Parenteral Nutrition (PN) refers to the intravenous administration of nutrients, including carbohydrates, proteins, fats, vitamins, minerals, and electrolytes, directly into the bloodstream. This critical medical intervention is indispensable for patients who are unable to absorb adequate nutrition through the gastrointestinal tract due to various medical conditions, such as severe digestive disorders, cancer, critical illness, or post-surgical recovery. As a life-sustaining therapy, the parenteral nutrition market plays a pivotal role in patient recovery, improving outcomes, and enhancing the quality of life for individuals facing severe malnutrition.

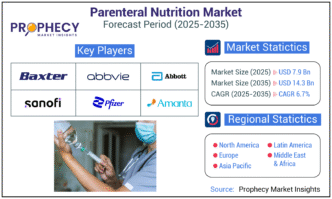

Market Valuation and Growth Trajectory

The global Parenteral Nutrition Market is experiencing consistent growth, driven by an increasing patient population requiring nutritional support. Recent estimates indicate that the market was valued at approximately USD 7.5 Billion in 2024. This essential market is projected to expand significantly, reaching an estimated USD 14.3 Billion by 2035, exhibiting a Compound Annual Growth Rate (CAGR) of 6.7% during the forecast period. This robust growth underscores the growing global burden of chronic diseases, the aging population, and continuous advancements in clinical nutrition.

Key Segments and Their Impact

The parenteral nutrition market is diverse, catering to a wide range of patient needs and clinical scenarios:

- By Nutrient Type:

- Carbohydrates: Often the largest segment, providing essential energy.

- Parenteral Lipid Emulsions: Crucial for energy, essential fatty acids, and preventing fatty acid deficiency. Notably, advancements in four-oil lipid emulsions are improving patient outcomes, including for pediatric patients.

- Single Dose Amino Acid Solutions: Provide protein building blocks for tissue repair and muscle maintenance.

- Vitamins & Minerals: Essential micronutrients for overall bodily functions.

- Trace Elements: Vital in small quantities for various metabolic processes.

- By Stage Type / Consumer Type:

- Adults: Dominates the market due to the high prevalence of chronic diseases, cancer, and age-related conditions requiring nutritional support in older adults.

- Pediatrics (Children and Neonates): Expected to be the fastest-growing segment, driven by the increased use of PN for preterm neonates and critically ill children.

- By Indication:

- Malnutrition/Nutritional Deficiency: A primary driver across all patient groups.

- Cancer Care: Patients undergoing chemotherapy or radiation often require PN due to appetite loss and malabsorption.

- Gastrointestinal Disorders: Conditions like Crohn’s disease, short bowel syndrome, or severe pancreatitis necessitate PN.

- Neurological Disorders: Dysphagia (difficulty swallowing) and other conditions leading to inability to consume food orally.

- Critical Care/Post-surgical Recovery: Providing vital nutrients during acute phases of illness or recovery.

- Other indications: Including HIV/AIDS, kidney diseases, etc.

- By Sales Channel / End-User:

- Hospitals & Clinics (Institutional Sales): Remain the largest segment, as initiation and complex management of PN often occur in these settings.

- Home Care & Long-term Care Settings: This segment is witnessing rapid growth, driven by the increasing preference for home-based care and advanced home parenteral nutrition (HPN) solutions, enhancing patient quality of life.

- Online Sales Channel: Emerging as a fast-growing segment for specific products, offering convenience for long-term nutrition management.

📥 Download the sample report here

https://www.prophecymarketinsights.com/market_insight/Insight/request-sample/1291

Market Dynamics: Forces at Play

Drivers:

- Increasing Prevalence of Chronic Diseases and Malnutrition: The rising global burden of chronic illnesses, including cancer, gastrointestinal disorders, and neurological conditions, significantly fuels the demand for PN. Malnutrition, particularly among hospitalized patients and the elderly, is a widespread concern.

- Aging Global Population: The growing geriatric demographic is more susceptible to chronic diseases and conditions that impair oral intake or nutrient absorption, leading to increased need for PN.

