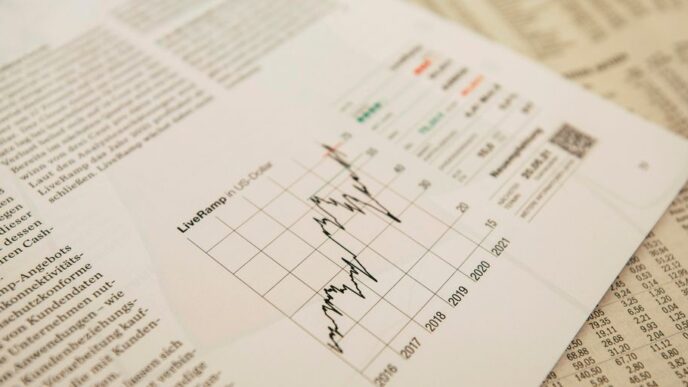

Japan’s Nikkei 225 index experienced a significant decline of 1.8% on Tuesday, closing at 38,474 points. This downturn was primarily driven by investor reactions to new semiconductor export restrictions proposed by the Biden administration, which have raised concerns in the market.

Key Takeaways

- The Nikkei 225 index closed at 38,474, marking a 1.8% drop.

- The decline was influenced by a slump in the Nasdaq, following US policy news.

- Semiconductor-related stocks were particularly affected.

- The yield on 10-year Japanese government bonds reached 1.25%, the highest in nearly 14 years.

Market Reaction to US Policy Changes

The Japanese market reopened after a three-day break, only to face immediate pressure from the semiconductor sector. Investors reacted swiftly to the news of the Biden administration’s proposed restrictions on exporting advanced semiconductors, which are crucial for artificial intelligence and other high-tech applications. This policy shift has raised alarms among investors, leading to a sell-off in semiconductor stocks across the board.

Impact on Semiconductor Stocks

The semiconductor industry is a vital component of Japan’s economy, and the new US regulations have sparked fears of reduced competitiveness in the global market. Key players in the semiconductor sector saw their stock prices tumble as investors sought to mitigate potential losses. The following companies were notably impacted:

- Sony Corporation

- Tokyo Electron

- Renesas Electronics

- Advantest Corporation

These companies are integral to Japan’s semiconductor supply chain, and their performance is closely tied to global demand and regulatory environments.

Bond Market Response

In addition to the stock market’s reaction, the yield on 10-year Japanese government bonds briefly climbed to 1.25%. This increase marks the highest level seen in nearly 14 years, reflecting similar trends observed in the US Treasury market. Rising bond yields often indicate investor concerns about inflation and economic stability, further complicating the financial landscape.

Looking Ahead

As the situation develops, investors will be closely monitoring the implications of the US semiconductor export restrictions. Analysts suggest that the Japanese market may continue to experience volatility as companies adjust to the new regulatory environment. The semiconductor sector’s performance will be a key indicator of Japan’s economic resilience in the face of international policy changes.

In conclusion, the recent drop in Japan’s Nikkei index underscores the interconnectedness of global markets and the significant impact that policy decisions in one country can have on another. Investors are advised to stay informed and consider the broader implications of these developments on their portfolios.

Sources

- Japan’s Nikkei index drops 1.8% on US chip rules, Tech in Asia.