- Advancements in PN Formulations and Delivery Systems: Innovations in lipid emulsions (e.g., multi-oil emulsions), multi-chamber bags (simplifying preparation), and specialized formulations for specific disease states are improving safety, efficacy, and ease of use.

- Growing Awareness and Clinical Guidelines: Increased understanding among healthcare professionals about the importance of early and adequate nutritional support in patient outcomes is driving PN adoption.

- Shift Towards Homecare Settings: Technological advancements and a desire for better patient quality of life are facilitating the safe and effective administration of PN in home settings.

Restraints:

- High Cost of Therapy: PN can be an expensive treatment, posing affordability challenges, especially in low-income regions.

- Risk of Complications: PN carries potential risks such as catheter-related bloodstream infections, liver complications, and metabolic imbalances, requiring stringent monitoring and skilled healthcare professionals.

- Complex Logistics and Cold Chain Management: Many PN formulations require strict temperature control, posing logistical challenges, particularly in regions with underdeveloped infrastructure.

- Product Shortages: Occasional shortages of essential PN components or finished products can disrupt patient care.

- Regulatory Scrutiny: Stringent regulatory requirements for the manufacturing and labeling of PN products ensure safety but can also impact market entry and product development.

Opportunities on the Horizon

The parenteral nutrition market is ripe with opportunities for innovation and expansion:

- Personalized Nutrition: Development of tailor-made PN formulations based on individual patient needs, genetics, and metabolic profiles, leveraging advanced diagnostics and data analytics.

- Digital Health Integration: Use of AI and digital platforms for remote monitoring of PN patients, real-time adjustments, and improved adherence in homecare settings.

- Sustainability in Packaging: A growing trend towards greener and eco-friendly packaging solutions for PN formulas.

- Emerging Markets: Untapped potential in developing economies in Asia Pacific, Latin America, and Africa, where healthcare infrastructure is improving and demand for advanced therapies is rising.

- Nutritional Support for Specific Conditions: Continued research and development into PN solutions optimized for specific disease states, such as inflammatory bowel disease, organ failure, or pediatric critical care.

Leading the Charge: Key Market Players

The global parenteral nutrition market is dominated by a few key players, alongside numerous regional and specialized manufacturers:

- Baxter International Inc.

- Fresenius Kabi AG

- B. Braun Melsungen AG

- Grifols, S.A.

- Otsuka Pharmaceutical Factory, Inc.

- Pfizer Inc. (Hospira Inc.)

- Sichuan Kelun Pharmaceutical Co., Ltd.

- Vifor Pharma

- American Regent (a subsidiary of Daiichi Sankyo)

- ICU Medical, Inc.

These companies are actively engaged in product innovation, expanding their manufacturing capabilities, entering strategic partnerships, and focusing on improving delivery systems to enhance patient safety and outcomes.

The Future of Nutritional Care

The parenteral nutrition market is set for continuous evolution, driven by a global commitment to improving patient care and combating malnutrition. As healthcare systems increasingly recognize the vital role of comprehensive nutritional support, innovations in PN formulations, alongside the expansion of home-based care models, will be crucial. The market’s trajectory points towards more personalized, safer, and accessible nutritional solutions, ultimately

Author:

Authored by Shweta.R, Business Development Specialist at Prophecy Market Insights. This comprehensive analysis is grounded in an extensive blend of primary interviews, industry expert consultations, and in-depth secondary research. It provides strategic insights into the evolving dynamics, competitive landscape, and emerging opportunities within the Parenteral Nutrition Market.

About Us:

Prophecy Market Insights is a leading provider of market research services, offering insightful and actionable reports to clients across various industries. With a team of experienced analysts and researchers, Prophecy Market Insights provides accurate and reliable market intelligence, helping businesses make informed decisions and stay ahead of the competition. The company’s research reports cover a wide range of topics, including industry trends, market size, growth opportunities, competitive landscape, and more. Prophecy Market Insights is committed to delivering high-quality research services that help clients achieve their strategic goals and objectives.

Contact Us:

Prophecy Market Insights